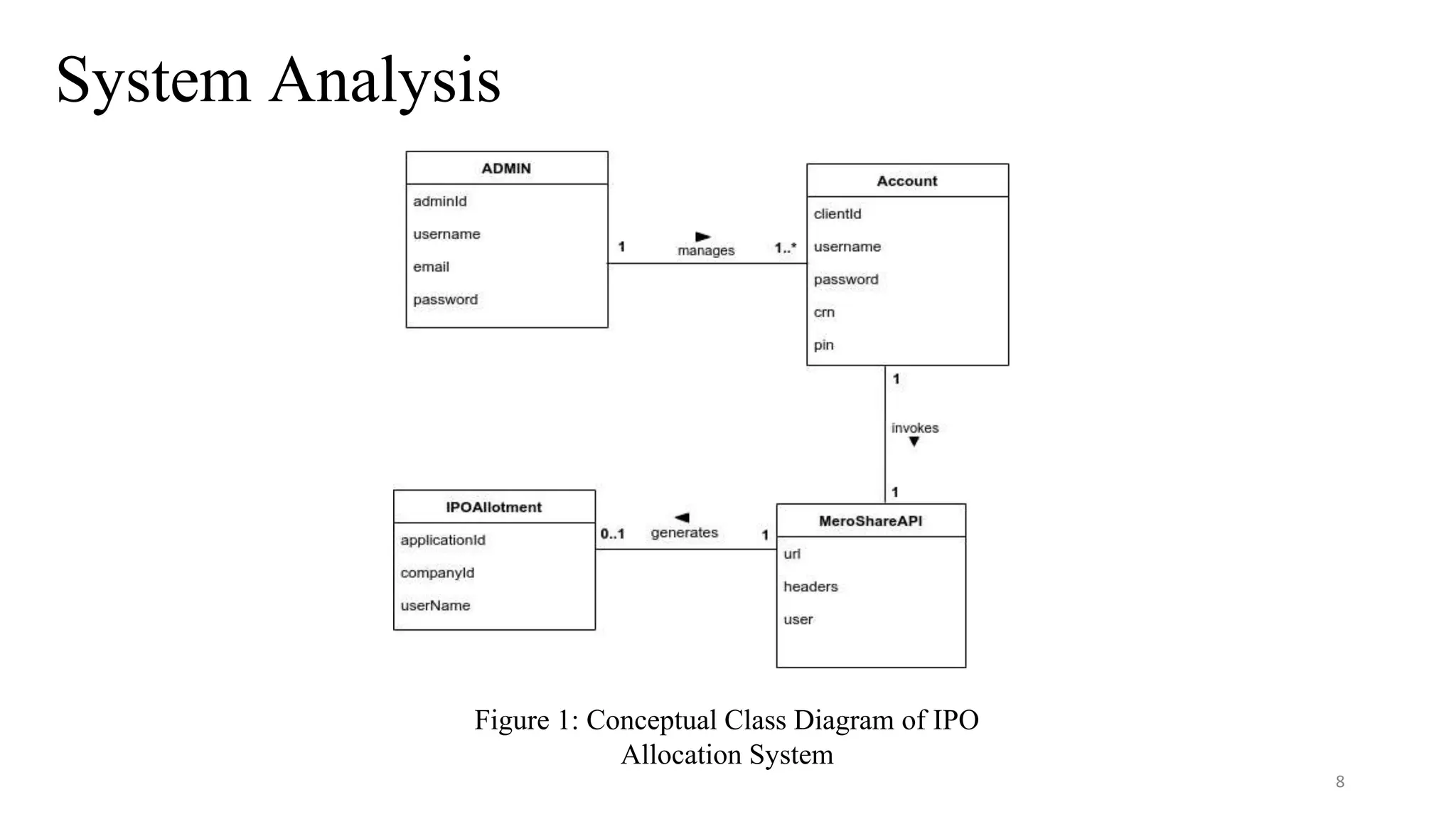

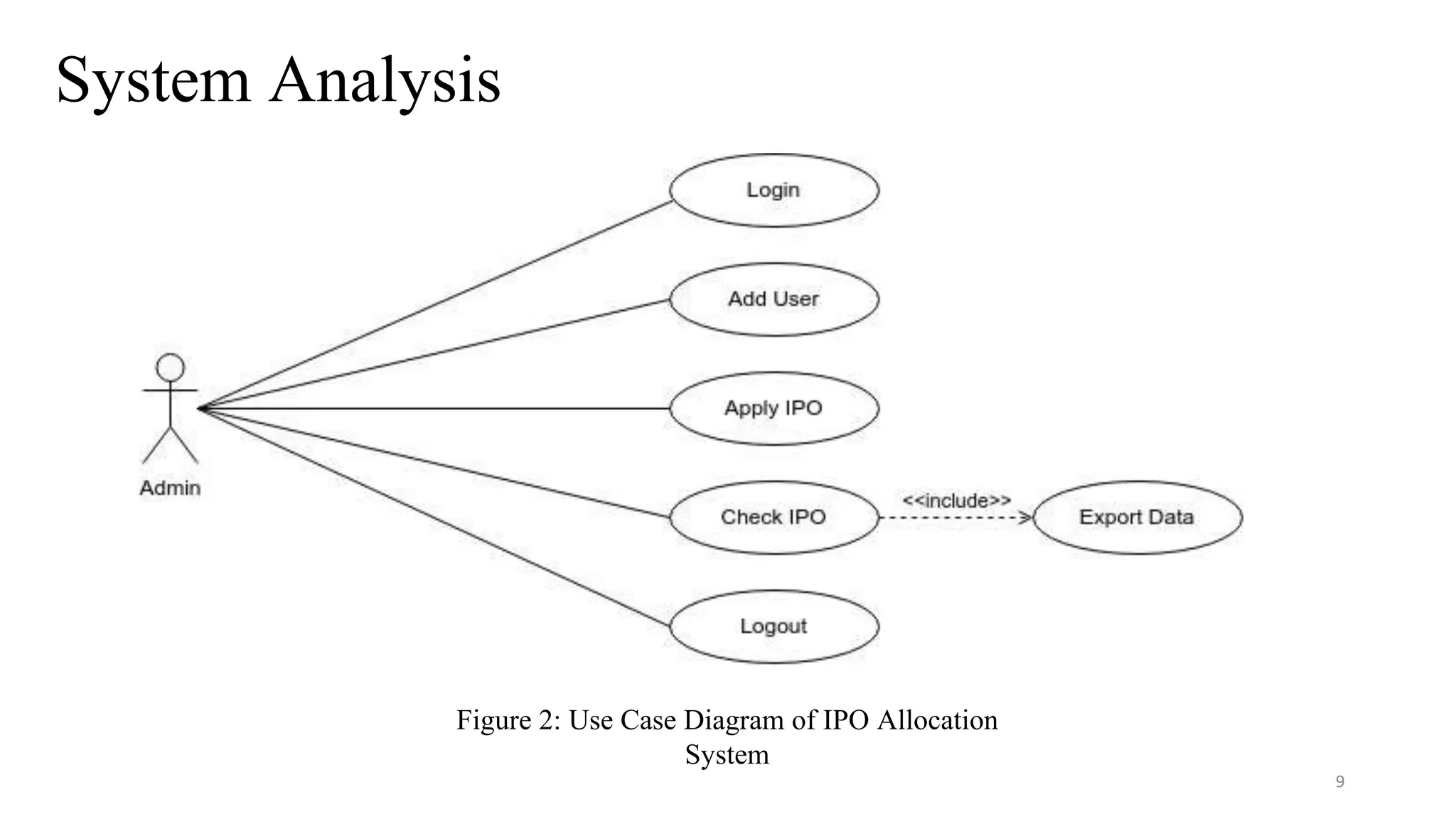

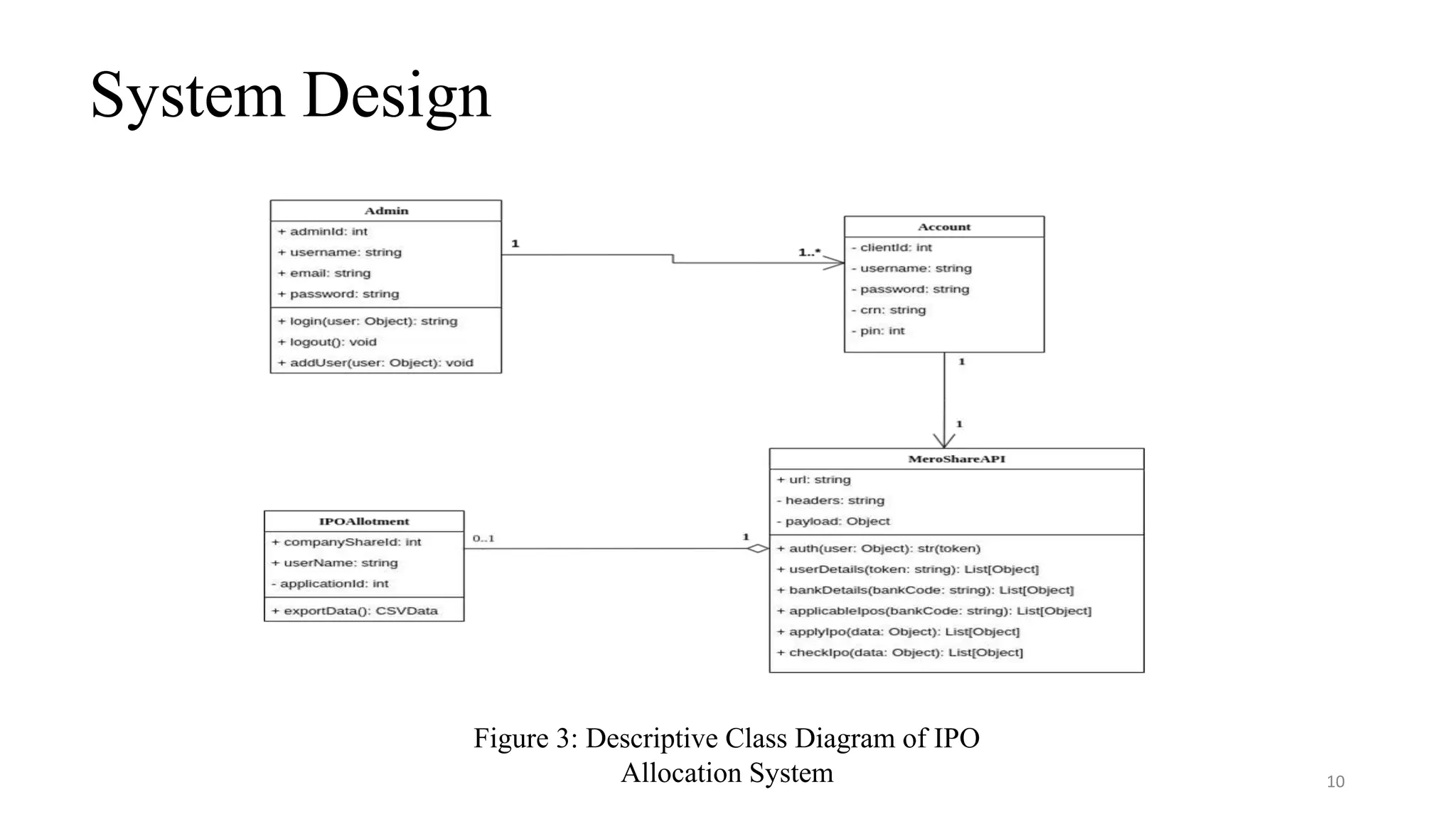

