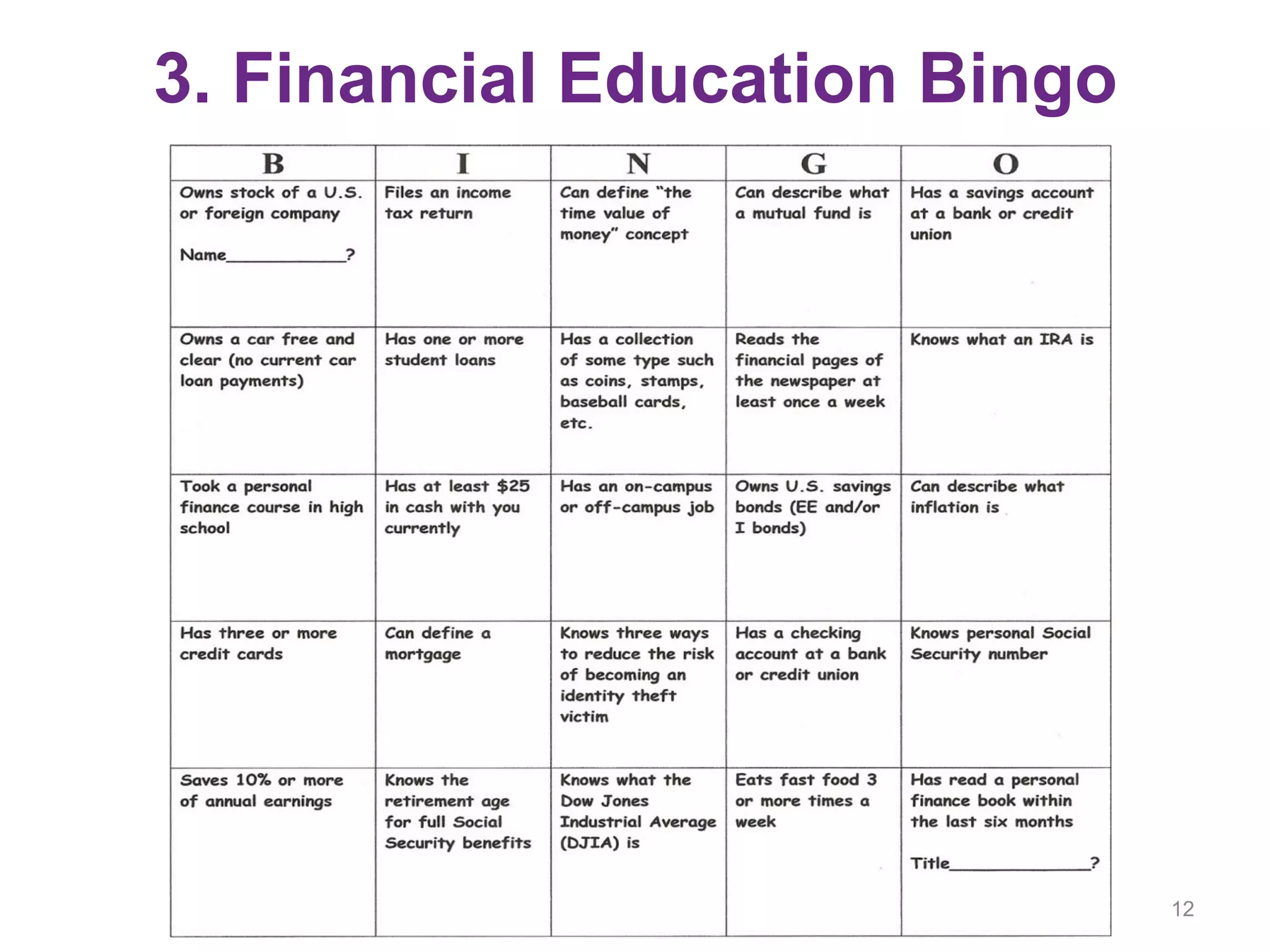

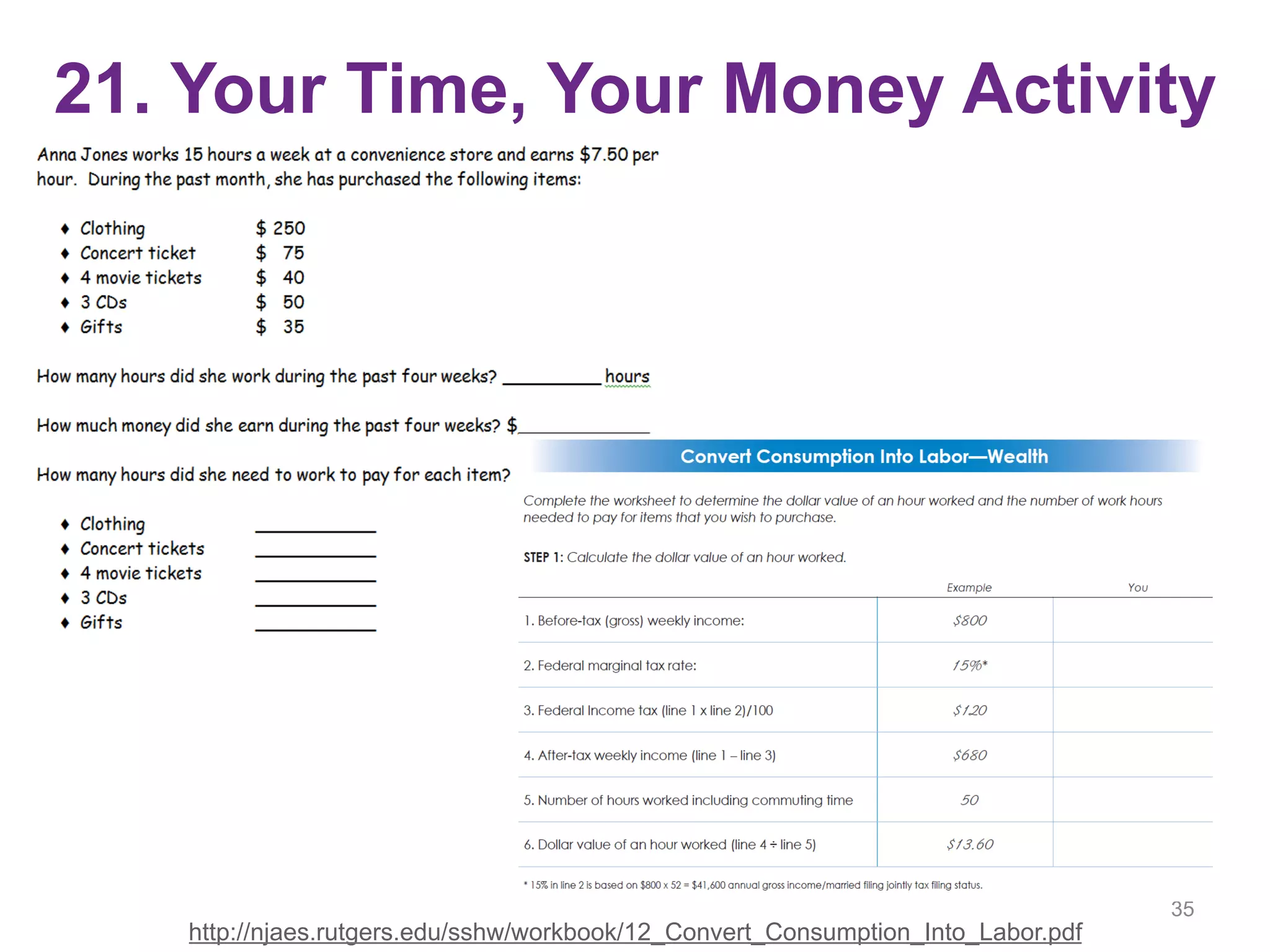

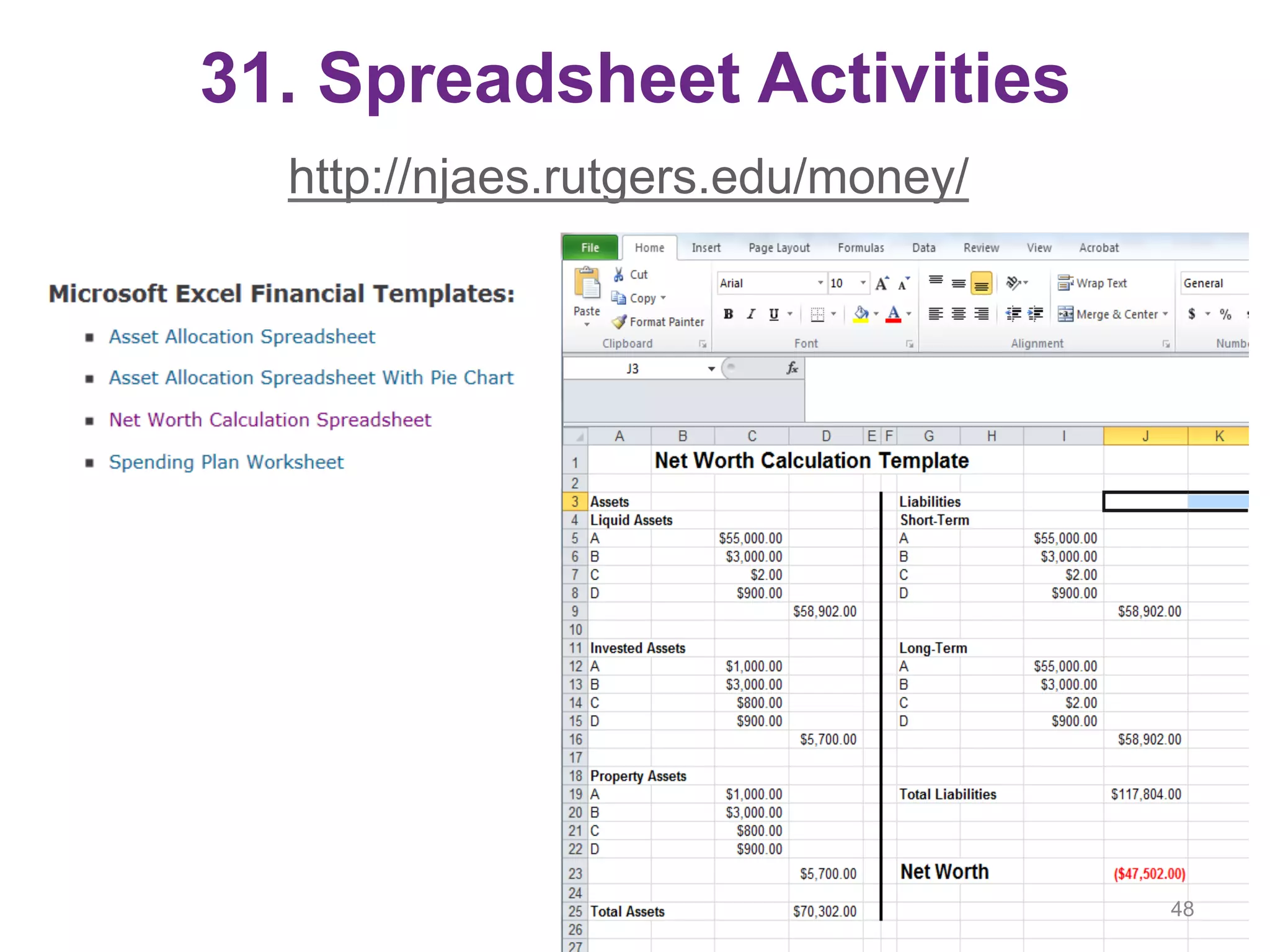

This document summarizes a webinar presented by Barbara O'Neill on personal finance learning activities. The webinar objectives were to share the results of her review of financial education resources, describe 50 interactive learning activities, and provide opportunities for participants to share effective activities. O'Neill presented and discussed 50 different learning activities for teaching personal finance topics in engaging ways, including videos, games, simulations, songs, crafts, and more. She encouraged participants to select a few activities to try out.