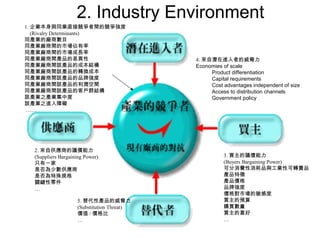

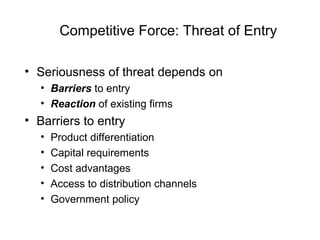

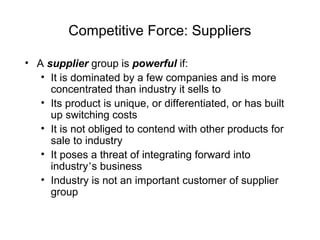

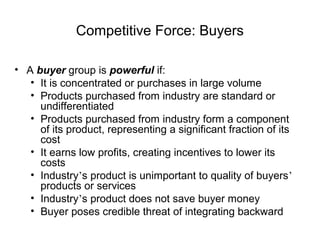

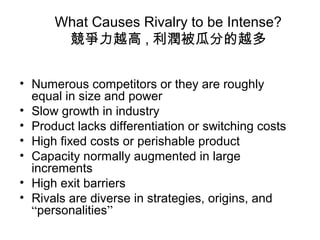

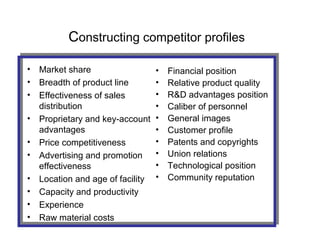

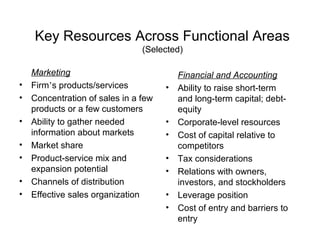

The document discusses factors in a firm's remote and industry environment that can impact its operations. The remote environment includes economic, social, political, technological, and ecological factors. The industry environment focuses on competitive forces like rivalry, potential new entrants, suppliers, buyers, and substitute products. It also examines operating factors like a firm's competitive position and ability to attract resources. The resource-based view of the firm and value chain analysis are introduced as frameworks to understand a firm's internal strengths and how it creates value.