The document is the annual report of Adani Logistics Limited for the financial year 2020-2021. It provides details of the company's financial performance including total income of Rs. 80,810.01 lakhs and profit for the year of Rs. 11,066.39 lakhs. It discusses the company's operational performance including details of logistics parks, CFS/Exim yards operated, and future expansion plans. It also provides information on subsidiaries and changes during the year.

![ADANI LOGISTICS LIMITED

Standalone Financial Statements for period 01/04/2020 to 31/03/2021

[700300] Disclosure of general information about company

Unless otherwise specified, all monetary values are in Lakhs of INR

01/04/2020

to

31/03/2021

01/04/2019

to

31/03/2020

Name of company ADANI LOGISTICS LIMITED

Corporate identity number U63090GJ2005PLC046419

Permanent account number of entity AABCI4157J

Address of registered office of company

Adani Corporate House,

Shantigram, Near Vaishno

Devi Circle, S G Highway,

Khodiyar, Ahmedabad -

382421 Gujarat, India

Type of industry

C o m m e r c i a l a n d

Industrial

Registration date 13/07/2005

Category/sub-category of company

Company Limited By

Shares Non Govt Company

Whether company is listed company No

Date of board meeting when final accounts were approved 03/05/2021

Date of start of reporting period 01/04/2020 01/04/2019

Date of end of reporting period 31/03/2021 31/03/2020

Nature of report standalone consolidated Standalone

Content of report Financial Statements

Description of presentation currency INR

Level of rounding used in financial statements Lakhs

Type of cash flow statement Indirect Method

Whether company is maintaining books of account and other relevant

books and papers in electronic form

Yes

Complete postal address of place of maintenance of computer

servers (storing accounting data)

Plot No B-7, Sec-132,

Noida(UP) - 201301

Name of city of place of maintenance of computer servers (storing

accounting data)

Noida

Name of state/ union territory of place of maintenance of

computer servers (storing accounting data)

Noida(UP)

Pin code of place of maintenance of computer servers (storing

accounting data)

201301

Name of district of place of maintenance of computer servers

(storing accounting data)

Noida

ISO country code of place of maintenance of computer servers

(storing accounting data)

+91

Name of country of place of maintenance of computer servers

(storing accounting data)

India

Phone (with STD/ ISD code) of place of maintenance of computer

servers (storing accounting data)

079-25555650

Disclosure of principal product or services [Table] ..(1)

Unless otherwise specified, all monetary values are in Lakhs of INR

Types of principal product or services [Axis]

Freight Transport

Services

01/04/2020

to

31/03/2021

Disclosure of general information about company [Abstract]

Disclosure of principal product or services [Abstract]

Disclosure of principal product or services [LineItems]

Product or service category (ITC 4 digit) code 9965

Description of product or service category

Inland Container

Deports

Turnover of product or service category 65,548.53

Highest turnover contributing product or service (ITC 8 digit) code 99651230

Description of product or service

Railway transport

services of

intermodal

containers

Turnover of highest contributing product or service 65,535.87](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/75/Adani-Logistics-2021-Annual-Report-pdf-1-2048.jpg)

![2

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

[700600] Disclosures - Directors report

Details of principal business activities contributing 10% or more of total turnover of company [Table] ..(1)

Unless otherwise specified, all monetary values are in Lakhs of INR

Principal business activities of company [Axis]

Product/service 1

[Member]

Product/service 2

[Member]

Product/service 3

[Member]

Product/service 4

[Member]

01/04/2020

to

31/03/2021

01/04/2020

to

31/03/2021

01/04/2020

to

31/03/2021

01/04/2020

to

31/03/2021

Details of principal business activities

contributing 10% or more of total turnover of

company [Abstract]

Details of principal business activities

contributing 10% or more of total turnover

of company [LineItems]

Name of main product/service

Storage and

Warehousing

Container Rail

Transportation

Road Transportation

Cargo Handling

Services

Description of main product/service

Storage and

Warehousing

Container Rail

Transportation

Road Transportation

Cargo Handling

Services

NIC code of product/service 5210 4912 4923 5224

Percentage to total turnover of company 4.00% 67.00% 10.00% 19.00%

Details of directors signing board report [Table] ..(1)

Unless otherwise specified, all monetary values are in Lakhs of INR

Directors signing board report [Axis] 1

01/04/2020

to

31/03/2021

Details of signatories of board report [Abstract]

Details of directors signing board report [LineItems]

Name of director signing board report [Abstract]

First name of director

V I K R A M

RUPCHAND

JAISINGHANI

Designation of director Chairman

Director identification number of director 00286606

Date of signing board report 03/05/2021](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-2-320.jpg)

![3

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Unless otherwise specified, all monetary values are in Lakhs of INR

01/04/2020

to

31/03/2021

Disclosure in board of directors report explanatory [TextBlock]

Textual information (1)

[See below]

Description of state of companies affair

Textual information (2)

[See below]

Disclosure relating to amounts if any which is proposed to carry to any

reserves

the directors do not

propose to carry amount

to reserves.

Disclosures relating to amount recommended to be paid as dividend

Textual information (3)

[See below]

Details regarding energy conservation

Textual information (4)

[See below]

Details regarding technology absorption

Textual information (5)

[See below]

Details regarding foreign exchange earnings and outgo

Textual information (6)

[See below]

Disclosures in director’s responsibility statement

Textual information (7)

[See below]

Details of material changes and commitment occurred during period

affecting financial position of company

There are no material

changes and commitments

affecting the financial

position of the Company

between the end of the

financial year and the

date of this report.

Particulars of loans guarantee investment under section 186 [TextBlock]

Textual information (8)

[See below]

Particulars of contracts/arrangements with related parties under section

188(1) [TextBlock]

Textual information (9)

[See below]

Details of contracts/arrangements/transactions not at arm's length

basis [Abstract]

Whether there are contracts/arrangements/transactions not at arm's

length basis

No

Details of material contracts/arrangements/transactions at arm's

length basis [Abstract]

Whether there are material contracts/arrangements/transactions at

arm's length basis

No

Date of board of directors' meeting in which board's report referred

to under section 134 was approved

03/05/2021

Disclosure of extract of annual return as provided under section 92(3)

[TextBlock]

Textual information (10)

[See below]

Details of principal business activities contributing 10% or more

of total turnover of company [Abstract]

Particulars of holding, subsidiary and associate companies [Abstract]

Name of company ADANI LOGISTICS LIMITED

Details of shareholding pattern of top 10 shareholders [Abstract]

Disclosure of statement on declaration given by independent directors

under section 149(6) [TextBlock]

Textual information (11)

[See below]

Disclosure for companies covered under section 178(1) on

directors appointment and remuneration including other matters

provided under section 178(3) [TextBlock]

N O T

APPLICABLE

Disclosure of statement on development and implementation of risk

management policy [TextBlock]

Textual information (12)

[See below]

Details on policy development and implementation by company on

corporate social responsibility initiatives taken during year

[TextBlock]

Textual information (13)

[See below]

Disclosure as per rule 8(5) of companies accounts rules 2014 [TextBlock]

Disclosure of financial summary or highlights [TextBlock]

Textual information (14)

[See below]

Disclosure of change in nature of business [TextBlock]

T h e r e a r e

no material changes and

commitments affecting

the financial position

of the Company between the

end of the financial year

and the date of this

report.

Details of directors or key managerial personnels who were

appointed or have resigned during year [TextBlock]

Textual information (15)

[See below]

Disclosure of companies which have become or ceased to be its

subsidiaries, joint ventures or associate companies during

year [TextBlock]

Textual information (16)

[See below]

Details relating to deposits covered under chapter v of companies act

[TextBlock]

Textual information (17)

[See below]

Details of deposits which are not in compliance with requirements

of chapter v of act [TextBlock]

Textual information (18)

[See below]](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-3-320.jpg)

![4

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Details of significant and material orders passed by

regulators or courts or tribunals impacting going concern

status and company’s operations in future [TextBlock]

Textual information (19)

[See below]

Details regarding adequacy of internal financial controls with

reference to financial statements [TextBlock]

Textual information (20)

[See below]

Disclosure of appointment and remuneration of director or

managerial personnel if any, in the financial year [TextBlock]

Textual information (21)

[See below]

Details of remuneration of director or managerial personnel [Abstract]

Number of meetings of board (A) 9

Details of signatories of board report [Abstract]

Name of director signing board report [Abstract]

