This document contains a petition for legal separation filed by Annette Cottonbetteridge against Russell Cottonbetteridge. It provides details of their 7-year marriage, 4-year-old child, date of separation in May 2017, and requests division of property, debts, maintenance, and a continuing restraining order. The petition outlines agreements between the parties regarding division of vehicles, family home, maintenance payments from Russell to Annette, and child support.

![FILED

12HAY 3l PH 3:31

,-,$llni,qixiJ'.**

Superior Court of Washington

County of

In re&e Marriage of:

ANNETIE COTTONBETTERIDGE

Petitioner;

and

RUSSELL COTTONBETTERIDGE

Respondent.

2'-3-03968'-6ISi',f

for

rl Separation (f$arriage)

GSP)

ra,1.12: check box if petition is

for:

Orderfor protection DV {PTORPRT}

UH

1.1 ldentification of Petitioner

Name ANNETTE CO'fTONBETTERIDGE" Birth date lAnJ ]o73

Last known resideuce KING COTINTY/IVASHINGTON.

1.2 ldentification of Respondent

Name RUSSELL COffiOhIBETTERIDGE, Sirth date 1A1ilQ6&

L ast L:nown residence KING COLINTY/WA SHII{GTON.

t.3 Children of the llllarriage Dependent Upon Elther or Both Spouses

t I Does not apply. There are oo children dependenton either or both spouses.

txl The husband and wife are both the legal (biotogical or adoptive) pareots of the following

depeldent childten:

Name RUSSELL RAMON BETTERIDGE Age 4YEAR$

I I The husband is and the wife is aot the Iegal parent of the following dependent children:

DOES NOTA?PLY

tlq The wife is ad &e husband is not ttre legal parent of ttre following dependent childrcn:

Pstturlegal Sqparafba efl.GSPJ - Page 1 d r0

WPF OR 0{-0110 Mandatory {ffio0e} - RCW 26.09-020; 28.09.030(4)

l. Basis](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-3-320.jpg)

![Name EBS

Name RWS

Name MJS

Age J-0)GABS

Age 9YFARS

Age SYEA&$.

7.4 Requestfor Legal Separation

lhis is areque$ for legal scpration in licu ofa dissolution ofmarriaga

{.5 Date and Place of Mardage

T}e parties were married onAUGUST 13, 2005 aIAUBIIRN, IYASIIINGTON,

1.6 Separation

I ] Hxbard and wife are not separated.

pA Husband and rvife separated oa IVIAY 17,201?..

This is &e date tcheck all that apply):

Fil thc parties moved into separate residences,

[ ] the parties tlivided their assets and liabilities.

t I petitioner filedthis petition.

[X] both parties egreed is tlre date of separation.

[ ] other:

1.7 Jurisdiction

This court has jurisdiction over t&e marriage.

fx:l This court has jurisdiction over {re respoa&nt because:

flq &o respondert is currently residing in Washingfon.

txl the petitioner andrespondent lived in Washington duringteirmarriage andthe

petitioner continues to reside, or be a member ofthe armed forces s€tioned, in

&is state,

pA the pstitioner and respondentmay have conceived a child whils v/ithin

Washington.

i I o&er:

I I This court does not harre jurisdiction over the respondent

Pet for Legal Sepantion {PILGSP) - Page 2 of 1A

WPF DR A1.O11O Mandatoty {6n008) - RCW26.A9-020; 26.O9.030(4)](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-4-320.jpg)

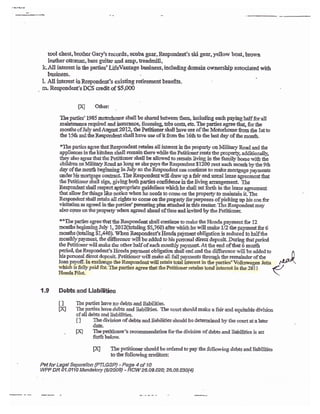

![1.8 Property

There is commulity or separate propeay owned by the parties. The court should make a fair aad

equitable division of all dre propert)'.

i I The division of properf should be determined by &e court at a larer date-

Dq The petitionetr's recorumendation for tfue division of prope{y is set .f:orth betow.

m The PETITIONER should be awarded the parties' interest ir the foflowing

properly:

**2011 HONDAPILOT

a. Pans with rack, knives, dining mirtor, hutch, kitchen table

b. Black couch, one idea chah Dyson Vacuua, dark storage sttonar

c. DVD storage dresseq one set bedside tables

d. surfboards

e. Family room flatscreea tv rvith blueray and black wii with all games, storage and kids movies sxcept as

provided b Respondeat

f. iMac alrd Macbook computers

g. Queensizr bed with mauress and linens

h. A1l kids teds and bedroom firmiarre as presently arranged in bedrooms

i- Black Stackingrvasherand dg,er

j. Petitioner's ski gear, children's ski geac children"s bikes

k.none

l. aoae

rir Petitioner's DCS credit of $20,000

fX] The RESPONDEIIf shosld be awadedtheparties'interesrin the following

propefl.y:

,$7 268 MILITARY ROAD SOUTTI AUBURN, WA

**VOLKSWAGEN JET'IA

a. CanonRebel camera

b- one ikea chair with footrest, black chaiq black office chair, light ottoman, brourn leafier couch, Iarge

desk

c. Clo&es dre$eraod sccond set ofbedside tables

d engine hoist

e. Fiatscreen fiom bedroom with Sasrsuug DYD and urhite wee, all grou.it up movies plus walld Cars,

lYinnie the Pooh, Srallace and Grommit

f. Acer touchscreen, Dell laptop, iPad

g Power tools. Air compressor, Motorclrle

h.Table Saw

i. KirchenAppliances*

j, All items that belonged to Res'pondent prior to tlre mariage: glass table, round hble, rvrought iron

cushion bench, bookshelf, wood dish holder, small fvfl/'CR combo, white car, adult trikes, red

Petfor Legal Sepaation {PTLGSP) - Page 3 of 10

WPF DR 0t .Ot t 0 Mandatory $12008) - rcW 26.09.020: 26.09.030(4)](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-5-320.jpg)

![changp to *re arrangement will begin wi& Reqlondeat's paycheck schduled for August E, 2012 and is

contiagent on Petitioner sccuring ernplo;rment with a salary minimum of $2,000 per montfi. Respondent

vill continue to deposit the remai:rder of each paycheck into the Petitioncr's credit unioo accouat as

cunently set up.Atthis pointlheRespoadentwill begin paying his proportioral share of childcare costs

for'RRB, not to arceed $400 a month (which takes into consideration the Respondent's availablc

discretioaary incomei,

The parties agree to this arrangemer$ for the duration of the Responde,nt's agreed commitment to pay all

or a portion of the Honda Pilot payments as set forth in section 1.8 above, at which point if thc parties

havenot r*oacile{ the mainteaaace rvill cease and the Respoadelt lvill be responsible for his total

proportionaie share of child care forRRB, removing tte $400 cap, and he shall coatinue to make ditect

deposit ofhis child support obligation cn13r

The agreed order of child support will be considered paid as long as the above agred division of&e

Respondent's monthly eamings is adhered to.

1.11 Continuing Restraining Order

I I Does rot apply.

fxl A eorrtinuing restaining onder should be eatered *,hich restrains or enjoins the

IXJ husband [ ] rvife from distubing the peacs of the other parly'

t ] A continuing reshaining ordsr should be eltered whicb restraits or enjoins the

I I husband [ ] wife &om going onto the grounds of or entering the home, work place or

school of t&e o&er par{y or the day care or school of Sre following children:

I ] A continuing restraining order should be entered qrhich restrahs or eqioinsthe [ ] husbaod

[ ] r+ife &om knorvingly coming within or krowing$ remaini'ng rii*rin

(distancc) ofthe home, work place or school ofthe offier parly ortire

daycare orschool of&ese children:

Other:

A conti:ruing restraining order should be eatered which reslrains or enjoins

(narne) from molestiag assauhing, harassing; or

stalking (namc) .. (Ifthc court orders &is relief thc

resrafued person will be prohibited frorn possessing a frearm or antmrmilion under

fedenal larxr for the duration of the order. An exception exis8 for law enforcement

officers and militarl'pe,monnel when cargrlng department/government-issued firearms.

18 U"S.c. $ 92s(aX1))

I I O&er:

1.12 Protection Order

IXI Does not appl),.

If you need immediate protection, contactthe clerklcourtfor RCIIY 26.50

Dom*tic Violence lorms or RCW {O.l4Antiharassment fonns.

1.13 Pregnancy

tA The wift is notpregnarf.

Petfor Isgal Separation 1PILGSP) - Page 6 of 10

WF DR A1.0110 Mandatw {62008) 'RCw 26.09.02a; 26.09.a30{4)

tl](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-8-320.jpg)

![t ] Tbe rryife is pregnat Note UnderRCW 26J,5.ll6"tle hasband is the presumed

falhen If husband orwife belieres the lusband b not the father, &is presarption

may be chalhnged up to two years afterthe birth of the ehild oras

provided in RCl{ 26.26500 throagh2626.62S-

ll O&er:

Pet for Legal Separafrbn {PTLGSP) - Page 7 of I B

WPF DR U.A11A Mandatory (62008) - RCW26.A9.020; 26.09.030{4)](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-9-320.jpg)

![1.14 Jurisdiction Over the Children

i I Does not apply because there are lro depeadentchildren.

fX] This courthasjurisdiction overfie children for&ereasons set forth belorr:.

