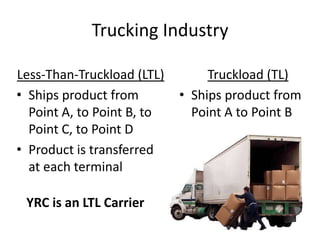

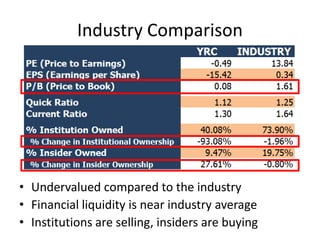

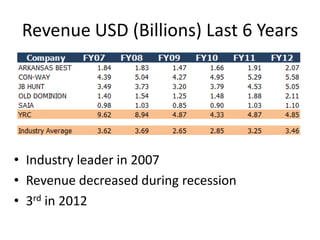

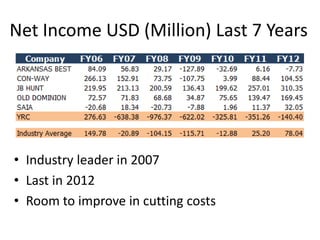

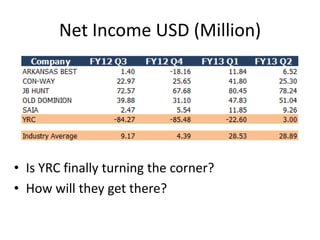

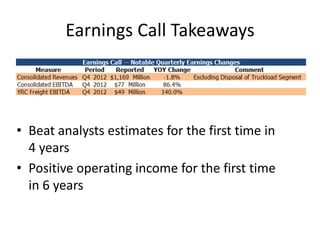

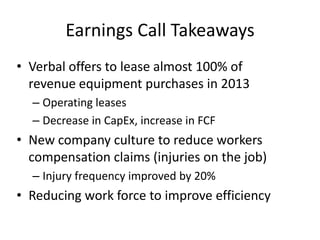

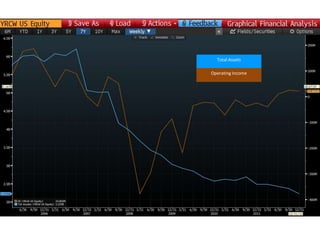

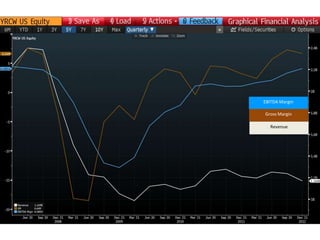

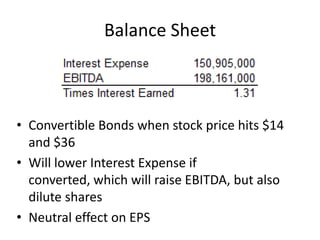

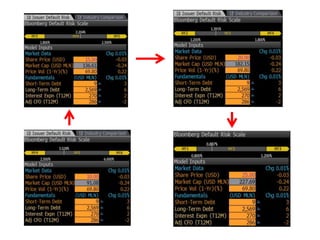

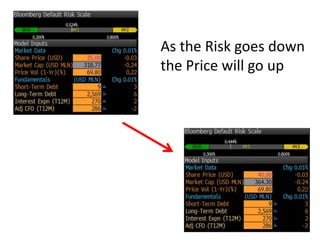

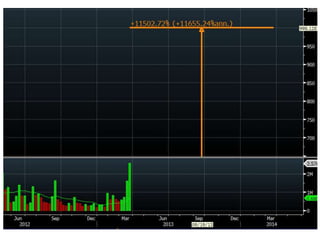

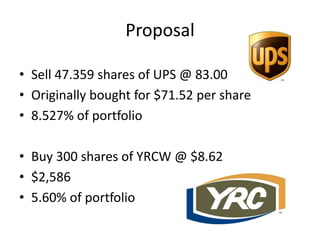

The document proposes selling shares of UPS, which have increased 19% since purchase, and using the proceeds to buy shares of YRCW. UPS is being sold to realize gains and pursue the opportunity in YRCW, a transportation company that services many large manufacturers. YRCW has struggled in recent years but is showing signs of a turnaround under new management, with goals of cutting costs, improving customer service, and increasing profitability. The investment thesis is that YRCW presents high risk but also high reward potential as the company restructures and the economy recovers.