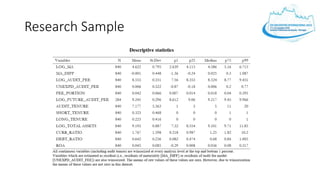

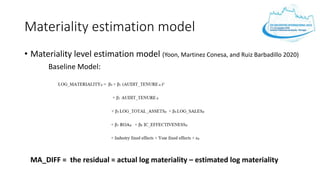

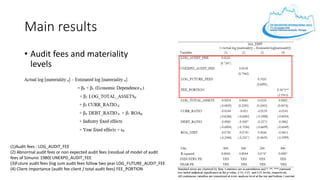

1) The study examines how economic dependence on clients, as measured by various audit fee factors, relates to materiality levels set by auditors.

2) It finds that only client importance, measured by the client's audit fee portion of the auditor's total fees, has a positive association with materiality levels.

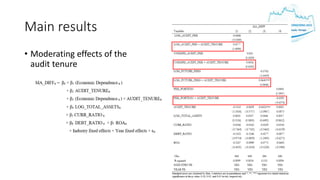

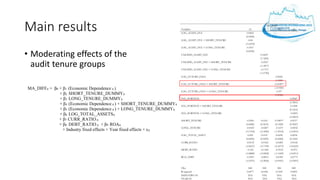

3) Audit tenure is found to moderate some relationships, with future audit fees showing a negative association with materiality for short tenures but no association for long tenures.

4) In general, the results suggest auditors maintain independence regardless of audit fee levels, as materiality levels are mostly unaffected by economic dependence on clients.