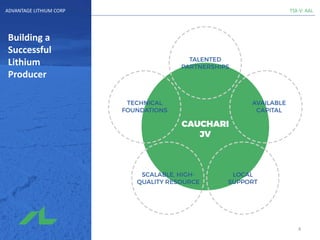

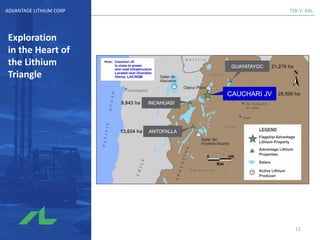

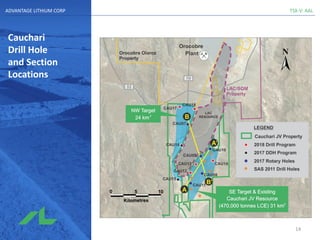

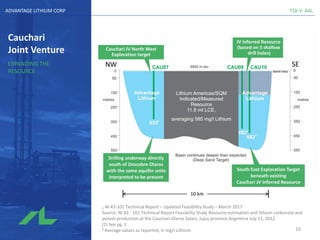

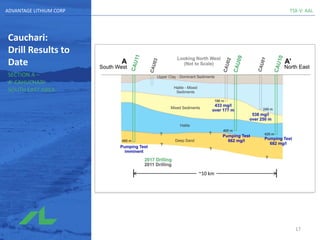

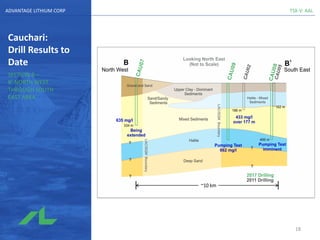

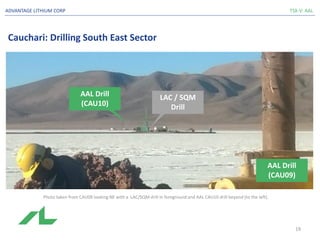

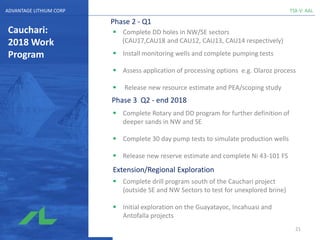

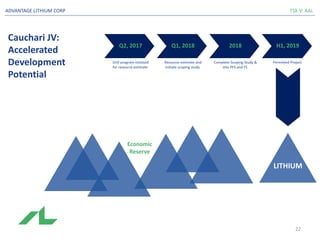

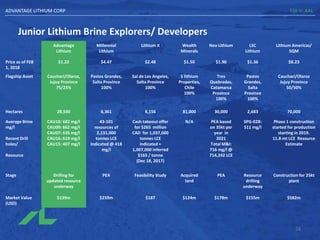

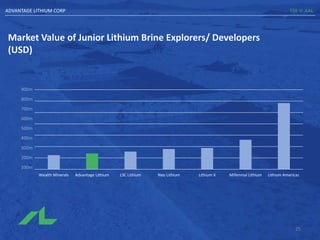

Advantage Lithium is exploring its Cauchari lithium project located in Jujuy Province, Argentina. Drilling in the project's southeast sector has returned high lithium grades, including 682 mg/l from one hole. Additional drilling is aimed at expanding the existing resource in the northwest and southeast areas. A resource estimate and scoping study are planned for early 2018 to evaluate development options for the project. Advantage holds a 75% interest in the Cauchari project through a joint venture with project neighbor Orocobre.