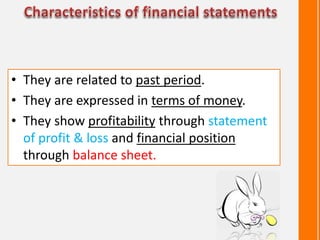

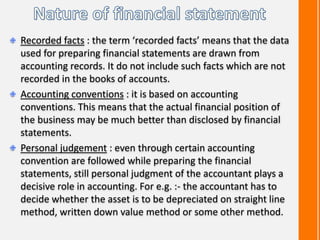

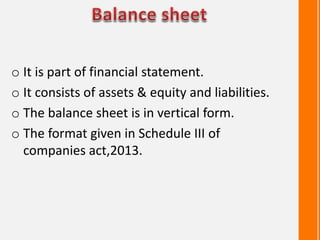

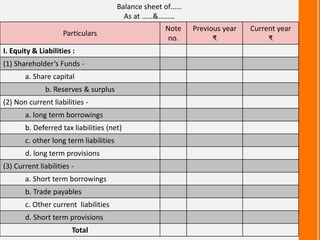

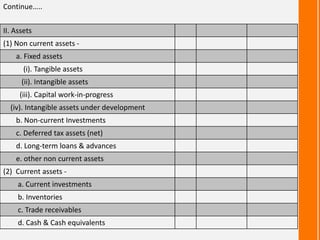

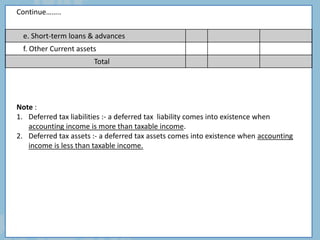

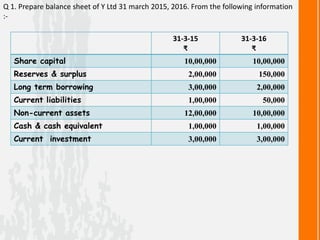

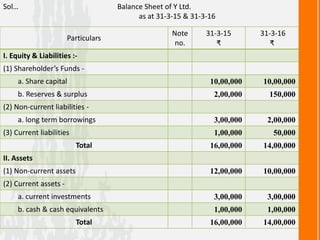

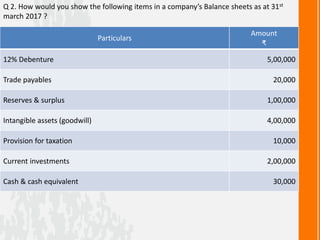

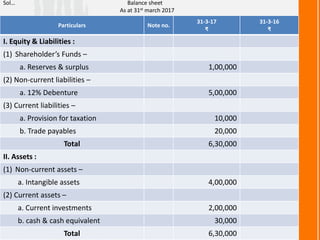

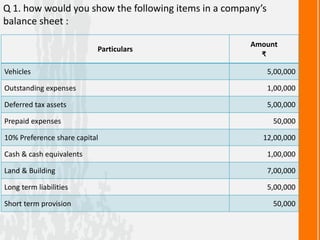

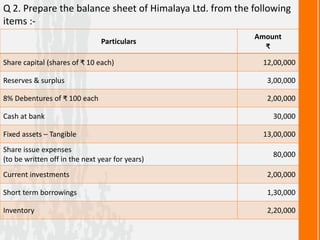

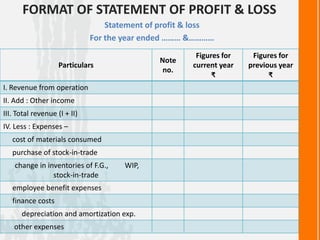

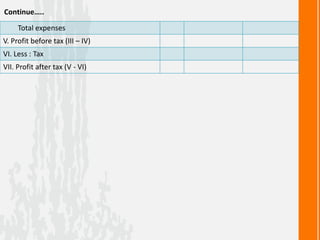

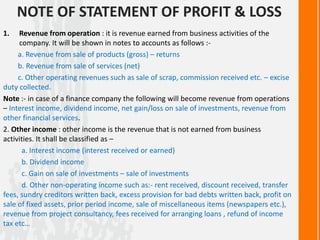

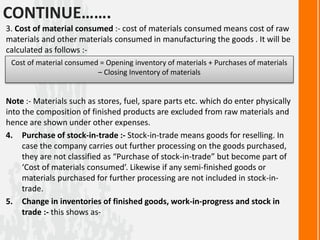

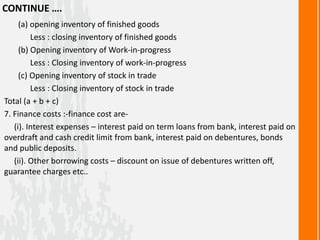

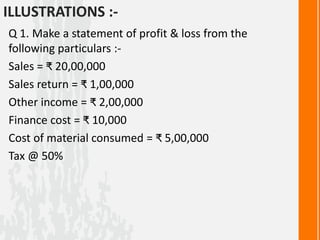

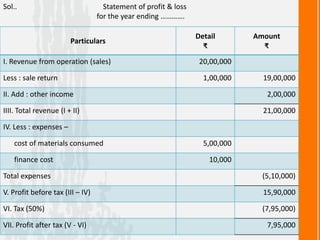

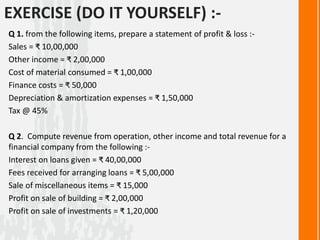

The document is a project report on financial statements prepared by a student, expressing gratitude to their mentor and parents for support. It covers key concepts such as the meaning, objectives, characteristics, and nature of financial statements, including detailed formats for the balance sheet and statement of profit & loss as per the Companies Act, 2013. Additionally, it includes illustrations and exercises to aid understanding of these financial statements.