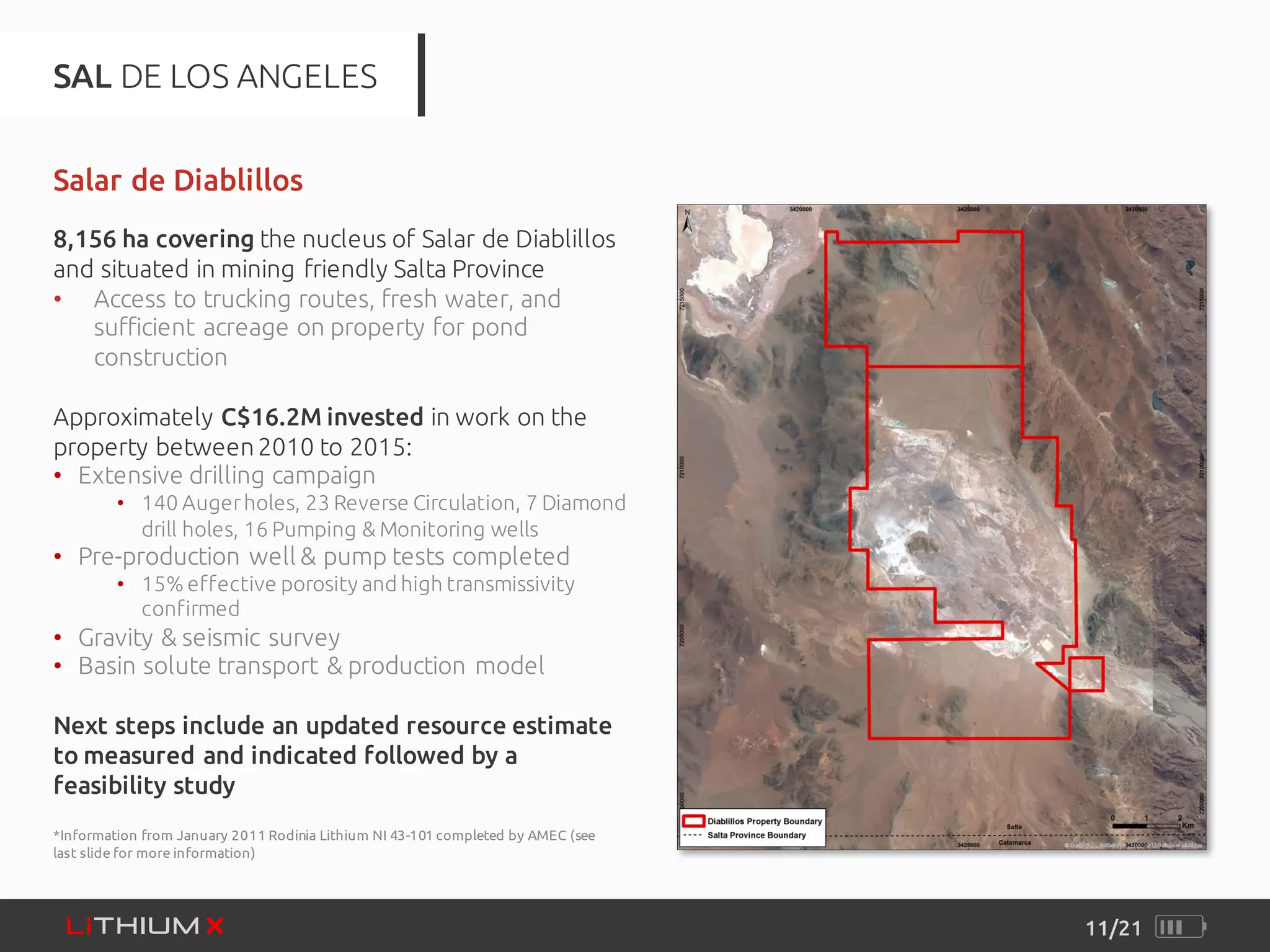

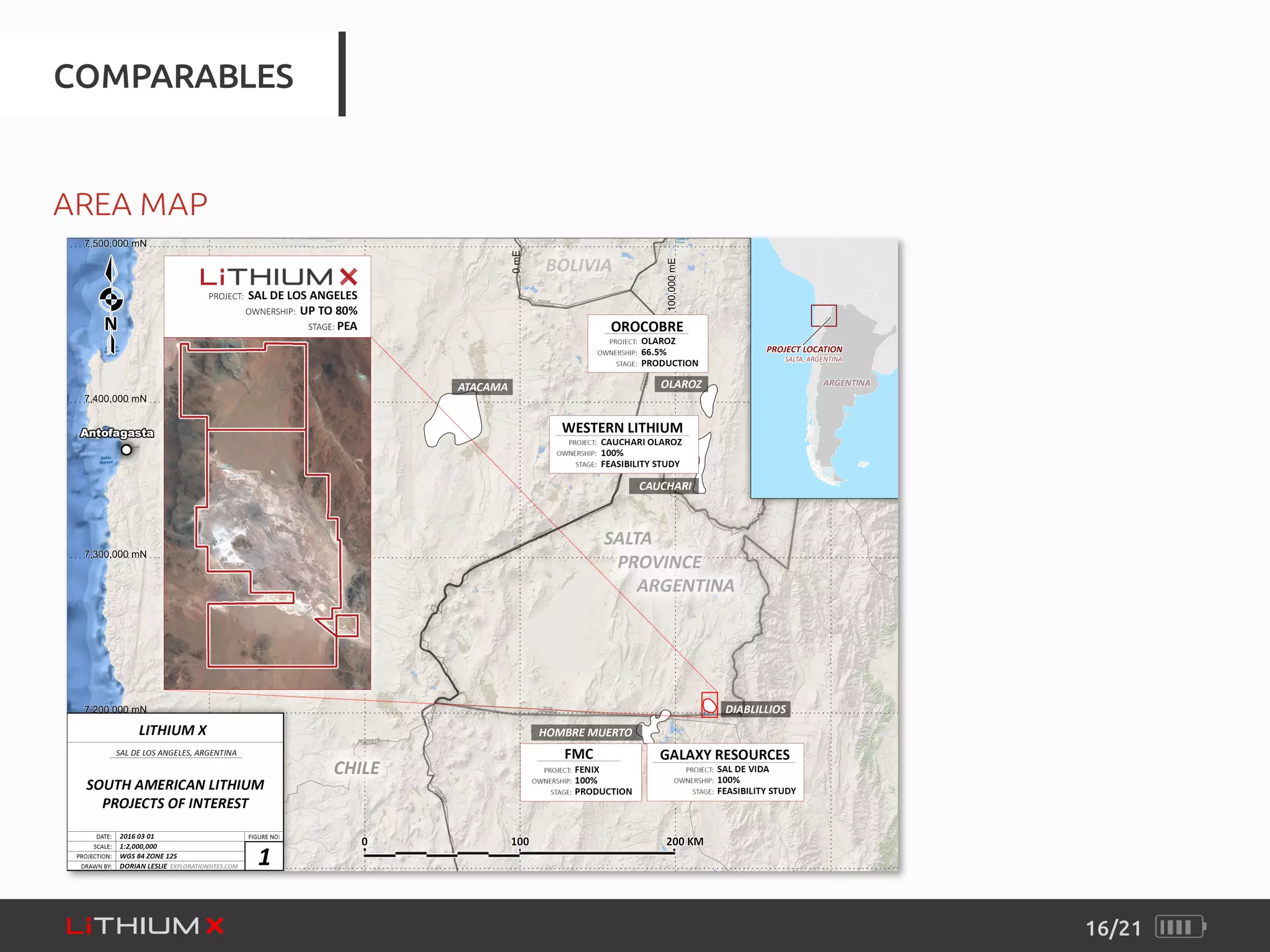

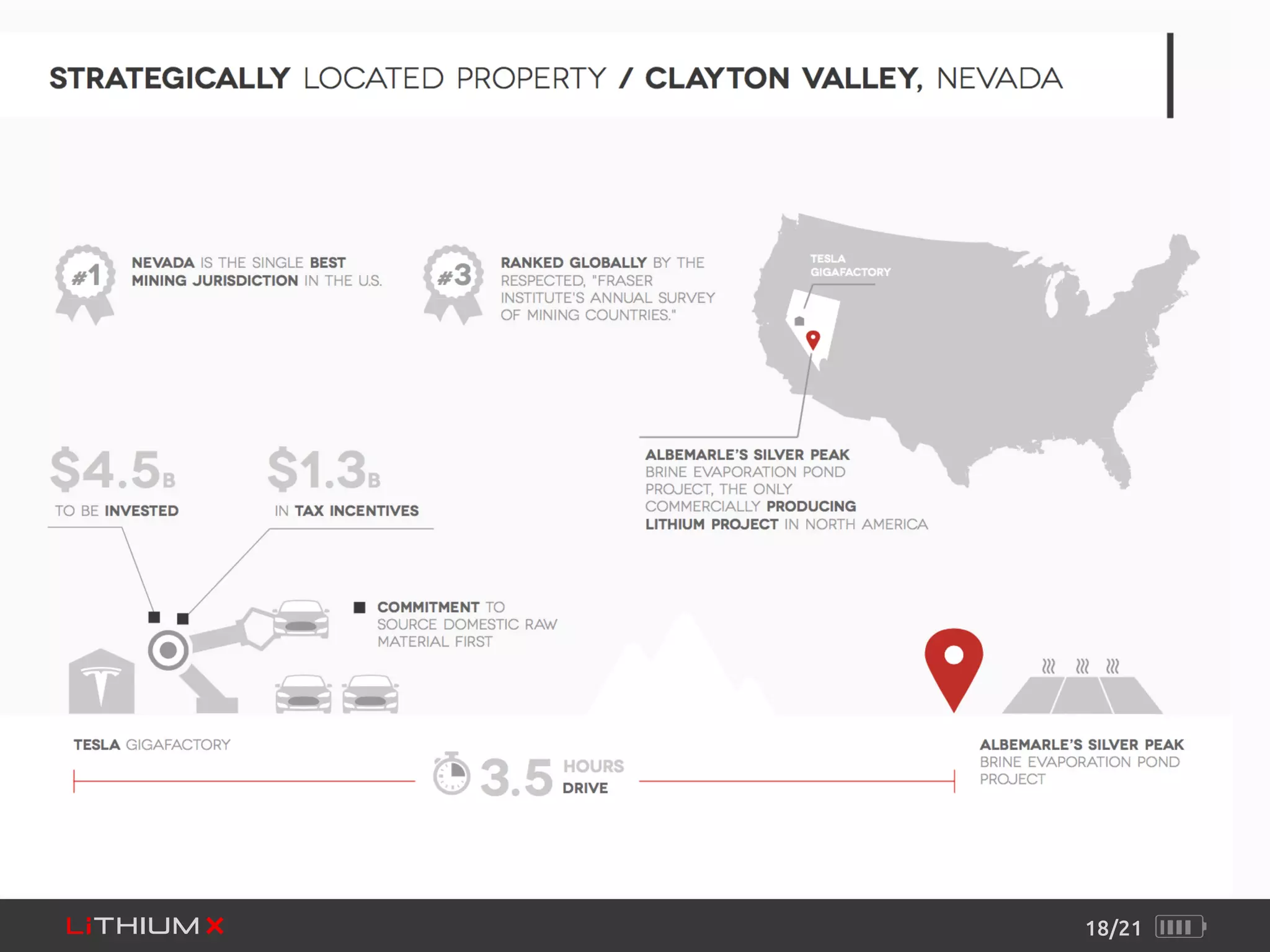

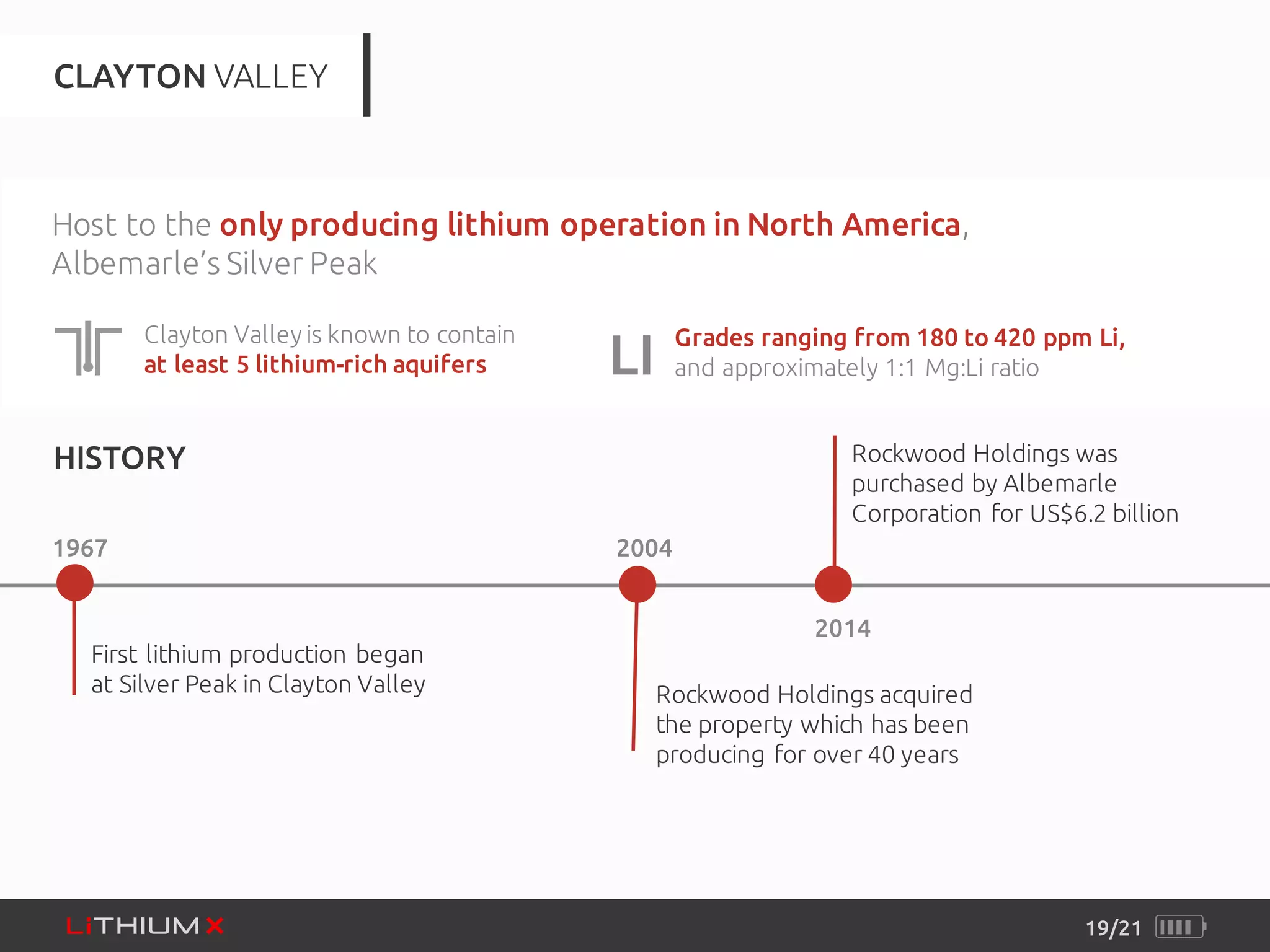