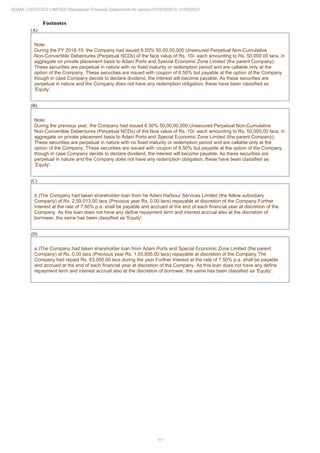

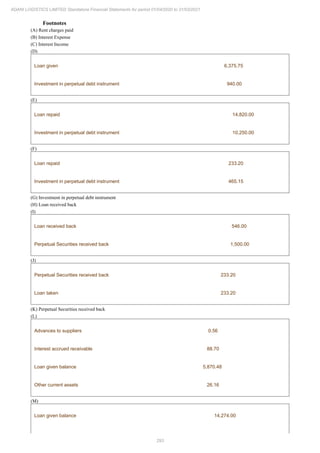

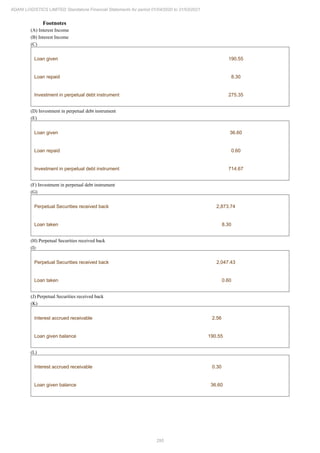

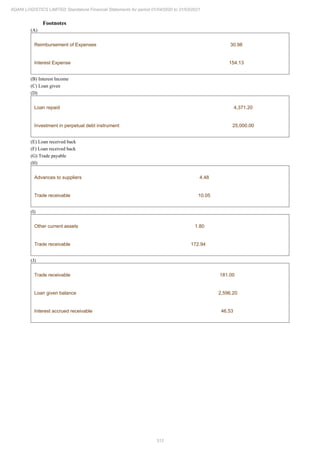

Footnotes

(A) Number of Board Meetings:

During the year under review, the Board met nine times on 4th May, 2020, 25th June, 2020, 1st August, 2020, 30th September, 2020,

31st October, 2020, 20th November, 2020, 2th February, 2021, 22nd March, 2021 and 30th March, 2021. The maximum time gap

between any two meetings is not more than 120 days.

The details of attendance of Directors at the Board Meetings held during the year under review are as under:

Name of Directors Meetings Attended

Held

Capt. Sandeep Mehta 9 9

Capt. Unmesh Abhyankar 9 9

Dr. Chitra Bhatnagar1 8 7

Ms. Komal Majmudar2 1 1

1Ceased w.e.f March 30, 2021 2Appointed w.e.f March 30, 2021

In compliance with the Companies Act, 2013 read with rules made thereunder, the option to participate in the Meeting through video

conferencing was made available for Directors.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-4-320.jpg)

![5

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (1)

Disclosure in board of directors report explanatory [Text Block]

DIRECTORS' REPORT

Dear Shareholders,

Your Directors are pleased to present the 16th Annual Report along with the audited financial statements of your Company for the financial

year ended on 31st March, 2021.

Financial Highlights:

The audited financial statements of the Company as on 31st March, 2021 are prepared in accordance with the relevant applicable Ind AS and

provisions of the Companies Act, 2013 (“Act”).

The summarized financial highlight is depicted below:

(Rs. in Lakhs)

Particulars 2020-21 2019-20

Revenue from Operations 65,548.53 73,819.67

Other Income 15,261.48 7,383.92

Total Income 80,810.01 81,203.59

Operating Expenses 50,401.34 48,796.75

Employee Benefits Expense 3,150.27 2,428.60

Depreciation and Amortization Expense 6,899.78 5,734.55

Finance Costs 3,676.89 5,837.79

Other expenses 2,958.80 2,708.84

Total Expense 67,087.71 65,506.53

Profit Before Tax 13,722.30 15,697.06

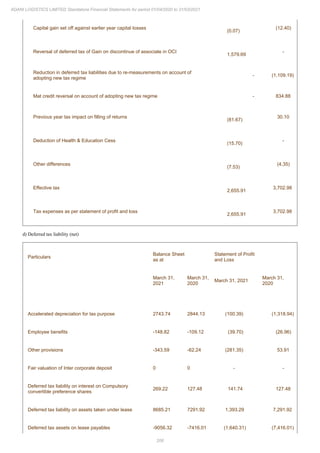

Tax Expense 2,655.91 3,702.98

Profit for the year 11,066.39 11,994.08

Other Comprehensive Income for the year (2,044.67) 6.96

Total Comprehensive Income for the year 9,021.72 12,001.04

There are no material changes and commitments affecting the financial position of the Company between the end of the financial year and

the date of this report.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-5-320.jpg)

![10

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

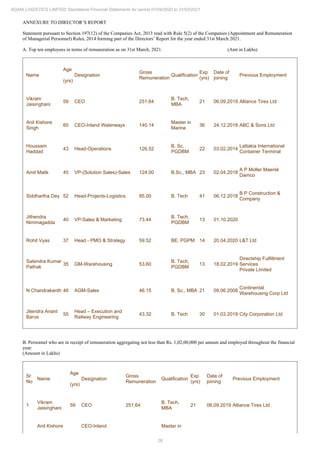

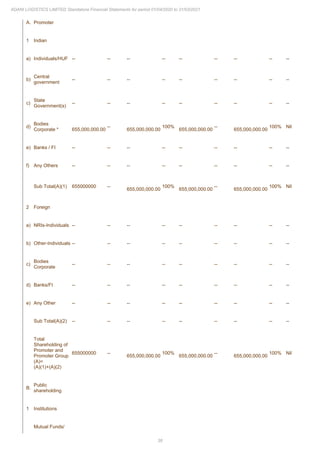

Particulars of Employees:

The particulars of employees as stipulated under Section 197 of the Companies Act, 2013 read with rule 5(2) of the Companies (Appointment

and Remuneration of Managerial Personnel) Rules, 2014, as amended from time to time is annexed, which forms part of this report.

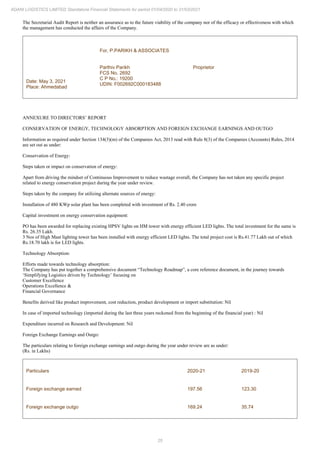

Conservation of Energy, Technology Absorption, Foreign Exchange Earning and Outgo:

The information on conservation of energy, technology absorption and foreign exchange earnings and outgo stipulated under Section 134(3)

(m) of the Companies Act, 2013 read with rule 8 of The Companies (Accounts) Rules, 2014, as amended from time to time is annexed, which

forms part of this Report.

Acknowledgement:

Your Directors are highly grateful for all the guidance, support and assistance received from the Central & State Government authorities,

Financial Institutions and Banks. Your Directors thank all members, esteemed customers, suppliers and business associates for their faith,

trust and confidence reposed in the Company.

Your Directors wish to place on record their sincere appreciation for the dedicated efforts and consistent contribution made by the employees

at all levels, to ensure that the Company continues to grow and excel.

For and on behalf of the Board of Directors

Place: Ahmedabad Vikram Jaisinghani

Date: May 3, 2021 (Chairman)

DIN: 00286606

ANNEXURE TO DIRECTOR’S REPORT

FORM NO. MGT-9

EXTRACT OF ANNUAL RETURN

as on the Financial Year ended on 31st March, 2021

[Pursuant to Section 92(3) of the Companies Act, 2013, and Rule 12(1) of the

Companies (Management and Administration) Rules, 2014]](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-10-320.jpg)

![21

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

c. Profits in lieu of salary under section 17(3) Income-tax Act, 1961 - -

2 Stock Option - -

3 Sweat Equity - -

4 Commission - -

as % of profit - -

others, specify - -

5 Others, (P.F. contribution of employee) 1.86 - 1.86

Total (A) 24.33 - 24.33

1Mr. Yogesh Dalal is not drawing any Remuneration from the Company.

PENALTIES / PUNISHMENT/ COMPOUNDING OF OFFENCES:

Type

Section of the

Companies Act

Brief

Description

Details of penalty/ punishment/

compounding fees imposed

Authority

[RD / NCLT/

COURT]

Appeal made, if any

(give details)

Company

Penalty

None

Punishment

Compounding

Directors

Penalty

None

Punishment

Compounding

Other Officers in default](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-21-320.jpg)

![22

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Penalty

None

Punishment

Compounding

ANNEXURE TO DIRECTORS’ REPORT

Form No. MR-3

SECRETARIAL AUDIT REPORT

FOR THE FINANCIAL YEAR ENDED 31.03.2021

[Pursuant to section 204(1) of the Companies Act, 2013 and ruleNo.9 of

the Companies (Appointment and Remuneration of Managerial Personnel Rules, 2014]

To,

The Members,

ADANI LOGISTICS LIMITED

CIN : U63090GJ2005PLC046419

AHMEDABAD.

