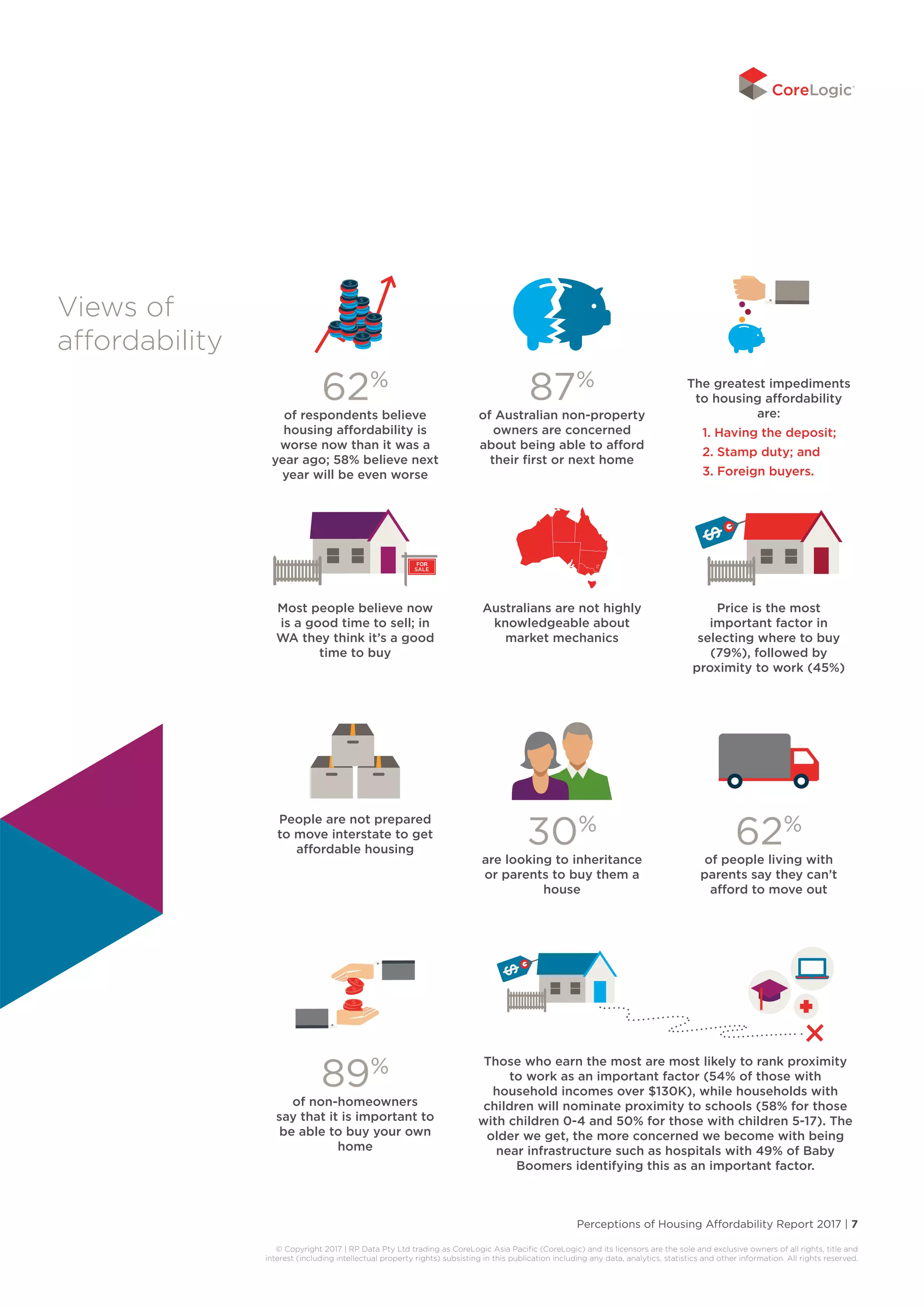

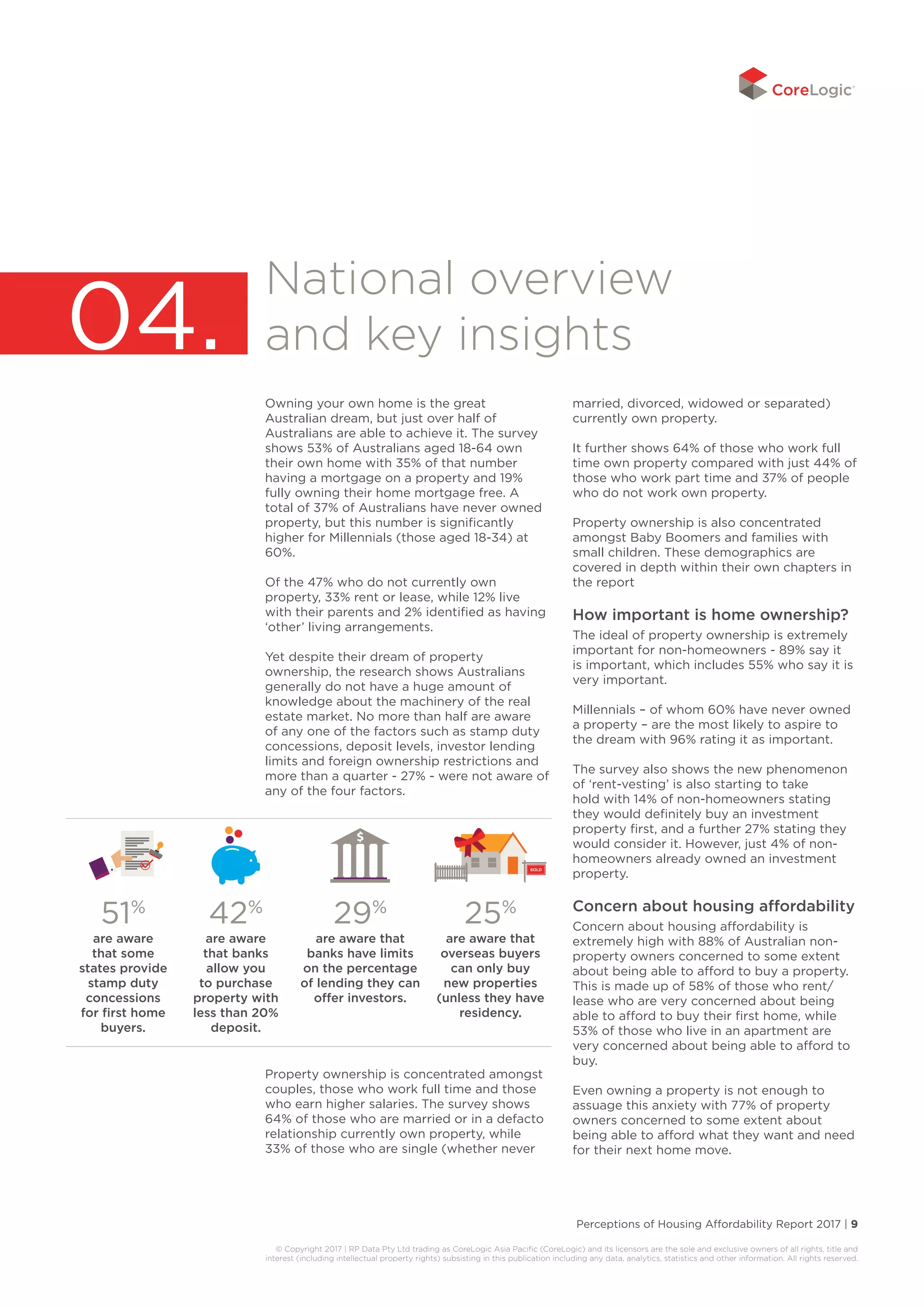

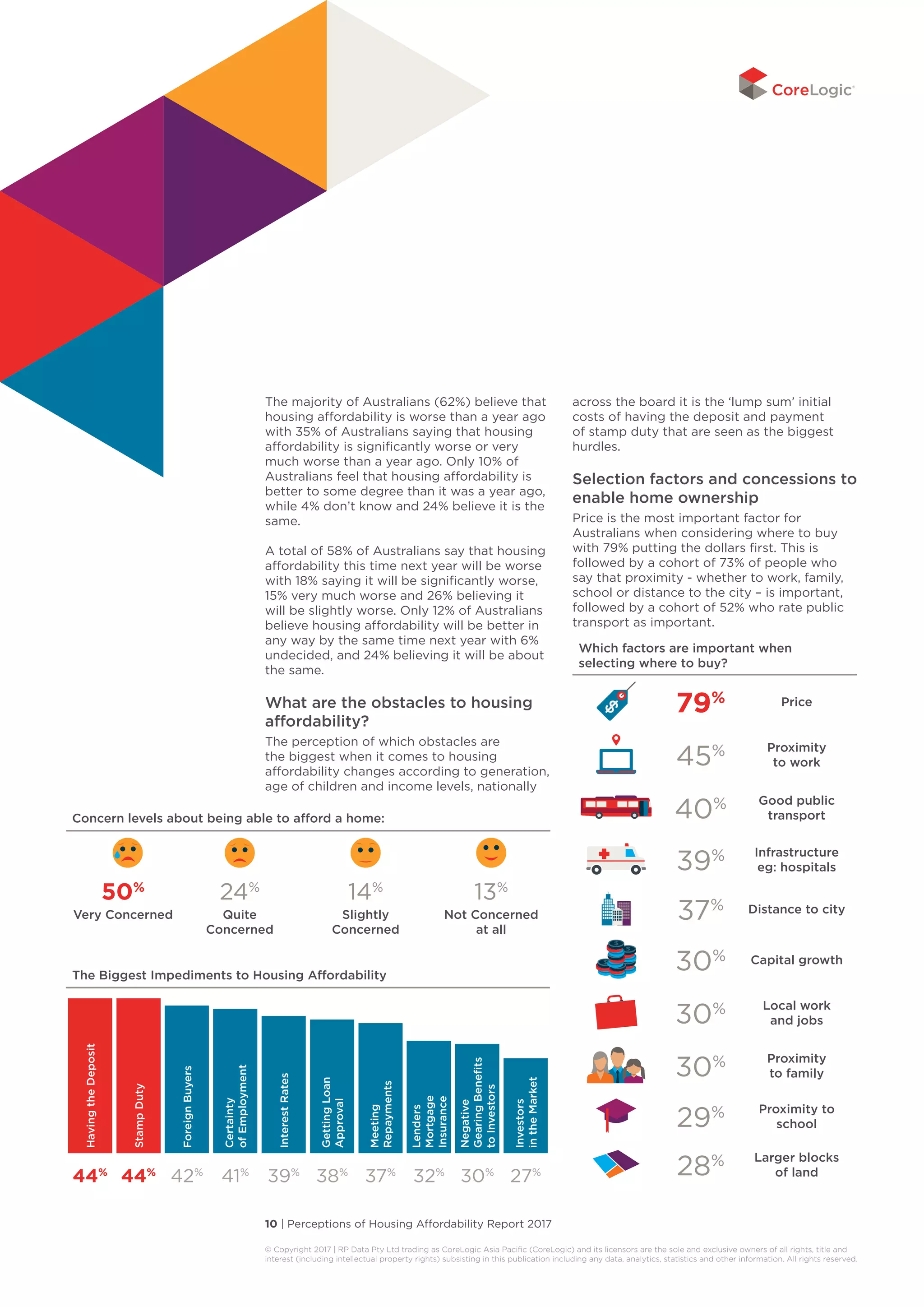

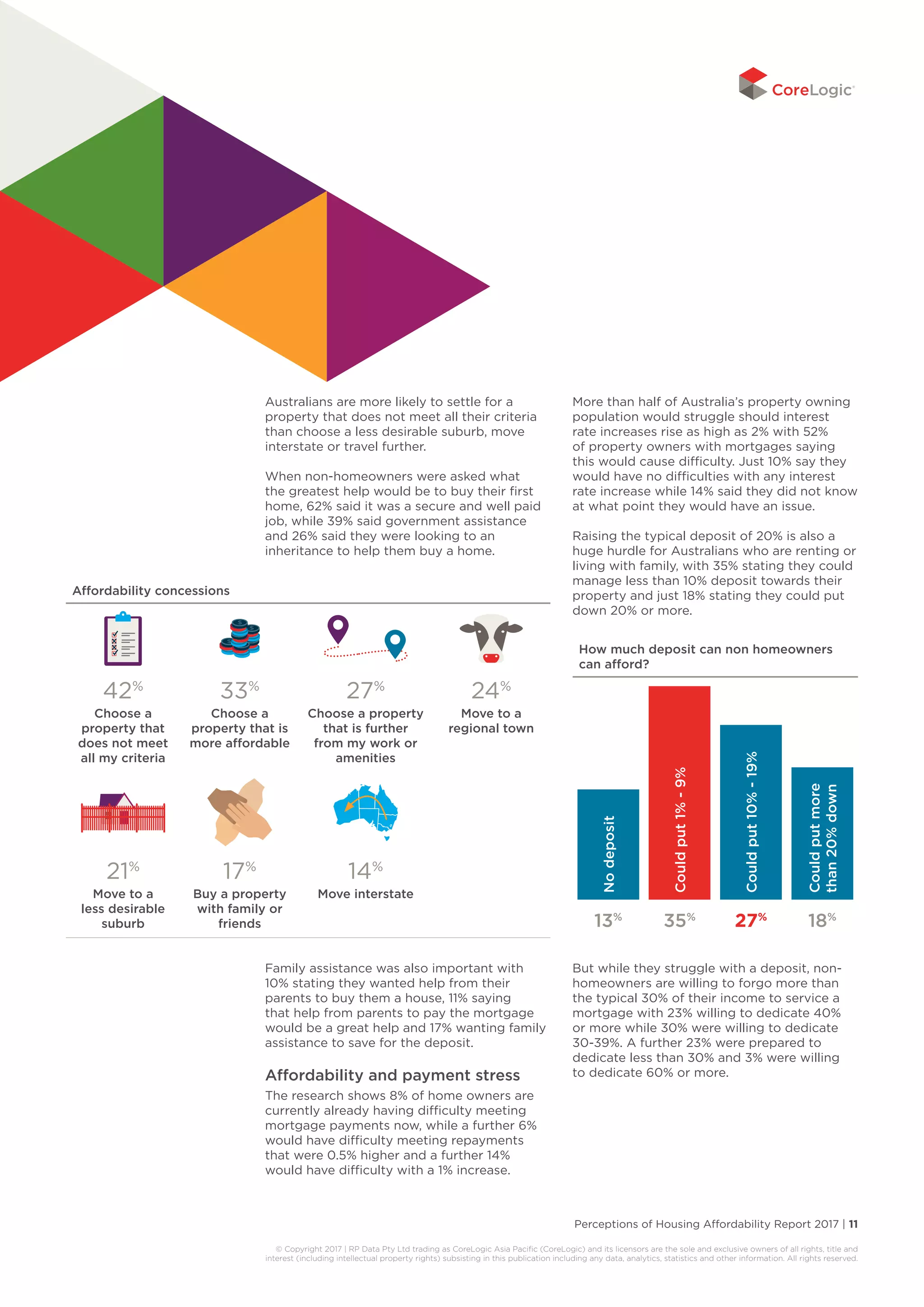

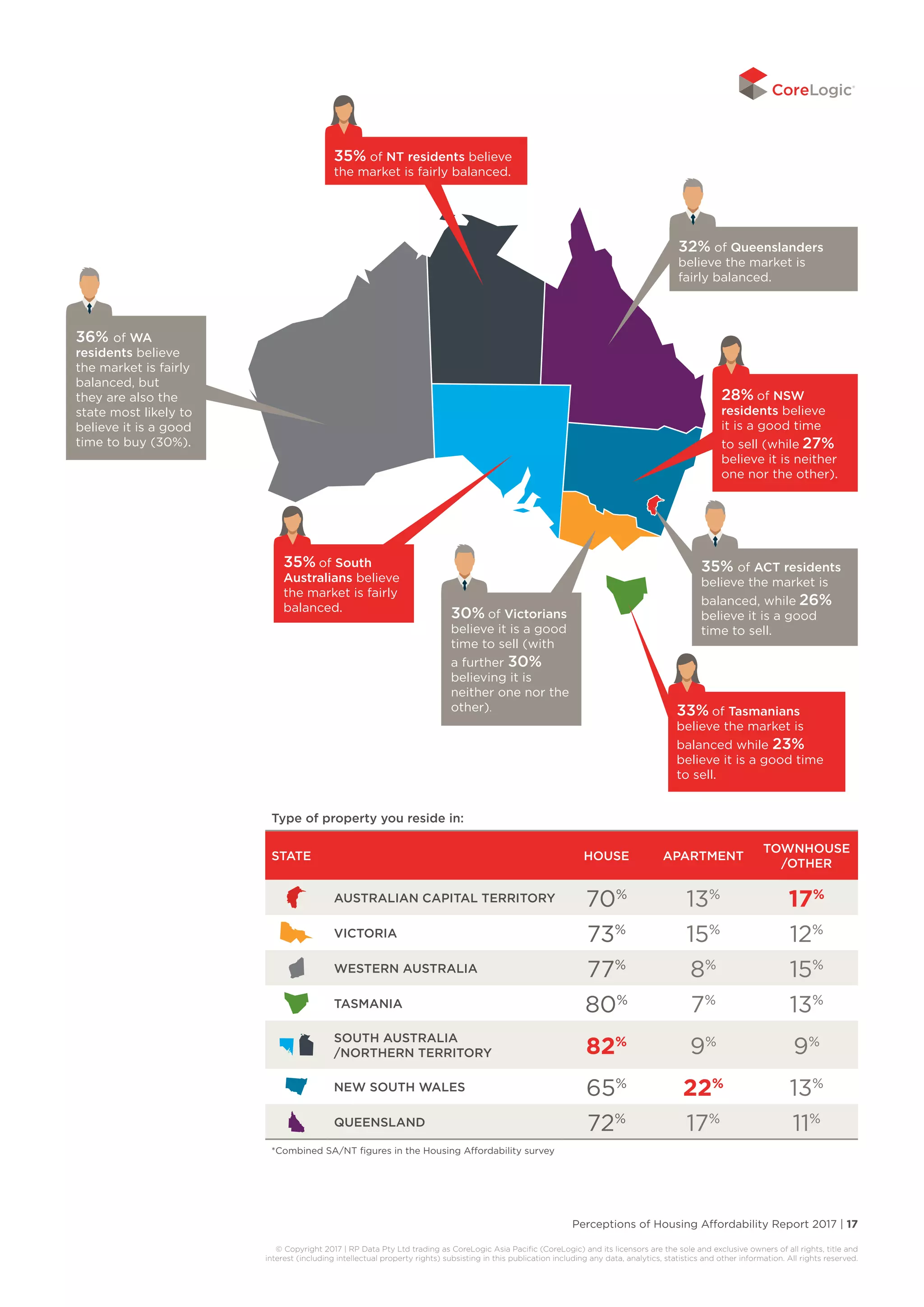

The 2017 Perceptions of Housing Affordability report by CoreLogic reveals that housing affordability in Australia has significantly worsened over the past 15 years, with the average cost of buying a home now requiring 7.2 times the annual income and taking 1.53 years to save for a 20% deposit. The report highlights that a growing number of younger Australians are staying with their parents longer to save for deposits, while concerns regarding affordability are high across demographics, with 88% of non-homeowners worried about being able to afford a home. Addressing this issue requires coordinated effort from all levels of government to create effective policies that enhance housing accessibility.

![6 | Perceptions of Housing Affordability Report 2017

© Copyright 2017 | RP Data Pty Ltd trading as CoreLogic Asia Pacific (CoreLogic) and its licensors are the sole and exclusive owners of all rights, title and

interest (including intellectual property rights) subsisting in this publication including any data, analytics, statistics and other information. All rights reserved.

