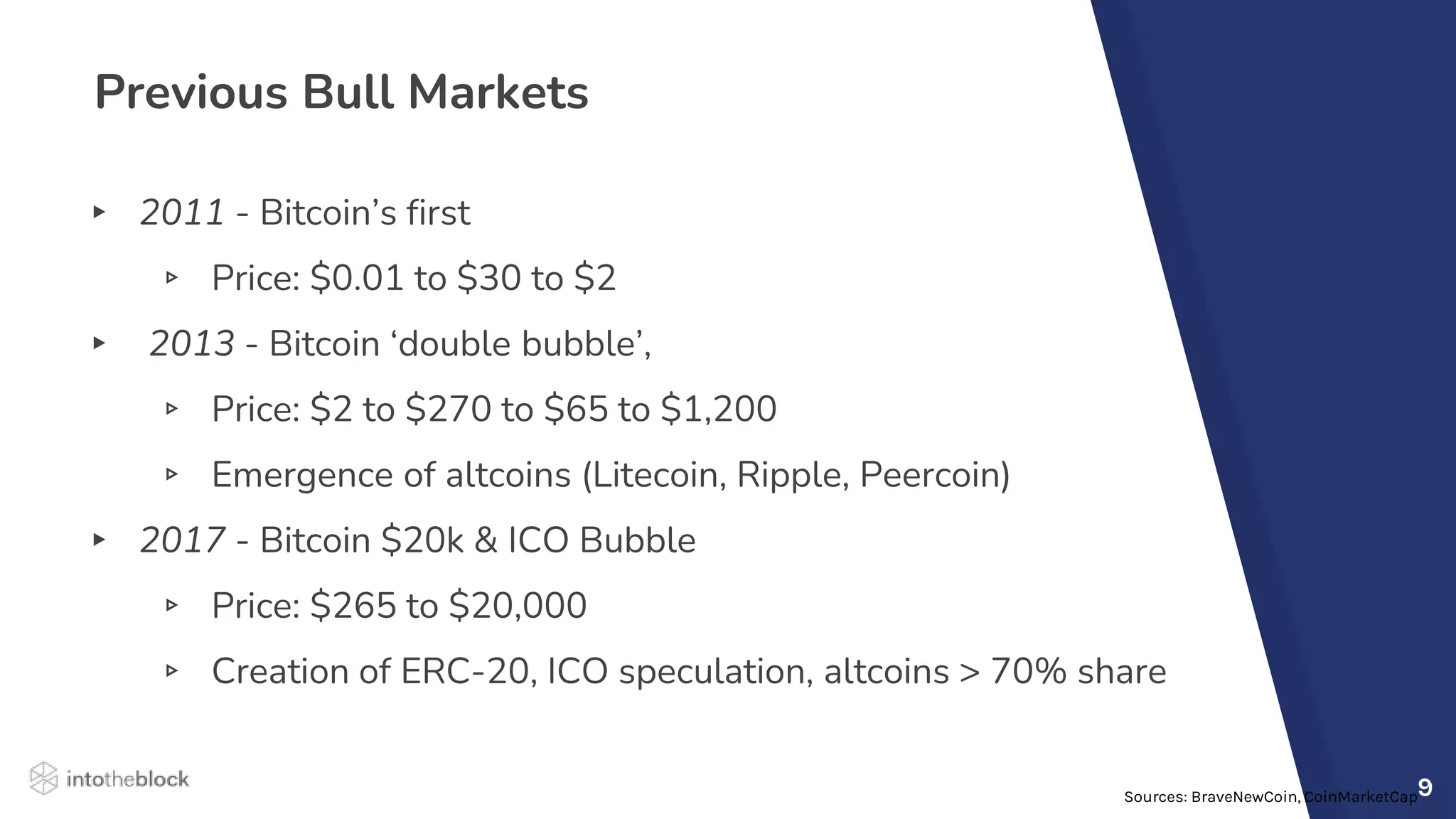

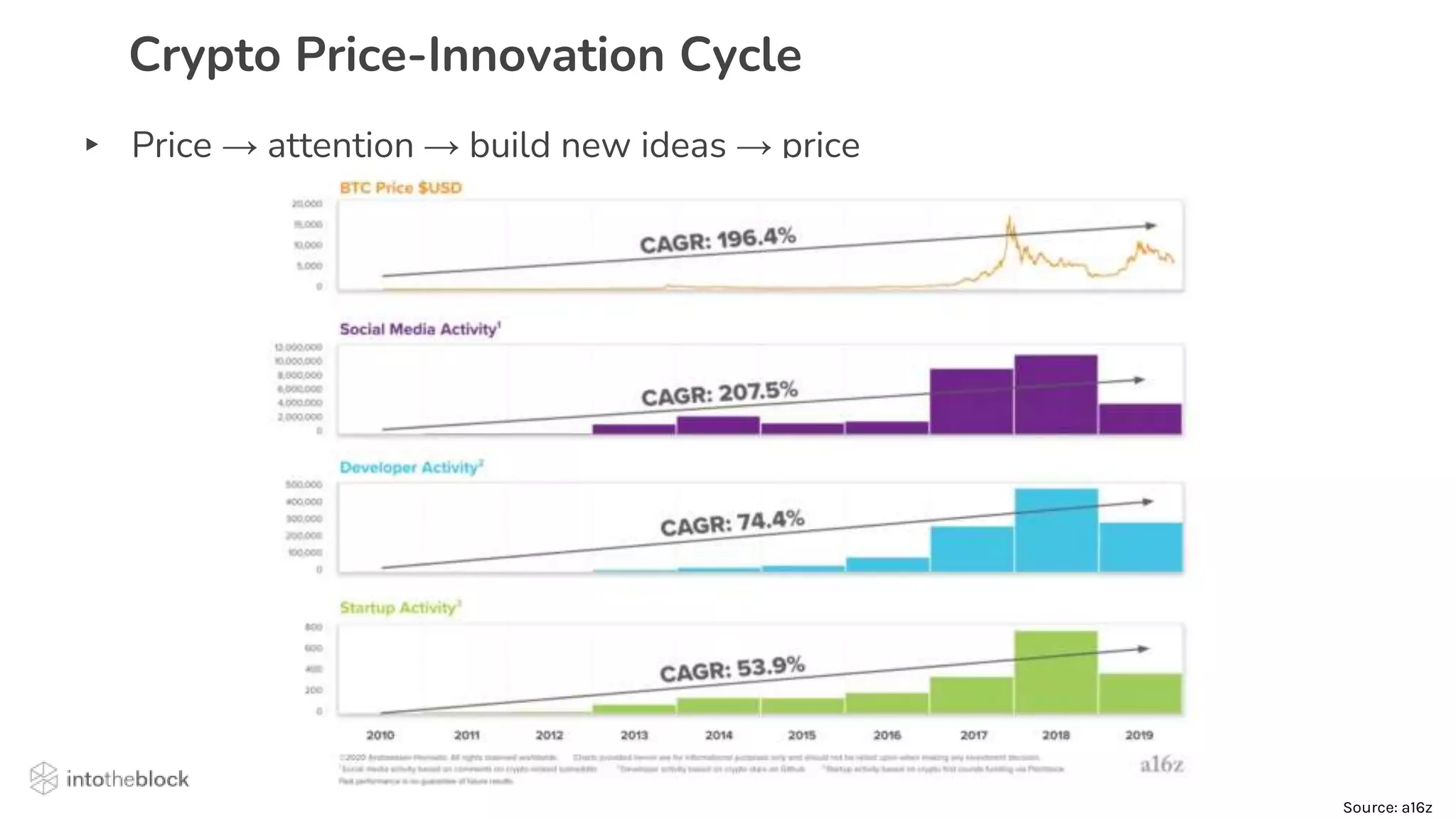

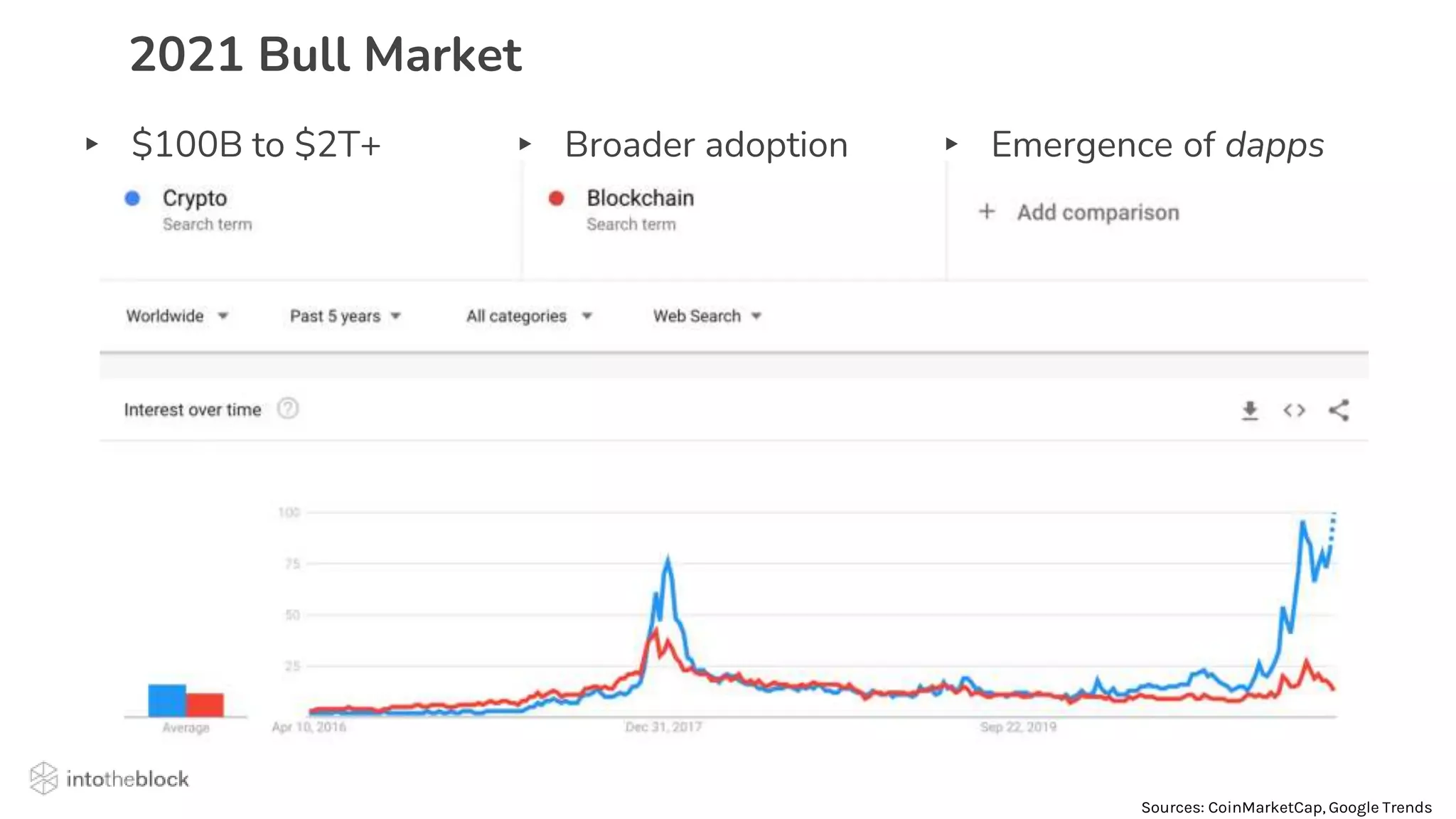

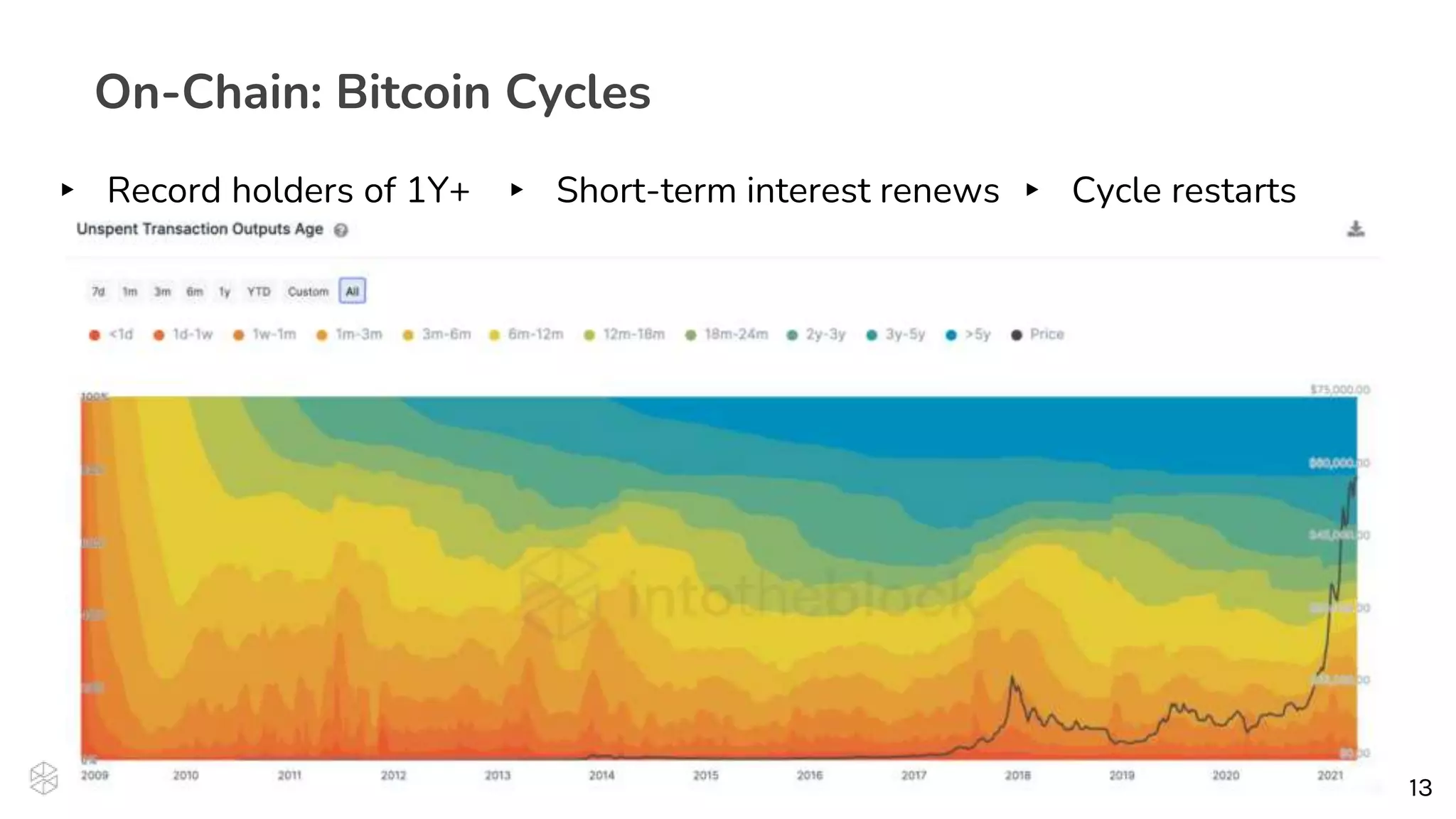