We have conducted the secretarial audit of the compliance of applicable statutory provisions and the adherence to good corporate practices

by ADANI LOGISTICS LIMITED, (CIN No :U63090GJ2005PLC046419) (hereinafter called the company). Secretarial Audit was

conducted in a manner that provided us a reasonable basis for evaluating the corporate conducts/statutory compliances and expressing our

opinion thereon.

Based on our verification of books, papers, minute books, forms and returns filed and other records maintained by the Company and also the

information provided by the Company, its officers, agents and authorized representatives during the conduct of secretarial audit, we hereby

report that in our opinion, the Company has, during the audit period covering the financial year ended on 31st March, 2021, complied with

the statutory provisions listed hereunder and also that the Company has proper Board-processes and compliance-mechanism in place to the

extent, in the manner and subject to the reporting made hereinafter:

We have examined the books, papers, minute books, forms and returns filed and other records maintained by the Company for the financial

year ended on 31st March, 2021 according to the provisions of:

The Companies Act, 2013 (the Act) and the rules made thereunder;

The Securities Contracts (Regulation) Act, 1956 (‘SCRA’) and the rules made thereunder:

The Depositories Act, 1996 and the Regulations and Bye-laws framed thereunder;

Foreign Exchange Management Act, 1999 and the rules and regulations made thereunder to the extent of Foreign Direct Investment,

Overseas Direct Investment and External Commercial Borrowings;

The following Regulations and Guidelines prescribed under the Securities and Exchange Board of India Act, 1992 (‘SEBI Act’);

The Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011;

The Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015: Not applicable as the company is an unlisted

Company;

The Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009 (upto November 10, 2018)

and Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018 (w.e.f. November 11, 2018):

Not applicable as the company is an unlisted Company;

Securities and Exchange Board of India (Share Based Employee Benefits) Regulations, 2014: Not applicable as the company is an unlisted

Company;

The Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008: Not applicable as the company is an

unlisted Company;

The Securities and Exchange Board of India (Registrars to an Issue and Share Transfer Agents) Regulations, 1993 regarding the Companies](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-22-320.jpg)

![30

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

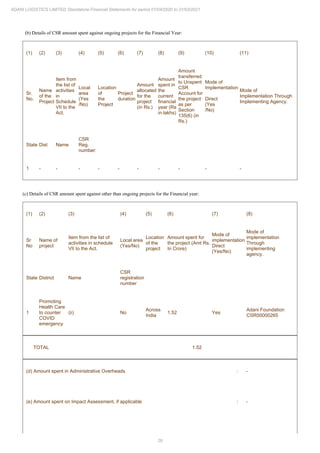

(f) Total amount spent for the Financial (8b + 8c + 8d + 8e) : Rs. 1.52 Crore

(g) Excess amount for set off, if any

Sr.

No.

Particular

Amount

(Rs. In Crore)

(i) Two percent of average net profit of the Company as per Section 135(5) 1.52

(ii) Total amount spent for the financial Year 1.52

(iii) Excess amount spent for the financial year [(ii)-(i)] -

(iv)

Surplus arising out of the CSR projects or programmes or activities of the previous financial years, if

any

-

(v) Amount available for set off in succeeding financial years [(iii) – (iv)] -

9.(a) Details of Unspent CSR amount for the preceding three financial years:

Sr. No.

Preceding

Financial

Year

Amount transferred to

Unspent CSR Account

under Section 135(6)

(in Rs.)

Amount spent in

the reporting

Financial Year

(in Rs.)

Amount transferred to any fund

specified under Schedule VII as per

Section 135(6), if any.

Amount remaining to

be spent in succeeding

financial years

(in Rs.)

Name

of the

Fund

Amount

(in Rs.)

Date of transfer

1 - - - - - - -

TOTAL

(b) Details of CSR amount spent in the financial year for ongoing projects of the preceding financial year(s):

(1) (2) (3) (4) (5) (6) (7) (8) (9)

Sr.

No

Project

ID

Name

of the

project

Financial Year in

which the project

was commenced

Project

duration

Total amount

allocated for the

project (in Rs.)

Amount spent on the

project in the

reporting Financial

Year

(in Rs.)

Cumulative amount

spent at the end of

reporting Financial

Year

(in Rs.)

Status of

the

Project-

Completed

/ ongoing

1 - - - - - - - -

TOTAL](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-30-320.jpg)

![33

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (7)

Disclosures in director’s responsibility statement

Directors’ Responsibility Statement: Pursuant to Section 134(5) of the Act, the Board of Directors, to the best of their knowledge and ability,

state the following: a. that in the preparation of the annual financial statements, the applicable accounting standards have been followed and

there are no material departures;; b. that such accounting policies have been selected and applied consistently and judgements and estimates

have been made that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company as at March 31, 2021

and of the profit of the Company for the year ended on that date; c. that proper and sufficient care has been taken for the maintenance of

adequate accounting records in accordance with the provisions of the Act for safeguarding the assets of the Company and for preventing and

detecting fraud and other irregularities; d. that the annual financial statements have been prepared on a going concern basis; e. that proper

internal financial controls were in place and that the financial control are adequate and operating effectively; f. that proper systems to ensure

compliance with the provisions of all applicable laws were in place and were adequate and operating effectively.

Textual information (8)

Particulars of loans guarantee investment under section 186 [Text Block]

Particulars of Loans, Guarantee or Investment:

The provisions of Section 186 of the Act with respect to a loan, guarantee or security or investment is not applicable to the Company as the

Company is engaged in providing infrastructural facilities and is exempted under Section 186 of the Act. The details of investment made

during the year under review are disclosed in the financial statements.

Textual information (9)

Particulars of contracts/arrangements with related parties under section 188(1) [Text Block]

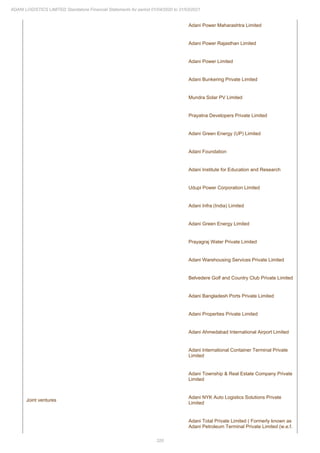

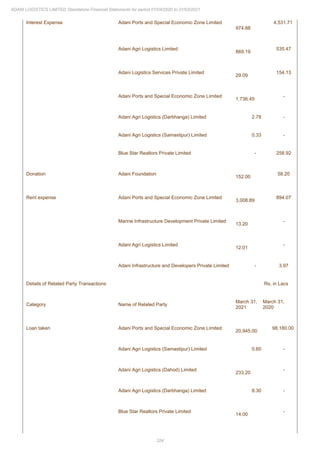

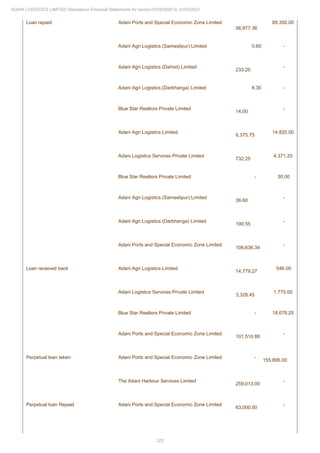

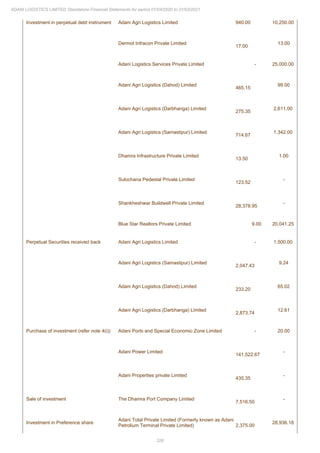

Related Party Transactions:

All the related party transactions entered into during the financial year were on an arm’s length basis and were in the ordinary course of

business. Your Company had not entered into any transactions with related parties which could be considered material in terms of Section

188 of the Act. Accordingly, the disclosure of related party transactions as required under Section 134(3)(h) of the Act in Form AOC-2 is not

applicable. Suitable disclosure as required by the Indian Accounting Standard (Ind AS 24) has been made in the notes to the Financial

Statements.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-33-320.jpg)

![34

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (10)

Disclosure of extract of annual return as provided under section 92(3) [Text Block]

NNEXURE TO DIRECTOR’S REPORT

FORM NO. MGT-9

EXTRACT OF ANNUAL RETURN

as on the Financial Year ended on 31st March, 2021

[Pursuant to Section 92(3) of the Companies Act, 2013, and Rule 12(1) of the

Companies (Management and Administration) Rules, 2014]

Registration and other details:

CIN : U63090GJ2005PLC046419

Registration Date : July 13, 2005

Name of the Company : Adani Logistics Ltd.