I ] l]ris court has orclusivc continuingjurisdiction The court has made a cLild

custody, p@nting plm, residenfi sdredule or visitation detennination in *ris matter and

r*ains j udsdiction uader RC$f, 26 27.21 l.

fX] This state is the home state of&e children because:

|X] the children Iived h trashinSon wifh a parent or a person acting as a paent for at

ieast six consecuti!'e months immediately prc,ceding tre commencenre$ of this

proceeding.

I I the children are less &an six months old and have lived in Y/ashington with a

pareilt or a person actilg as parent since birtb-

Xl any abserces frorn lV?tshington harre been only temporary.

pq Washingfon was thc home *rte of &e childrcn within six montbs beforc the

commencem€rt ofthis proceeding and the children are absent &om the state but a

parent or person acting as a paeirt conlbued O live in this state.

t I The children and the pareats or the drildrcn and at least one pasot or person acting as a

parcnl have significant connoctioa wi& the state other &an merc physical presenoe; atd

substantial evidence is available in this state concerning tlre children's care, protetiorq

training ad personal relationsltipq and

I I the children have no home state elserrhere"

t I the childrent ipmc s€b has declined to exercise jurisdiction on the ground {rat

&is state is tbe more ap,prcpriale forurn underRCW 2627.261 or .271.

t I AIi courts in te children's home state Lave declinEd to e:relcise jurisdiclion on &e goutrd

tlat a court ofthis state is the more appropriate forum to detennine the custody of the

cbildren under RCW 2627.267 q .27 l -

tl No otlrer state has jurisdiction.

I ] This court has temponary eirreryencyjurisdiction over this proceeding because the childrcn

aIE prssent in this state and fhe ch.ildren havs beer abatrdoned or it is necossary in an

emergenc,y to protect the children because the childreq or a sibling or parent ofthe children

is subjected to ordrreatened with abuse. RCW2627.23l.

t ] There is a previous custody dstermination &at is eatitled to be enforced under

this chapterorachild custody proeeedrng has been comrnenced in a court sfa

state haviog.lurisdiction under RCW 26 27 .2U through 26.27 -221 - the

requirements ofRCW 26 .27 231{3) apply to this matter. This staft's jurlsdictioa

over the children shall last until (date) _ . .

t ] Therc is ao previous custdy determination frat is entitled to be eaforced undcr

this chapter aud a child custody prccerding has aot beeo commeuced in a court

of a state having jurisdiction under RCW 26 27 30 1 througfu 26.27 221- If aa

action is notfiled in (rotentiai home siats)_ by thetime

&e child has been in Yashington forsixmonths, (date) #

then lVashington'sjurisdicticn will be final aad contiauing.

Pet for Legal Sepantion {YILCSP) - Page I d 10

WPF DR A1.0110 Mandatory {6n0Aq - RCW26-09.a20;26.09.030{4)](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-10-320.jpg)

![tl Other:

{.15 Child Suppc* and Parenling Plan for Dependent Children

t] Tbepartieshavenodependentchildren.

IA A parenting plan md an older of ciild $$pon pur$antto the Washington St*e child

support sta:hrtes should be entered forthe following children uiho are dependent upon

bothparties:

Nsmes ofChildren

RUSSELL RAI,ION BETTERIDGE (4 YEARS)

The petitioner's proposed parenting plan for the children listed above is athched and is

incorporated by referenee'as part of this ?etitiora pursuaot to RCW 26.09.181.

The petitioner's proposed child support rorksheets for the children lised above is

attached and is incorporated by reference as part of this Petitioa.

(The follorving infi>rmation is reqrrired only for ttrose children who arc included in the petitioner's

proposod pareating plaa.)

During tlre last fir'e yea:s5 &e childron have lived:

txl in no place other than the stale of l!-ashington aud.with rto person cther than the

petitioner or the respoadeal

I I in &e follovring places with &e follou'ing p€rsons {list each placetlre childen

livd inciuding &e sbte of 1{'ashington, the dates &e chil&en lived there aad the

narnes of the persoos with whom the children livsd. The present addresses of

tfiose pwsons must he listed in the Confidential Information Form):

Qleirns t0 custody or visitation.

H] The petitioner docs not know of any persoa other than the respondent who has

physieal custody of, or claims to have custody or visiation rights to, the shildren.

I ] The following persons have physical custody of, or claim to have custody or

visitation rightsto, the cbildren (listtheir naales aad &e children conoeraed

bclow and list their presentaddressss in the Confidential Informdion Form. Do

not listttre responding party):

Isvolvemeot in any ottrcr proceeding concerning the chil&ea.

[X] The petifiorrerhas not been involved in any otherproceeding regarding&e

children.

t I The petitioner has bcen involvd in the following proceedings regarding tte

children:

Pet for Legal Sqan{ion {PILGSP) - Page 9 of fi

WPF DR A1.Ufi Mandatory $fr008) - RCW 26-A9.020; 26.09.A30{4}](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-11-320.jpg)

![Other legal proceedings concerning the children.

fX] Tbe petitioner does not knorv of any o&er legal proceedings concerrring the

clildren.

I ] The petitioner knows of the following legal proceedings that concern the children

(lis the cirildren concerncd, t}e corut, the caseiumber and tte kind of

proceeding):

1.16 Other

The partics agree tha! although f}ere is nc existing iegal obligation on thc pac of the Responden! the

Respondent has an agreed obligation to tile Petitiorsr's clrildren that wcre harmed while under

Respondent's protection and with Respondent's knowledge of at least a portion oflhatharm, Theparties

therefore agree that the provisions set forth in this petition as to finances aad living arrangsments shatl not

be reduced for 18 months from the day this pet*ion is filed due to any change ofmind on the

Respondsnt's part for any reason.

ll. Relief Requested

The petitioner Requests the court to enter a decree of legal separation aad to grant the relief below.

tX Providereasonablemaintenanc,e forthe [ ] husband ffi wife.

i ] Approve thepetitioner's proposed parenting plan for thc dependent children l:sted irr

paragraph 1.15.

IX Determine support far the dependent children listed in paragraph 1.15 pursuant to the

Washington State ch ild support statutes.

Approve ltre separatioa contract or prenuptial agrcemcnt-

Divide the propert)' and liabilities.

Change name of wife to (first middle, Iast):

Change narne of lusband to (first, middle, Iast):

Entef a domestic violence pro@1i6n srder.

Enter an antilarassmeat protection order.

Enter a continuing restrainiry order.

Order psyment of day care cxpens€s for the children listed in paragraph 1-15.

,{nard &e tax exemptions for the dependent children listed in paxagraph 1.15 as follows:

Order payment.of atorney fees. other profe.rsional fees and costs.

Other:

I]

txl

tl

tl

I]

I]

il

txl

tl

I]

tl

*%!aa{"a>

PetforLegal Sepaation {PTLGSP} - Page 10of 1A

WPF DR U.a110 Mandatory {6n008) - RCVl 26.09.02A; 26.o9.$A{a)](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-12-320.jpg)

![FILED

l? JUt{ I 5 pil Z; S0

-..- -t:{tiG c0u}{TY

:ur(fitcg couaT'cLif;K

xrHi, w,r' &lpn -

Superior Gou* of lffashington

County of KING

In retrc i!{arriage of;

ANNEITE C OTTONBETTERID GE

md

Ru s s ELL CO TT0I'TBETTERIDGE

. 12-$03968-6

Decree of Legal Separaticn

{DCLGSP}

I Clerk's action required

1.1

l. Judgment/Order S um maries

Restrai ning Order Su mmary:

[X] Does not apply. [ ] Restraining Order Surnmary is set fcrrtlt belorv:

of persoa{s) restrained: Nameofperson(s)

protected: See paragraph 3.8.

Yiolation of a Res-tnining Order in ?aagraph 3,8 BelowWigt Actual

Terms is a Crtmlnal Ofense Under Chapbr 26.50 RCl/[ and Wlll Subject the

RCW 26.49.450.

{.2 Raal Property Judgment Summary:

[ ] Does rot app1y. fX.l Real Property Jtdgment St,mna{y is set for& klory:

's properly ta,x parcei oraccountoumber:

Or

-egat description ofthe property aurarded (includiss tot, bloclq plaq or sectiso. to'imship, range, county and stat4:

RESIDENCE AT 3'7'268 MILTTARY RD. S. AUBURN. V/A 98001

{LL INTEREST IN PROPERI}- IS AWARDED TO TI{E }IUSBAND/RESPONDSNT

ieePase for fulI leeal descriprion

{.3 lllloney Judgment Summary: -

[X] Does notapply- t] Judgment Summary is setforth belor'.

A Judgment creditor

B- Judgmentdebtor

C. Principaljudgmentamount $

Deqee (DCD) {DCLGSP) {DCINMC) - Page 1 of 4

VWF DR U.0&0 Mandatory {v2008} - RCW 26.ae"030; "040; .070 {3)

of i8

to](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-15-320.jpg)

!['l

.

Unless o&erwise provided herein, the husbaad sball pay all liabilities incurred by him siace &e date

ofseparation-

3.5 Liabilities to be Paid by the tYife

The wife shall pay the cornmunig crr separate liabilities set forlh in Ex,tibk A, Petition for

Legat Separation This exhibit is atbched or filed aad incorporated by refererce as part of

thisdesee.