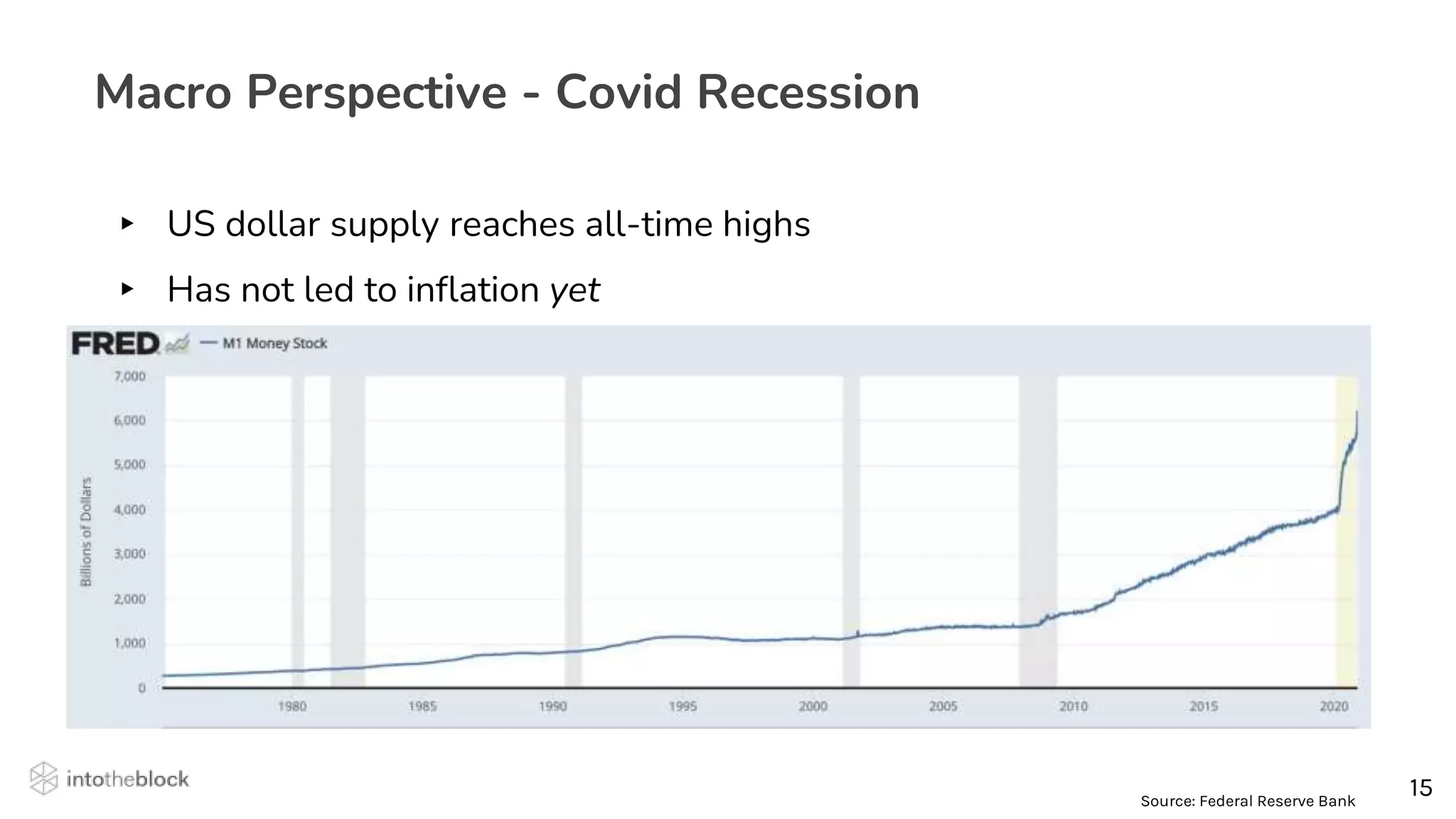

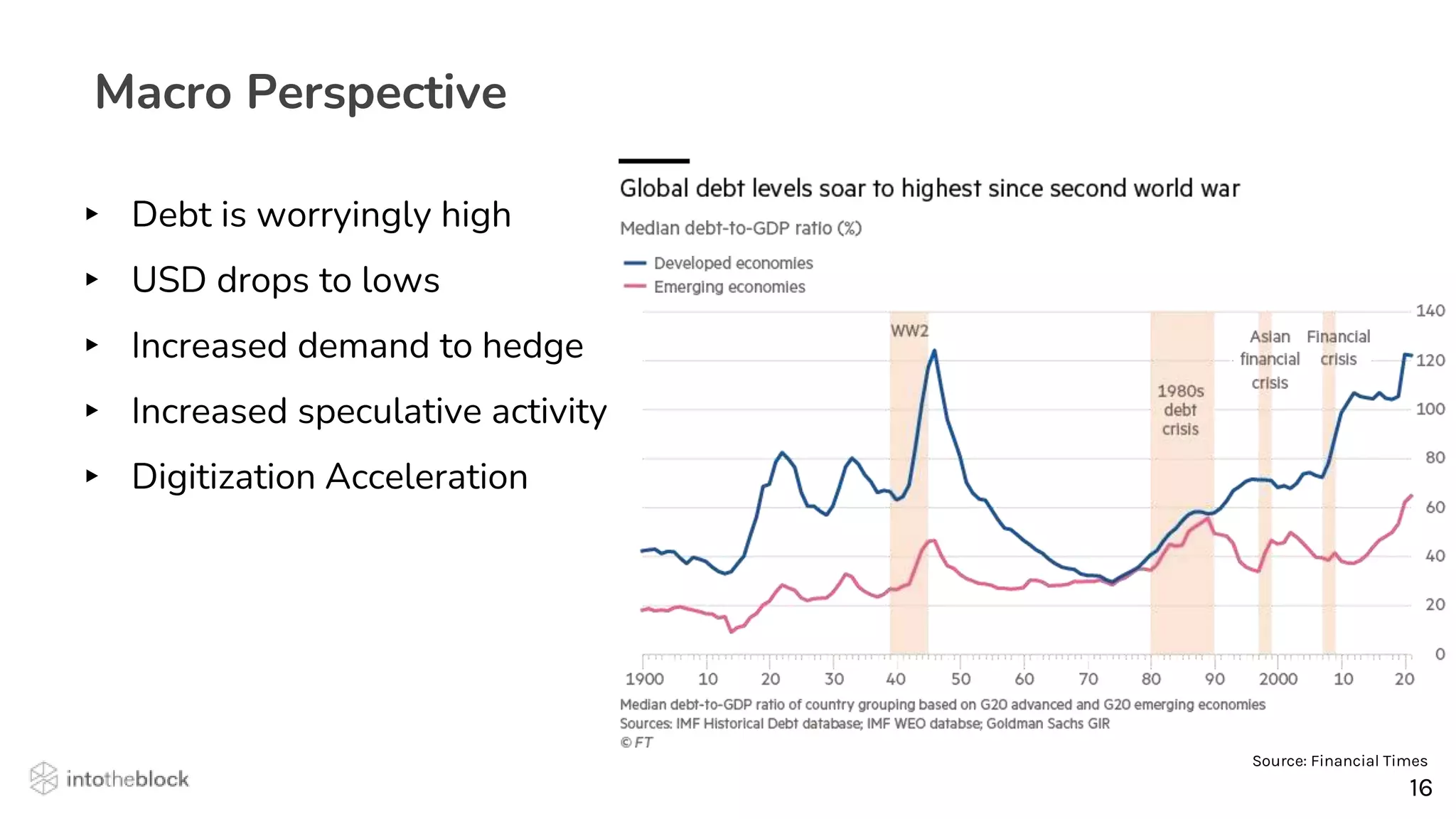

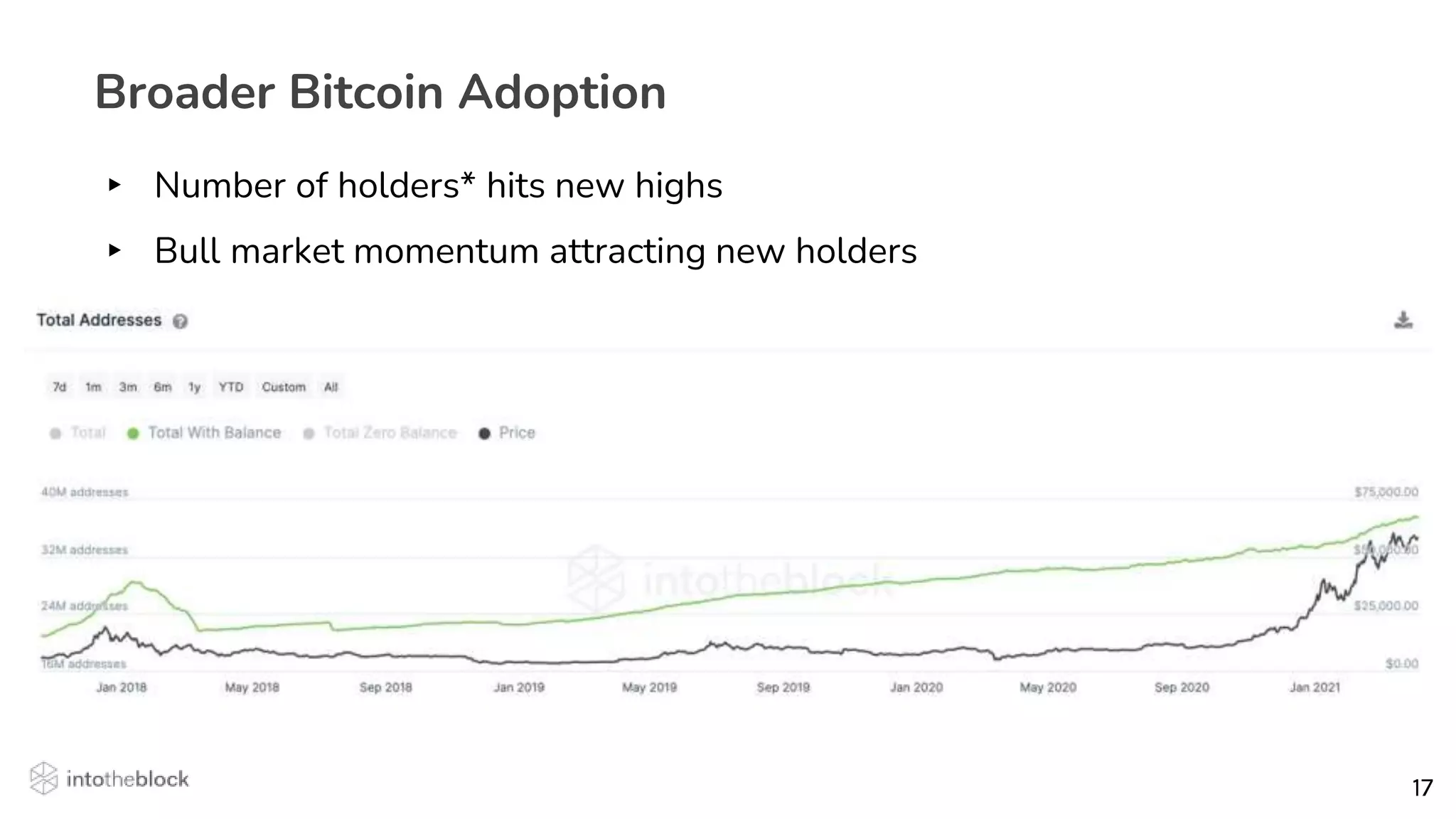