Category / Sub-Category of the Company : Company limited by share

Address of the Registered office and contact

details

:

Adani Corporate House, Shantigram, Nr. Vaishno Devi Circle, S. G.

Highway, Khodiyar, Ahmedabad – 382421 Gujarat, India

Whether listed company : No

Name, Address and Contact details of

Registrar and Transfer Agent, if any

:

Link In time India Private Limited

C-101, 247 Park, L.B.S. Marg, Vikhroli (West)Mumbai, Maharashtra-400083

Principal business activities of the company:

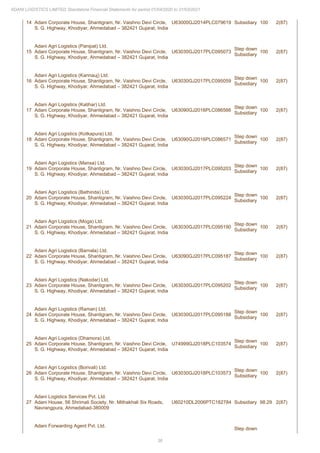

All the business activities contributing 10 % or more of the total turnover of the company shall be stated:

Name and description of main Products/Services NIC Code of the Product/ service % to total turnover of the company

Container Rail Transportation 4912 67%

Road Transportation 4923 10%

Cargo Handling Services 5224 19%

Storage and Warehousing 5210 4%

Total 100%

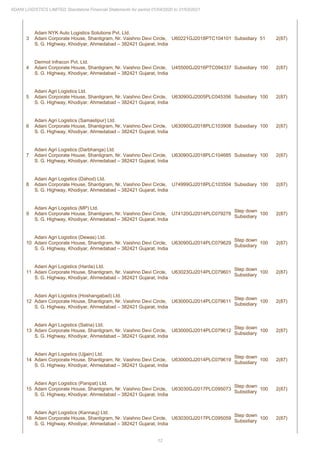

Particulars of holding, subsidiary and associate companies:

Holding/ % of](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-34-320.jpg)

![44

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

1 Gross salary

a.

Salary as per provisions contained in section 17(1) of the

Income-tax Act, 1961

20.62 - 20.62

b. Value of perquisites u/s 17(2) Income-tax Act, 1961 1.85 - 1.85

c. Profits in lieu of salary under section 17(3) Income-tax Act, 1961 - -

2 Stock Option - -

3 Sweat Equity - -

4 Commission - -

as % of profit - -

others, specify - -

5 Others, (P.F. contribution of employee) 1.86 - 1.86

Total (A) 24.33 - 24.33

1Mr. Yogesh Dalal is not drawing any Remuneration from the

Company.

PENALTIES / PUNISHMENT/ COMPOUNDING OF OFFENCES:

Type

Section of the

Companies Act

Brief

Description

Details of penalty/ punishment/

compounding fees imposed

Authority

[RD / NCLT/

COURT]

Appeal made, if any

(give details)

Company

Penalty

None

Punishment

Compounding

Directors](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-44-320.jpg)

![45

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Penalty

None

Punishment

Compounding

Other Officers in default

Penalty

None

Punishment

Compounding

Textual information (11)

Disclosure of statement on declaration given by independent directors under section 149(6) [Text Block]

The Company has received declaration from Ms. Komal Majmudar, Independent Director of the Company confirming that she meets the

criteria of independence as provided in Section 149(6) of the Companies Act, 2013 and there has been no change in the circumstances which

may affect her status as independent director during the year.

Textual information (12)

Disclosure of statement on development and implementation of risk management policy [Text Block]

Risk Management:

Your Company has a formal risk assessment and management system which identifies risk areas, evaluates their consequences, initiates risk

mitigation strategies and implements corrective actions where required.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-45-320.jpg)

![46

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (13)

Details on policy development and implementation by company on corporate social responsibility initiatives taken

during year [Text Block]

Corporate Social Responsibility (CSR) Committee:

The present members of the CSR Committee are Mr. Vikram Jaisinghani, Capt. Unmesh Abhyankar and Ms. Komal Majmudar.

The Company has identified Education, Community Health, Sustainable Livelihood and Community Infrastructure as the core sectors for

CSR. The role and functions of the CSR Committee are in conformity with the requirements of Section 135 of the Act read with rules made

thereunder. The Annual Report on CSR activities is annexed, which forms part of this report.

During the year under review, the Committee met two times on 4 th May, 2020 and 1 st August, 2020.

The details of attendance of the members at the Committee meeting during the year are as under:

Name of Members Meetings

Held Attended

Capt. Sandeep Mehta 2 2

Capt. Unmesh Abhyankar 2 2

Dr. Chitra Bhatnagar 2 2

Ms. Komal Majmudar 1 0 0

1 Appointed w.e.f March 30, 2021.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-46-320.jpg)

![47

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (14)

Disclosure of financial summary or highlights [Text Block]

Financial Highlights:

The audited financial statements of the Company as on 31 st March, 2021 are prepared in accordance with the relevant applicable Ind AS and

provisions of the Companies Act, 2013 (“Act”).

The summarized financial highlight is depicted below:

(Rs. in Lakhs)

Particulars 2020-21 2019-20

Revenue from Operations 65,548.53 73,819.67

Other Income 15,261.48 7,383.92

Total Income 80,810.01 81,203.59

Operating Expenses 50,401.34 48,796.75

Employee Benefits Expense 3,150.27 2,428.60

Depreciation and Amortization Expense 6,899.78 5,734.55

Finance Costs 3,676.89 5,837.79

Other expenses 2,958.80 2,708.84

Total Expense 67,087.71 65,506.53

Profit Before Tax 13,722.30 15,697.06

Tax Expense 2,655.91 3,702.98

Profit for the year 11,066.39 11,994.08

Other Comprehensive Income for the year (2,044.67) 6.96

Total Comprehensive Income for the year 9,021.72 12,001.04](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-47-320.jpg)

![48

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (15)

Details of directors or key managerial personnels who were appointed or have resigned during year [Text Block]

Directors and Key Managerial Personnel:

Capt. Sandeep Mehta was re-appointed as Managing Director w.e.f 20.03.2021 for a period of three years and resigned as Managing Director

w.e.f May 3, 2021.

Dr. Chitra Bhatnagar ceased to be Independent Director w.e.f March 30, 2021 upon completion of her second term as Independent Director.

Mr. Vikram Jaisinghani was appointed as Managing Director of the Company w.e.f May 5, 2021 and Ms. Komal Majmudar was appointed as

Independent Director w.e.f March 23, 2021 for a period of five years.

Pursuant to the requirements of the Companies Act, 2013 and Articles of Association of the Company, Capt. Unmesh Abhayankar (DIN:

03040812) is liable to retire by rotation and being eligible offer himself for re-appointment. The Board recommends his appointment as

Director of the Company retiring by rotation.

The Company has received declaration from Ms. Komal Majmudar, Independent Director of the Company confirming that she meets the

criteria of independence as provided in Section 149(6) of the Companies Act, 2013 and there has been no change in the circumstances which

may affect her status as independent director during the year.

In terms of the provisions of Section 203 of the Act, Mr. Vikram Jaisinghani, Managing Director, Mr. Piyush Gandhi, Chief Financial Officer

and Mr. Yogesh Dalal, Company Secretary are the Key Managerial Personnel of the Company.

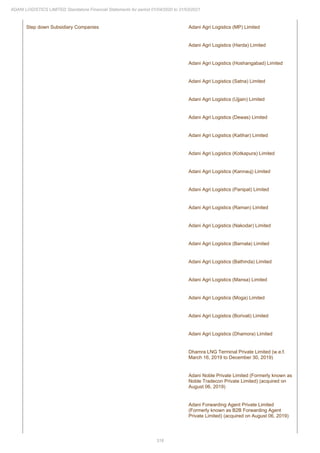

Textual information (16)

Disclosure of companies which have become or ceased to be its subsidiaries, joint ventures or associate companies

during year [Text Block]

During the year under review, your Company has divested/sold 5,01,10,000 equity shares of Rs. 10/- each held in Dhamra Infrastructure

Private Limited to The Dhamra Port Company Limited and its nominees at a total consideration of INR 75,16,50,000 (Rupees Seventy Five

Crores Sixteen Lakhs Fifty Thousand only) and accordingly ceased to be Holding Company of Dhamra Infrastructure Private Limited w.e.f

March 22, 2021.

During the year under review, the Company has divested/sold entire Equity Stake of 4,34,42,879 Equity shares of Rs. 10/- each of Snowman

Logistics Limited and accordingly ceased to be Associate Company of Snowman Logistics Limited.

