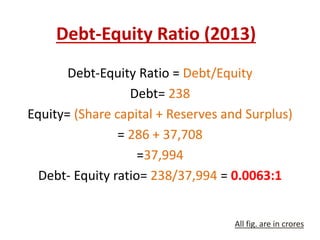

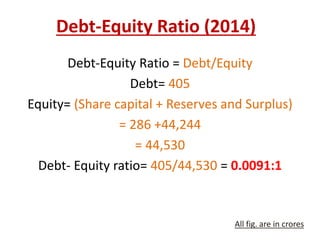

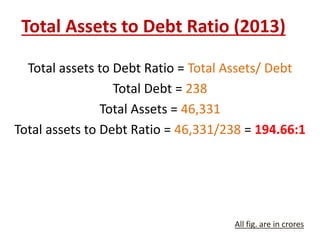

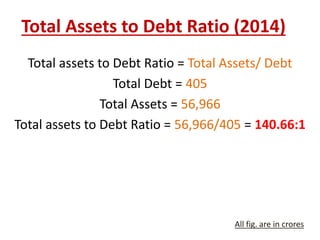

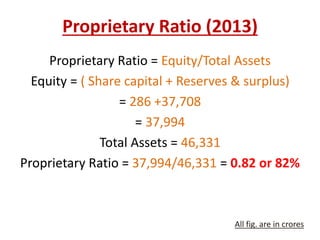

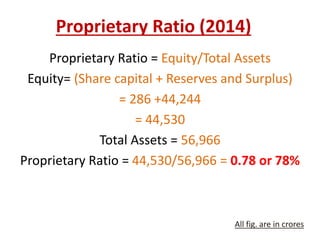

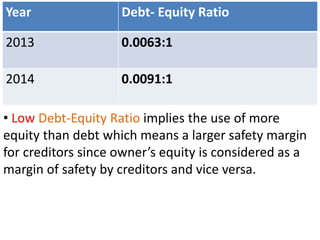

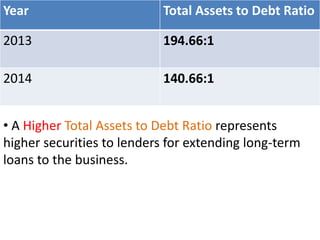

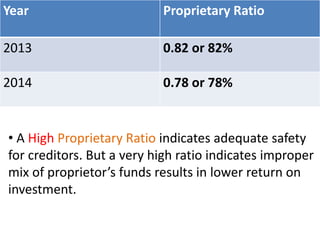

This document analyzes various solvency ratios for Infosys, including debt-equity ratio, total assets to debt ratio, and proprietary ratio for 2013 and 2014. The debt-equity ratio was low for both years, implying more equity financing. The total assets to debt ratio was high for both years, representing higher security for lenders. The proprietary ratio was high but declined slightly, indicating adequate safety for creditors. The document concludes the ratios show Infosys has a strong financial position and safety margins.