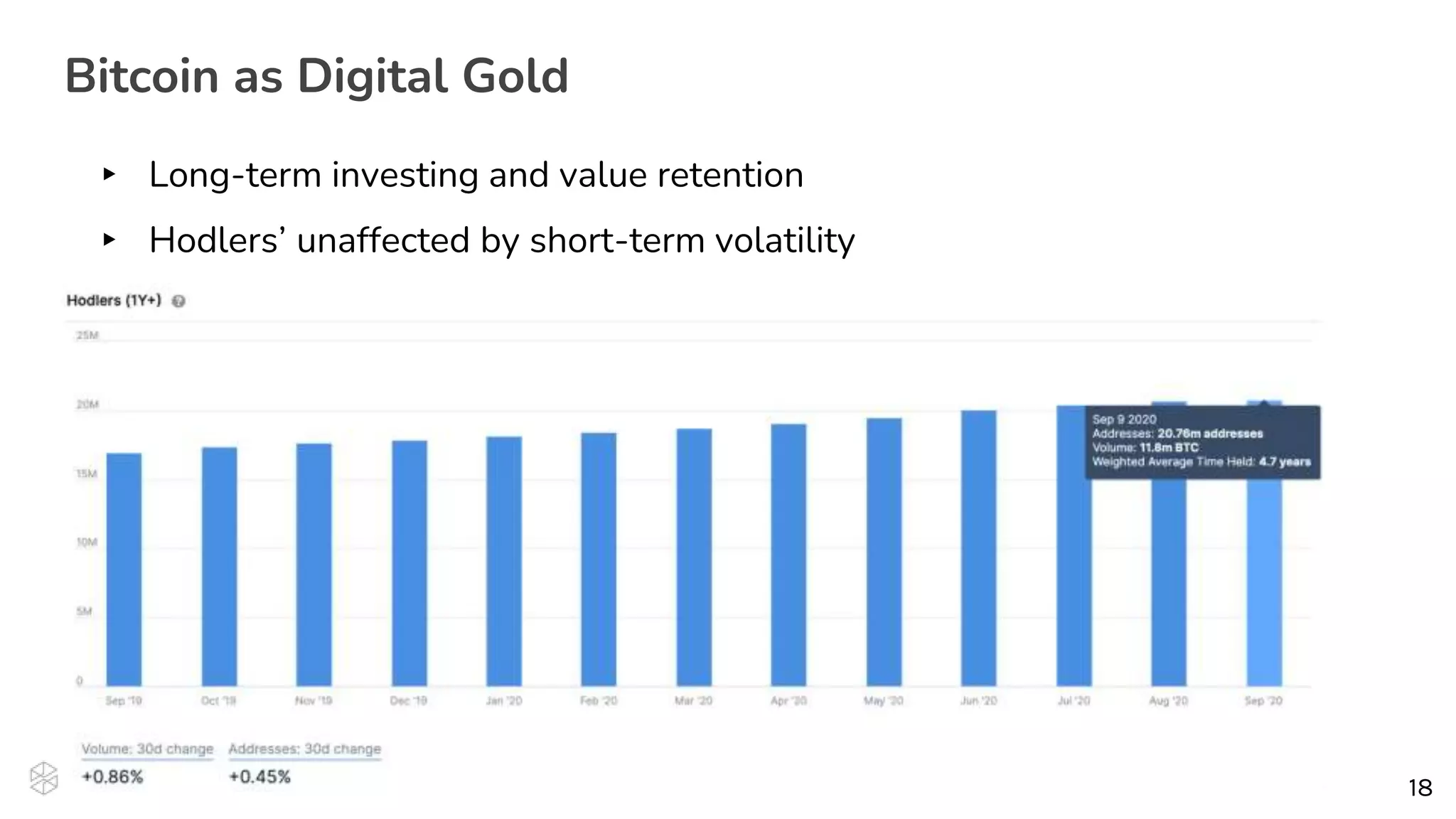

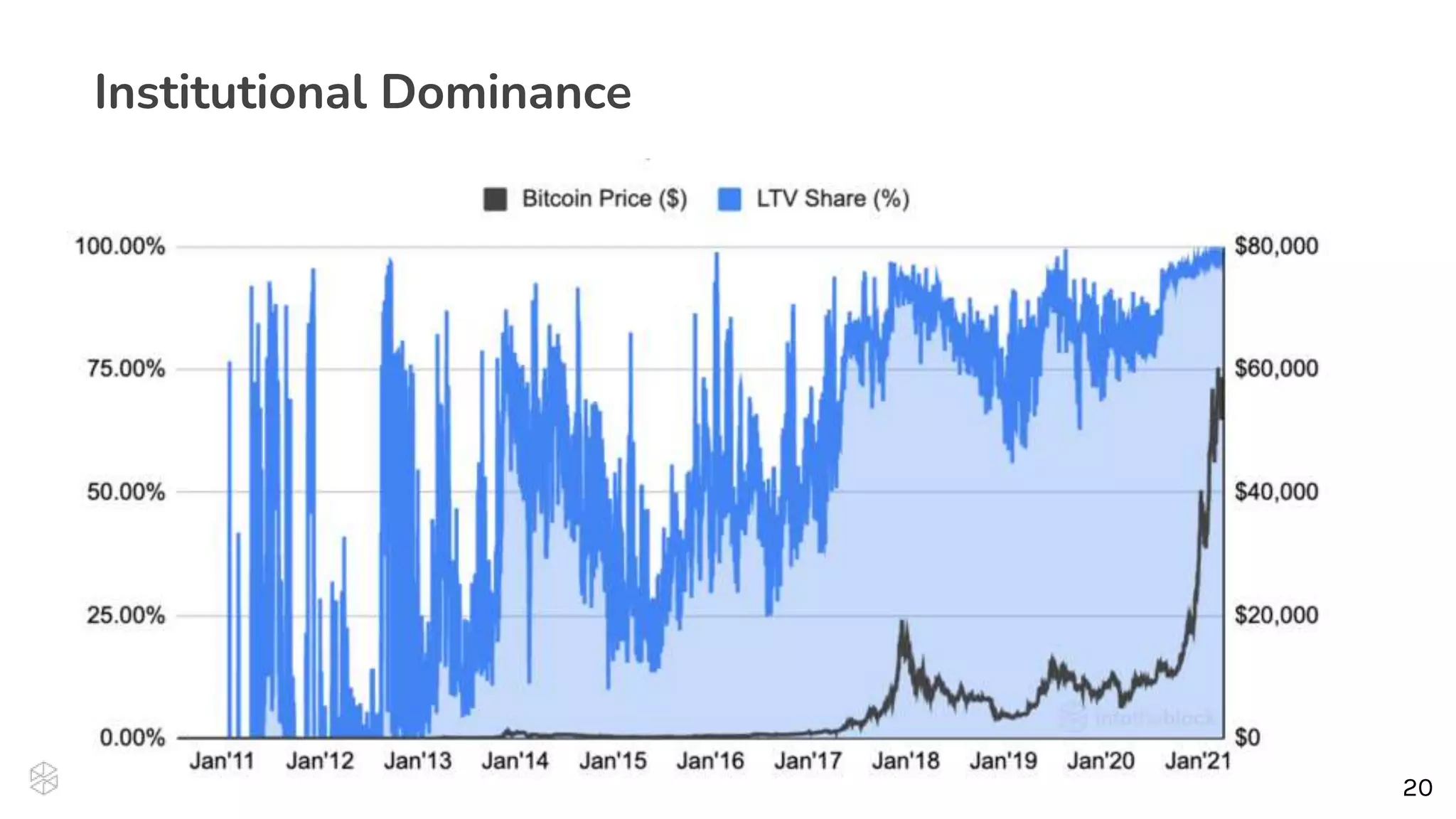

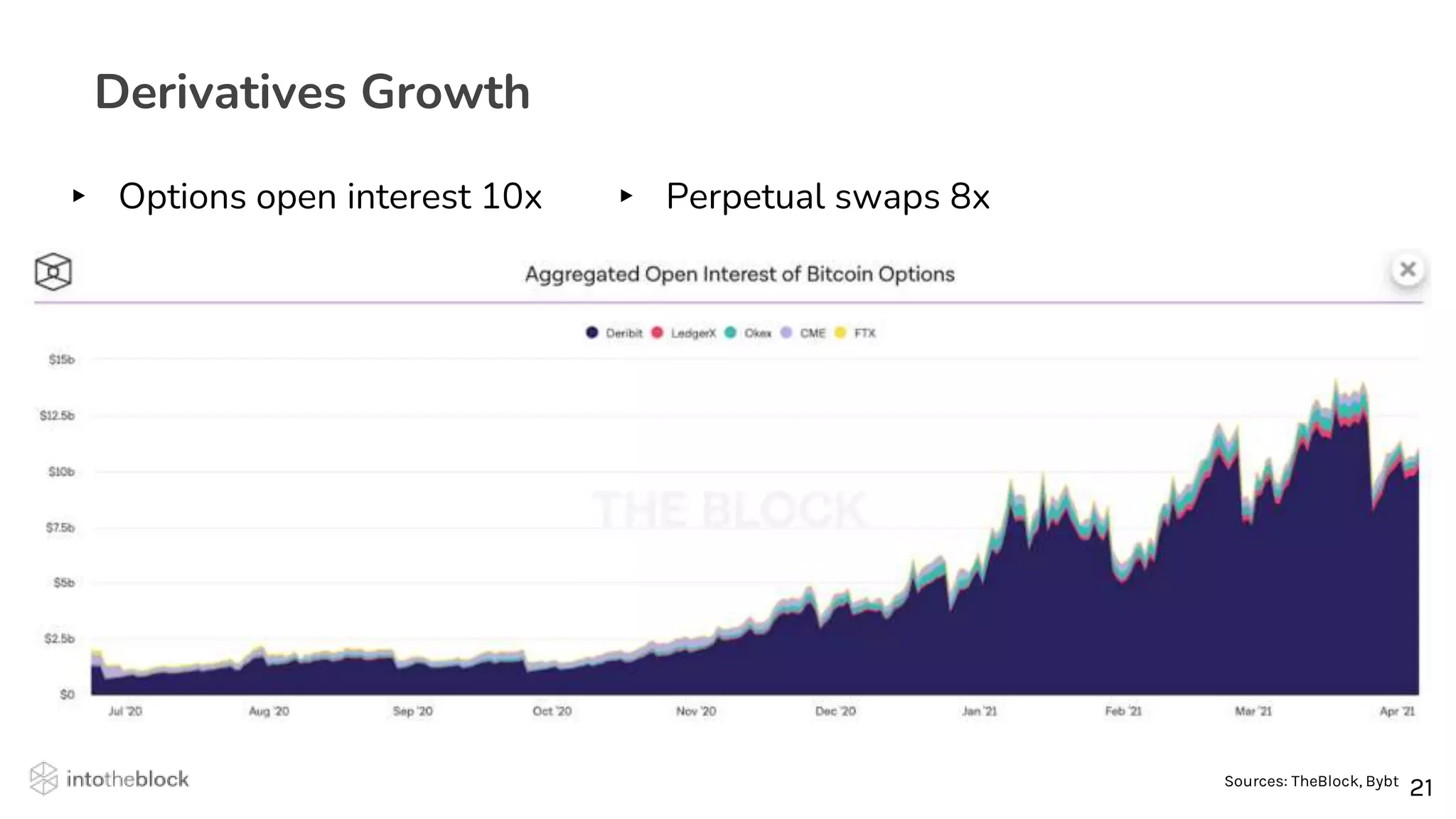

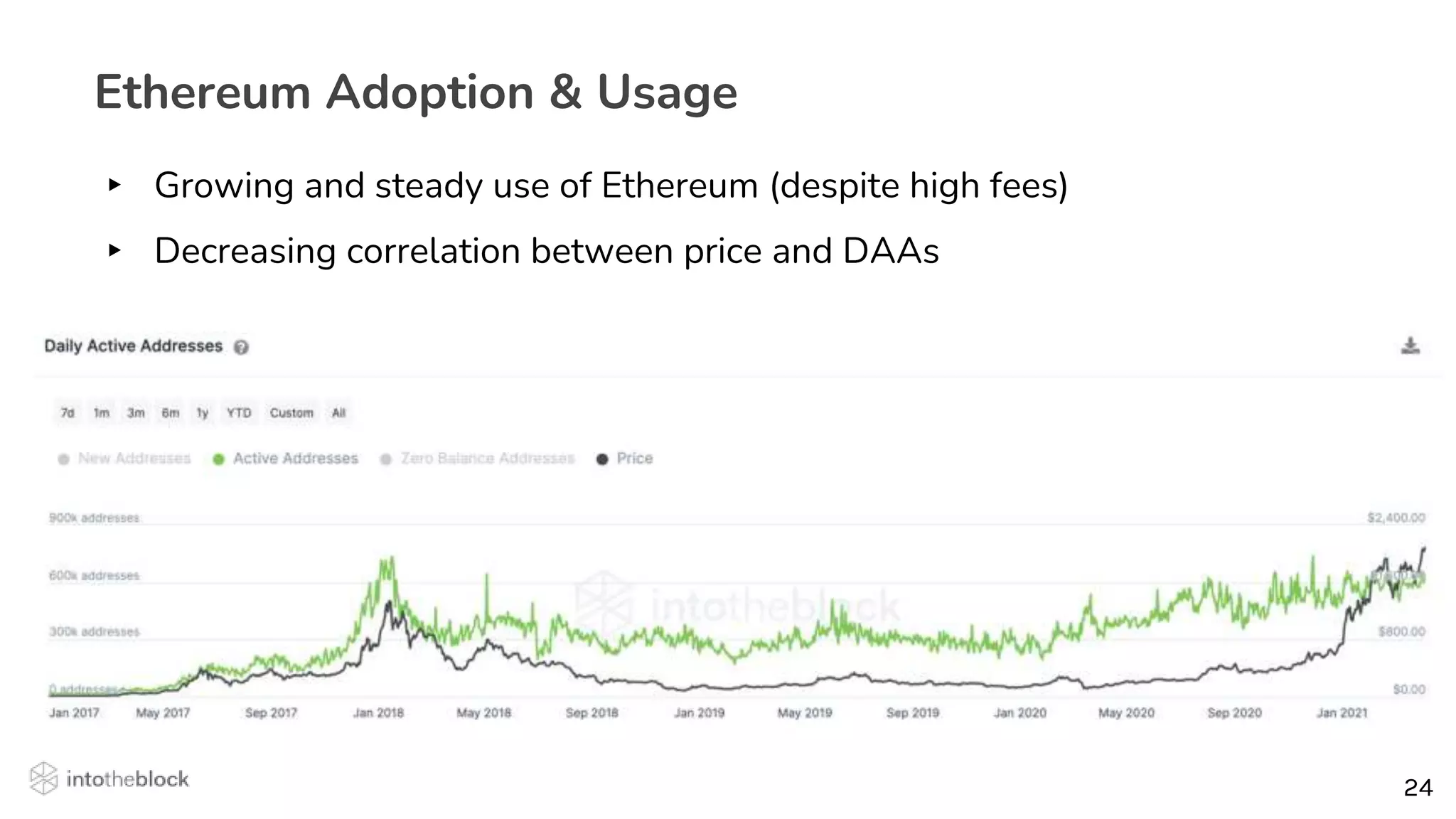