Your Company has entered in to share purchase agreement with Shankheshwar Buildwell Private Limited and acquired upto 100% equity

stake i.e. 10,000 equity shares (“Equity”) having face value of Rs. 10/- each from Adani Properties Private Limited (“Equity Seller”) at a

total consideration of Rs. 81,53,951/- (Rupee Eighty-One Lakh Fifty Three Thousand Nine Hundred Fifty One Only) and 10,00,00,000

compulsorily convertible preference shares (“CCPS”) having face value of Rs. 10/- each from Adani Power Limited (“CCPS Seller”) at a

total consideration of Rs. 815,39,51,458/- (Rupees Eight Hundred Fifteen Crore Thirty Nine Lakh Fifty One Thousand Four Hundred Fifty

Eight Only) and accordingly became Holding Company of Shankheshwar Buildwell Private Limited w.e.f March 30, 2020.

Your Company has entered in to share purchase agreement with Sulochna Pedestal Private Limited and acquired upto 100% equity stake i.e.

10,00,000 equity shares (“Equity”) having face value of Rs. 10/- each from Adani Properties Private Limited (“Equity Seller”) at a total

consideration of Rs. 3,53,80,668/- (Rupees Three Crore Fifty-Three Lakh Eighty Thousand Six Hundred Sixty-Eight Only) and 4,00,00,000

compulsorily convertible preference shares (“CCPS”) having face value of Rs. 100/- each from Adani Power Limited (“CCPS Seller”) at a

total consideration of Rs. 14,15,22,67,332/- (Rupees Fourteen Hundred Fifteen Crore Twenty-Two Lakh Sixty-Seven Thousand Three

Hundred Thirty-Two Only) and accordingly became Holding Company of Sulochna Pedestal Private Limited w.e.f March 31, 2021.

Textual information (17)

Details relating to deposits covered under chapter v of companies act [Text Block]

Fixed Deposits:

During the year under review, your Company has not accepted any fixed deposits within the meaning of Section 73 of the Act read with rules

made thereunder.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-48-320.jpg)

![49

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (18)

Details of deposits which are not in compliance with requirements of chapter v of act [Text Block]

Fixed Deposits:

During the year under review, your Company has not accepted any fixed deposits within the meaning of Section 73 of the Act read with rules

made thereunder.

Textual information (19)

Details of significant and material orders passed by regulators or courts or tribunals impacting going concern

status and company’s operations in future [Text Block]

Significant and material orders passed by the regulators or courts or tribunals impacting the going concern status of the Company:

There are no significant and material orders passed by the Regulators or Courts or Tribunals which would impact the going concern status

and the Company’s future operations

Textual information (20)

Details regarding adequacy of internal financial controls with reference to financial statements [Text Block]

Internal financial control systems and their adequacy:

Your Company has an internal control system, commensurate with the size, scale and complexity of its operations. The internal audit

department monitors and evaluates the efficacy and adequacy of internal control system in the Company, its compliance with operating

systems, accounting procedures and policies of the Company.

Textual information (21)

Disclosure of appointment and remuneration of director or managerial personnel if any, in the financial year

[Text Block]

Directors and Key Managerial Personnel:

Capt. Sandeep Mehta was re-appointed as Managing Director w.e.f 20.03.2021 for a period of three years and resigned as Managing Director

w.e.f May 3, 2021.

Dr. Chitra Bhatnagar ceased to be Independent Director w.e.f March 30, 2021 upon completion of her second term as Independent Director.

Mr. Vikram Jaisinghani was appointed as Managing Director of the Company w.e.f May 5, 2021 and Ms. Komal Majmudar was appointed as

Independent Director w.e.f March 23, 2021 for a period of five years.

Pursuant to the requirements of the Companies Act, 2013 and Articles of Association of the Company, Capt. Unmesh Abhayankar (DIN:

03040812) is liable to retire by rotation and being eligible offer himself for re-appointment. The Board recommends his appointment as

Director of the Company retiring by rotation.

The Company has received declaration from Ms. Komal Majmudar, Independent Director of the Company confirming that she meets the

criteria of independence as provided in Section 149(6) of the Companies Act, 2013 and there has been no change in the circumstances which

may affect her status as independent director during the year.

In terms of the provisions of Section 203 of the Act, Mr. Vikram Jaisinghani, Managing Director, Mr. Piyush Gandhi, Chief Financial Officer

and Mr. Yogesh Dalal, Company Secretary are the Key Managerial Personnel of the Company.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-49-320.jpg)

![50

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

[700500] Disclosures - Signatories of financial statements

Details of directors signing financial statements [Table] ..(1)

Unless otherwise specified, all monetary values are in Lakhs of INR

Directors signing financial statements [Axis] 1 2

01/04/2020

to

31/03/2021

01/04/2020

to

31/03/2021

Details of signatories of financial statements [Abstract]

Details of directors signing financial statements [Abstract]

Details of directors signing financial statements [LineItems]

Name of director signing financial statements [Abstract]

First name of director

V I K R A M

RUPCHAND

JAISINGHANI

U N M E S H

MADHUSUDAN

ABHYANKAR

Designation of director Managing Director Director

Director identification number of director 00286606 03040812

Date of signing of financial statements by director 03/05/2021 03/05/2021

Unless otherwise specified, all monetary values are in Lakhs of INR

01/04/2020

to

31/03/2021

Name of company secretary YOGESH DALAL

Permanent account number of company secretary AHBPD3697E

Date of signing of financial statements by company secretary 03/05/2021

Name of chief financial officer PIYUSH BABULAL GANDHI

Permanent account number of chief financial officer ADNPG7067M

Date of signing of financial statements by chief financial officer 03/05/2021](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-50-320.jpg)

![51

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

[700400] Disclosures - Auditors report

Disclosure of auditor's qualification(s), reservation(s) or adverse remark(s) in auditors' report [Table] ..(1)

Unless otherwise specified, all monetary values are in Lakhs of INR

Auditor's qualification(s), reservation(s) or adverse remark(s) in auditors' report [Axis]

Auditor's

favourable remark

[Member]

01/04/2020

to

31/03/2021

Disclosure of auditor's qualification(s), reservation(s) or adverse remark(s) in auditors' report [Abstract]

Disclosure of auditor's qualification(s), reservation(s) or adverse remark(s) in auditors' report

[LineItems]

Disclosure in auditors report relating to fixed assets

Textual information

(22) [See below]

Disclosure in auditors report relating to inventories

(ii) As explained to

us, the inventories

were physically

verified during the

year by the

Management at

reasonable intervals

and no material

discrepancies were

noticed on physical

verification.

Disclosure in auditors report relating to loans

Textual information

(23) [See below]

Disclosure in auditors report relating to compliance with Section 185 and 186 of Companies Act, 2013

Textual information

(24) [See below]

Disclosure in auditors report relating to deposits accepted

Textual information

(25) [See below]

Disclosure in auditors report relating to maintenance of cost records

Textual information

(26) [See below]

Disclosure in auditors report relating to statutory dues [TextBlock]

Textual information

(27) [See below]

Disclosure in auditors report relating to default in repayment of financial dues

Textual information

(28) [See below]

Disclosure in auditors report relating to public offer and term loans used for purpose for which

those were raised

Textual information

(29) [See below]

Disclosure in auditors report relating to fraud by the company or on the company by its officers

or its employees reported during period

Textual information

(30) [See below]

Disclosure in auditors report relating to managerial remuneration

Textual information

(31) [See below]

Disclosure in auditors report relating to Nidhi Company

(xii) The Company

is not a Nidhi

Company and hence

reporting under

clause (xii) of

paragraph 3 of the

Order is not

applicable.

