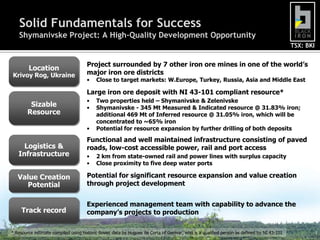

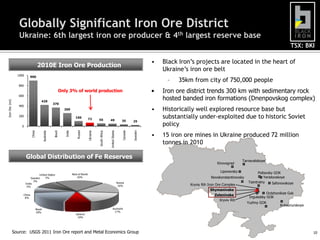

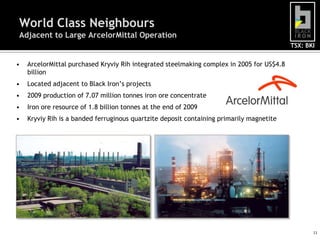

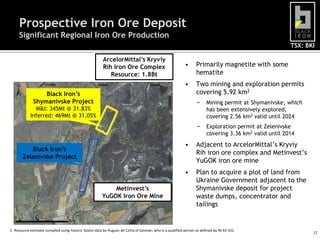

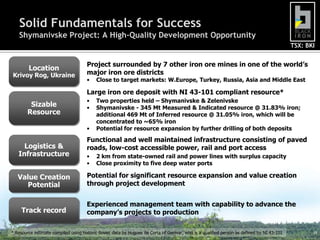

1. Black Iron is an emerging iron ore company that acquired two projects, Shymanivske and Zelenivske, located in Ukraine's major iron ore district near existing infrastructure.

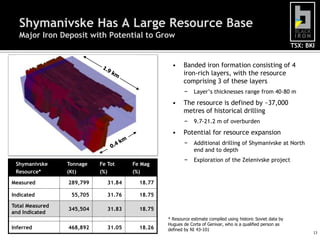

2. The Shymanivske project has a NI 43-101 compliant resource of 345Mt measured and indicated resource at 31.83% iron and additional 469Mt inferred resource.

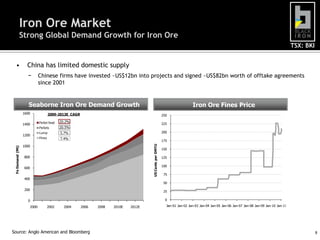

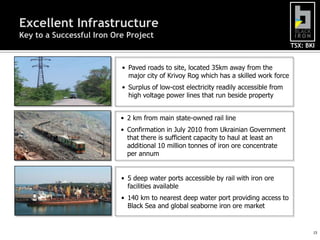

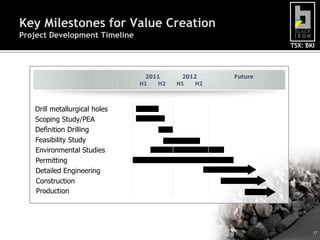

3. Black Iron plans to produce 10Mtpa of 65% iron pellets by mid-2015, capitalizing on Ukraine's status as a mining friendly country and the global growth in iron ore demand.