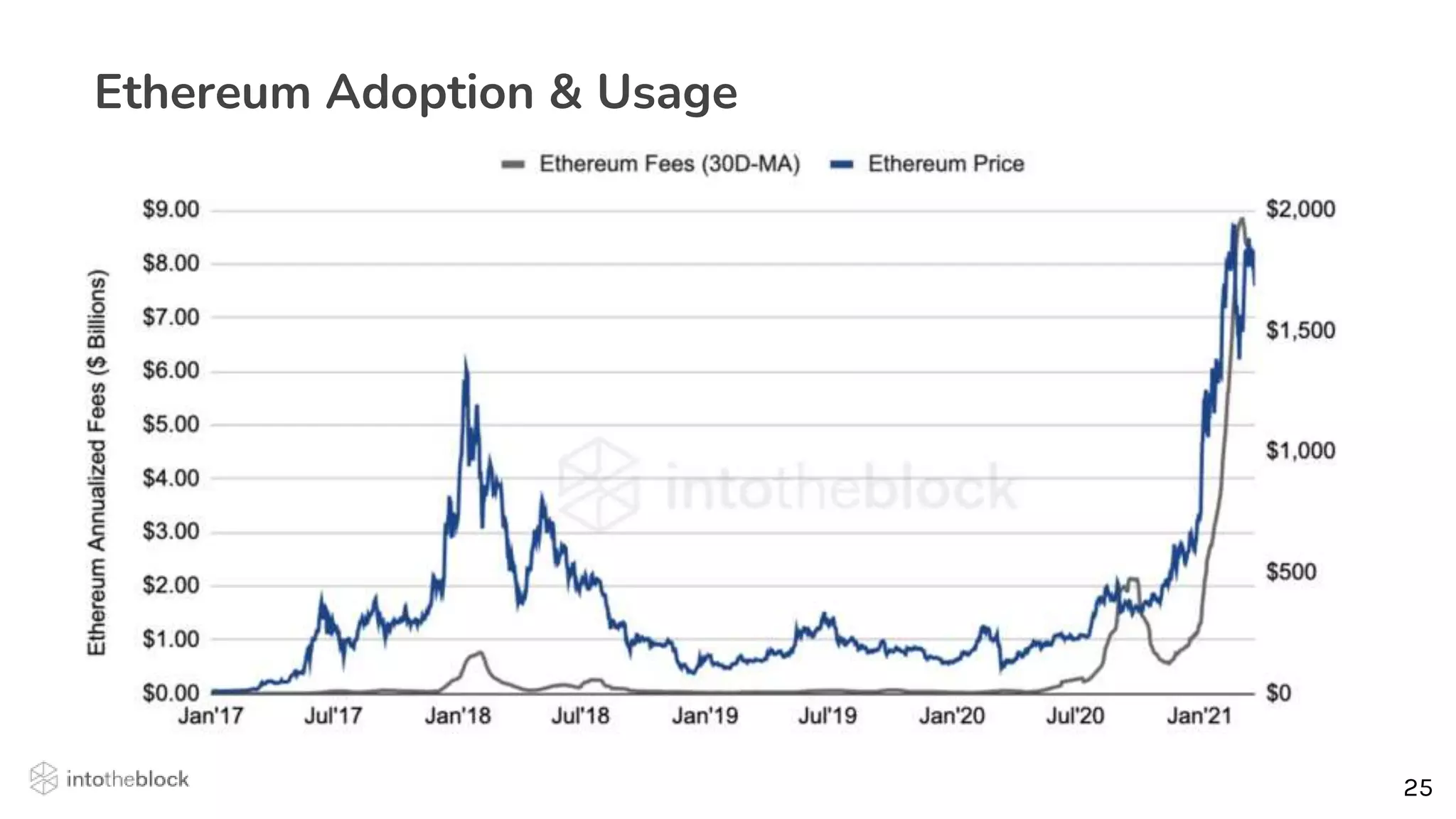

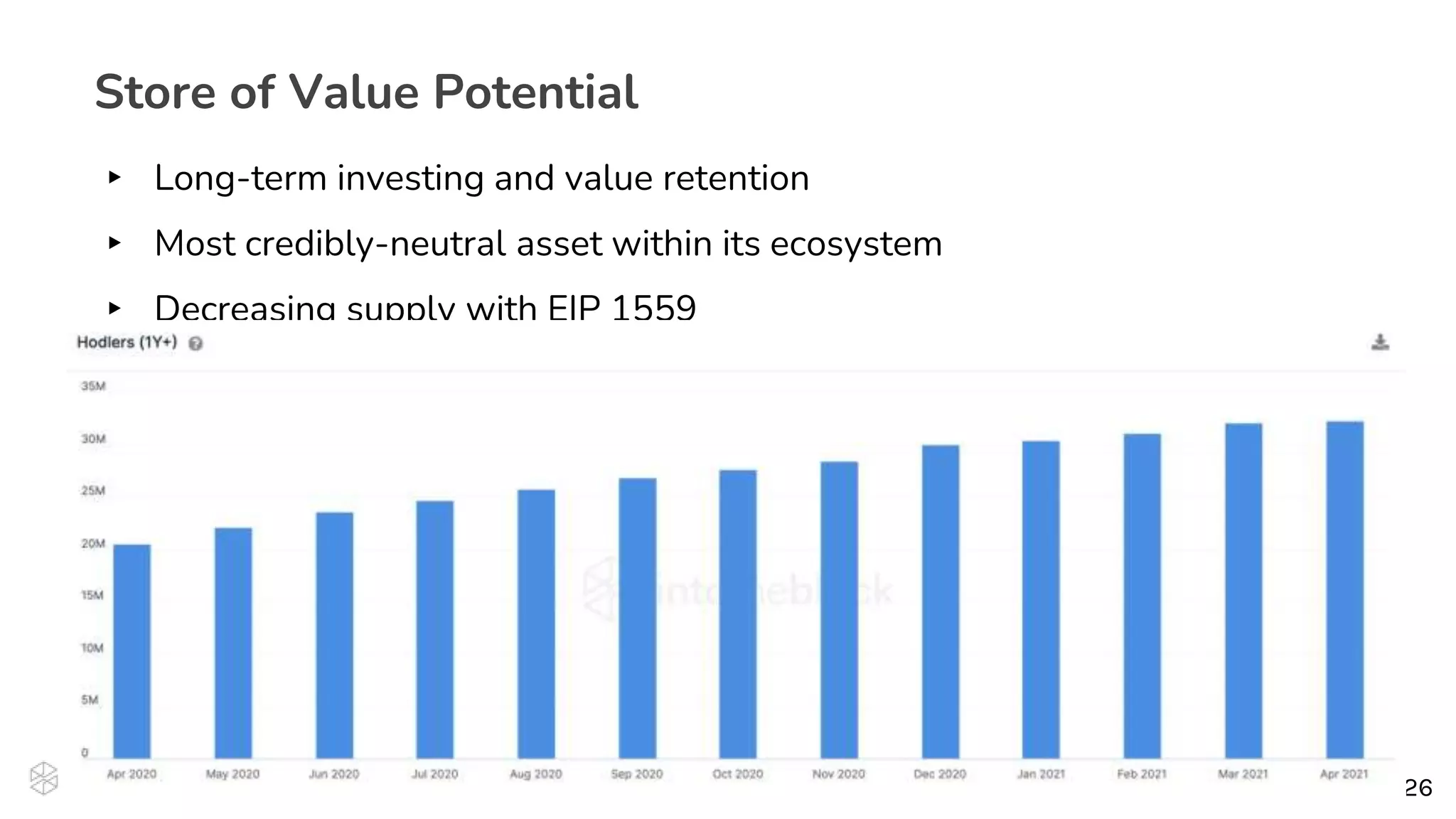

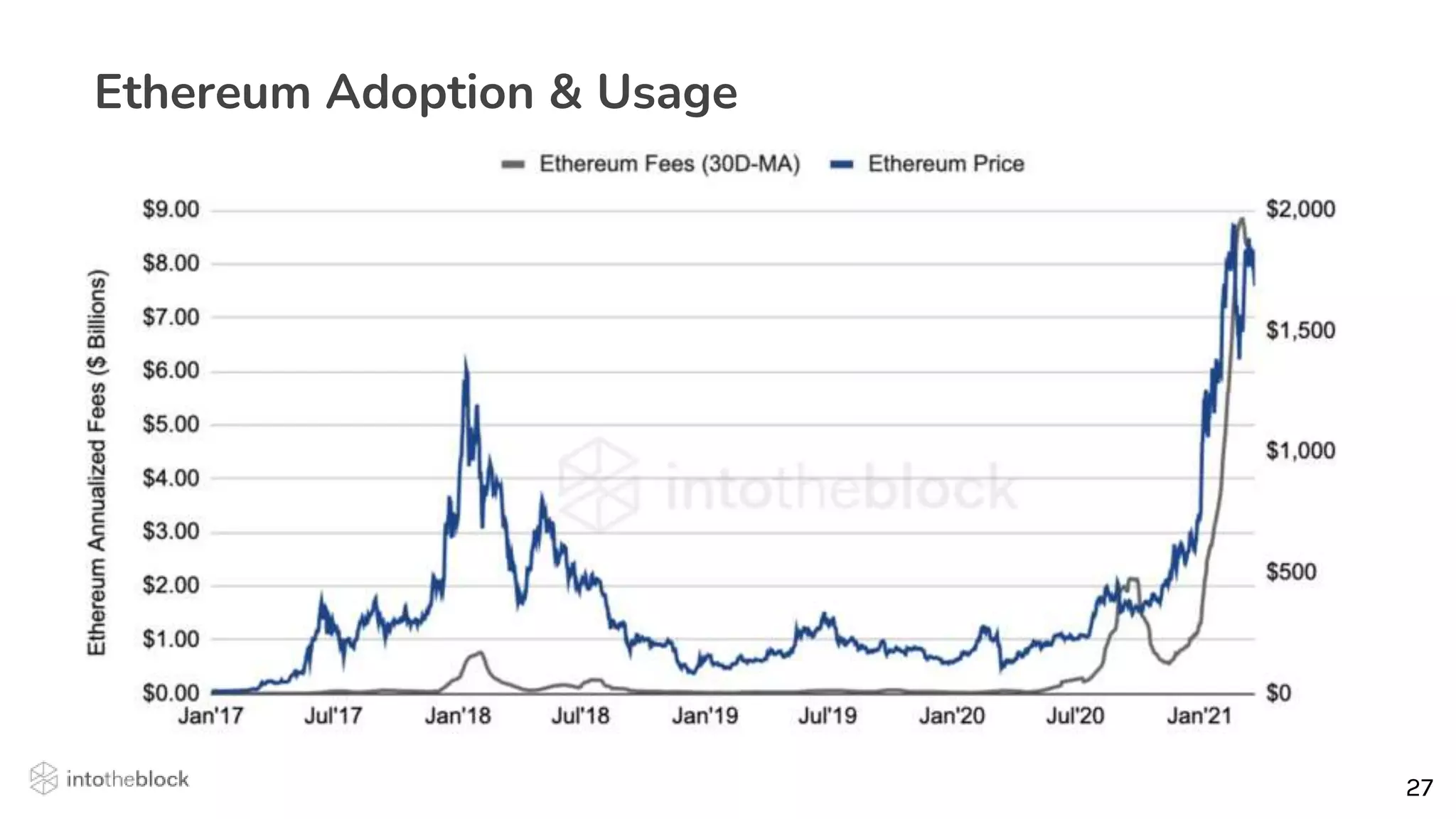

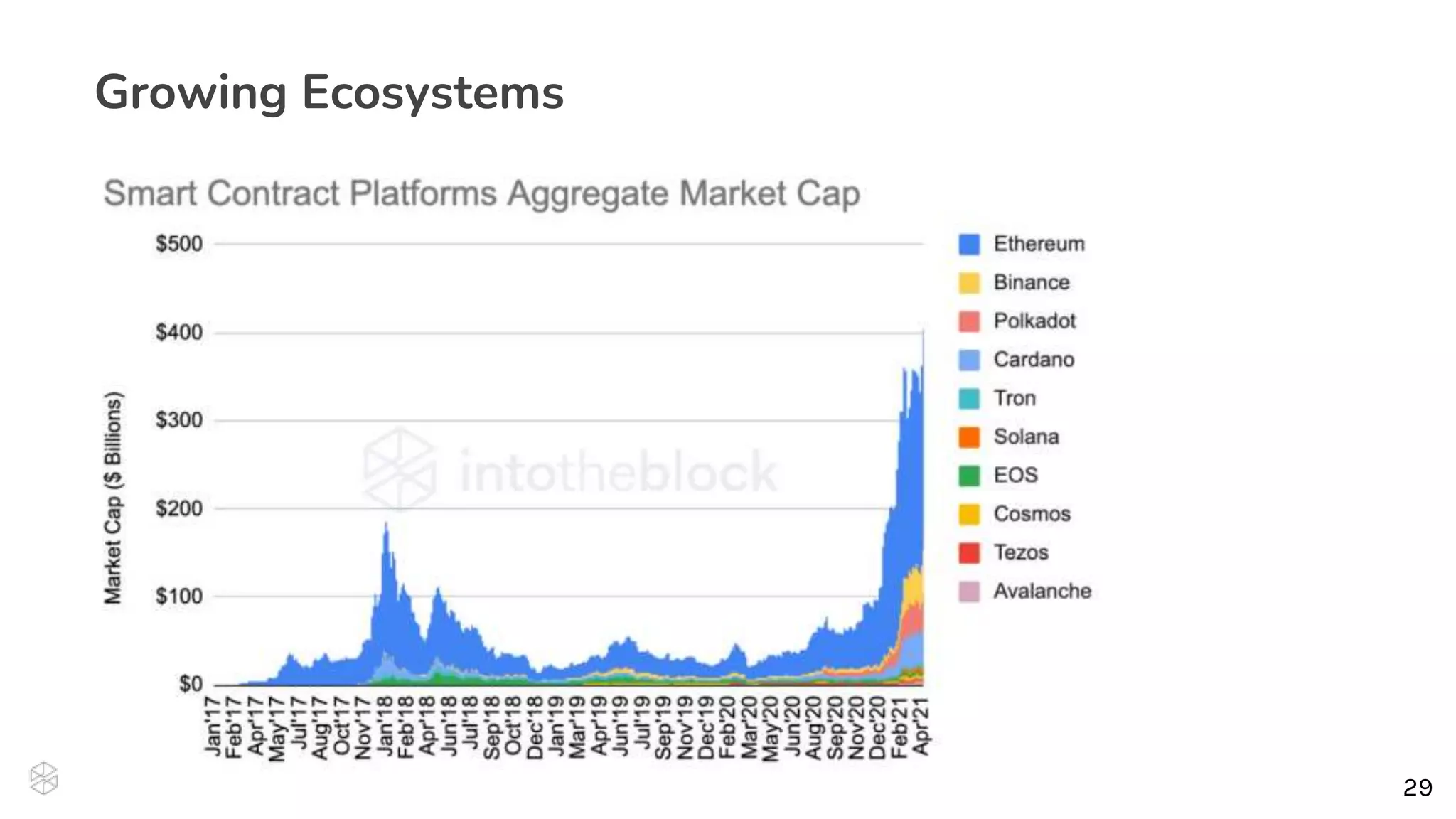

