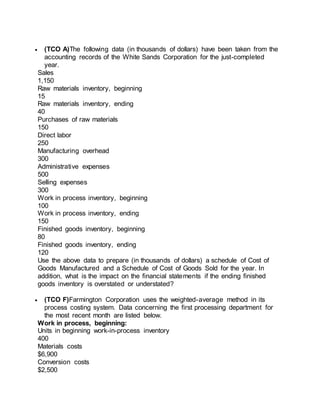

The document contains details about the ACCT 505 final exam with multiple questions covering various topics in accounting, such as calculating return on investment (ROI), breakeven sales, making-or-buying analysis, cash budgets, and income statement preparation using both absorption and variable costing methods. It includes specific scenarios involving different companies and the accounting decisions they must make based on provided financial data. The information is structured around exam questions with corresponding tasks and points for completion, indicating a comprehensive assessment of accounting knowledge.