Unless othemrise provided hereiq the u'ife shall pay all liabilities ircurred by her siace Se date of

sepaJation.

3.6 Hold Harmless Provision

Each party shali hold the other pady harmless frcm any collection action relatiug 1o

-reparaft or conrmuaity liabiiities set fortlr above, including reasonable attorney's fees and

cost incurred in defendilrg against any attemp8 io collect an obligation of tle otlrer party.

3.7 Maintenance

The husband shall pay main&nance as set for& in Exbibit,& Petition for Legal Separation.

This exhibit is attached or filed and incorporated by reference as part of this decree.

The obligation to pay firuremainienanc€ istffmicated upon tle deatir ofeitherparly or{he

remariage ofthe parly receiving mahtenance ualess otherurise specificd belotv:

Paymeots shall be made:

FA directlyto &e otherspouse.

Continuing Restraining Order

lXJ DoesnotapPlY.

3.9 Protection Order

[K] Does notapply.

I I The parties shall comply vitlr trc [ ] domestic violence [ ] antiharassment ftcr for

Protection signed bythe courtor this dareordated

in this cause nrmrbec The Order for Protectioa signed by the court is approved and

incorporated as part of this dacree-

3-10 Jurisdiction &er tlre Children

Deree {DCD} fDCL€sP) {DCINMG) -Page 3of 4

WPF DR U.0400 Mandatory P2,008) - RCW 26.09.030; -040; .070 t3)](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-17-320.jpg)

![The ccurt has juriSiction over the cLildren as set fodh in tb€ Findings of Fact and

Conslusions oflasv.

3.11 Parenting Plan

The parties shall comply with the Pareating PIan signed by tlre oourt on this date

or dated May 31 ,2A12. The Parenting Plan signed }y the court is approved and

incorporated as part of this decree.

3.{2 Child Support

Child support shall be paid in accordance rvith the Order of Child Suppoa si$ed b],the

court on this date or datd May 3 l , 2012. This order is incolporated as part of this decree.

3.r3 Attorney Fees, Other Professional Fees and Costs

Doesnotapply.

3.74 Name Cftanges

N

I]

Rssponeleirt or respondent's la*yen

A signature below is actuai notice of this arder.

[ ] Presented by:

[] Approved forenuy*:

I I Hotice for prcsentation raived:

Signaturc of Respondent or Larvl'criWSBA

Decree {DCD) {DCLGSP) (DCINMG} - Page 4 of 4

WPF DR O4.O40A Mandatory $2008) - RcW26.09.030; .O40; .070 {3)

to

UW*snotapply.

The wife's name shall be

(frrs[ middle, lasr name)

Tlre husbard's name

(firs1 middle. last narne)

Petitioner or petitioner's laryer:

A signature below is actual notice of this order.

lt[Presented by:

IJ Approvedforea{v:

[ ] Notice forpreseirtation waived:](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-18-320.jpg)

![?{o{9s

{"8

*wuif ft

Property

Ihere is corumrrrif or separatc properqy owxed by &e parlies. TLe conrt sbouid malce a fair aqd

egiable division of ali &e property.

i I Tlre divisioa ofprqperty should be deternin€d by the corrt at a laer &te-

p( The petitioner's-recor:uaendation for the division ofpmperty is setforth below.

D0 ThePEITIIONER*ouidbemarded &eparties' inbrsstin thefolowitrg

Plgperly:

+*20i.1 IIONDAPILOT

a. ?au rrith rack, ioives, {inir€oirror, hutch, kiichen bble

b" Black coucho oae idea cbair, Dysoa Vacuum, dark storage oftoman

c. DI& stcrrage dresseq one setbcdside rables

d. surftoerds

e. Family room flatscreen tv with blueray and btrackrvii with all ganes, storage asd kids movies erceptas

ptoviiled to Respondant

f- lMac and Macbook computers

g- Queeasize Hwith:nataess and linens

h" AII ki& beds aad beilroom fursime as presen{y anarged in }edrooms

i. Slack Stackingwaster and dryer

j. Petitionert ski gear, children's ski geaq ctildrEtr's bltes

k.none

I. none

m. Petitionet's DCS credit of 320,000

'

fE theRESPO}{DE}{Tshouldbe axrarded&eparties' interesliathe folloxiag

Propelty:

47268 MILITARY ItCIAD SOUIII AUBURN,'WA

**YOLKS'WAGENJETTA ,

a- CaaonRebelcanera

b.one ikeachahwi&focitrest,blackcLair; blackofiice chaiC lightottotaao, broc'm leatirerooucfu laage

desk

c. Clothes dresser and second setofbedsidetables

d- enginehoist

e- Flatsc:een ftoo bedrooa. wit& Sarrsurg DYD ad wfute wee. all grola up rrovi* plus *'all-E, Cars,

'Whrnie

&e.Pooh, Wallace aad Grommit

f. Acer touchscrceq Deil lap1op, iPad

g:. Power bols, Air compr',esssr, Motorc]'cle

b-Table&qr

i. KirjhenAppliaaces*

j. AIt itenrs thd beloaged to R€qroadeflt priorto &e marriage; glass table, round table, wraught iroa

cushionbeuch,bookshelf,]rood dish holder,sfiall tvIV'CRcombo,white car, adiltbikes,red

Pet for Legal Separation {Fr{'GsP) - Page 3 d 10

WPF DR ALoill Mandatory t62,008) - rcW 26-A9.02a: 26.a9.a30$)](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-19-320.jpg)

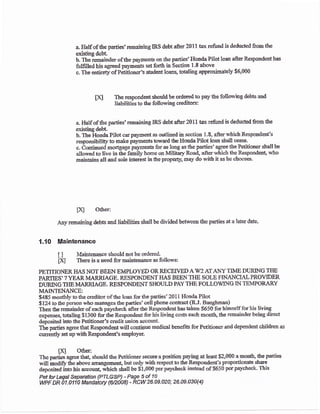

![a. Half of &e parties'remaiaiuglRS debt afer2011 tax refrmdis de&rctedf,om dre

existingdebt

b, Ihe remainder oftte paymenE on &e parties'Elorda Pilot loan aterRespondenllas

firtfilled his agreed paymcnts sotftr& in Sectioa 1.8 above

c. The entiretyof?etidoaer's student loaas, totalirg approrimately $6,000

The reqpcn:deot shor{d be oreleredto pay tbe folltm'ing deba ard

Iiabilities to tlre followiag creditors:

a Half of the parties'remaining IRS debt affer 201l tali rcfirf,d is deducEd from &e

existing debt

b. ?he $orila ?ilot car pagarent as outlined in section 1 .8, a*ct rvhictr Respondent's

reqpcasibility ro arle paymerb toward tbe lJo:rda PIot loa shall ceasa

c. eoatinued mo*gage paymeo8 for as long as the parties' agree the Petitioaer sball be

allorrad to liw in &e &mly hone cn Miliry Roa{ afler q'hioh &e Respondeat, who

maintaim all and sole iaterest in thcprotr)erly, fray do n{& it as he chooses.

fr(l o&ec

As$'remaining debts and liabilities shall be divided betrryeen &e paaties at a later da&.

1.10 llllaintendnce

Mairter:mce should rot be clrdered

Tlcre is a need for raintenance as follows:

PETTIONER IIAS NOT BEEN EMPLO:'gD OR RECETYED A W2 ATANTTIME DIIRING I}IE

P3RflES' 7 ]ES& MARRIAGA RESPONDE'T{T I{AS BEEN II{E SOI.E M.IA}{CIAL PROI/IDER

DTTRING T}IE MARRIAGE. BESPSNDBTT ${OI'LD PAY THE FOLLO]Ytr.{G IN TEMPDRARY

MA6ITET{ANCE

5485 moa&iy to &e creditor of &e loaa ftr dreparties' 2011 I{onda ?ilot

$124 to the person who ma!€es theprties'cell phone coahact [RJ. Banghmas)

Tlrea. the r€maiadgr cif each paychecli a&er &e Rspoadent.&as taken $650 for himself for his living

expenses" totaling $i300 for tbe Respondmt for his living costs each montL, the remainder being direct

deposited into the Peiitionet's creditunion account.

Tde parties agr€e tlat Respoadent.will contioue medic*l beaeits for Petitioner and depeodent children as

curreatly set up rvith Respondcct's employer

F(j O&ec

Thcparties ageet&a! should&e Peiitionerse$rreapositionpayingatlcast$2,0O0 amoafl;&e parties

vitl aodify l}re above anutgunent, but ooly *ith respect to the Respc,ndeafs proportionate share

deposited intohis accounq rvhieh sball be $1,000 perprycheck instead sf$650 perpaycheck This

PetforLegal Sepatation {e_ILGSP) - Page 5 af 10

WPFDR o1.a110 Mandaw $zo0g) - RCW26.O9.O2A; 26.09.030{4)

ta

I]

tx](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-21-320.jpg)

![?{8{98

t

:.."

change to thc a,rraagement will bEgin ryith Respoadecfs sche{uled for August 8, 2812 and is

eontingeat oo. ?etitioner securiag vaployment .l'i& a salary rriuimum of$2r000 per mon&- Respondent

wili contiaue to deposit &e remaindcr of each paycheck into the P. etitiorcr's credit ulion accourt as

cuneatly ,set lpAt this point &e Respondert rvill bryin prying lis propoaional slrare of childcare costs

for RRB, aot 1o qxceed 5400 a mmth (which tukes into consideradon tie Reqpoadeat's anailable

discretiolay ircome).