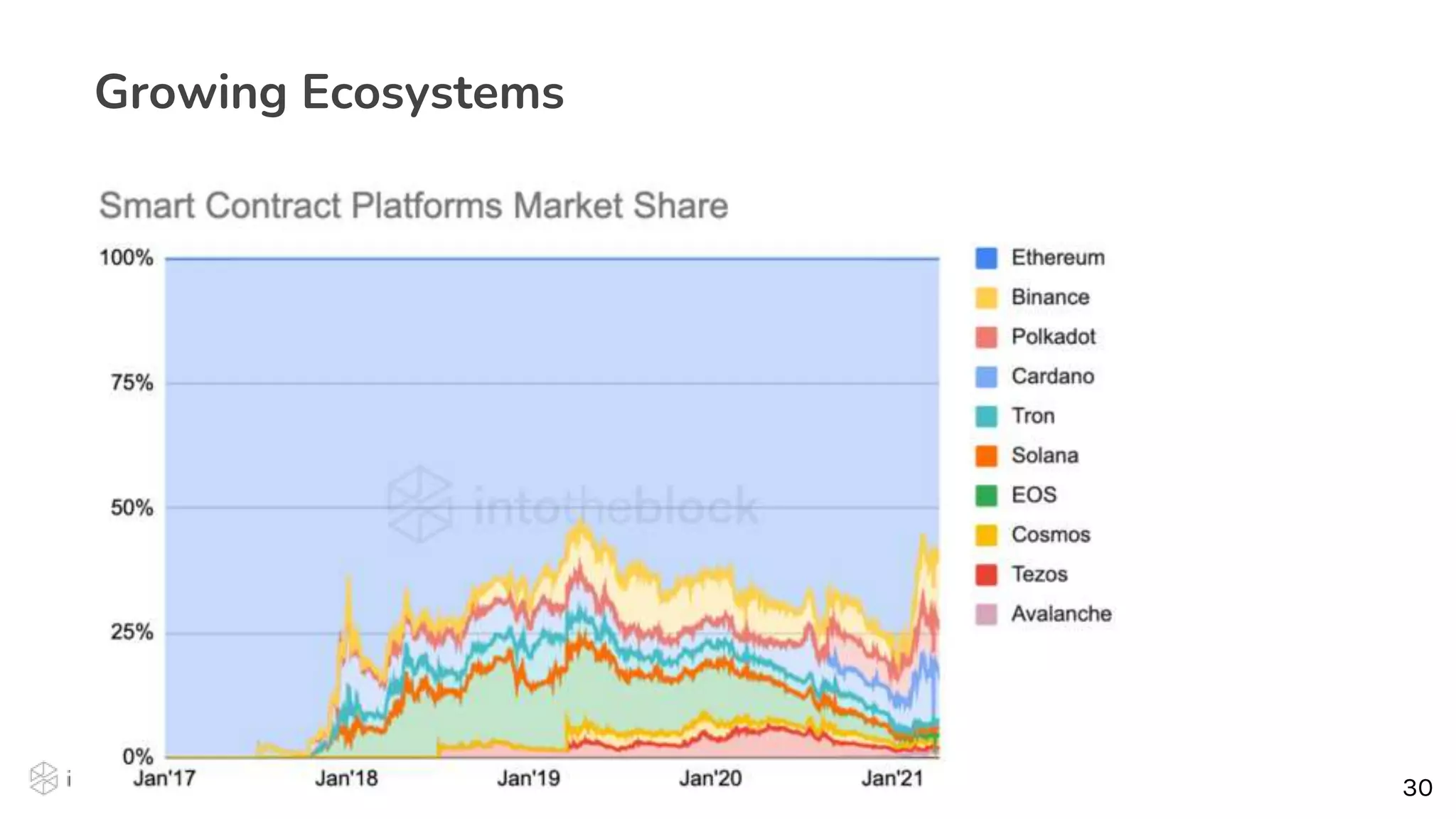

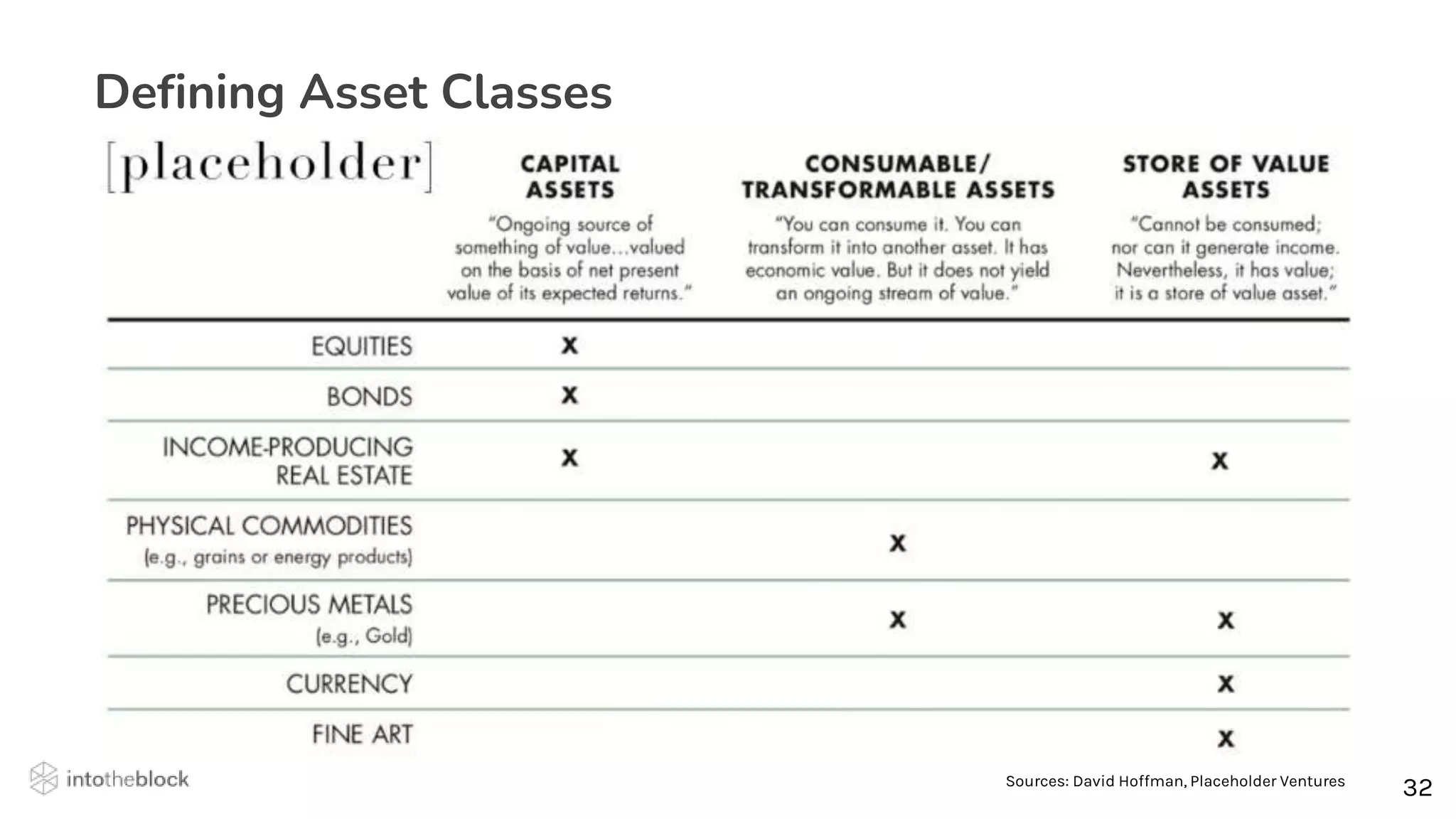

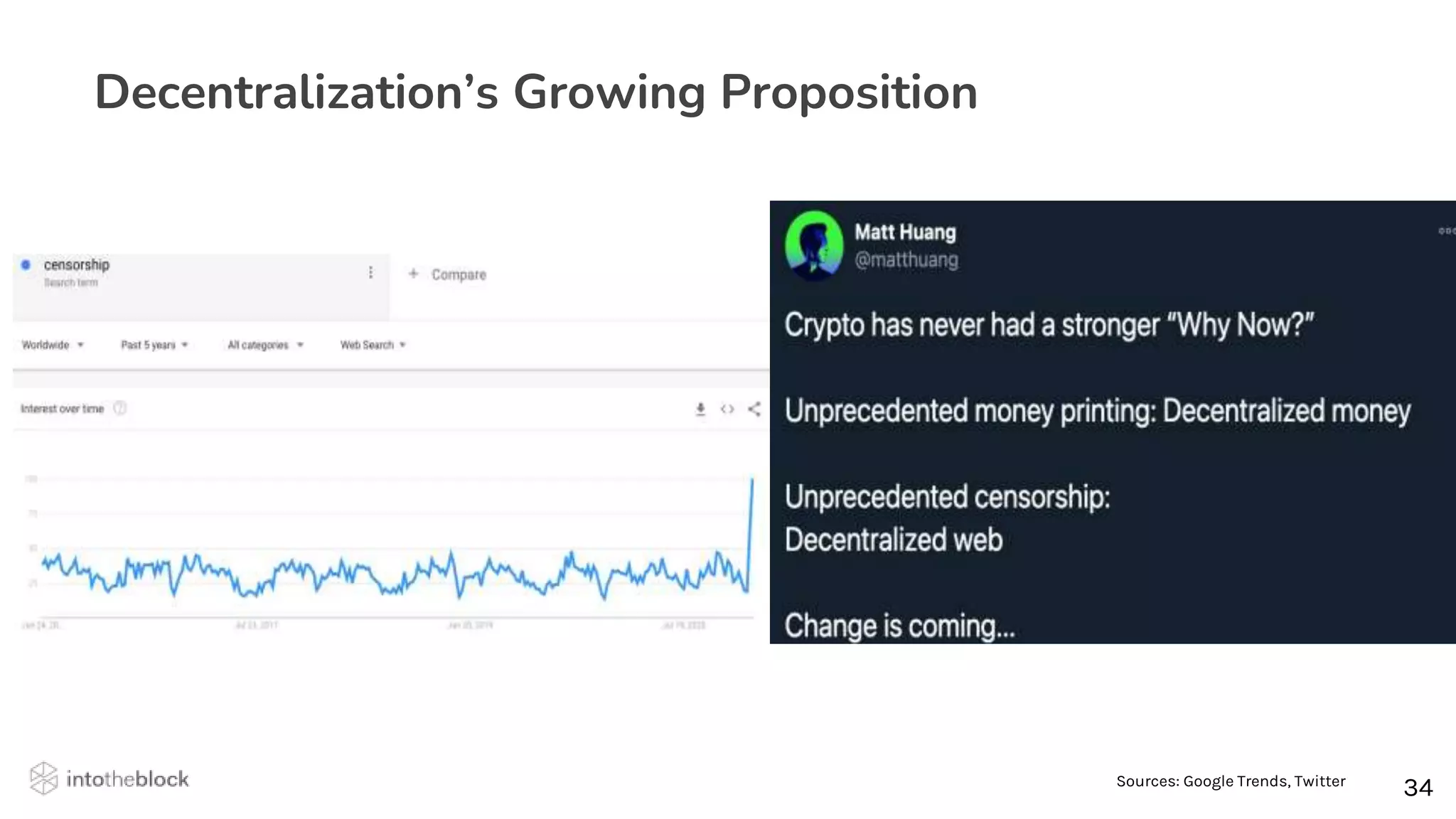

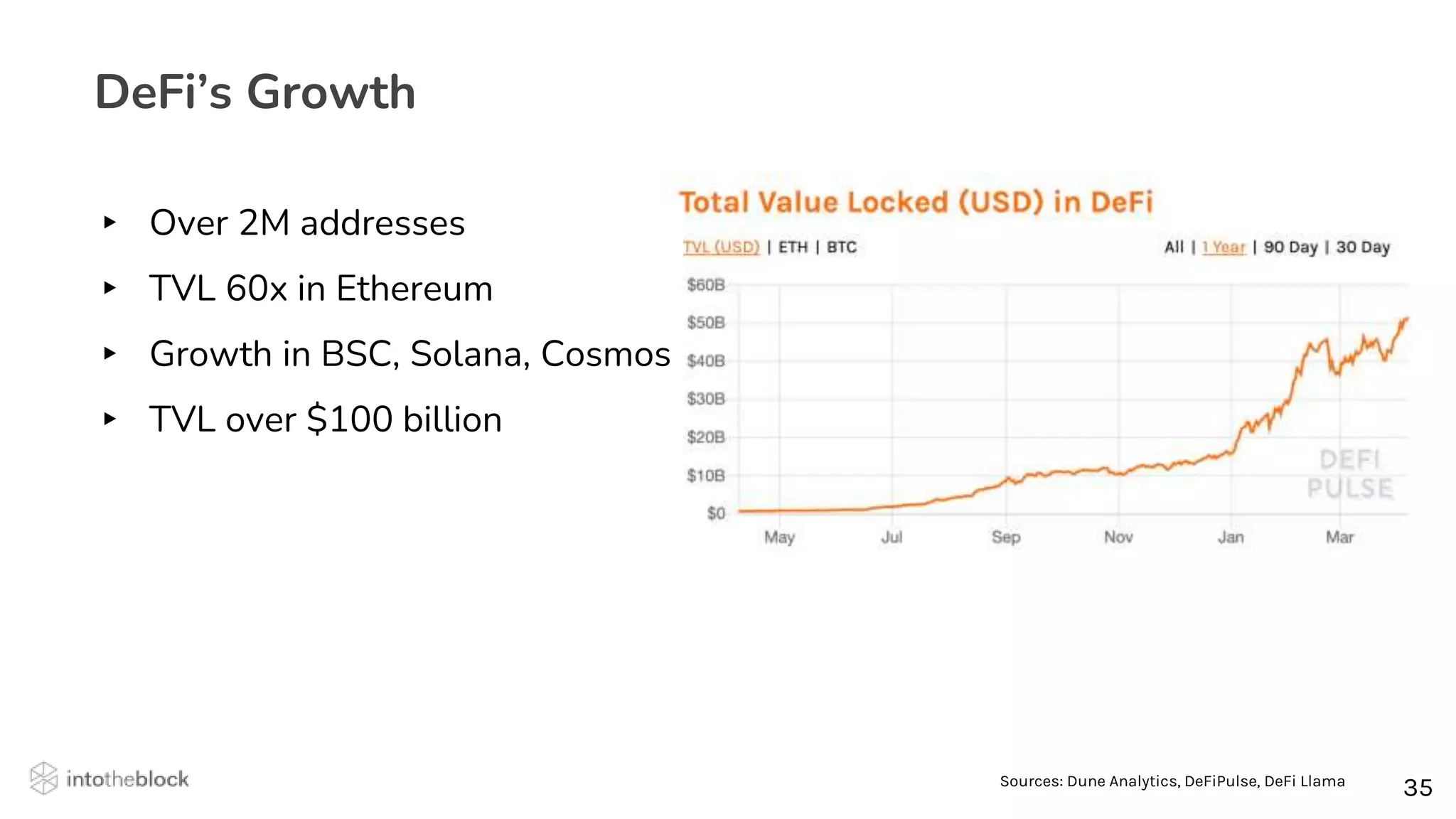