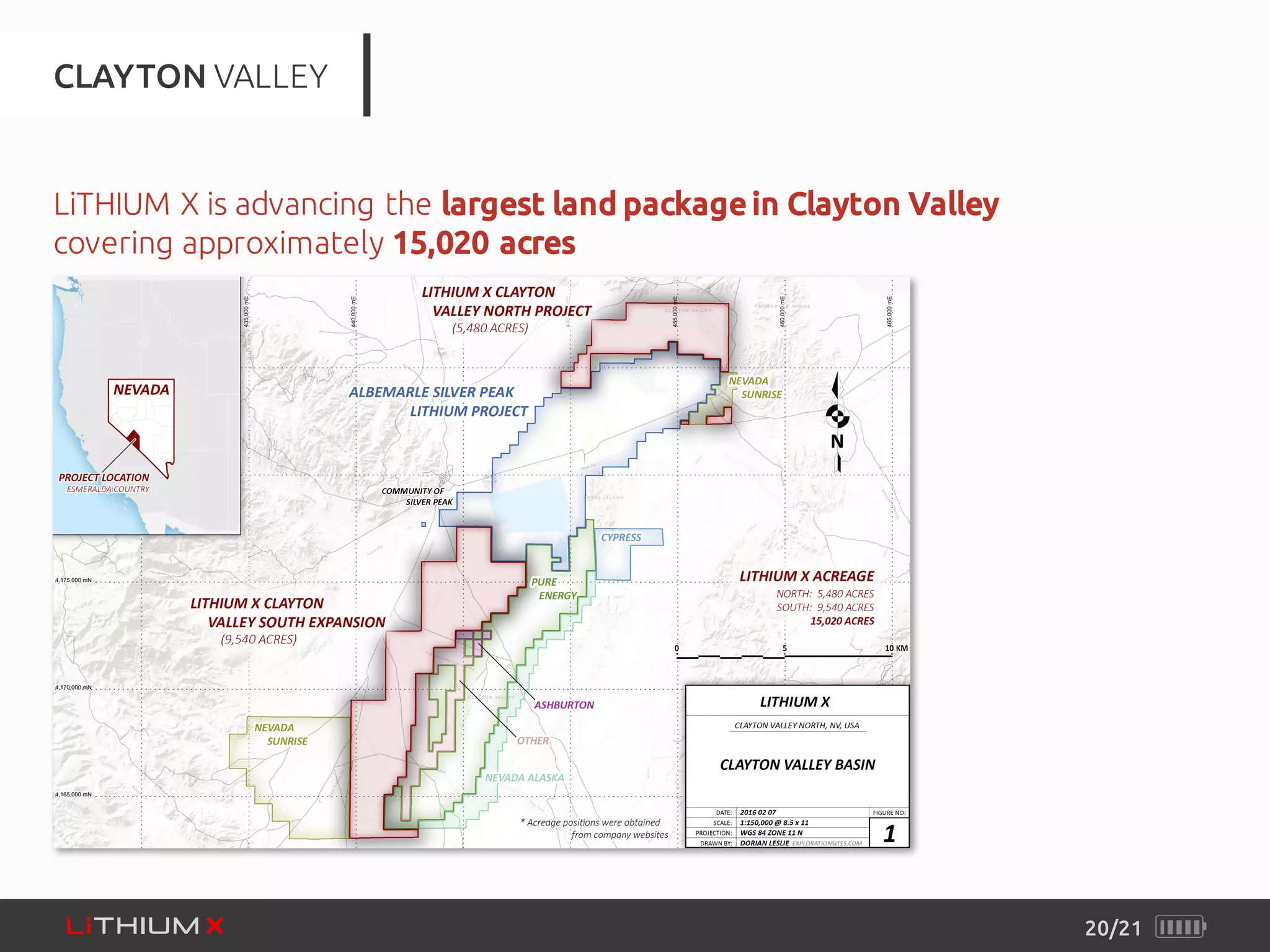

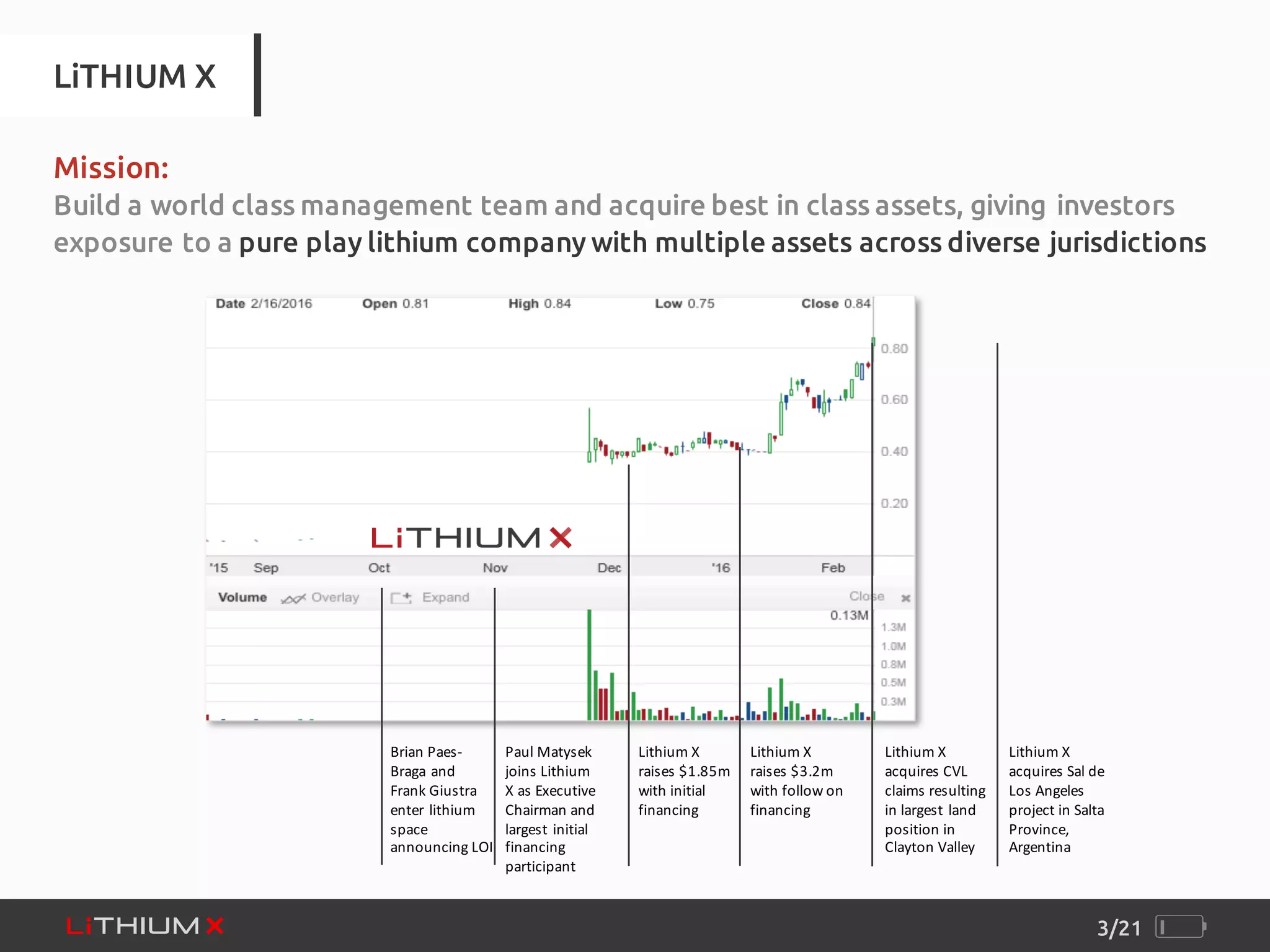

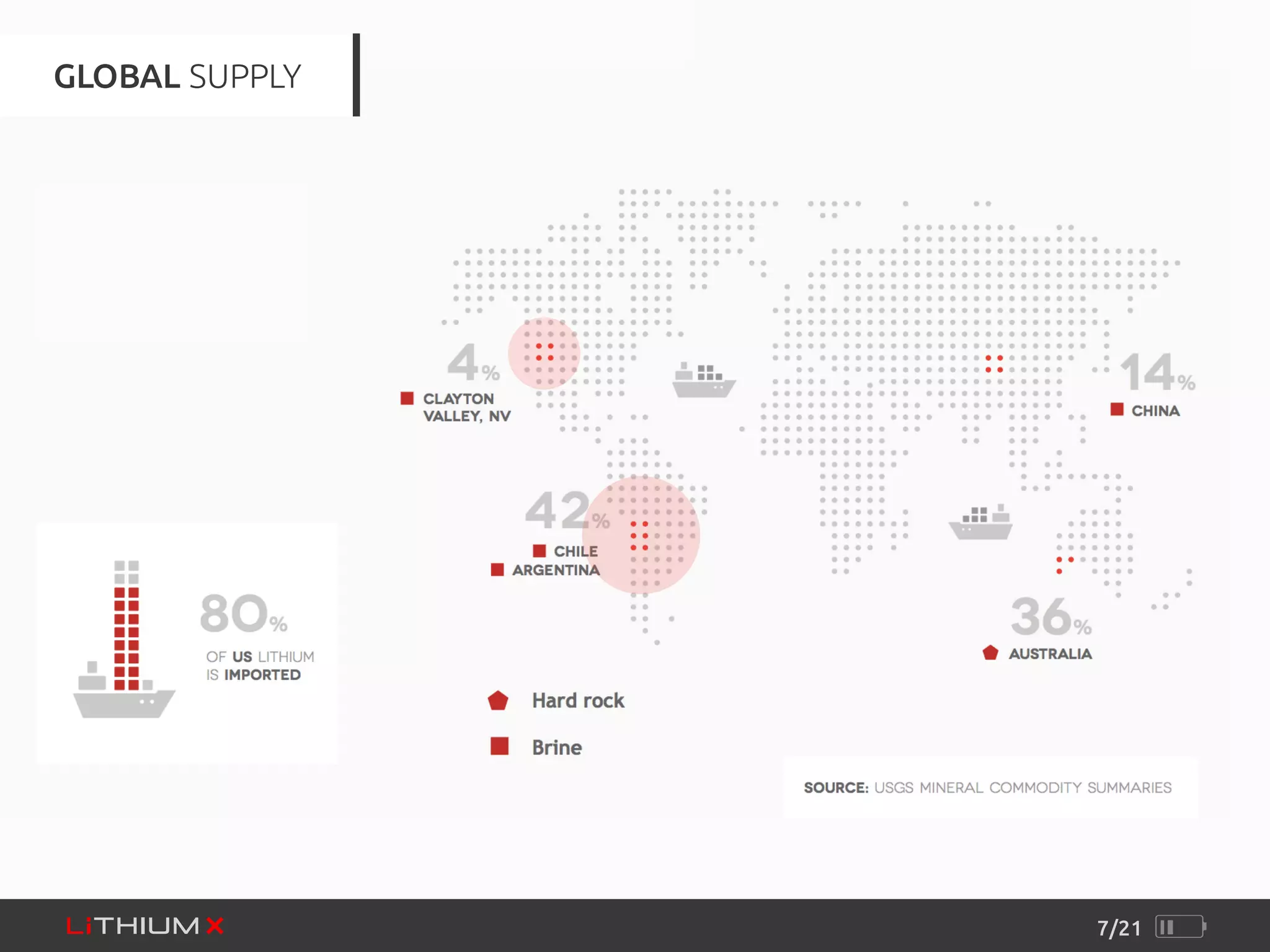

The document outlines forward-looking statements regarding Lithium X, highlighting factors that could impact its future performance, including global economic conditions and lithium prices. The company aims to build a world-class management team and acquire prime lithium assets, positioning itself for growth amid increasing demand for lithium due to the energy storage revolution. It details its two main projects—Sal de los Angeles in Argentina and a significant land holding in Clayton Valley, Nevada—while emphasizing the expertise of its management team and potential for profitability with updated resource estimates.

![8/21

“Pricesof lithium carbonate have jumped about 250

percent in China in the past year” [160,000 Yuan / ton

or US$24,600]](https://image.slidesharecdn.com/lithium-xcorporatepresentation-160316204207/75/LiTHIUM-X-Corporate-Presentation-8-2048.jpg)