Thc parties agree to &is arangement for the duration of ihe Respondeofs agrecd coamiinaent to pry all

or alirction ofthc Honda Pilotpa5xreCIts as set forth in sestioa 1,8 above, atwhich point if the palties

haveaot reccaciled, the maintetrance will eease and frc Reqpoudent will be responsibie for his CItaI

proportionate share of child care for RRB, removing &e $4Q0 cap, and he *aII contirue to make direct

deposit ofhis child support obligation oaly-

T}re agr€ed order of ohild srpporr will be considered paid as long as dre above agreed division of &e

Respondent's rnontlly eami:rgs is adhEred to.

1.11 Continuing Restraining Order

Il Does se1sp1r.

IX] A csstinuing restaining order should be eatered rar&ich restains or eqjoins the

ffi husbaad [] vifa$om{istunbinglhepeace ofihe o$erparg',

I I A contiauing restrahing order should be entercd u&ich reshai* rrr enjoias tte

[ ] husbmd [ ] r{fe &on going orto the grouods of or eoteringtbe home, workplace or

sclool of the o$w pad3r or rfie day care cr sc*r o ol of f&e follawing shildrcn ;

-

I ] A conti:ruiogesirairing ordec shorrld bc entered vrhiol resiaias or eojoins the [ ] hxsband

[ ] vife from t:no,r'iag]y caming *ithin or lcrowingly remainirrg *i&itr

(distance) _oftLe homq work place or school ofthe o&er party or the

day ca* or school of these cijldren:

I I A continuing resh2inirrg s{dl€r shorrld be entered vrbicbrestrains or earjoias

(narne) *omaolestidg assaulting, &arassing or

stalkiag (uarne) , (If &e coitrt orders &ls reiie,{, &e

ieseaiald persi itrre!*, orarr:mstition under

federal lawfor&e duration of &e order. An orceptioaexise for lzrw esfgrc@sat

ofrcers md military persornel when carrying departmendlgouerrment-issued firearms.

18 U.s-c- $ 9zs(a{1))

II O&ec

1.12 Protection Order

Dq Does:rotatrply.

If you need irnmediate protection, contact the cler*t'court for RC$I26-5'0

Dom estic Violence forms or RCW 1 0.'l 4 Aniiha rassrnent foms.

1.{3 Pregnancy

HI Thewi& isaotPregnant

Pet fur Legat Ssparatbn (F"fLGs?) - Page 6 of 10

WF DR 01,O110 t{landaW {6mA8} - RCW28.0s.a2a; 2&o9.O3a{a)](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-22-320.jpg)

![1

8

I

10

1l

l2

15

l6

I8

t9

20

I]

t4

l7

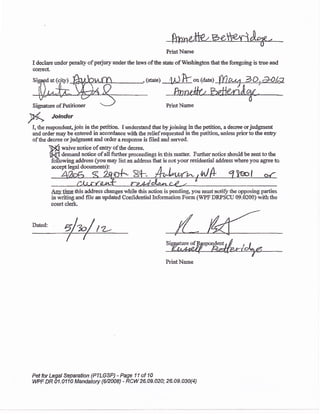

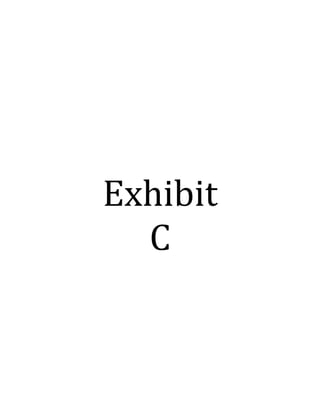

74 Addehdun to De.,e, LG*. ** * r#*@ by Rtj368dcottql8sfrel,dgo 37260 furu Rd S. Aubu7., WASWI

2, Rent paid by Patitioner to R€spondent

Th6 parlies agree that Petitioner's rental obligation to Respondent shall be

reduced proportionateiy to the redudim in Respondont's Medical Care Covefago

obtigauoo aboye, mBaning irstead of paying $1200 a moDth rsnl, Pe.tifloner

shall livo in the Property located at 37268 Military Rd. S. and pay Raspondent

S25o/rmnth in rent whilo she cominues lo roside lhere with her four children

under the terms of the rental agresmont whlch sha terminate no later than

January 2014 or the end of lhs managsmsnt Faioing of p€titio er in her currgnt

position with BankeCs Lif6. PBtitionBr will hold respondsnl harmtess if morlgage

lender torec,loGes on proporty prior to lhis date aDd this porlion ot rsspondert's

obligation will end.

3. Malntenance transferc ,,|&>Ub

The parties agree that the respondent will continue the payc!fi alofations as set

in July 2012, with thB exception that the rent payrnents of $#lmonth shall be

induded in respondentb hansfer, maktog the totat tEnsfer amouot S95O per

paycheck to respondent, remainder afrer auto loan and cell phona, transfened lo

petitionsr for 18 months until January 2014.

4. One Time Ralocatlon asslstance

For the rnonlh of September the parties agrce that the respondent will get gi09O,

f|e first afld last rnonth's rent rather than rEnt due to the respondent's need for an

apartment deposit. The petitioner shall give respondeDt g1,O9O on 9/5/12 and lhe

respondent will adjust the transfers according to the agreement io number 3 above

bofore the 10/8/12 paycheck is a ocated.

5, Divlsion of Property tlot lncluded ln Dscroa

Th€ bllorrving property was not induded in the inal d€cree erter€d on June 15,

2012 and the paribs 6gre€ on th6 folowing a[ocatioo of DropErty:

198oa1 and Trailers: Respondent; Motorhoma will be Respond;nls atr6r January,

2014; Caniod Food Stol-age: Split equally; Deep Freezer: petitio.ler Folding

Bookcases; Respondent 8K Generator: Respondent after Jan. ?014 or homes

bredosure; Assorted Motorcycle Equipment and dothing: Respondent;

Heavy metal sheMng llnil Respordefit](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-25-320.jpg)

![I

3

4

5

5

7

t

9

l0

ll

,2

l3

I4

t5

t6

t7

IE

l9

20

2t

23

21

[.

Concluaion

Th€padi€s hav6 agrB€d 10 tha abor/e €fiarEes/additons lo th€ inal

d€crge.

Patitioo.rr

A3iSDatu& balow is 6dual lotica of{& otdca

Rcspodioti

A sicnarutE bclov is a.tual notic! ofthis

!{.Frescned by:

t ] A9prurld &r cnEy:

at-1-D-fuhr+^,wk

Date trrd Plsc4 of Siloatuc

1H!*@","on*..,",*-,r&

o c! [ ] fEs.{ cd by:

Wffi ffir;;:tr#,**M,,^**nnn*,

// @-*BpSSELL corToNr€TTEru.DGE - R6p](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-26-320.jpg)

