Embed presentation

Download to read offline

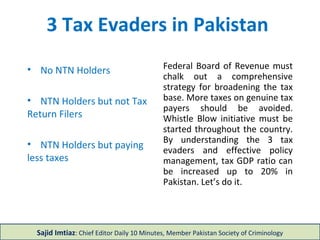

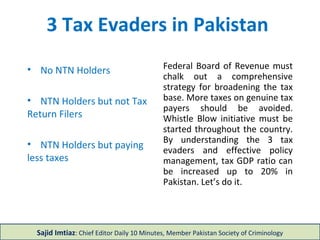

The document discusses improving Pakistan's tax collection by focusing on three types of tax evaders: those without an NTN, those with an NTN but not filing tax returns, and those underpaying taxes. It recommends that the Federal Board of Revenue develop a comprehensive strategy to expand the tax base through a whistleblower initiative to identify evaders, while avoiding increasing taxes on existing taxpayers. By addressing these three types of evaders and effective policy management, the document suggests Pakistan could increase its tax to GDP ratio to 20%.