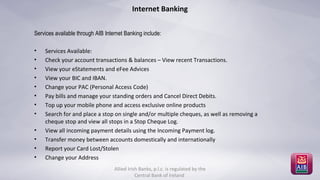

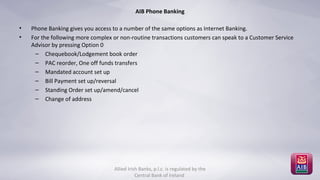

This document provides information about Allied Irish Banks' phone and internet banking services. It discusses the increasing rate of household internet usage in Ireland from 2008 to 2013. It then summarizes the benefits of phone and internet banking, including checking balances and transactions, viewing statements, paying bills and transferring funds between accounts domestically and internationally. Limits for different types of transfers are also outlined. Instructions for signing up for eStatements and performing various banking tasks like transfers and payments through the online and phone banking platforms are provided. The document repeatedly notes that Allied Irish Banks is regulated by the Central Bank of Ireland.