Executive

summary

By every measure, housing affordability has

worsened over the past 15 years. The cost of

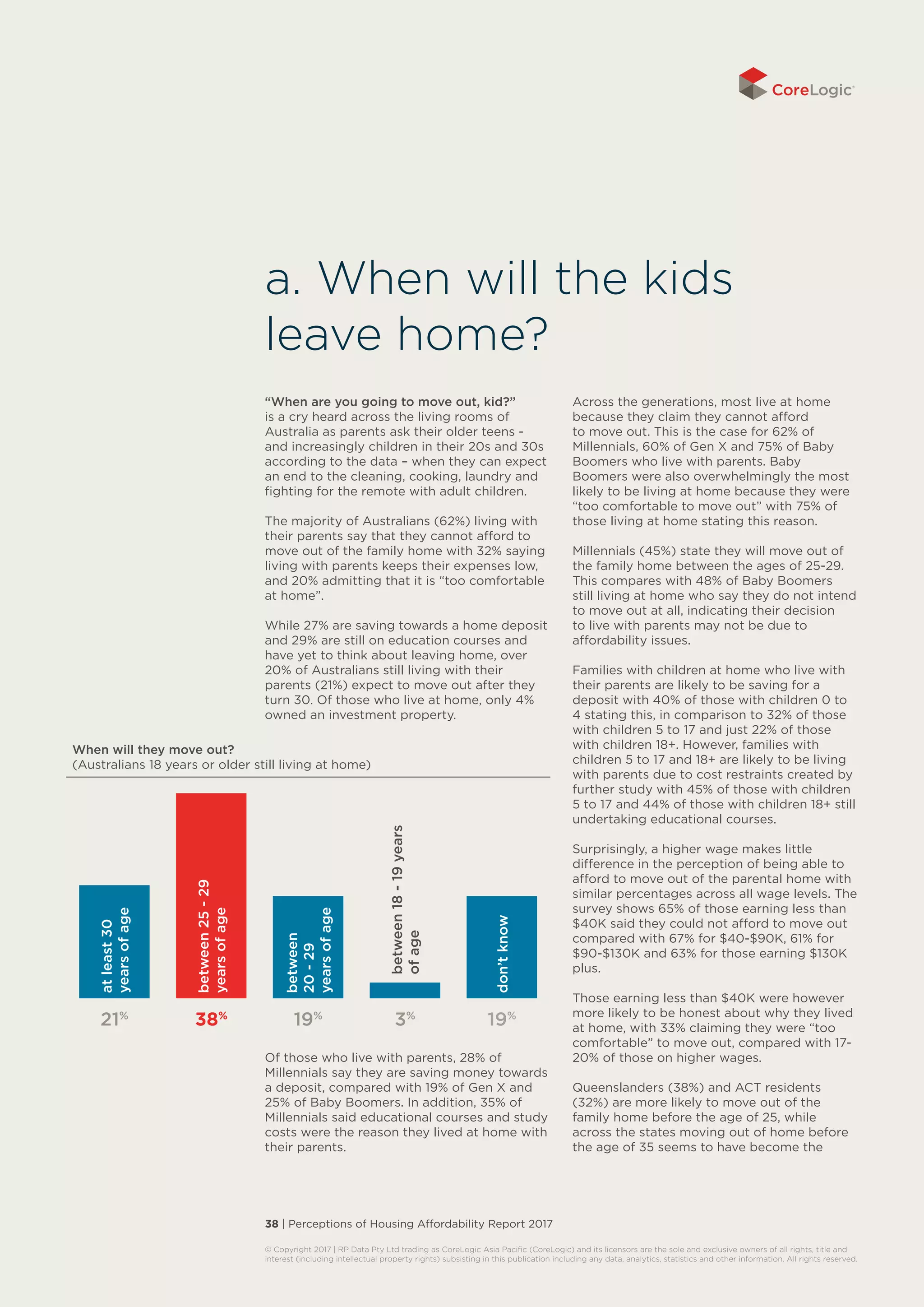

buying a dwelling currently takes 7.2 times6

the annual income of a typical household – up

from 4.2 times income 15 years ago.

It now takes 1.5[2]

years of household income

to save for a 20% deposit on a dwelling

compared with 0.8 years 15 years ago and

servicing a typical loan of 80% of the value of

a dwelling now requires 38.8%[3]

of household

income, compared with 25.2% in 2001.

How has this happened? As a result of low

interest rates, we have seen a reduction in the

costs associated with servicing a mortgage

which has led to financial institutions lending

ever higher amounts in markets where

demand is outstripping supply. Meanwhile

the ‘deposit hurdle’ has risen, creating a

financial barrier for new entrants to the

market and high migration has increased

dwelling demand, particularly in Sydney and

Melbourne.

Transaction costs are also playing a significant

role. Stamp duty costs on the median priced

dwelling are now around $35,000 across both

Sydney and Melbourne which is adding to the

savings challenge of prospective buyers.

To keep the dream of home ownership alive,

the Perceptions of Housing Affordability

Report identifies that Australians are making

more and more concessions in terms of

income sacrifice, property suitability factors

and staying at home with parents longer

to save for their own place, but they are

struggling.

That struggle is being fought hardest across

the generations, across different family

types, across different wage brackets – and

even across states - with older and richer

sections of society becoming the property

‘haves’ while others risk being branded ‘least

likely’ unless governments at all levels come

together to radically rethink ways to address

supply and demand.

6

CoreLogic 2017

2,3

ibid

02.](https://image.slidesharecdn.com/2017-05-corelogichousingaffordabilityreportmay2017-170508062701/75/2017-05-CoreLogic-Perceptions-of-Housing-Affordability-Report-6-2048.jpg)