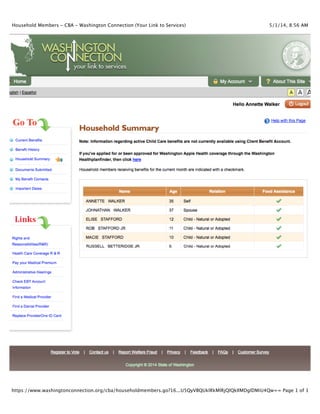

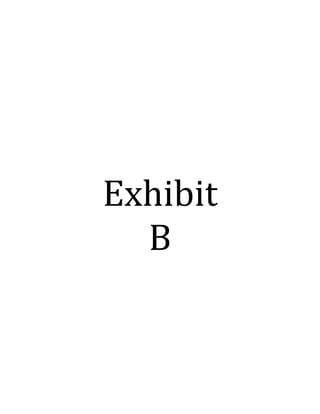

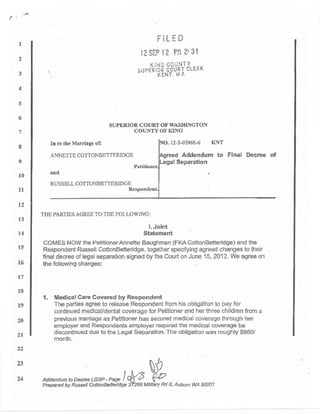

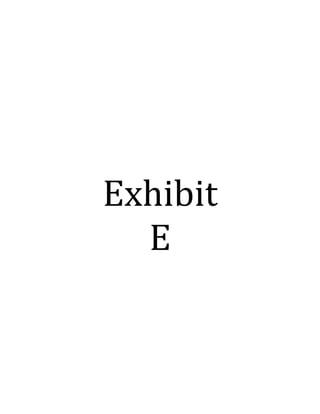

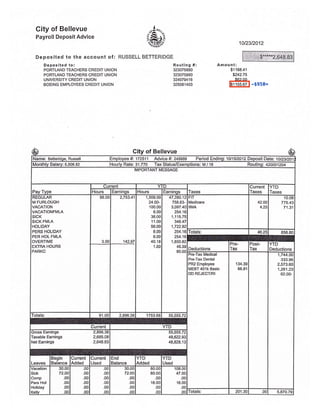

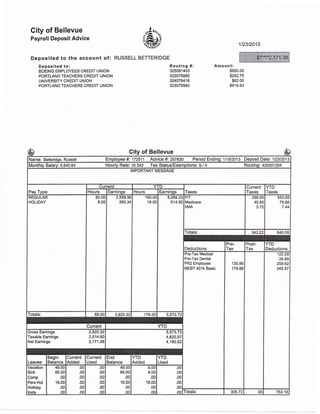

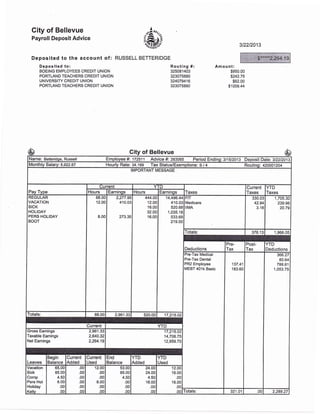

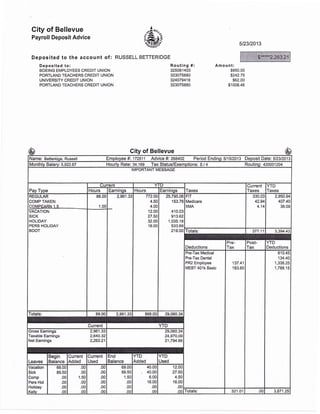

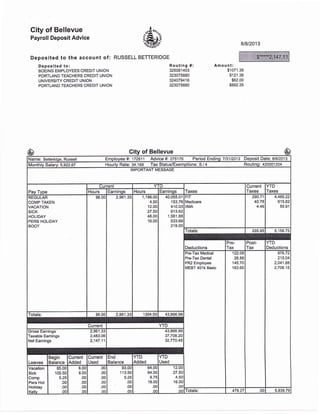

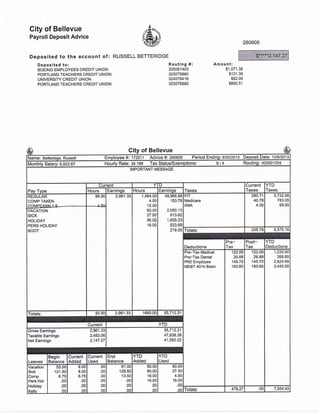

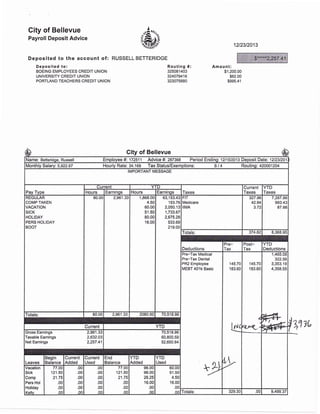

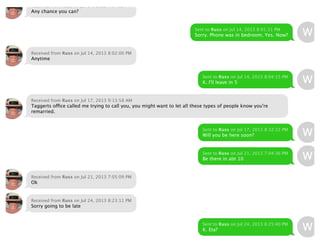

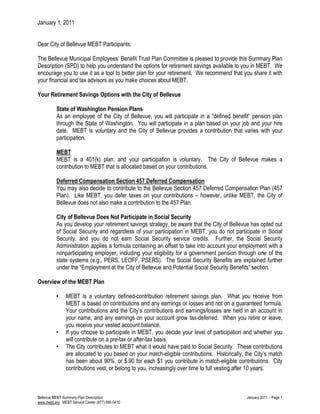

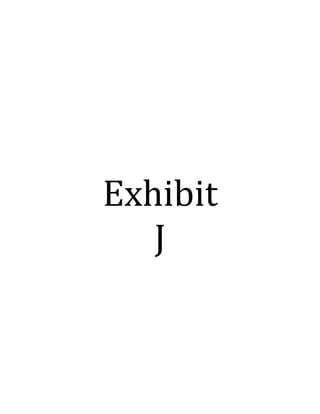

![City of Bellevue

Payroll Deposit Advice

.4",.

#3tur]i-o." 1217t2012

Deposited to the account of : RUSSELL BETTERIDGE

Deposited to:

PORTLAND TEACHERS CREDIT UNION ]

PORTLAND TEACHERS CREDIT UNION

UNIVERSITY CREDIT UNION i

BOEING EMPLOYEES CREDIT UNION i

Routing #:

323075880

323075880

324079416

325081403

Amount:

$1 188.41

$242.75

$62.00

$657.14

c of Bellevue

Name: Betteridge, Russell Employee #'. 172511 Advice #: 253929 Period Endinq: 11130t2012 Deposit Datei 12t7t2012

Monthly Salary: 5,506.82 Hourly Rate: 31.770 Tax Status/Exemptions: S / 4 Routing: 20001204

IMPORTANT MESSAGE

Pay Type

Current

Taxes

Current

Taxes

YTD

TaxesHours Earninqs Hours E.arntnos

REGULAR

M FURLOUGH

VACATION

VACATIONFMLA

srcK

SICK FMLA

HOLIDAY

PERS HOLIDAY

PER HOL FMLA

OVERTIME

EXTRA HOURS

PARKC

72.00

16.00

1.50

2,245.09

508.32

71.48

1 752.O0

24.00-

105.00

8.00

36.00

11.00

80.00

8.00

8.00

43.18

1.50

54,619.02

758.63-

3,256.25

254.16

1,115.75

349.47

2,485.40

254.16

254.16

1,993.78

45.39

90.00

FII

Medicare

IIMA

302_72

39.03

3.43

312.78

893.41

82.79

Totals: 345.18 1,288.98

Deductions

Pre-

Tax

Post-

Tax

YTD

Deductions

Pre- Medical

Pre-Tax Dental

PR2 Employee

MEBT 401k Basic

DD REJECT/RI

106.21

26.88

131.O7

65.25

1,956.42

387.72

2,963.50

1,475.33

62.00-

fotals: 89.50 2,824.89 2028.68 63,958.91

Current YTD

Gross Eamings 2,624.89

Taxable Eamings 2,495.48

Net Earnings 2,150.30

63,958.91

57,175.94

55,948.96

Leaves

Begin

Balance

gurrent

Added

Current

Used

End

Balance

YTD

Added

YTD

Used

vacation

Sick

Comp

Pers Hol

Holiday

Kellv

33.00

80.00

.00

.00

.00

00

8.00

8.00

.00

.00

.00

o0

.00

.00

.00

.00

.00

.00

4't.0c

88.00

.00

.00

.00

.00

96.00

96.00

.00

16.00

.00

.00

1 13.00

47.00

.00

16.00

.00

.00 Totals: 329.41 .001 6,720.97

$***"*2,150.30](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-35-320.jpg)

