Sourbah Modgil presented a 3 sentence summary of a presentation on ratio analysis:

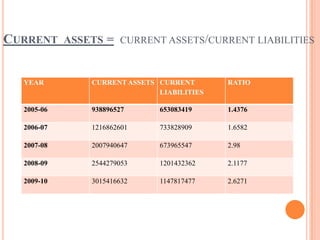

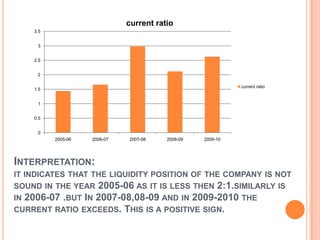

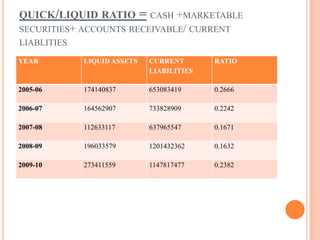

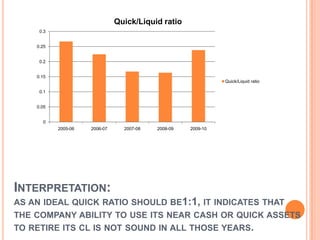

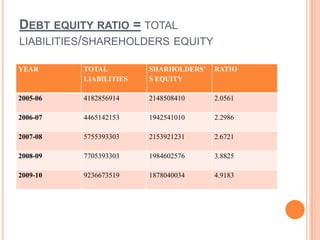

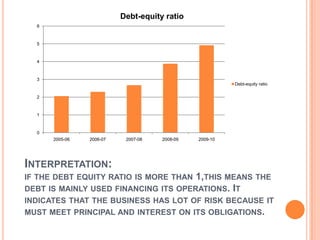

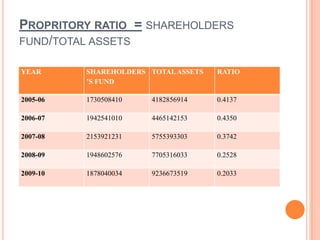

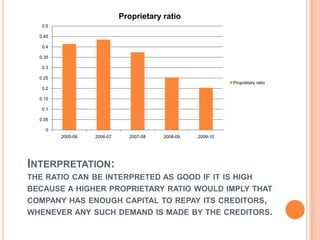

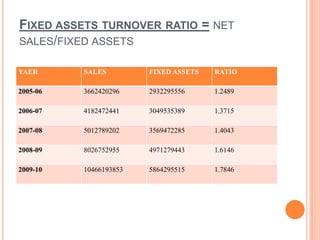

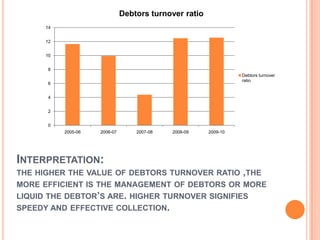

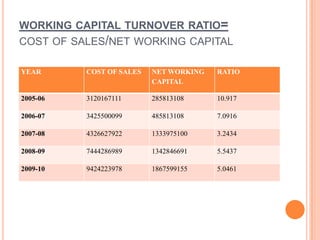

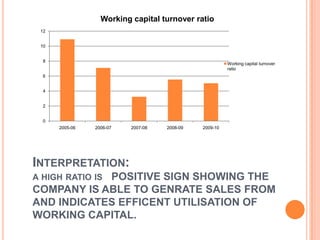

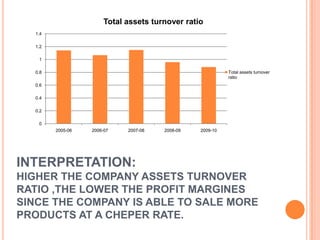

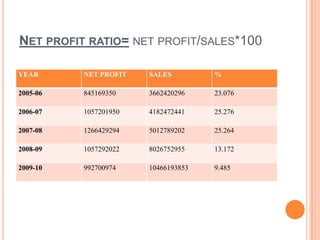

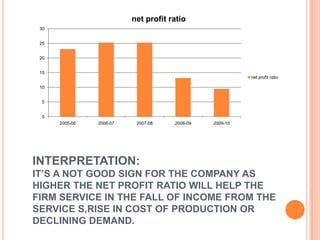

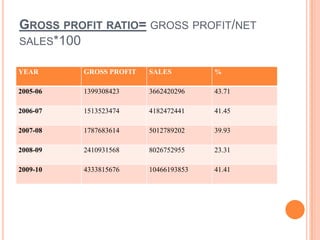

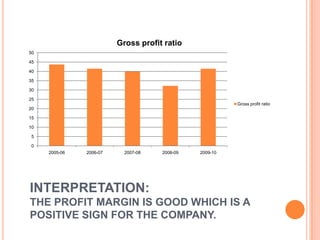

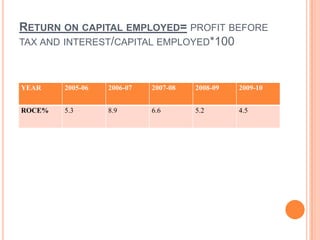

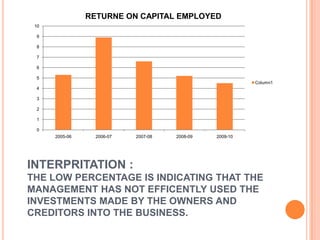

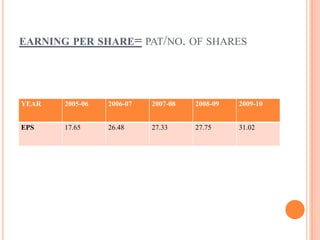

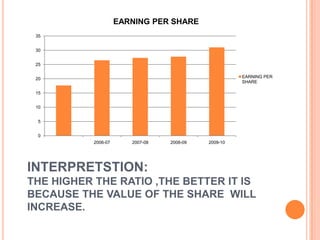

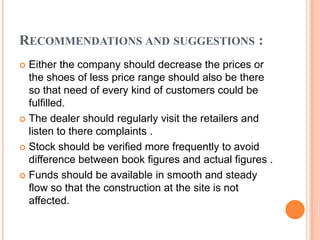

The presentation provided an overview of ratio analysis for a footwear company called Liberty Group, discussing various financial ratios like current ratio, quick ratio, debt-equity ratio, and gross profit ratio calculated for Liberty Group from 2005-2010 to analyze the company's financial position and performance. The ratios revealed both strengths like improving current ratio over time, as well as weaknesses like low quick ratios, indicating areas for the company to improve its liquidity and reduce debt levels.