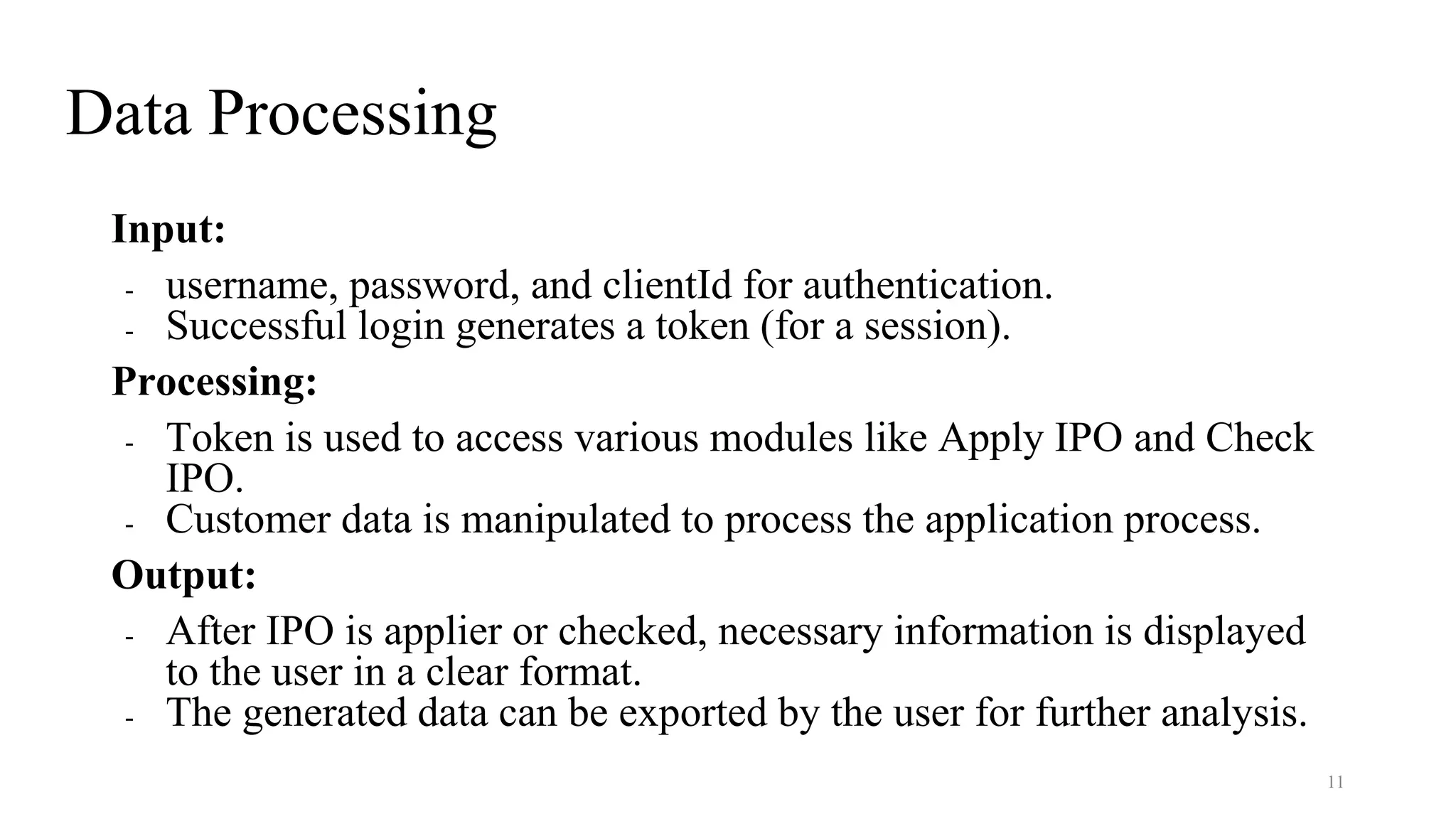

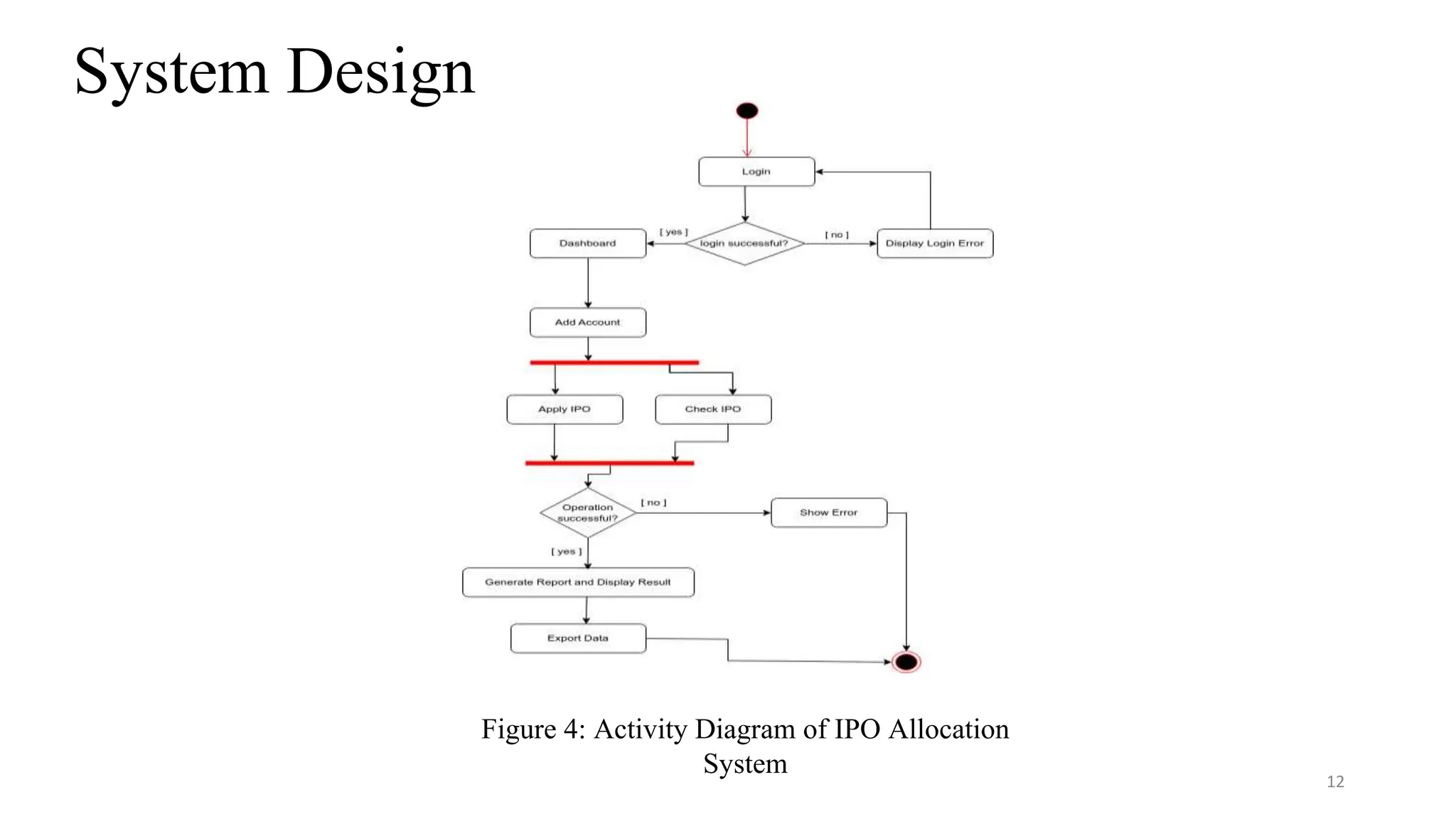