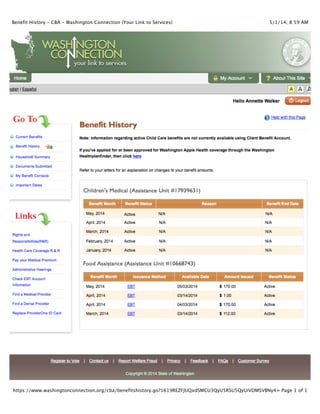

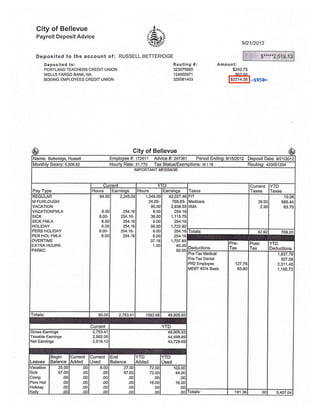

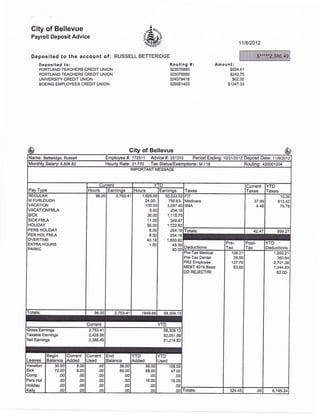

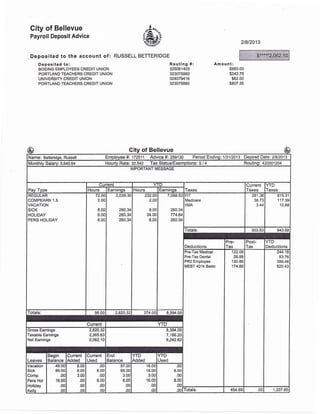

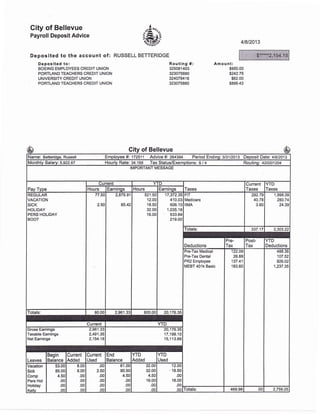

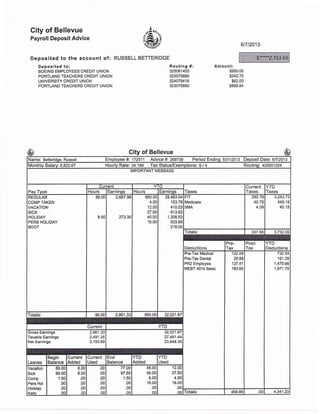

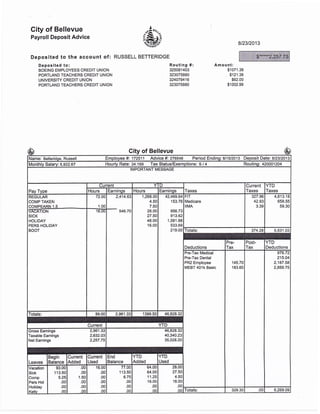

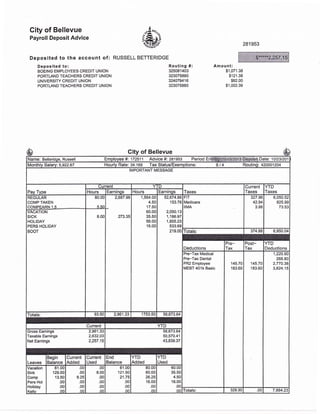

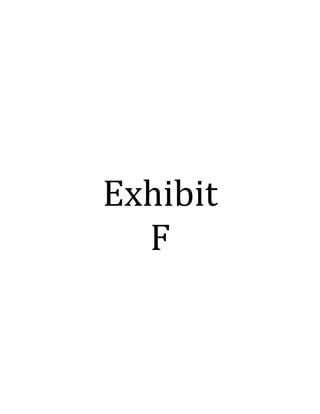

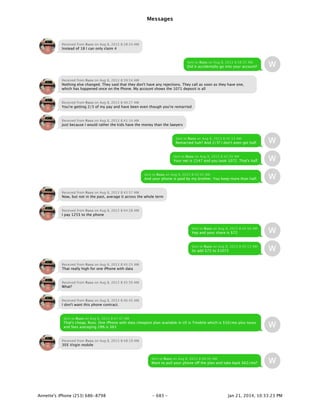

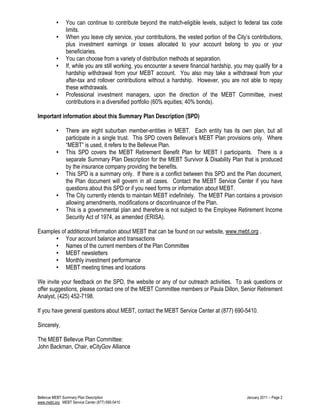

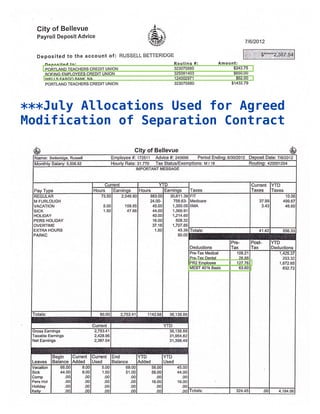

![Gity of Bellevue

Payroll Deposit Advice

Deposited to the account of :

Deposlted to:

BOEING EMPLOYEES CREDIT UNION

PORTLAND TEACHERS CREDIT UNION

UNIVERSITY CREDIT UNION

PORTLAND TEACHERS CREDIT UNION

.4"",

&i{srr]i-c.r"

RUSSELL BETTERIDGE

12t2112012

Routing #:

325081403

323075880

324079416

323075880

Amount:

$950.00

$242.75

$62.00

$993.56

of Bellevue

Name: Betteridqe, Russell Employee #: 172511 Advice #:255234 Period Ending:1211512012 Deposit Date: 121211201

Monthly Salary: 5,506.82 Hourly Rate: 31.770 Tax Status/Exemptions: S/ 4 Routing: 420001204

IMPORTANT MESSAGE

Pay Type

Current YI

Taxes

Current

Taxes

YTD

TaxesHours Earninos Hours Earninos

RE,GUTAR

M FURLOUGH

VACATION

VACATIONFMLA

SICK

SICK FMLA

HOLIDAY

PERS HOLIDAY

PER HOL FMLA

OVERTIME

EXTRA HOURS

PARKC

69.00

8.00

3.00

1.50

2,403.94

254.16

95.31

1,821.00

24.00-

105.00

8.00

44.00

14.OO

80.00

8.00

8.00

44.68

1.50

57,022.96

758.63-

3,256.25

254.16

1,369.91

444.78

2,485,40

254.16

254.16

2,065.26

45.39

90.00

FIT

Medicare

IIMA

336.0C

40.9?

3.2e

648.78

934.38

86.08

Totals: 380.26 1,669.24

Deductions

Pre-

Tax

Post-

Tax

YTD

Deductions

Pre-Tax Medical

Pre-Tax Dental

PR2 Employee

MEBT 401k Basic

DD REJECT/RI

13'l .07

65.25

1,956.42

387.72

3,094.57

1,540.58

62.00-

Totals: 81.50 2,424.89 2110.18 66,783.80

Current YTD

Gross Eamings 2,824.89

Taxable Eamings 2,628.57

Net Eamings 2,248.31

66,783.80

59,804.51

58,197.27

Leaves

Begin

Balance

Current

Added

Current

Used

End

Balance

YTD

Added

YTD

Used

Vacation

Sick

Comp

Pers Hol

Holiday

Kellv

41.00

88.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.o0

11.00

.00

.00

.00

00

41.00

77.OO

.00

.00

.00

.00

96.00

96.00

.00

16.00

.00

.00

113.00

58.00

.00

16.00

.00

.00 fotals: 196.32 .00 6,917.29

'$****2,248.31

Taxes](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-36-320.jpg)

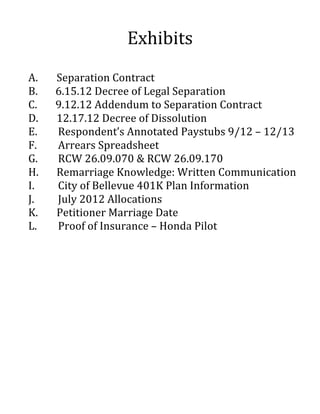

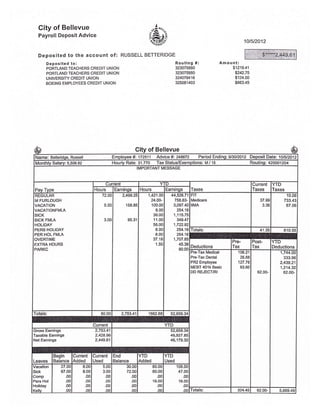

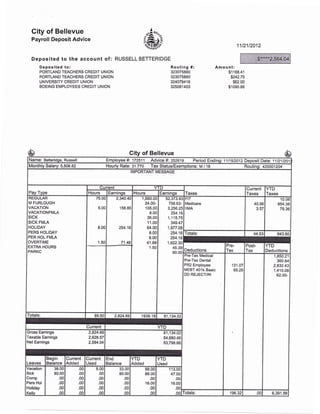

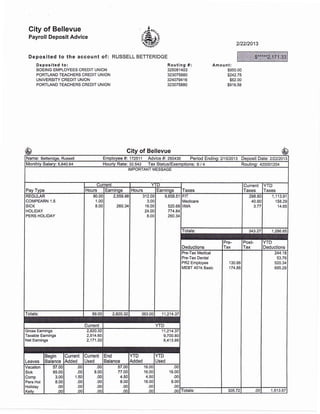

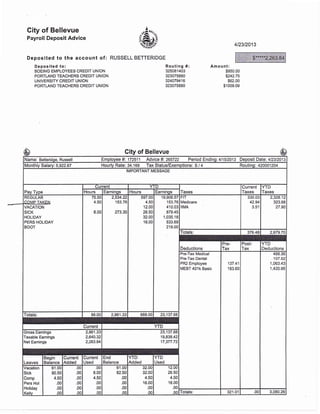

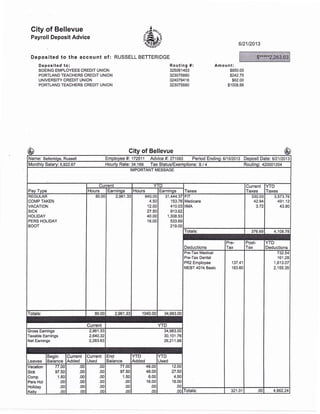

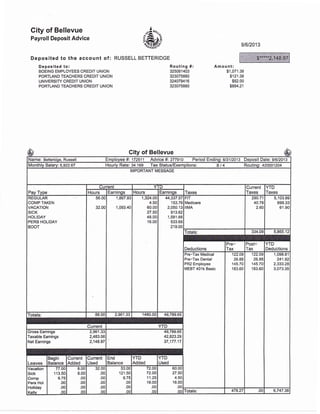

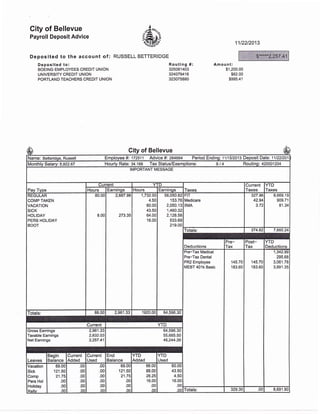

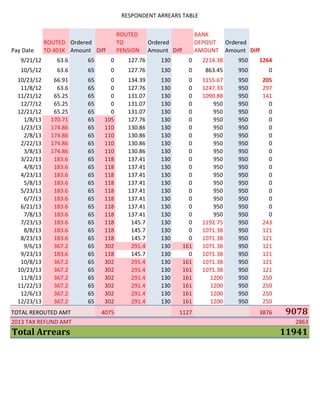

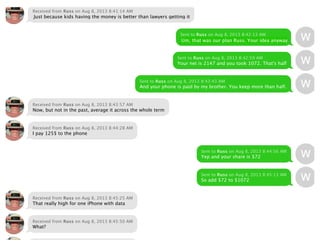

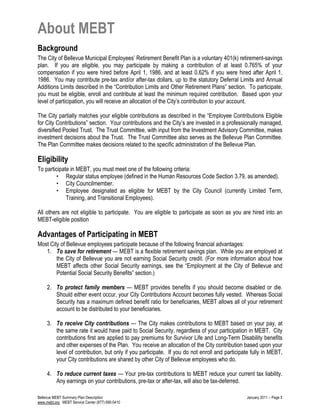

![City of Bellevue

Payroll Deposit Advice

Deposited to the account of:

Deposited to:

BOEING EMPLOYEES CREDIT UNION

PORTLAND TEACHERS CREDIT UNION

UNIVERSITY CREDIT UNION

PORTLAND TEACHERS CREDIT UNION

"4"",

RUSSELL BETTERIDGE

7t23t2013

Routing #:

325081403

323075880

324079416

323075880

Am ou nt:

$1192.75

$0.01

$62.00

$1002.63

City of Bellevue

Name: Betteridqe, Russell Employee #i 172511 Advice #i 273807 Period Ending'.711512013 Deposit Datei 712312013

Monthly Salary: 5,922.67 lourly Rate: 34.169 Tax Status/Exemptions: s / 4 Routing: 42ooo12o4

IMPORTANT MESSAGE

Pay Type

c rnt YTD

Taxes

Current

Taxes

YTD

TaxesHours Earninqs Hours Earnings

REGULAR

COMP TAKEN

(]r)MPFARN,i 6

80.00 2,687.98

273.35

1,100.00

4.50

6.50

'l2.oo

27.50

48.00

16.00

37,093.68

153.76

410.03

913.62

1,581.88

533.69

219.00

FIT

Medicare

IIMA

327.96

42.94

3.74

4,194.51

574.84

51.45

VACATION

SICK

HOLIDAY

PERS HOLIDAY

BOOT

8.0c

Totals: 374.64 4,820.80

Deductions

Pre-

Tax

Post-

Tax

YTD

Deductions

Pre- lax Medrcal

Pre-Tax Dental

PR2 Employee

MEBT 401k Basic

145.70

183.60

u54.63

1 88.1 6

1,896.18

2,522.55

Totals: 88.50 2,961.33 1214.50 40,905.66

Current YTD

Gross Eamings 2,96'1 .33

faxable Eamings 2,632.03

Net Eamings 2,257.39

40,905.66

35,225.14

30,623.34

Leaves

Begin

Balance

Current

Added

Current

Used

End

Balance

YTD

Added

YTD

Used

vacation

Sick

Comp

Pers Hol

Holiday

Kellv

B5.UU

105.50

4.50

.00

.00

.00

.00

.00

.75

.00

.00

.00

.00

.00

.00

.00

,00

oo

85.00

105.50

5.25

.00

.00

o0

56.00

56.00

9.75

16.00

.00

o0

12.00

27.50

4.50

16.00

.00

.00 TotaIS: 329.30 .00 5,461.52

8*****r 9tr'7 1Ov LrLv t .eJ

-$950=

-$65

————-](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-50-320.jpg)

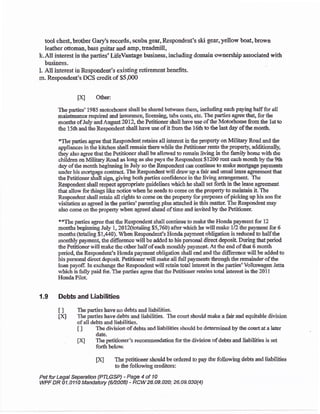

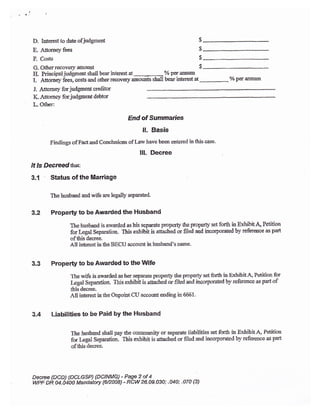

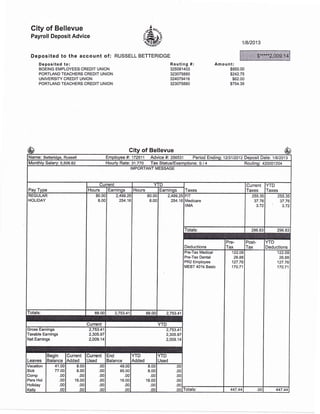

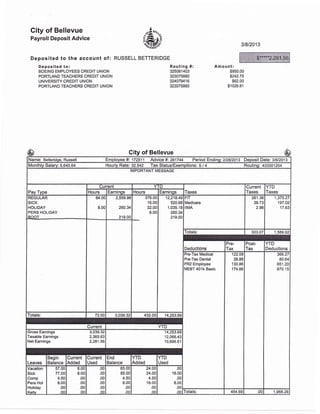

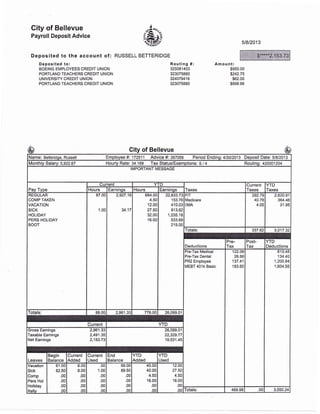

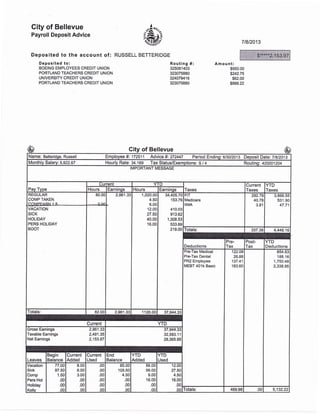

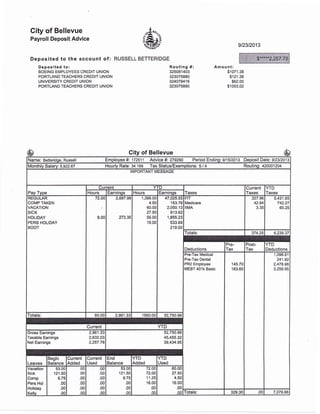

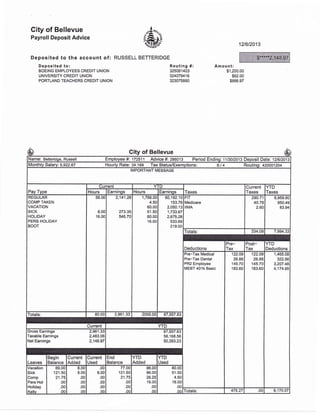

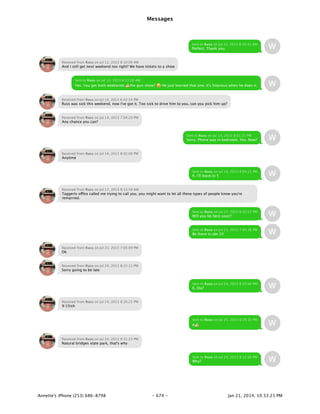

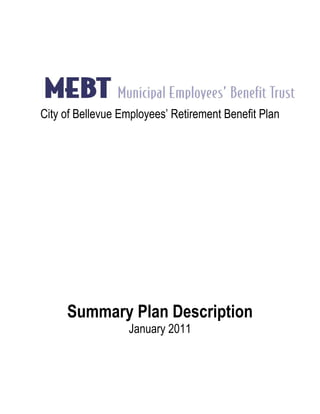

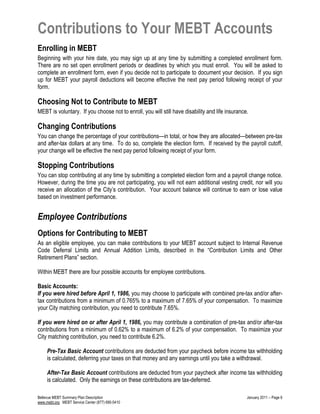

![City of Bellevue

Payroll Deposit Advice

^

.-a BE,

a3'srr'ii-s{'

111812013

Deposited to the account of : RUSSELL BETTERIDGE

Deposited to:

BOEING EMPLOYEES CREDIT UNION ]

UNIVERSITY CREDIT UNION i

PORTLAND TEACHERS CREDIT UNION

Routing #:

325081403

324079416

323075880

Amou nt:

$1,200.00

$62.00

$885.48

City of Bellevue

Name: Betteridqe, Russell lmployee #i 172511 Advice #i 283307 Period Ending:1013112013 Deposit Dale'. 111812013

Month lv Salary i 5,922.67 lourly Rate: 34.169 Tax Status/Exemptions: S / 4 Routing: 420001204

