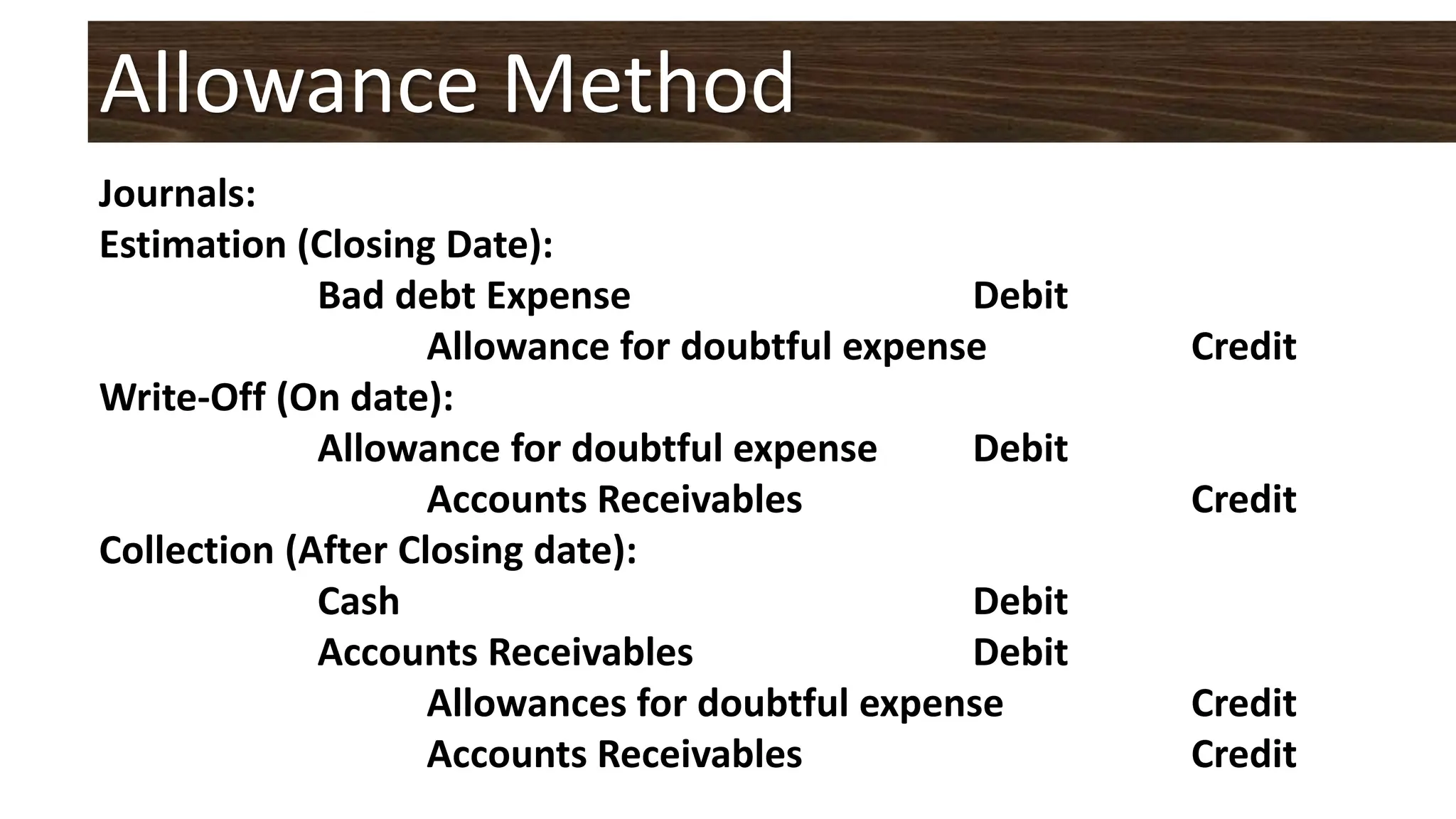

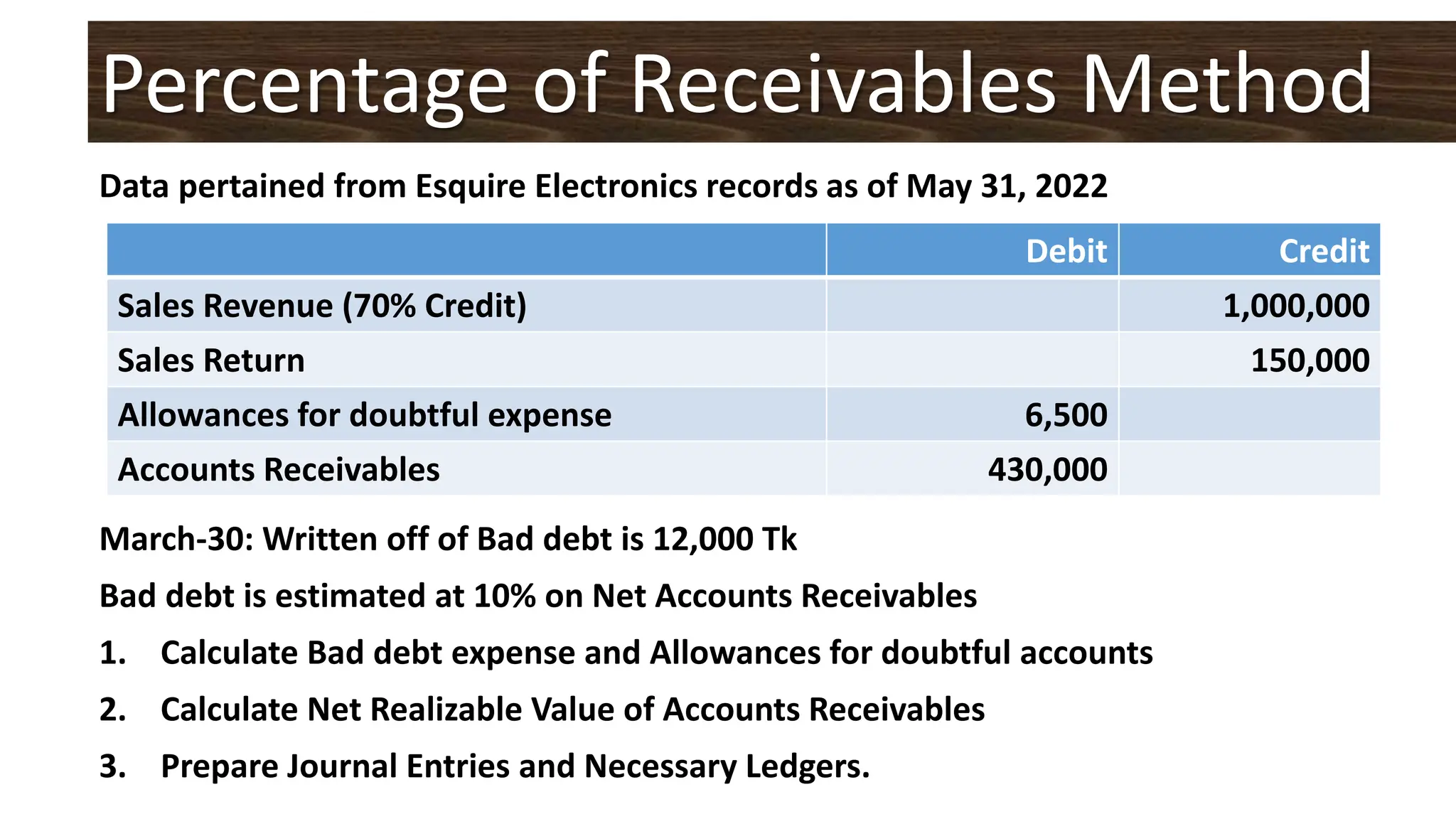

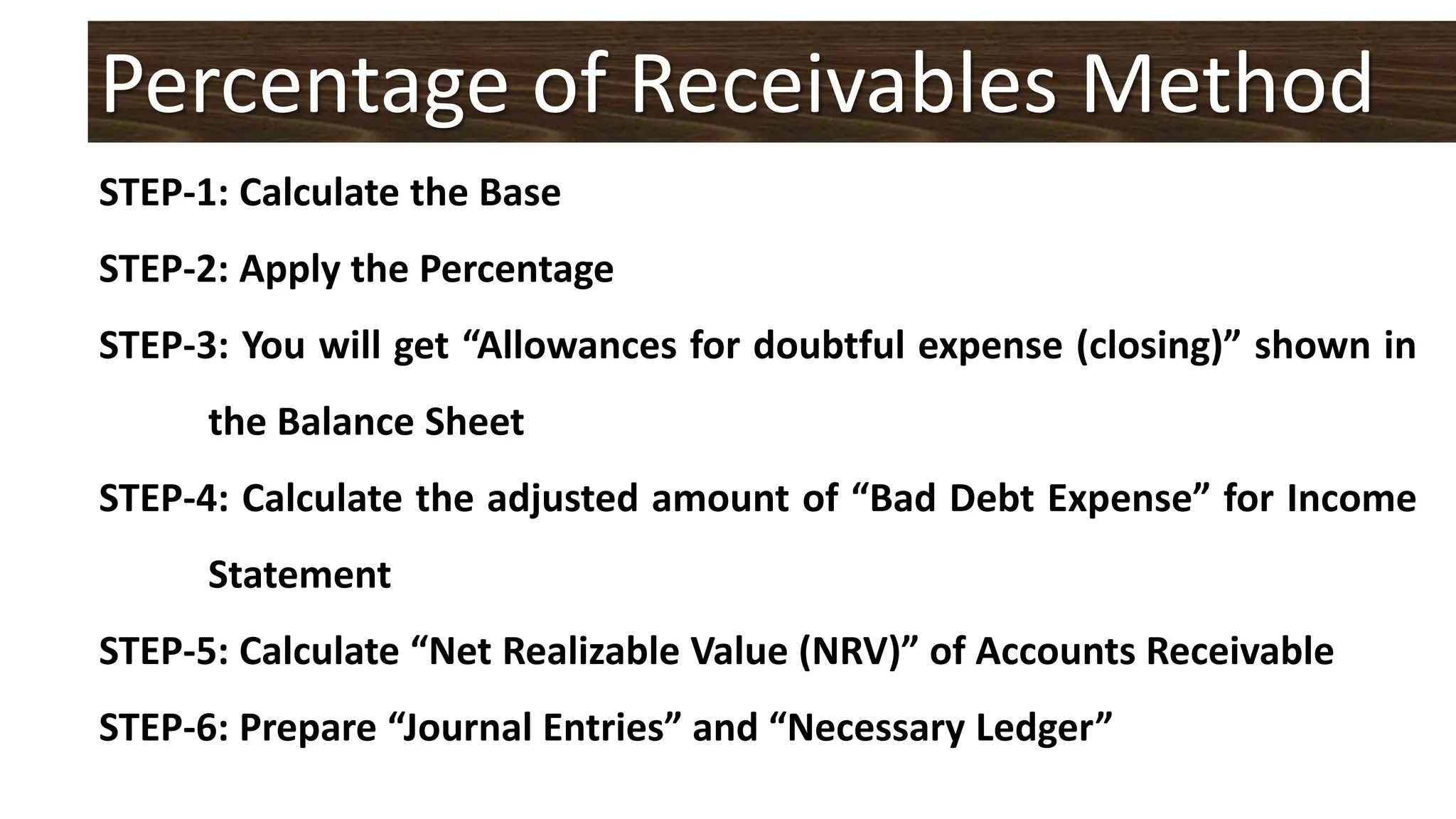

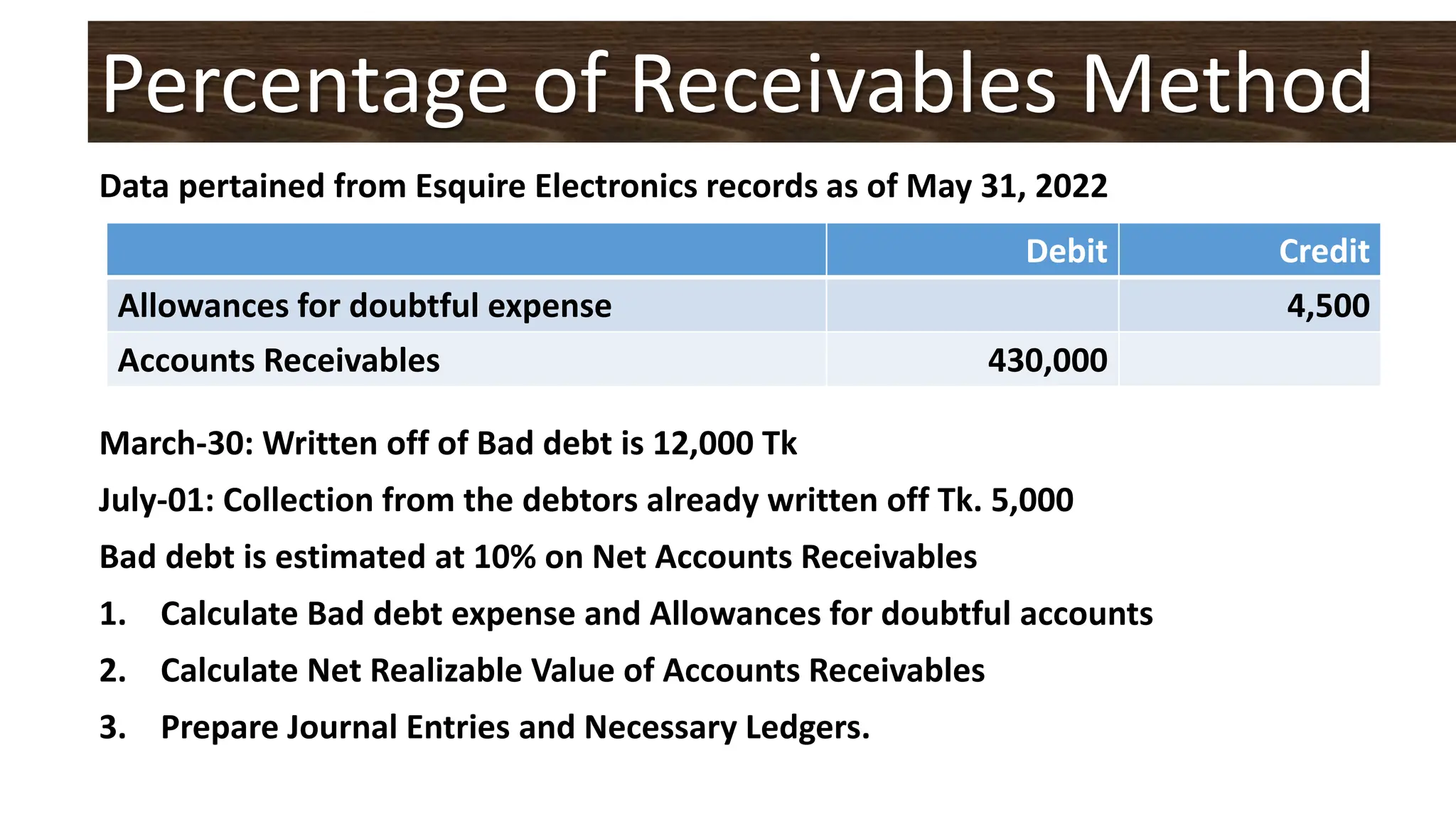

This document discusses accounting for receivables including valuation techniques like the direct write-off method and allowance method. The allowance method estimates uncollectible amounts and records an allowance account rather than directly writing off receivables. The document also describes calculating the allowance using the percentage of sales method, which bases bad debt expense on net credit sales, and the percentage of receivables method, which bases the allowance on net accounts receivable. Sample journal entries are provided for recording estimated allowances, write-offs, and collections under each method.