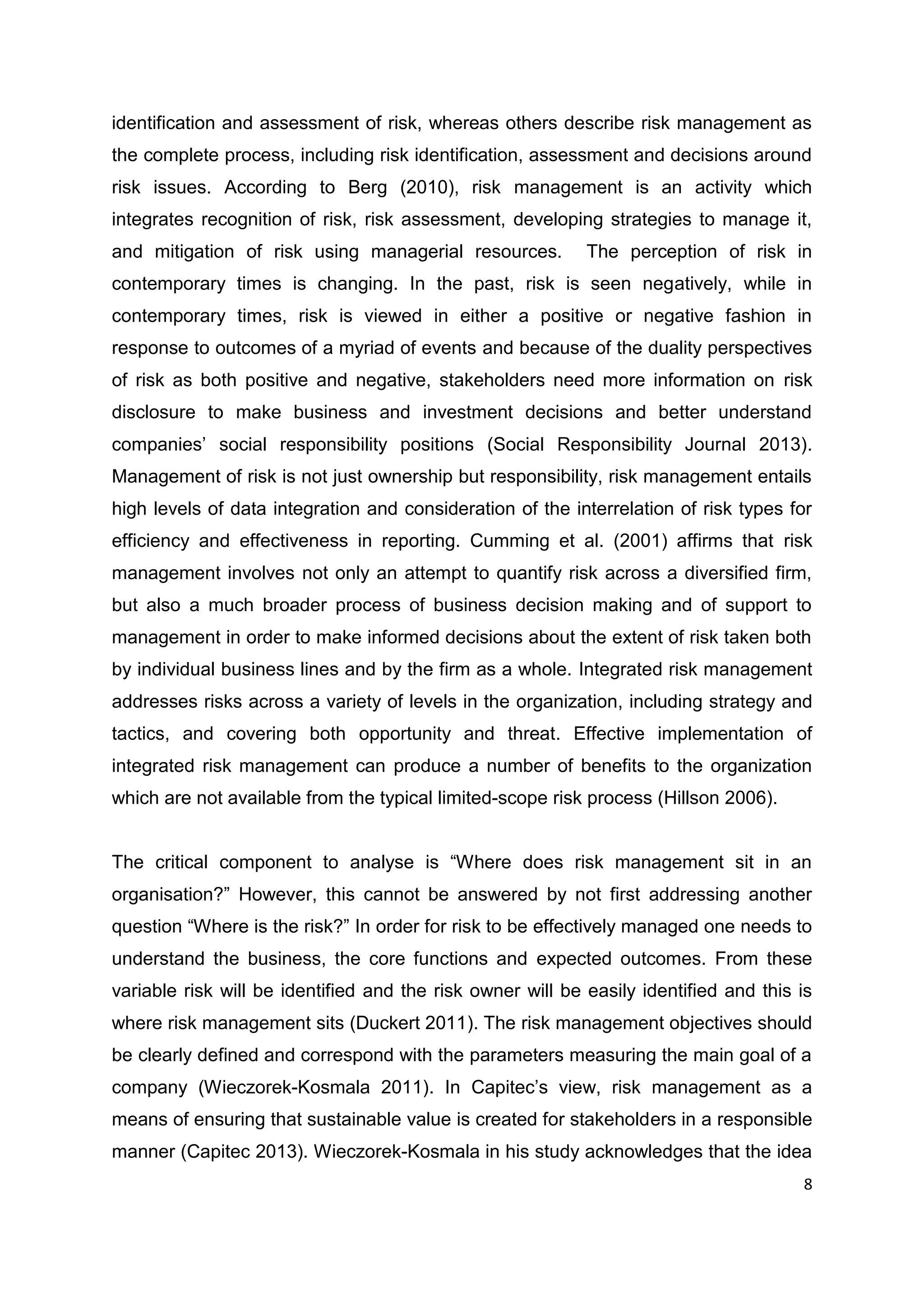

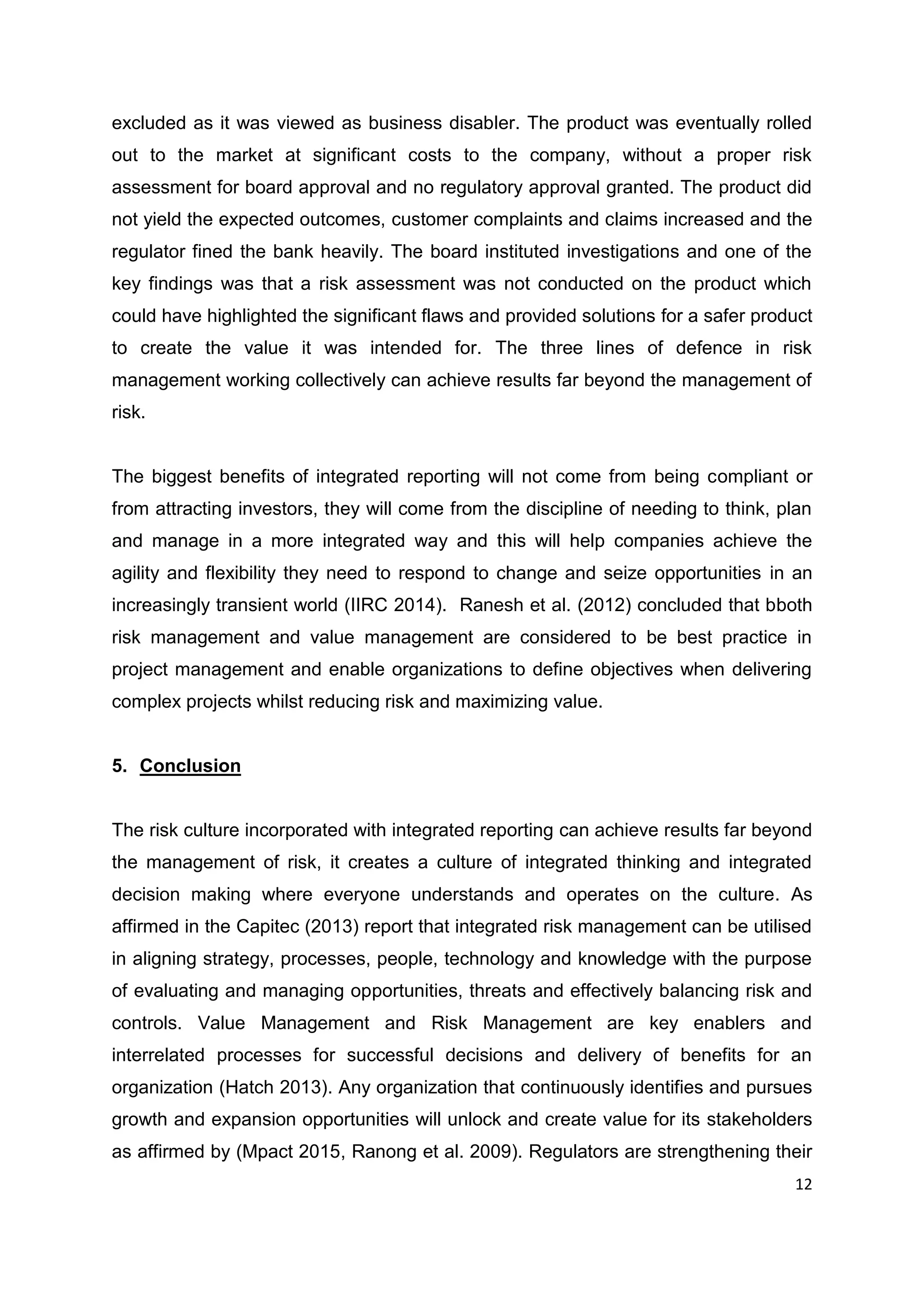

This document is a field study report on adding value to businesses through integrated risk reporting from the perspective of financial institutions. It discusses risk management, integrated reporting, and value creation. The study aims to broaden the understanding of how financial institutions can use integrated risk reporting to create value. Risk management is seen as a responsibility that involves high levels of data integration and consideration of interrelated risk types to effectively report on risk in its broadest context. Integrated risk reporting uses key risk and performance indicators to measure business sustainability against emerging risks.