IMPORTANT MESSAGE

Pay Type

Current YTD

Taxes

Current

Taxes

YTD

TaxesHours Earninos Hours Earnings

REGULAR

COMP TAKEN

VACATION

stcK

HOLIDAY

PERS HOLIDAY

BOOT

88.00

8.00

2,687'.98

273.35

1,652.00

4.50

60.00

43.50

56.00

'16.00

55,362.84

153.76

2,050.13

1,460.32

1,855.23

533.69

219.00

FIT

Medicare

IIMA

290.71

40.78

4.09

6,341.23

866.77

77.62

fotals: 335.58 7,285.62

Deductions

Pre-

Tax

Post-

Tax

YTD

Deductions

Pre-Tax Medical

Pre-Tax Dental

PR2 Employee

MEBT 401k Basic

122..09

26.88

145.70

183.60

122.09

26.88

145.7C

183.6C

1,342.99

295.68

2,916.08

3,807.75

Totals: 96.00 2,961.3s 1832.001 61,634.97

Current YTD

Gross Eamings 2,961.33

Taxable Eamings 2,483.0G

Net Eamings 2,147.48

61,634.97

53,053.47

45,986.85

Leaves

3egin

Balance

Current

Added

Current

Used

End

Balance

YTD

Added

YTD

Used

Vacation

Sick

Comp

Pers Hol

Holiday

Kellv

61.00

121 .50

21.75

.00

.0c

.0c

8.00

8.00

.00

.00

.00

on

.00

8.00

.00

.00

.00

oo

t 9.0u

12',t.50

21.75

.00

.00

00

88.00

88.00

26.25

16.00

.00

o0

60.00

43.50

4.50

16.00

.00

.00 fotals: 478.27 .00 8,362.50

$*****2,147.48

No Direct Deposit Set-up for Ordered Honda Payment

-$950 =

-$65

—————](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-57-320.jpg)

![RCW 26.09.070

Separation contracts.

(1) The parties to a marriage or a domestic partnership, in order to promote the amicable settlement of

disputes attendant upon their separation or upon the filing of a petition for dissolution of their marriage or

domestic partnership, a decree of legal separation, or declaration of invalidity of their marriage or domestic

partnership, may enter into a written separation contract providing for the maintenance of either of them, the

disposition of any property owned by both or either of them, the parenting plan and support for their children

and for the release of each other from all obligation except that expressed in the contract.

(2) If the parties to such contract elect to live separate and apart without any court decree, they may

record such contract and cause notice thereof to be published in a legal newspaper of the county wherein

the parties resided prior to their separation. Recording such contract and publishing notice of the making

thereof shall constitute notice to all persons of such separation and of the facts contained in the recorded

document.

(3) If either or both of the parties to a separation contract shall at the time of the execution thereof, or at a

subsequent time, petition the court for dissolution of their marriage or domestic partnership, for a decree of

legal separation, or for a declaration of invalidity of their marriage or domestic partnership, the contract,

except for those terms providing for a parenting plan for their children, shall be binding upon the court unless

it finds, after considering the economic circumstances of the parties and any other relevant evidence

produced by the parties on their own motion or on request of the court, that the separation contract was

unfair at the time of its execution. Child support may be included in the separation contract and shall be

reviewed in the subsequent proceeding for compliance with RCW 26.19.020.

(4) If the court in an action for dissolution of marriage or domestic partnership, legal separation, or

declaration of invalidity finds that the separation contract was unfair at the time of its execution, it may make

orders for the maintenance of either party, the disposition of their property and the discharge of their

obligations.

(5) Unless the separation contract provides to the contrary, the agreement shall be set forth in the decree

of dissolution, legal separation, or declaration of invalidity, or filed in the action or made an exhibit and

incorporated by reference, except that in all cases the terms of the parenting plan shall be set out in the

decree, and the parties shall be ordered to comply with its terms.

(6) Terms of the contract set forth or incorporated by reference in the decree may be enforced by all

remedies available for the enforcement of a judgment, including contempt, and are enforceable as contract

terms.

(7) When the separation contract so provides, the decree may expressly preclude or limit modification of

any provision for maintenance set forth in the decree. Terms of a separation contract pertaining to a

parenting plan for the children and, in the absence of express provision to the contrary, terms providing for

maintenance set forth or incorporated by reference in the decree are automatically modified by modification

of the decree.

(8) If at any time the parties to the separation contract by mutual agreement elect to terminate the

separation contract they may do so without formality unless the contract was recorded as in subsection (2)

of this section, in which case a statement should be filed terminating the contract.

[2008 c 6 § 1010; 1989 c 375 § 4; 1987 c 460 § 6; 1973 1st ex.s. c 157 § 7.]

Notes:

Part headings not law -- Severability -- 2008 c 6: See RCW 26.60.900 and 26.60.901.](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-64-320.jpg)

![thirty percent and the change would cause significant hardship, the court may implement the change in two

equal increments, one at the time of the entry of the order and the second six months from the entry of the

order. Twenty-four months must pass following the second change before a motion for another adjustment

under this subsection may be filed.

(8)(a) The department of social and health services may file an action to modify or adjust an order of child

support if public assistance money is being paid to or for the benefit of the child and the child support order

is at least twenty-five percent above or below the appropriate child support amount set forth in the standard

calculation as defined in RCW 26.19.011 and reasons for the deviation are not set forth in the findings of fact

or order.

(b) The department of social and health services may file an action to modify or adjust an order of child

support in a nonassistance case if:

(i) The child support order is at least twenty-five percent above or below the appropriate child support

amount set forth in the standard calculation as defined in RCW 26.19.011;

(ii) The department has determined the case meets the department's review criteria; and

(iii) A party to the order or another state or jurisdiction has requested a review.

(c) The determination of twenty-five percent or more shall be based on the current income of the parties

and the department shall not be required to show a substantial change of circumstances if the reasons for

the deviations were not set forth in the findings of fact or order.

(9) The department of social and health services may file an action to modify or adjust an order of child

support under subsections (5) through (7) of this section if:

(a) Public assistance money is being paid to or for the benefit of the child;

(b) A party to the order in a nonassistance case has requested a review; or

(c) Another state or jurisdiction has requested a modification of the order.

(10) If testimony other than affidavit is required in any proceeding under this section, a court of this state

shall permit a party or witness to be deposed or to testify under penalty of perjury by telephone, audiovisual

means, or other electronic means, unless good cause is shown.

[2010 c 279 § 1; 2008 c 6 § 1017; 2002 c 199 § 1; 1997 c 58 § 910; 1992 c 229 § 2; 1991 sp.s. c 28 § 2;

1990 1st ex.s. c 2 § 2; 1989 c 416 § 3; 1988 c 275 § 17; 1987 c 430 § 1; 1973 1st ex.s. c 157 § 17.]

Notes:

Part headings not law -- Severability -- 2008 c 6: See RCW 26.60.900 and 26.60.901.

Short title -- Part headings, captions, table of contents not law -- Exemptions and waivers from

federal law -- Conflict with federal requirements -- Severability -- 1997 c 58: See RCW 74.08A.900

through 74.08A.904.

Severability -- Effective date -- Captions not law -- 1991 sp.s. c 28: See notes following RCW

26.09.100.

Effective dates -- Severability -- 1990 1st ex.s. c 2: See notes following RCW 26.09.100.

Effective dates -- Severability -- 1988 c 275: See notes following RCW 26.19.001.

Severability -- 1987 c 430: "If any provision of this act or its application to any person or circumstance

is held invalid, the remainder of the act or the application of the provision to other persons or

circumstances is not affected." [1987 c 430 § 4.]](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-66-320.jpg)

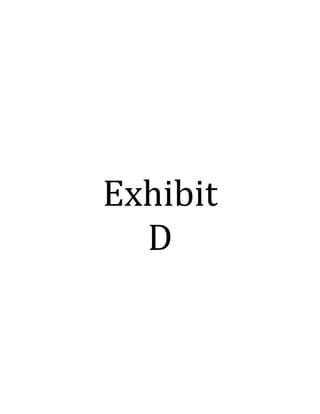

![& State Farm Flre and Ca6ualty Comp.ny

PO Box 5000

Oupont WA 98327-5000

NAMED INSURED

Ar3 47-2254-2 X

WALKER, JON & AI{NETTE

1514 zTI)TH AVE E

LAKE TAPPS }lA 9859I.5221

FIBE OVL10645-2'X

DECLARATIONS PAGE

PAGE 1 OF2

POLTCY NUtrBER 212 s3A3-C26-47

PoLICY PEBIOD SEP 26 2013 io MAR 26 2014

12:01 A.L/ Standard Time

lle

STATE FABI,] PAYMENT PLAN NUI4BEB

1187934615

AGENT

DAN I.ICCLUNG

1911 MAIN ST

suivtNER, wA 98390-1819

PHONE: (253)863-7927

OO NOT PAY PBEMIUMS SHOWN ON THIS PAGE.

IF AN AMOUNT IS DUE, THEN A SEPARATE STATEMENT IS ENCLOSED,

YOUR CAR

HONDA PILOT SPOBT WG 5FNYF4H52BBO26645 103H114300

Each Accrdent

Comorehensive Coveraoe - $100 Oeduciibe

Car Rental and Travel Expenaea Coveraqe

Each D Each Loss

Underinsured lvlotor Vehicle Cover

Each Pelson. Each Accident

U1 Underinsurcd Motor Vehicle Pro $2.41

$50.000

YEAR MAKE MOOEL BSOY STYLE VEHICLE ID. NUMB€F CLASS

2011

SYMBOLS COVEHAGE & LIMITS PREMIUMS

Bodily lnjury Lim ts

-

w

U

Badllv lniriw Lim 16](https://image.slidesharecdn.com/5-140503183753-phpapp02/85/5-15-exhibits-86-320.jpg)