This document provides an overview and update on the annuity market:

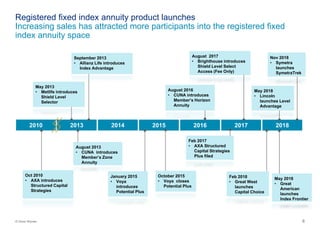

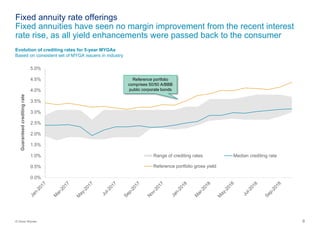

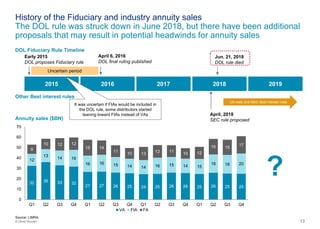

1. Fixed indexed annuity and registered fixed indexed annuity sales have been the main drivers of increasing annuity sales in recent years.

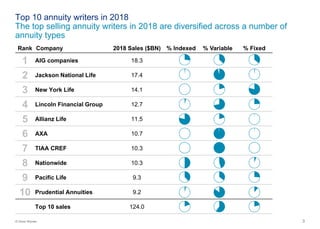

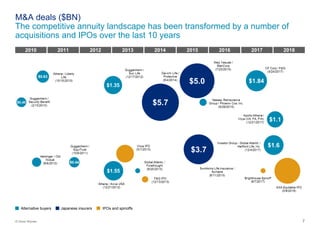

2. The top 10 annuity writers in 2018 were diversified across fixed, variable, and indexed annuity types.

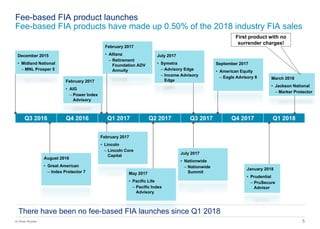

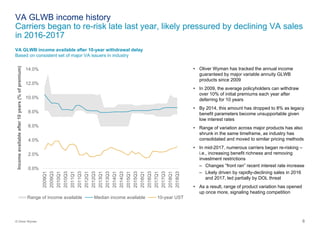

3. Recent annuity product innovation has been largely incremental, focused on de-risking features and liquidity for variable and fixed indexed annuities.