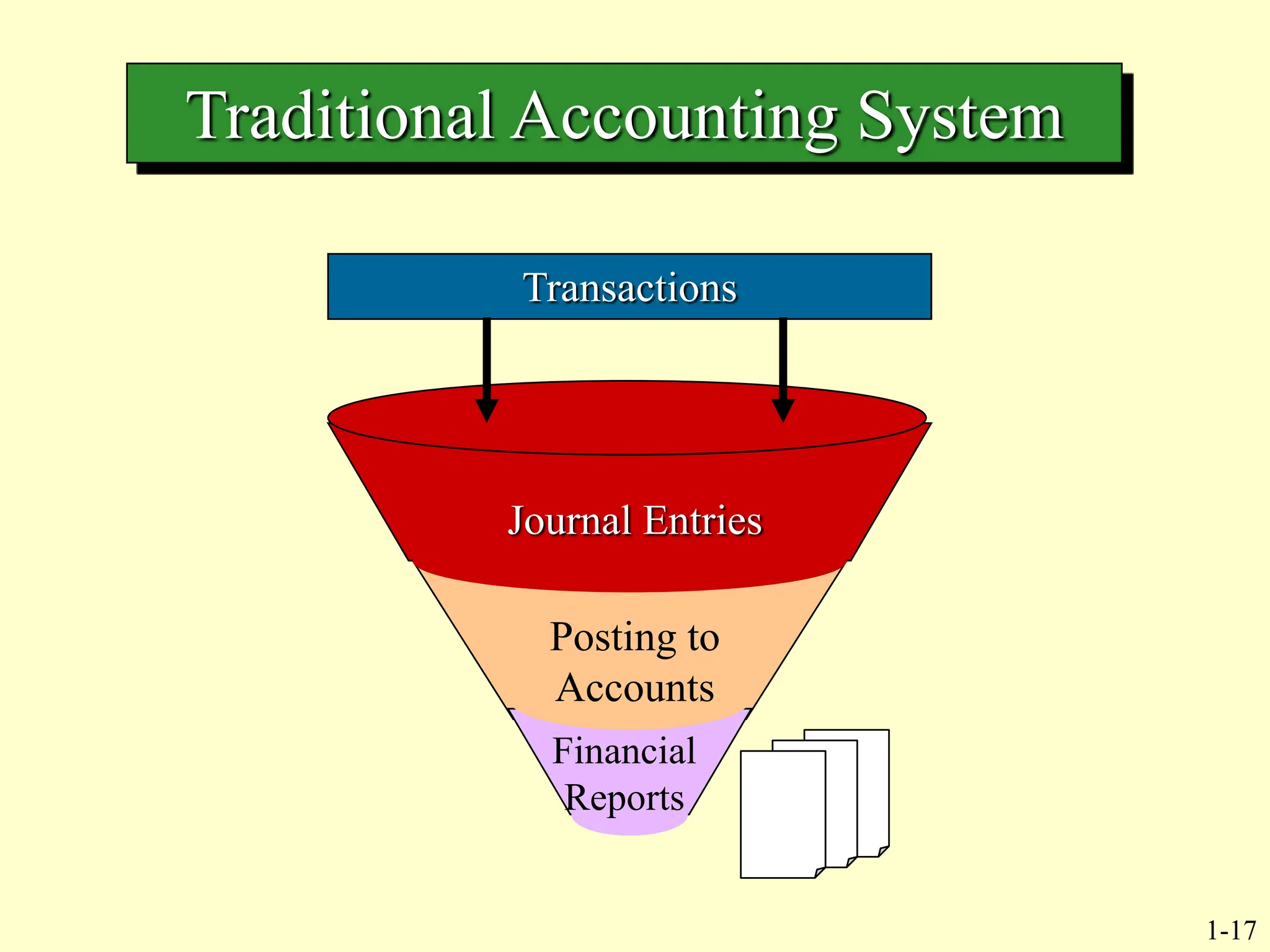

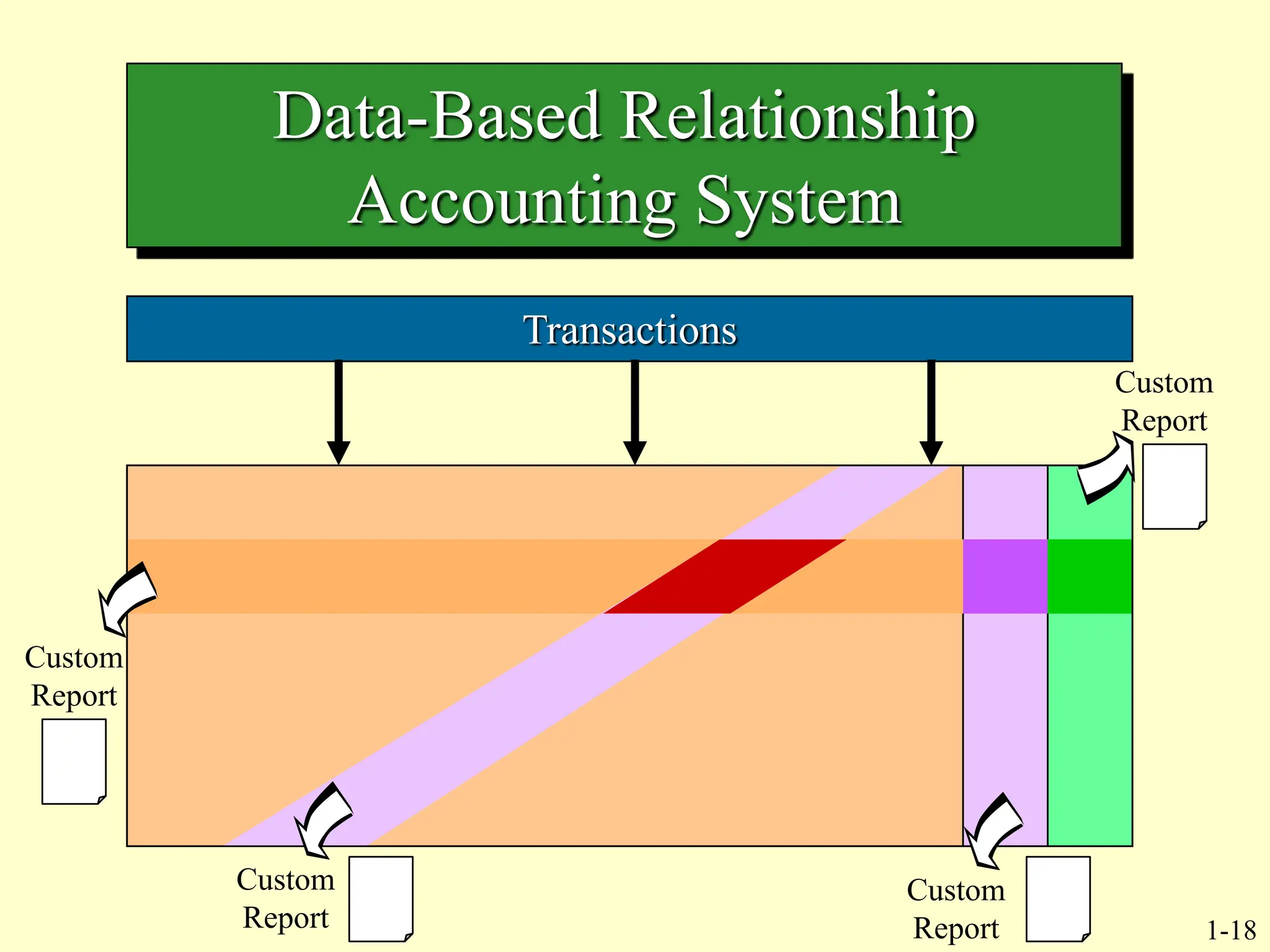

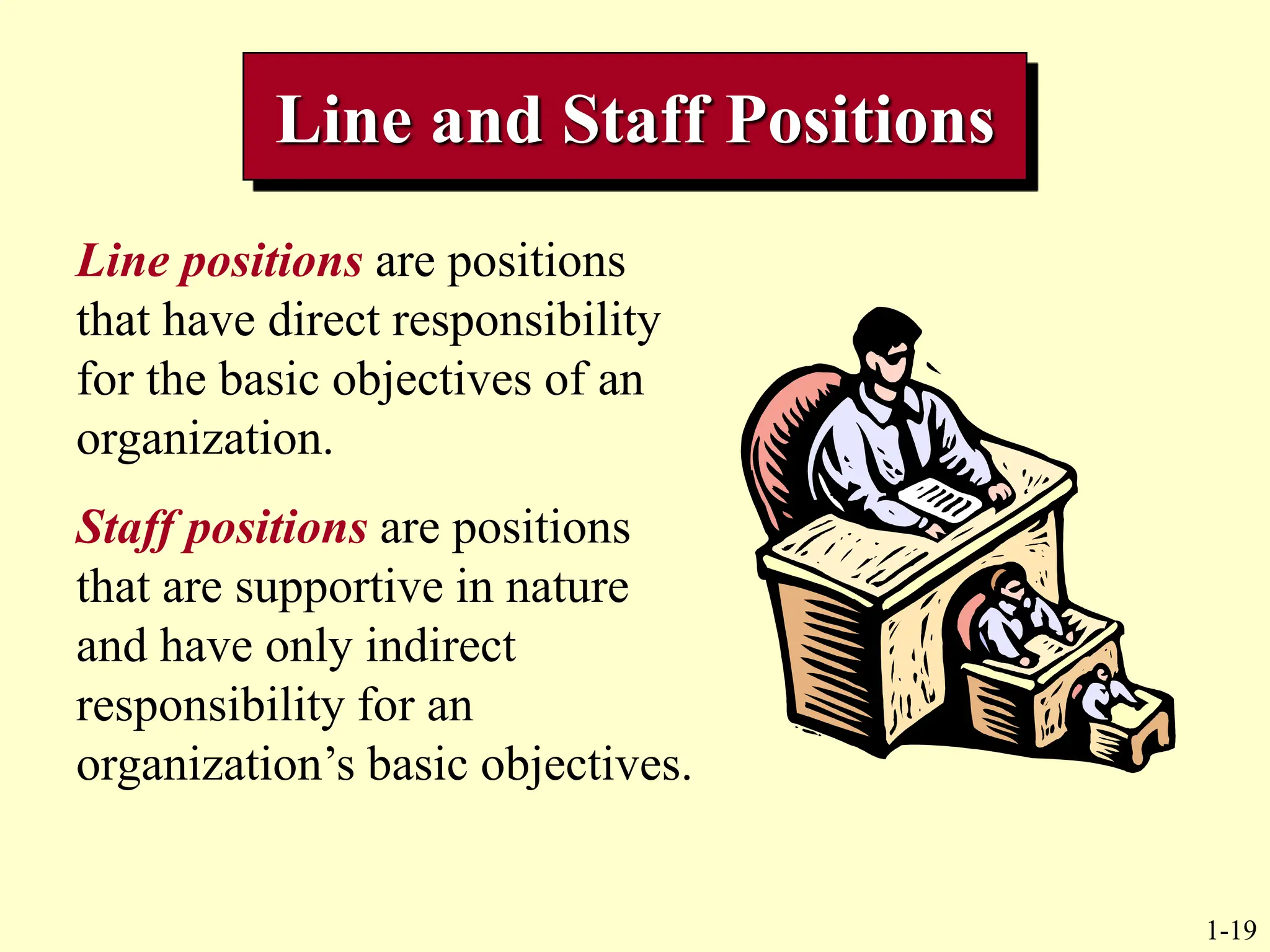

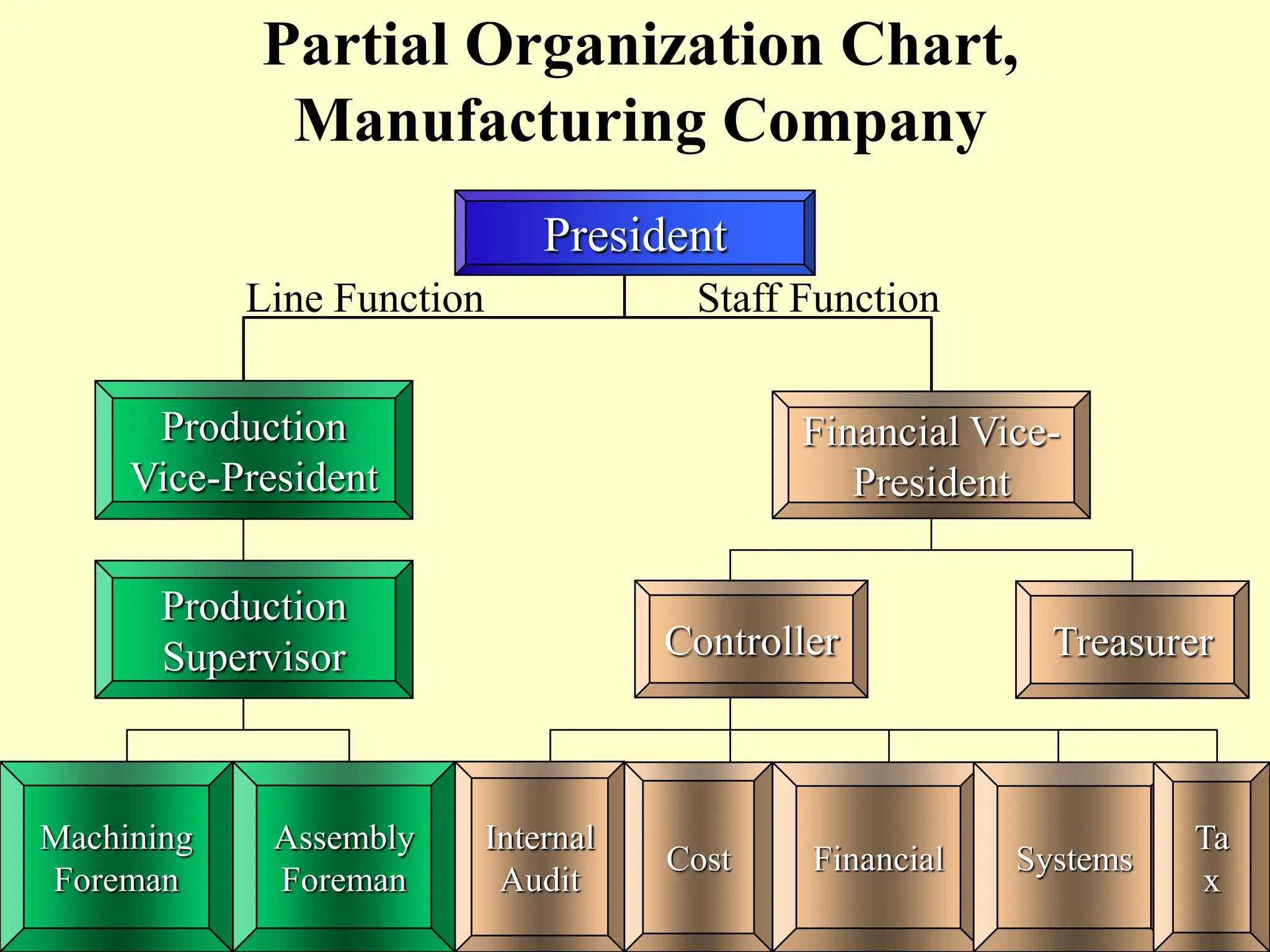

This document provides an introduction to cost management. It discusses the differences between financial accounting and cost management, and identifies several current factors affecting cost management, such as global competition, advances in technology, and an increased focus on customers and quality. It also describes the roles and responsibilities of management accountants, including ethical standards, and lists three common professional certifications for internal accountants.