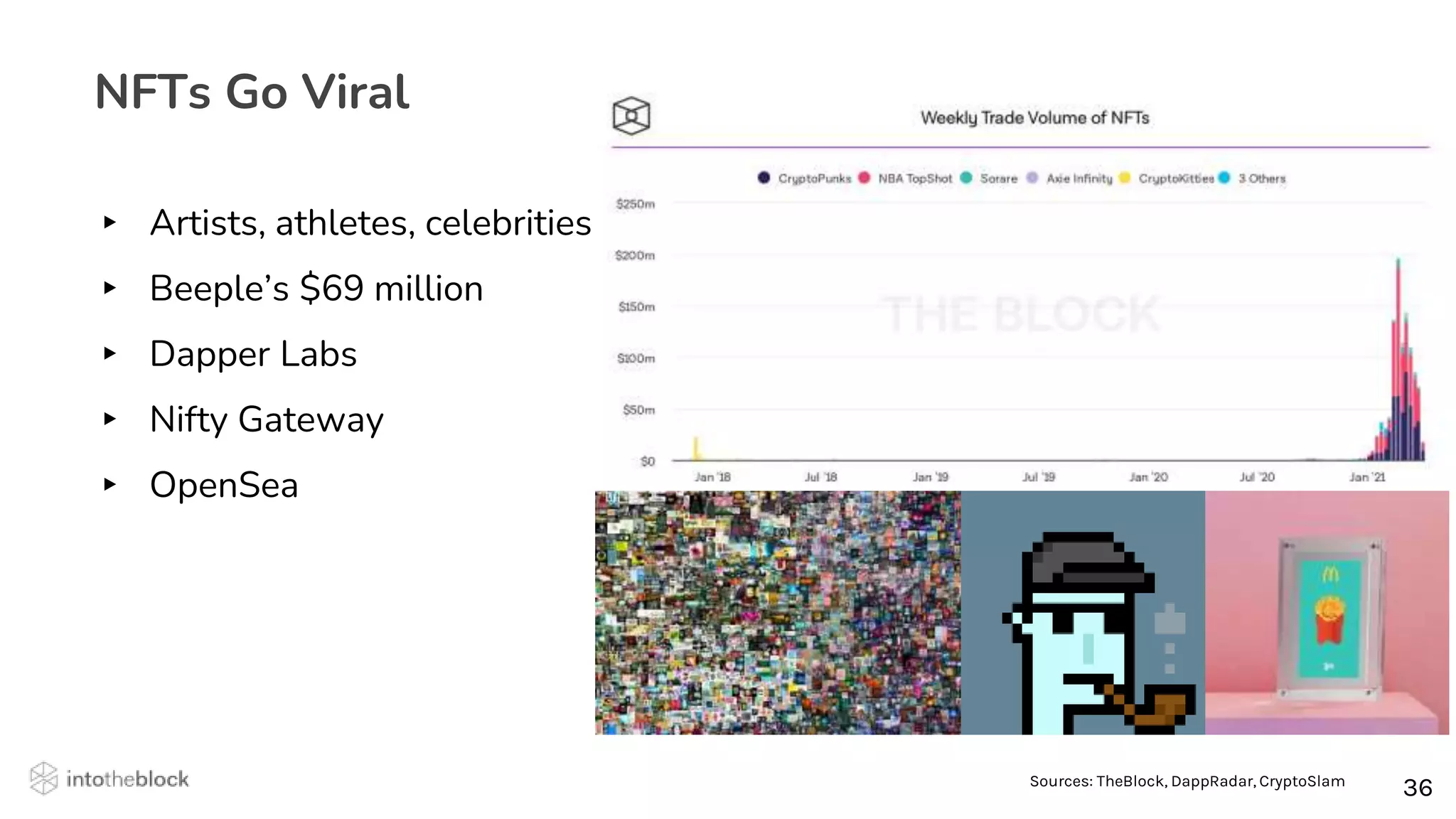

This document provides a comprehensive overview of the cryptocurrency bull markets, highlighting key trends and indicators, particularly focusing on Bitcoin and Ethereum. It outlines historical bull markets, driving forces behind recent market movements, and the emergence of new sectors such as DeFi and NFTs. Additionally, it discusses institutional adoption and changes in market dynamics compared to previous cycles.