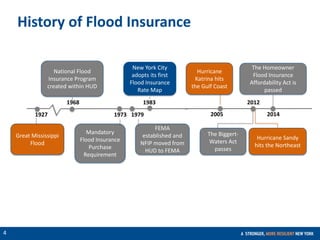

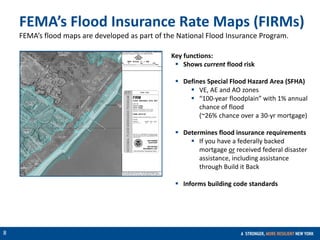

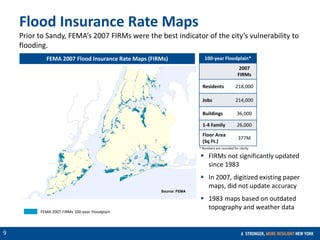

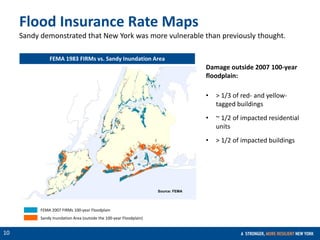

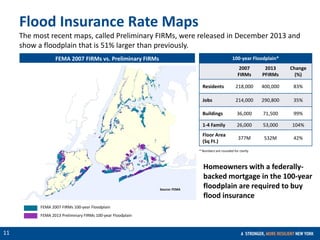

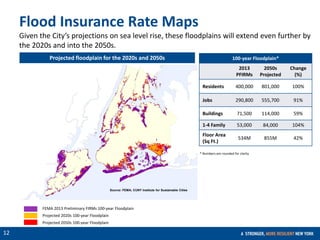

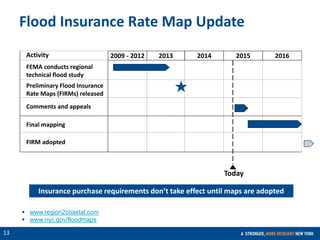

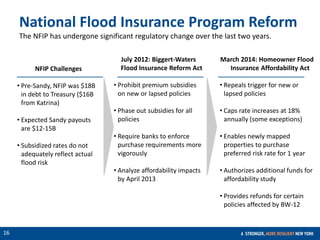

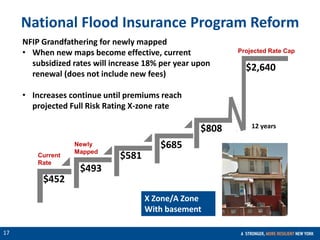

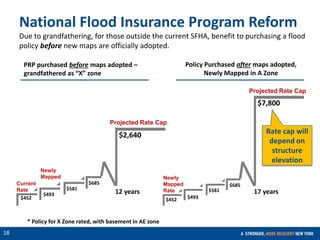

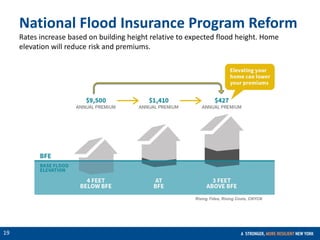

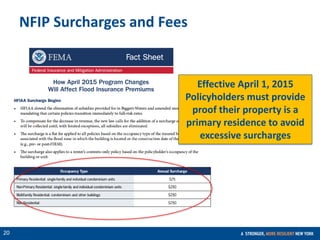

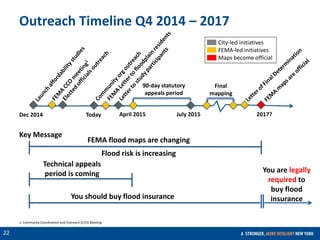

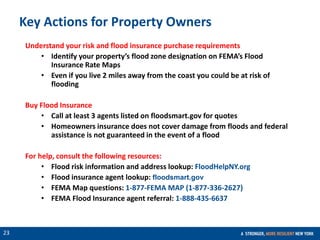

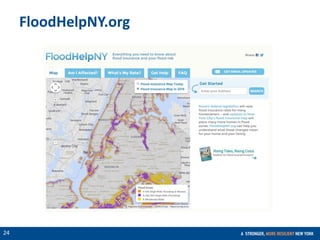

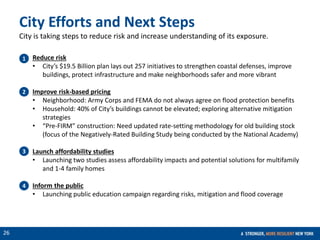

New FEMA flood insurance rate maps for New York City have expanded the floodplain and updated insurance requirements, with upcoming changes effective after 2016. The city is investing $19.5 billion in a resiliency plan to mitigate flood risk, which includes enhancing coastal defenses and conducting affordability studies. Residents are urged to understand their flood risks and secure insurance, as significant increases in the floodplain and insurance rates are anticipated due to sea level rise.