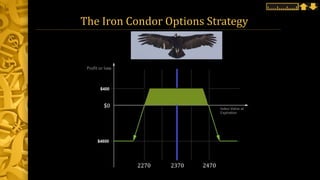

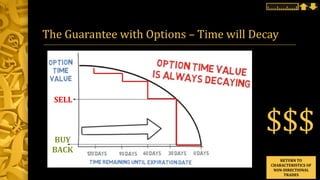

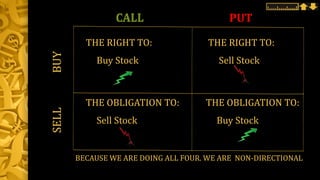

This document provides information about a group called Vancouver Disciplined Trading Hub (VDTH) that meets every Sunday to discuss trading strategies. The group is led by Karim Adatia, Maki Yanagi and other financial educators. They teach about disciplined trading, which involves predefining risk, cutting losses, and using systematic money management. Their inspiration comes from traders like Mark Douglas and Norman Hallet. The group offers content and programs on non-directional and directional trades that utilize options strategies. Non-directional trades focus on range-bound markets using techniques like iron condors that benefit from time decay. The document provides disclaimers about the educational nature of the content and that they are not providing individual recommendations

![Non-Directional Trade Characteristics

RANGE-BOUND [within 95% c.i.]

INDEX-LINKED [SPX]

25-DAY TIMEFRAME

GUARANTEED TIME DECAY

OPTION WRITING [selling]

AVERAGE RETURN ~ 8% / 3 weeks

What

does this

mean?](https://image.slidesharecdn.com/2017-03-12slideshare-170312225033/85/2017-03-12-Meetup-Slides-12-320.jpg)