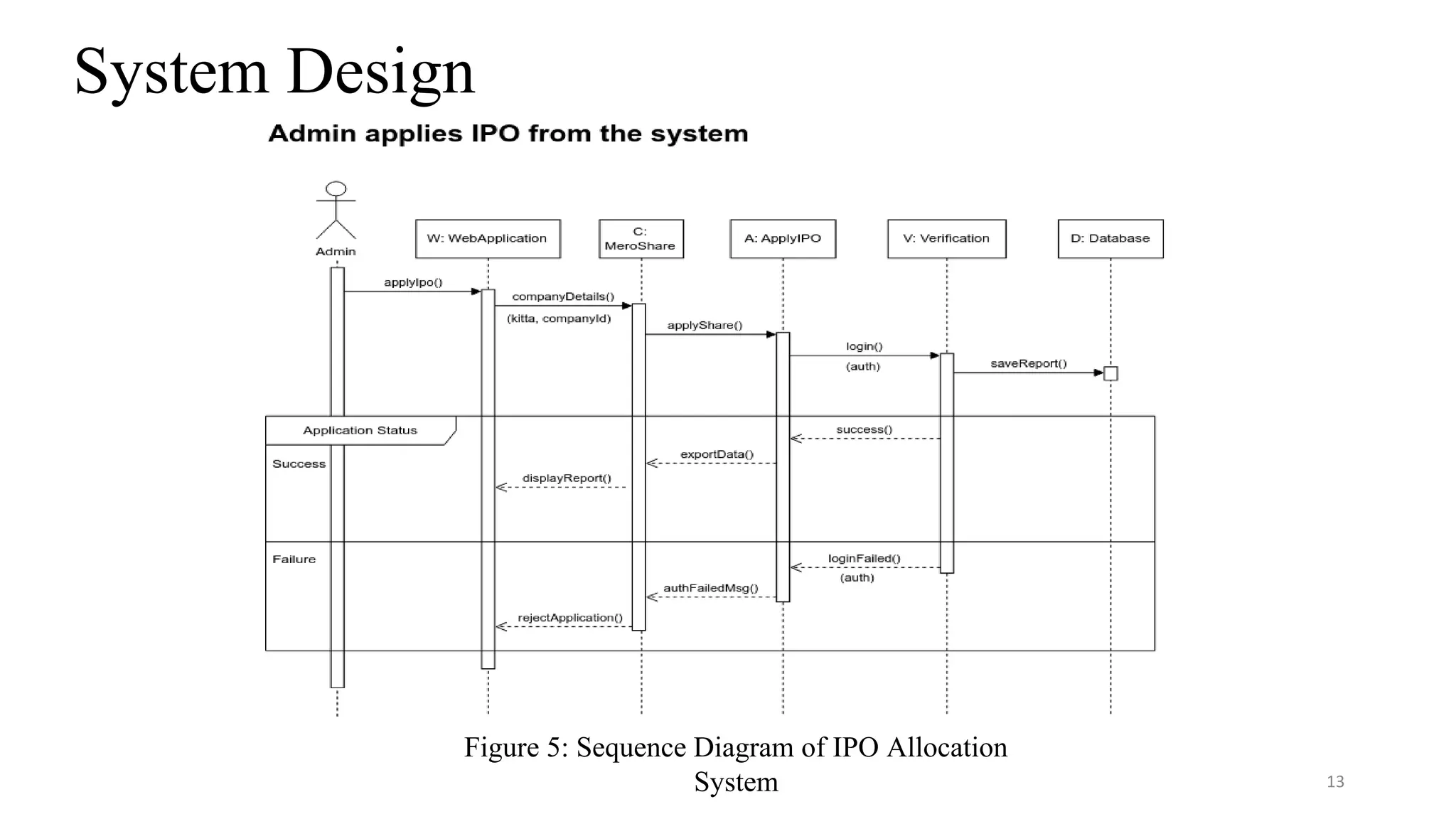

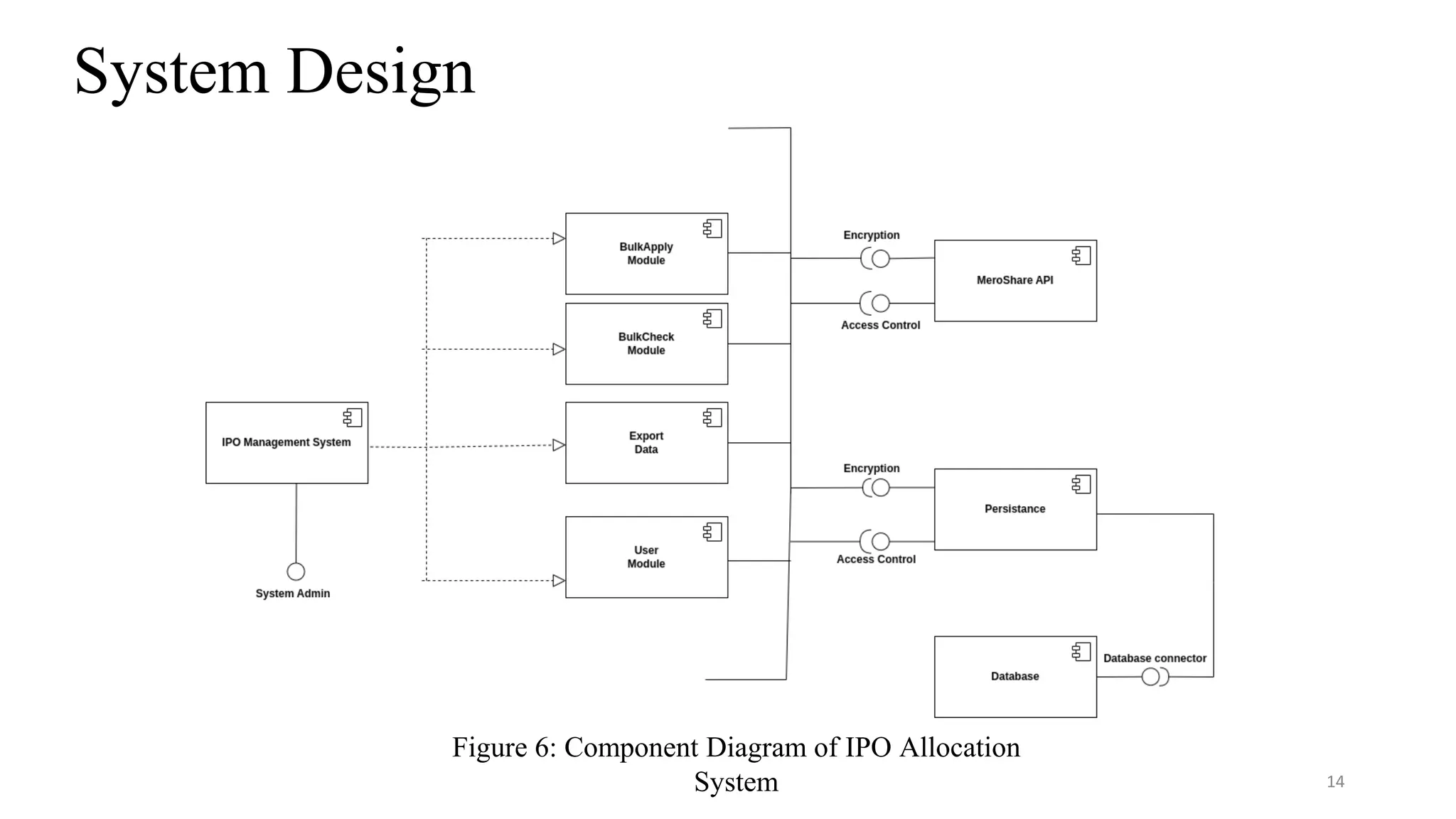

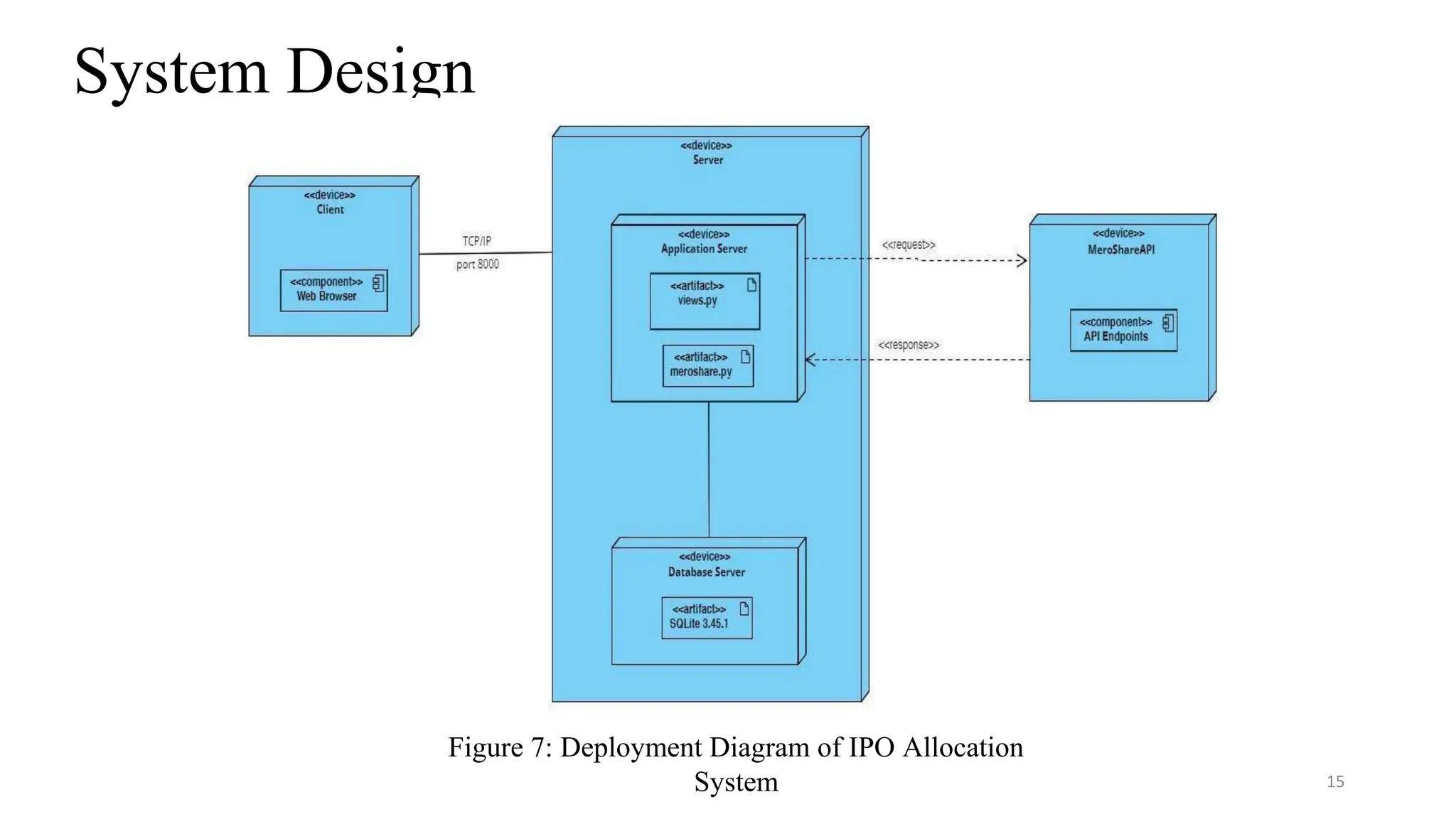

