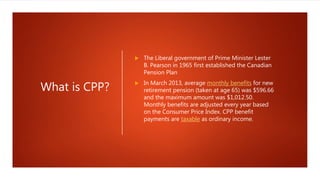

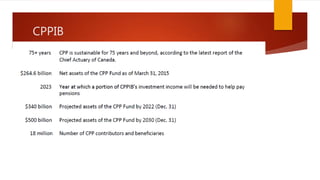

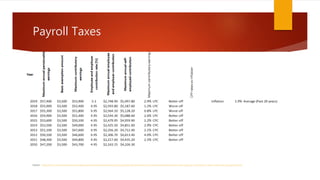

The document discusses the Canadian Pension Plan (CPP) and various retirement savings programs, highlighting the need for better funding and management of retirement options in Canada. It revisits past government policies and critiques current strategies regarding retirement benefits and taxation. The author emphasizes the importance of empowering individuals in financial planning and urges changes to ensure long-term sustainability of programs like the Old Age Security (OAS) and the CPP.