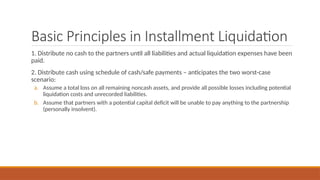

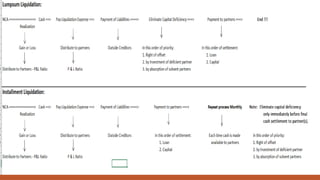

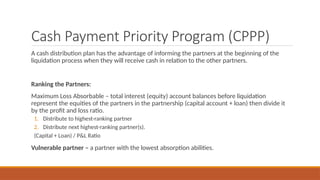

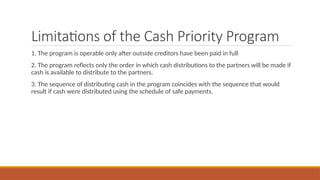

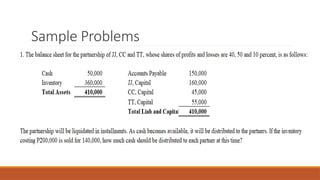

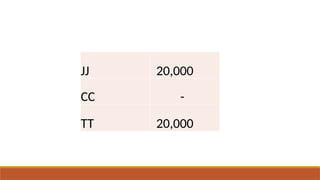

Partnership liquidation involves the winding up process where partnerships settle obligations, convert assets to cash, and distribute remaining balances among partners. It outlines types of liquidation (lump-sum and installment), basic procedures for sharing gains and losses, and the order of priority for asset distribution among creditors. Essential procedures include advance planning, handling liquidation expenses, and distributing cash to partners based on their capital accounts.