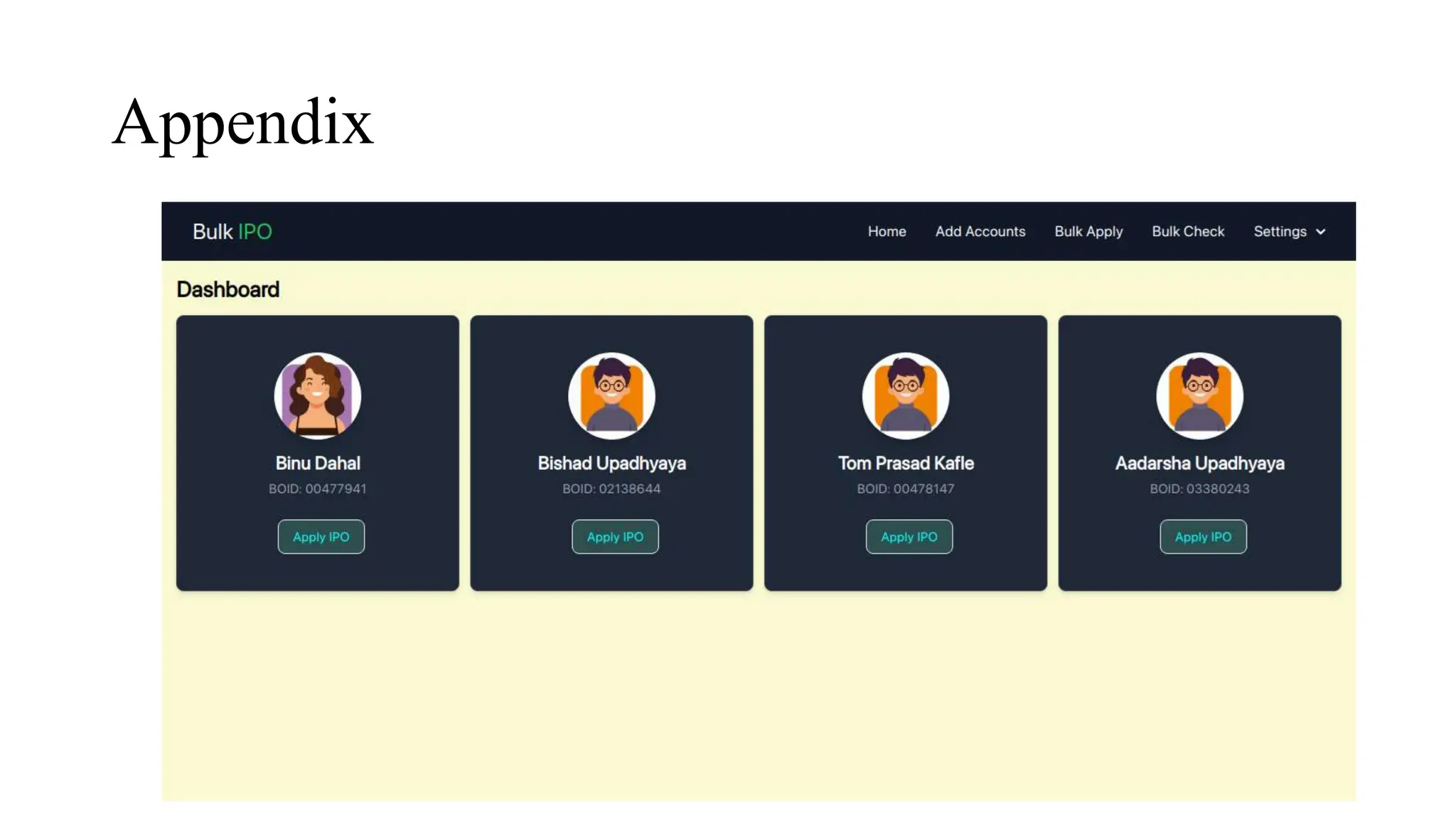

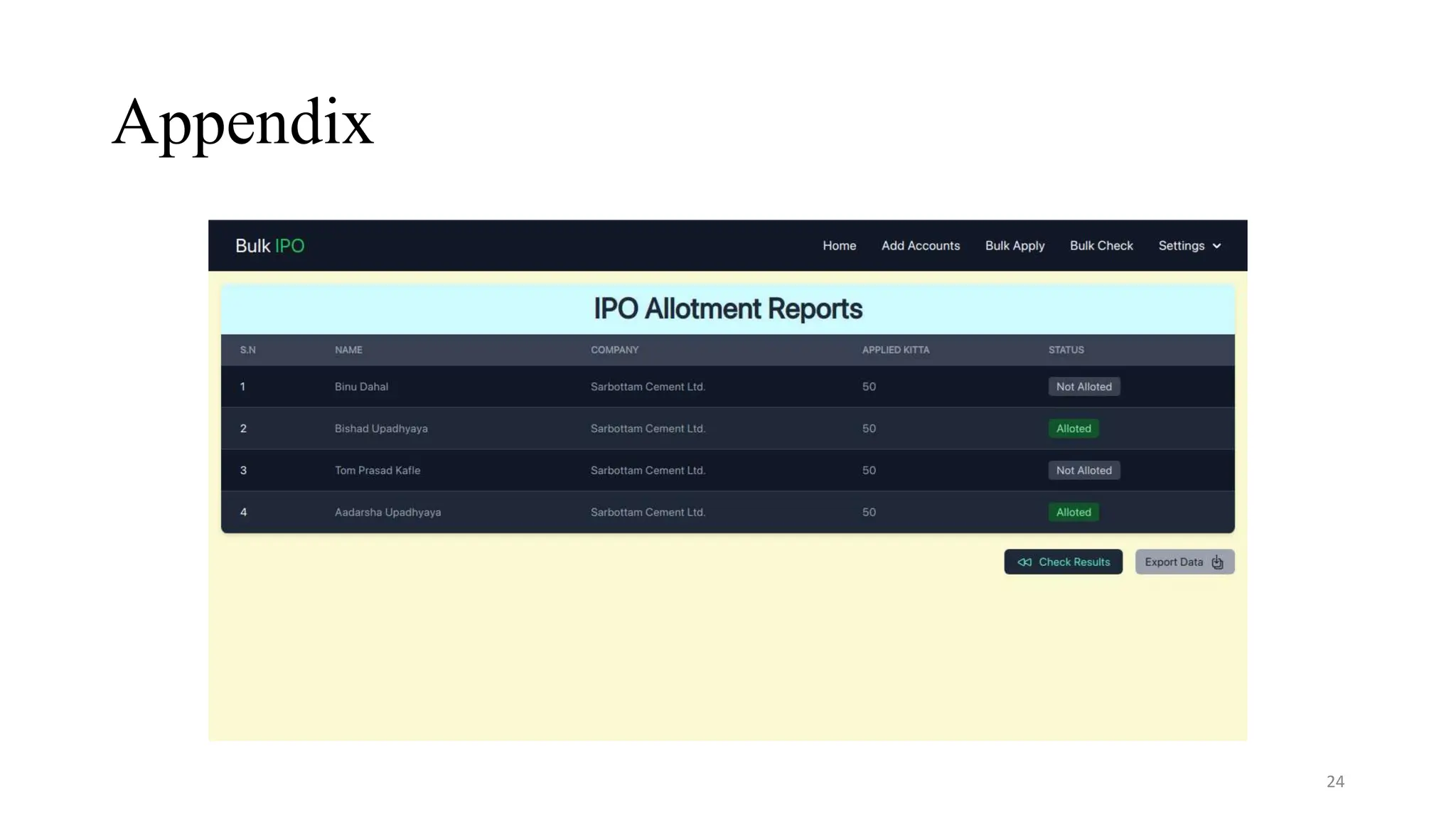

The document is a report on an IPO allocation system developed by Aadarsha Upadhyaya under the supervision of Er. Dhiraj Kumar Jha, aimed at automating and streamlining the IPO application and allotment process. It discusses the system's architecture, security measures, user interactions, and testing methodologies to enhance efficiency and minimize human error. The report emphasizes the transformation of the traditional IPO process into a more productive and accurate automated solution.