Disclosure in auditors report relating to transactions with related parties

Textual information

(32) [See below]

Disclosure in auditors report relating to preferential allotment or private placement of shares or

convertible debentures

Textual information

(33) [See below]

Disclosure in auditors report relating to non-cash transactions with directors or persons connected

with him

Textual information

(34) [See below]

Disclosure in auditors report relating to registration under section 45-IA of Reserve Bank of India

Act, 1934

(xvi) The Company

is not required to be

registered under

section 45-IA of the

Reserve Bank of

India Act, 1934.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-51-320.jpg)

![52

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Details regarding auditors [Table] ..(1)

Unless otherwise specified, all monetary values are in Lakhs of INR

Auditors [Axis] 1

01/04/2020

to

31/03/2021

Details regarding auditors [Abstract]

Details regarding auditors [LineItems]

Category of auditor Auditors firm

Name of audit firm

Deloitte Haskins &

Sells LLP

Name of auditor signing report

Raval Kartikeya

Dharmendra

Firms registration number of audit firm 117366W

Membership number of auditor 106189

Address of auditors

19th Floor,

Shapath-V,

Permanent account number of auditor or auditor's firm AACFD4815A

SRN of form ADT-1 G50544899

Date of signing audit report by auditors 03/05/2021

Date of signing of balance sheet by auditors 03/05/2021

Unless otherwise specified, all monetary values are in Lakhs of INR

01/04/2020

to

31/03/2021

Disclosure in auditor’s report explanatory [TextBlock]

Textual information (35)

[See below]

Whether companies auditors report order is applicable on company Yes

Whether auditors' report has been qualified or has any reservations or

contains adverse remarks

No

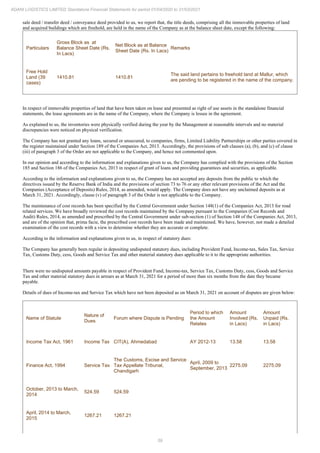

Textual information (22)

Disclosure in auditors report relating to fixed assets

(i) (a) The Company has maintained proper records showing full particulars, including quantitative details and situation of property, plant and

equipment. (b) Some of the property, plant and equipment were physically verified during the year by the Management in accordance with a

programme of verification, which in our opinion provides for physical verification of all the property, plant and equipment at reasonable

intervals. According to the information and explanations given to us, no material discrepancies were noticed on such verification. (c)

According to the information and explanations given to us and the records examined by us and based on the examination of the registered

sale deed / transfer deed / conveyance deed provided to us, we report that, the title deeds, comprising all the immovable properties of land

and acquired buildings which are freehold, are held in the name of the Company as at the balance sheet date, except the following: Particulars

Gross Block as at Balance Sheet Date (Rs. In Lacs) Net Block as at Balance Sheet Date (Rs. In Lacs) Remarks Free Hold Land (39 cases)

1410.81 1410.81 The said land pertains to freehold land at Mallur, which are pending to be registered in the name of the company. In respect

of immovable properties of land that have been taken on lease and presented as right of use assets in the standalone financial statements, the

lease agreements are in the name of the Company, where the Company is lessee in the agreement.

Textual information (23)

Disclosure in auditors report relating to loans

(iii) The Company has not granted any loans, secured or unsecured, to companies, firms, Limited Liability Partnerships or other parties

covered in the register maintained under Section 189 of the Companies Act, 2013. Accordingly, the provisions of sub clauses (a), (b), and (c)

of clause (iii) of paragraph 3 of the Order are not applicable to the Company, and hence not commented upon.

Textual information (24)

Disclosure in auditors report relating to compliance with Section 185 and 186 of Companies Act, 2013

(iv) In our opinion and according to the information and explanations given to us, the Company has complied with the provisions of the

Section 185 and Section 186 of the Companies Act, 2013 in respect of grant of loans and providing guarantees and securities, as applicable.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-52-320.jpg)

![54

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (27)

Disclosure in auditors report relating to statutory dues [Text Block]

According to the information and explanations given to us, in respect of statutory dues:

The Company has generally been regular in depositing undisputed statutory dues, including Provident Fund, Income-tax, Sales Tax, Service

Tax, Customs Duty, cess, Goods and Service Tax and other material statutory dues applicable to it to the appropriate authorities.

There were no undisputed amounts payable in respect of Provident Fund, Income-tax, Service Tax, Customs Duty, cess, Goods and Service

Tax and other material statutory dues in arrears as at March 31, 2021 for a period of more than six months from the date they became

payable.

Details of dues of Income-tax and Service Tax which have not been deposited as on March 31, 2021 on account of disputes are given below:

Name of Statute

Nature of

Dues

Forum where Dispute is Pending

Period to which

the Amount

Relates

Amount

Involved (Rs.

in Lacs)

Amount

Unpaid (Rs.

in Lacs)

Income Tax Act, 1961 Income Tax CIT(A), Ahmedabad AY 2012-13 13.58 13.58

Finance Act, 1994 Service Tax

The Customs, Excise and Service

Tax Appellate Tribunal,

Chandigarh

April, 2009 to

September, 2013

2275.09 2275.09

October, 2013 to March,

2014

524.59 524.59

April, 2014 to March,

2015

1267.21 1267.21

Commissioner of Goods

and Service Tax,

Panchkula

April, 2015

to March,

2016

754.68 754.68

Commissioner of Goods

and Service Tax,

Gurugram

April, 2016

to June,

2017

2635.76 2635.76

Commissioner of Goods

and Service Tax,

Gurugram

April, 2014

to

June, 2017

0.66 0.66

There are no dues of Sales Tax, Customs Duty, Excise Duty, Value Added Tax and Goods and Service Tax as on March 31, 2021 on account

of disputes.

Textual information (28)

Disclosure in auditors report relating to default in repayment of financial dues

(viii) In our opinion and according to the information and explanations given to us, the debentures issued by the Company are perpetual in

nature and no interest payment and principal repayment were contractually due. The Company has not taken any loans or borrowings from

banks, financial institutions or the government.](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-54-320.jpg)

![56

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (35)

Disclosure in auditor’s report explanatory [Text Block]

INDEPENDENT AUDITOR'S REPORT

To The Members of Adani Logistics Limited

Report on the Audit of the Standalone Financial Statements

Opinion

We have audited the accompanying standalone financial statements of Adani Logistics Limited (“the Company”), which comprise the

Balance Sheet as at March 31, 2021, and the Statement of Profit and Loss (including Other Comprehensive Income), the Statement of Cash

Flows and the Statement of Changes in Equity for the year then ended, and a summary of significant accounting policies and other

explanatory information.

In our opinion and to the best of our information and according to the explanations given to us, the aforesaid standalone financial statements

give the information required by the Companies Act, 2013 (“the Act”) in the manner so required and give a true and fair view in conformity

with the Indian Accounting Standards prescribed under section 133 of the Act read with the Companies (Indian Accounting Standards) Rules,

2015, as amended, (“Ind AS”) and other accounting principles generally accepted in India, of the state of affairs of the Company as at March

31, 2021, and its profit , total comprehensive income, its cash flows and the changes in equity for the year ended on that date.

Basis for Opinion

We conducted our audit of the standalone financial statements in accordance with the Standards on Auditing specified under section 143(10)

of the Act (SAs). Our responsibilities under those Standards are further described in the Auditor’s Responsibility for the Audit of the

Standalone Financial Statements section of our report. We are independent of the Company in accordance with the Code of Ethics issued by

the Institute of Chartered Accountants of India (ICAI) together with the ethical requirements that are relevant to our audit of the standalone

financial statements under the provisions of the Act and the Rules made thereunder, and we have fulfilled our other ethical responsibilities in

accordance with these requirements and the ICAI’s Code of Ethics. We believe that the audit evidence obtained by us is sufficient and

appropriate to provide a basis for our audit opinion on the standalone financial statements.

Information Other than the Financial Statements and Auditor’s Report Thereon

The Company’s Board of Directors is responsible for the other information. The other information comprises the information included in the

Directors' report and Annexures thereof, but does not include the standalone financial statements and our auditor’s report thereon.

Our opinion on the standalone financial statements does not cover the other information and we do not express any form of assurance

conclusion thereon

In connection with our audit of the standalone financial statements, our responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent with the standalone financial statements or our knowledge obtained during

the course of our audit or otherwise appears to be materially misstated.

If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to

report that fact. We have nothing to report in this regard.

Management’s Responsibility for the Standalone Financial Statements

The Company's Board of Directors is responsible for the matters stated in section 134(5) of the Act with respect to the preparation of these

standalone financial statements that give a true and fair view of the financial position, financial performance including other comprehensive

income, cash flows and changes in equity of the Company in accordance with the Ind AS and other accounting principles generally accepted

in India. This responsibility also includes maintenance of adequate accounting records in accordance with the provisions of the Act for

safeguarding the assets of the Company and for preventing and detecting frauds and other irregularities; selection and application of

appropriate accounting policies; making judgments and estimates that are reasonable and prudent; and design, implementation and

maintenance of adequate internal financial controls, that were operating effectively for ensuring the accuracy and completeness of the

accounting records, relevant to the preparation and presentation of the standalone financial statement that give a true and fair view and are

free from material misstatement, whether due to fraud or error.

In preparing the standalone financial statements, management is responsible for assessing the Company’s ability to continue as a going

concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management

either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those Board of Directors are also responsible for overseeing the Company’s financial reporting process.

Auditor’s Responsibility for the Audit of the Standalone Financial Statements

Our objectives are to obtain reasonable assurance about whether the standalone financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of

assurance, but is not a guarantee that an audit conducted in accordance with SAs will always detect a material misstatement when it exists.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be

expected to influence the economic decisions of users taken on the basis of these standalone financial statements.

As part of an audit in accordance with SAs, we exercise professional judgment and maintain professional skepticism throughout the audit.

