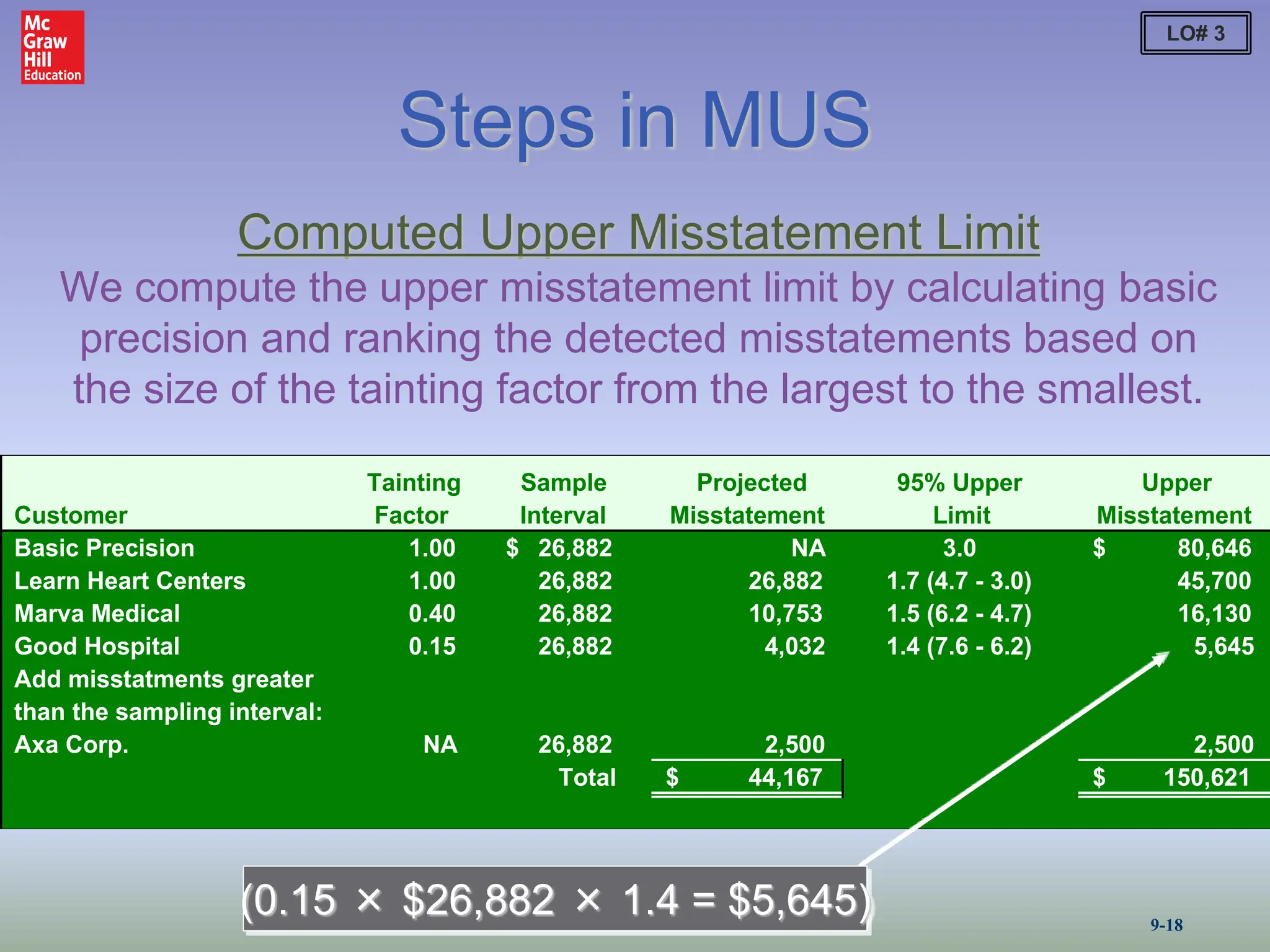

This document discusses audit sampling techniques for substantive tests of account balances, specifically monetary unit sampling (MUS). It outlines the steps in applying MUS, including: 1) planning by defining the population, sampling unit, and misstatements, 2) determining sample size based on desired confidence level, tolerable misstatement, expected population misstatement, and population size, 3) selecting the sample, 4) performing audit procedures on the sample, 5) calculating the projected misstatement and upper limit, and 6) drawing conclusions by comparing the upper limit to the tolerable misstatement. An example application of MUS to test accounts receivable is provided to illustrate these steps.