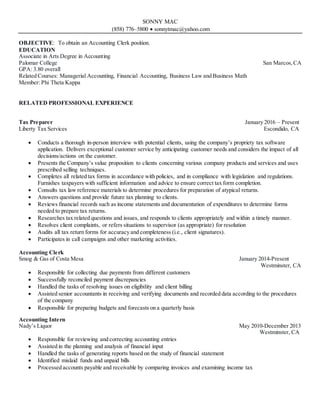

Sonny Mac is seeking an Accounting Clerk position. He has over 15 years of experience in accounting, sales, and tax preparation. He has an Associate's Degree in Accounting from Palomar College with a 3.8 GPA. His most recent experience is as a Tax Preparer at Liberty Tax Services where he prepares tax returns and provides customer service.