We also:

Identify and assess the risks of material misstatement of the standalone financial statements, whether due to fraud or error, design and

perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our

opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may

involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Obtain an understanding of internal financial control relevant to the audit in order to design audit procedures that are appropriate in the

circumstances. Under section 143(3)(i) of the Act, we are also responsible for expressing our opinion on whether the Company has adequate

internal financial controls system in place and the operating effectiveness of such controls.

Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the

management.

Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained,

whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a

going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related

disclosures in the standalone financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on

the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease to](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-56-320.jpg)

![61

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

[700700] Disclosures - Secretarial audit report

Details of signatories of secretarial audit report [Table] ..(1)

Unless otherwise specified, all monetary values are in Lakhs of INR

Signatories of secretarial audit report [Axis] 1

01/04/2020

to

31/03/2021

Details of signatories of secretarial audit report [Abstract]

Details of signatories of secretarial audit report [LineItems]

Category of secretarial auditor

Secretarial auditors

firm

Name of secretarial audit firm

P.PARIKH &

ASSOCIATES

Name of secretarial auditor signing report

PARTHIV

PRAVINBHAI

PARIKH

Firms registration number of secretarial audit firm F2692

Membership number of secretarial auditor 2692

Certificate of practice number of secretarial auditor 19200

Date of signing secretarial audit report 03/05/2021

Unless otherwise specified, all monetary values are in Lakhs of INR

01/04/2020

to

31/03/2021

Disclosure in secretarial audit report explanatory [TextBlock]

Textual information (36)

[See below]

Whether secretarial audit report is applicable on company Yes

Whether secretarial audit report has been qualified or has any

observation or other remarks

No](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-61-320.jpg)

![62

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Textual information (36)

Disclosure in secretarial audit report explanatory [Text Block]

Form No. MR-3

SECRETARIAL AUDIT REPORT

FOR THE FINANCIAL YEAR ENDED 31.03.2021

[Pursuant to section 204(1) of the Companies Act, 2013 and ruleNo.9 of

the Companies (Appointment and Remuneration of Managerial Personnel Rules, 2014]

To,

The Members,

ADANI LOGISTICS LIMITED

CIN : U63090GJ2005PLC046419

AHMEDABAD.

We have conducted the secretarial audit of the compliance of applicable statutory provisions and the adherence to good corporate practices

by ADANI LOGISTICS LIMITED, (CIN No :U63090GJ2005PLC046419) (hereinafter called the company). Secretarial Audit was

conducted in a manner that provided us a reasonable basis for evaluating the corporate conducts/statutory compliances and expressing our

opinion thereon.

Based on our verification of books, papers, minute books, forms and returns filed and other records maintained by the Company and also the

information provided by the Company, its officers, agents and authorized representatives during the conduct of secretarial audit, we hereby

report that in our opinion, the Company has, during the audit period covering the financial year ended on 31st March, 2021, complied with

the statutory provisions listed hereunder and also that the Company has proper Board-processes and compliance-mechanism in place to the

extent, in the manner and subject to the reporting made hereinafter:

We have examined the books, papers, minute books, forms and returns filed and other records maintained by the Company for the financial

year ended on 31st March, 2021 according to the provisions of:

The Companies Act, 2013 (the Act) and the rules made thereunder;

The Securities Contracts (Regulation) Act, 1956 (‘SCRA’) and the rules made thereunder:

The Depositories Act, 1996 and the Regulations and Bye-laws framed thereunder;

Foreign Exchange Management Act, 1999 and the rules and regulations made thereunder to the extent of Foreign Direct Investment,

Overseas Direct Investment and External Commercial Borrowings;

The following Regulations and Guidelines prescribed under the Securities and Exchange Board of India Act, 1992 (‘SEBI Act’);

The Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011;

The Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015: Not applicable as the company is an unlisted

Company;

The Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009 (upto November 10, 2018)

and Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018 (w.e.f. November 11, 2018):

Not applicable as the company is an unlisted Company;

Securities and Exchange Board of India (Share Based Employee Benefits) Regulations, 2014: Not applicable as the company is an unlisted

Company;

The Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008: Not applicable as the company is an

unlisted Company;

The Securities and Exchange Board of India (Registrars to an Issue and Share Transfer Agents) Regulations, 1993 regarding the Companies

Act and dealing with client: Not applicable as the company is an unlisted Company;

The Securities and Exchange Board of India (Delisting of Equity Shares) Regulations, 2009: Not applicable as the company is an unlisted

Company;

The Securities and Exchange Board of India (Buyback of Securities) Regulations, 1998 (up to September 10, 2018) and The Securities and

Exchange Board of India (Buyback of Securities) Regulations 2018 (w.e.f. September 11, 2018) : Not applicable as the company is an

unlisted Company; and

The Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015: Not applicable as the

company is an unlisted Company.

Laws specifically applicable to the industry to which the company belongs, as identified by the management, that is to say: -

The Indian Railway Act, 1989

The Punjab Shops and Establishment Act, 1958

The Contract Labour Regulation and Abolition Act, 1970](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-62-320.jpg)

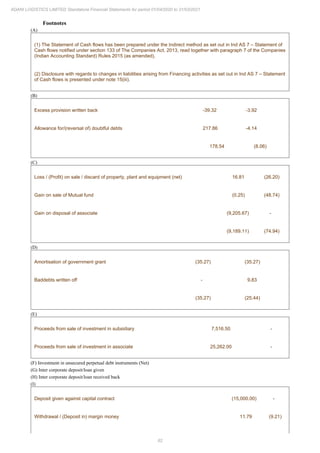

![64

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

[110000] Balance sheet

Unless otherwise specified, all monetary values are in Lakhs of INR

31/03/2021 31/03/2020 31/03/2019

Balance sheet [Abstract]

Assets [Abstract]

Non-current assets [Abstract]

Property, plant and equipment (A) 1,04,212.07

97,799.67 58,124.78

Capital work-in-progress (B) 17,129.41

8,110.25

Other intangible assets 1,813.16 2,145.52 2,450.31

Non-current financial assets [Abstract]

Non-current investments 4,08,737.48 2,81,158.56

Loans, non-current 6,097.63 16,870.2

Other non-current financial assets 88,389.35 101.91

Total non-current financial assets 5,03,224.46 2,98,130.67

Other non-current assets 10,761.36 12,772.85

Total non-current assets 6,37,140.46 4,18,958.96

Current assets [Abstract]

Inventories 564.41 549.69

Current financial assets [Abstract]

Current investments 0 0

Trade receivables, current 10,308.09 13,635.22

Cash and cash equivalents 450.28 1,016.39

Bank balance other than cash and cash equivalents (C) 102.51

12.39

Loans, current 5,125.46 49,500

Other current financial assets 1,239.77 20,143.57

Total current financial assets 17,226.11 84,307.57

Other current assets 5,166.89 3,736.34

Total current assets 22,957.41 88,593.6

Total assets 6,60,097.87 5,07,552.56

Equity and liabilities [Abstract]

Equity [Abstract]

Equity attributable to owners of parent [Abstract]

Equity share capital 65,500 65,500 32,500

Other equity 5,46,806.77 3,57,755.54

Total equity attributable to owners of parent 6,12,306.77 4,23,255.54

Non controlling interest 0 0

Total equity 6,12,306.77 4,23,255.54

Liabilities [Abstract]

Non-current liabilities [Abstract]

Non-current financial liabilities [Abstract]

Borrowings, non-current 0 23,182.36

Other non-current financial liabilities (D) 33,895.13

28,605.19

Total non-current financial liabilities 33,895.13 51,787.55

Provisions, non-current 256.18 0

Deferred tax liabilities (net) 2,149.44 2,676.16

Deferred government grants, Non-current (E) 18.36

53.63

Total non-current liabilities 36,319.11 54,517.34

Current liabilities [Abstract]

Current financial liabilities [Abstract]

Borrowings, current 0 12,850

Trade payables, current (F) 4,546.43

5,686.5

Other current financial liabilities 5,516.98 8,353.11

Total current financial liabilities 10,063.41 26,889.61

Other current liabilities 1,141.44 1,667.23

Provisions, current 231.87 340.41

Current tax liabilities 0 847.16

Deferred government grants, Current (G) 35.27

35.27

Total current liabilities 11,471.99 29,779.68

Total liabilities 47,791.1 84,297.02

Total equity and liabilities 6,60,097.87 5,07,552.56](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-64-320.jpg)

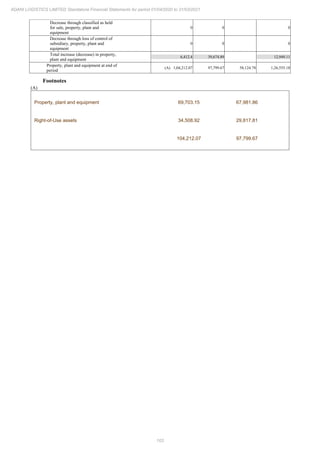

![69

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

[210000] Statement of profit and loss

Earnings per share [Table] ..(1)

Unless otherwise specified, all monetary values are in Lakhs of INR

Classes of equity share capital [Axis] Equity shares [Member] Equity shares 1 [Member]

01/04/2020

to

31/03/2021

01/04/2019

to

31/03/2020

01/04/2020

to

31/03/2021

01/04/2019

to

31/03/2020

Statement of profit and loss [Abstract]

Earnings per share [Abstract]

Earnings per share [Line items]

Basic earnings per share [Abstract]

Basic earnings (loss) per share from

continuing operations

[INR/shares] 1.69 [INR/shares] 2.22 [INR/shares] 1.69 [INR/shares] 2.22

Total basic earnings (loss) per share [INR/shares] 1.69 [INR/shares] 2.22 [INR/shares] 1.69 [INR/shares] 2.22

Diluted earnings per share [Abstract]

Diluted earnings (loss) per share from

continuing operations

[INR/shares] 1.69 [INR/shares] 2.22 [INR/shares] 1.69 [INR/shares] 2.22

Total diluted earnings (loss) per share [INR/shares] 1.69 [INR/shares] 2.22 [INR/shares] 1.69 [INR/shares] 2.22](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-69-320.jpg)

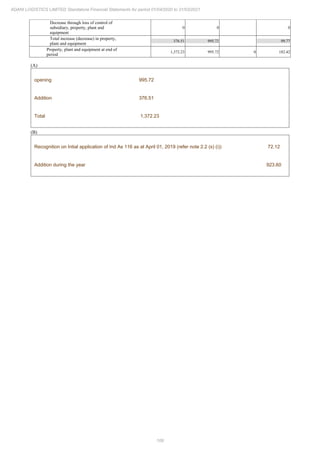

![70

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Unless otherwise specified, all monetary values are in Lakhs of INR

01/04/2020

to

31/03/2021

01/04/2019

to

31/03/2020

Statement of profit and loss [Abstract]

Income [Abstract]

Revenue from operations 65,548.53 73,819.67

Other income 15,261.48 7,383.92

Total income 80,810.01 81,203.59

Expenses [Abstract]

Cost of materials consumed 0 0

Changes in inventories of finished goods, work-in-progress and

stock-in-trade

0 0

Employee benefit expense 3,150.27 2,428.6

Finance costs 3,676.89 5,837.79

Depreciation, depletion and amortisation expense 6,899.78 5,734.55

Other expenses (A) 53,360.77

51,505.59

Total expenses 67,087.71 65,506.53

Profit before exceptional items and tax 13,722.3 15,697.06

Total profit before tax 13,722.3 15,697.06

Tax expense [Abstract]

Current tax 1,587.18 4,159.04

Deferred tax 1,068.73 -456.06

Total tax expense 2,655.91 3,702.98

Total profit (loss) for period from continuing operations 11,066.39 11,994.08

Tax expense of discontinued operations 0 0

Total profit (loss) from discontinued operations after tax 0 0

Total profit (loss) for period 11,066.39 11,994.08

Comprehensive income OCI components presented net of tax [Abstract]

Whether company has other comprehensive income OCI components

presented net of tax

No No

Other comprehensive income net of tax [Abstract]

Total other comprehensive income -2,044.67 6.96

Total comprehensive income 9,021.72 12,001.04

Comprehensive income OCI components presented before tax [Abstract]

Whether company has comprehensive income OCI components presented

before tax

Yes Yes

Other comprehensive income before tax [Abstract]

Components of other comprehensive income that will not be

reclassified to profit or loss, before tax [Abstract]

Other comprehensive income, before tax, gains (losses) on

remeasurements of defined benefit plans

-62.57 9.3

Other comprehensive income that will not be reclassified to

profit or loss, before tax, others

-3,577.54 0

Other comprehensive income that will not be reclassified to

profit or loss, before tax

-3,640.11 9.3

Components of other comprehensive income that will be

reclassified to profit or loss, before tax [Abstract]

Exchange differences on translation before tax [Abstract]

Total other comprehensive income, before tax, exchange

differences on translation

0 0

Debt instrument through other comprehensive income before tax

[Abstract]

Other comprehensive income, before tax, Debt instrument

through other comprehensive income

0 0

Cash flow hedges before tax [Abstract]

Total other comprehensive income, before tax, cash flow hedges 0 0

Hedges of net investments in foreign operations before tax

[Abstract]

Total other comprehensive income, before tax, hedges of net

investments in foreign operations

0 0

Change in value of time value of options before tax [Abstract]

Total other comprehensive income, before tax, change in

value of time value of options

0 0

Change in value of forward elements of forward contracts before

tax [Abstract]

Total other comprehensive income, before tax, change in

value of forward elements of forward contracts

0 0

Change in value of foreign currency basis spreads before tax

[Abstract]

Total other comprehensive income, before tax, change in

value of foreign currency basis spreads

0 0](https://image.slidesharecdn.com/adanilogistics2021annualreport-230110033041-d9cea45e/85/Adani-Logistics-2021-Annual-Report-pdf-70-320.jpg)

![71

ADANI LOGISTICS LIMITED Standalone Financial Statements for period 01/04/2020 to 31/03/2021

Other comprehensive income, before tax, net

movement in regulatory deferral account balances

related to items that will be reclassified to

profit or loss [Abstract]

Total other comprehensive income, before tax,

net movement in regulatory deferral account

balances related to items that will be

reclassified to profit or loss

0 0

Financial assets measured at fair value through other

comprehensive income before tax [Abstract]

Total other comprehensive income, before tax,

financial assets measured at fair value through other

comprehensive income

0 0

Other comprehensive income that will be reclassified to profit

or loss, before tax, others

0 0

Total other comprehensive income that will be reclassified to

profit or loss, before tax

0 0

Total other comprehensive income, before tax -3,640.11 9.3

Income tax relating to components of other comprehensive

income that will not be reclassified to profit or loss

[Abstract]

Income tax relating to remeasurements of defined benefit plans

of other comprehensive income

-15.75 2.34

Others income tax relating to components of other

comprehensive income that will not be reclassified to

profit or loss

-1,579.69 0

Aggregated income tax relating to components of other

comprehensive income that will not be reclassified to

profit or loss

-1,595.44 2.34

Income tax relating to components of other comprehensive

income that will be reclassified to profit or loss [Abstract]

Aggregated income tax relating to components of other

comprehensive income that will be reclassified to profit

or loss

0 0

Total other comprehensive income -2,044.67 6.96

Total comprehensive income 9,021.72 12,001.04

Earnings per share explanatory [TextBlock]

Earnings per share [Abstract]

Basic earnings per share [Abstract]

Basic earnings (loss) per share from continuing operations [INR/shares] 1.69 [INR/shares] 2.22

Total basic earnings (loss) per share [INR/shares] 1.69 [INR/shares] 2.22

Diluted earnings per share [Abstract]

Diluted earnings (loss) per share from continuing operations [INR/shares] 1.69 [INR/shares] 2.22

Total diluted earnings (loss) per share [INR/shares] 1.69 [INR/shares] 2.22

Footnotes

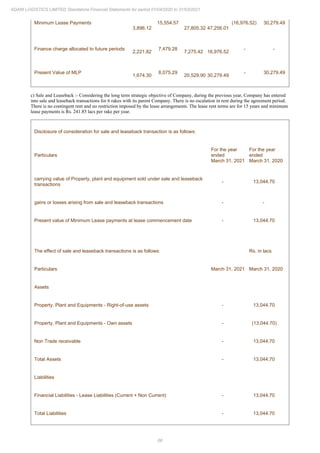

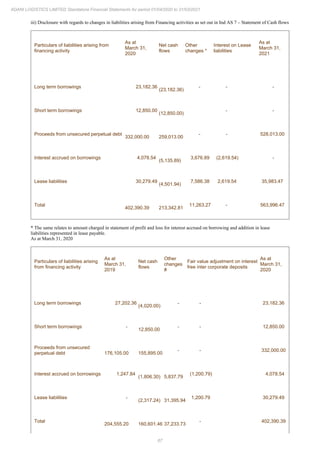

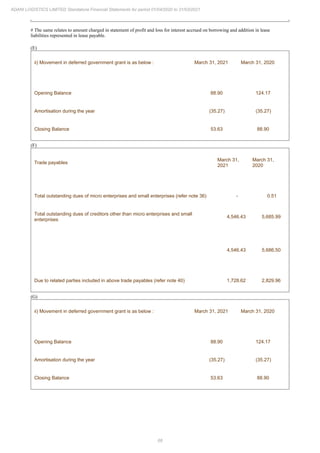

(A)