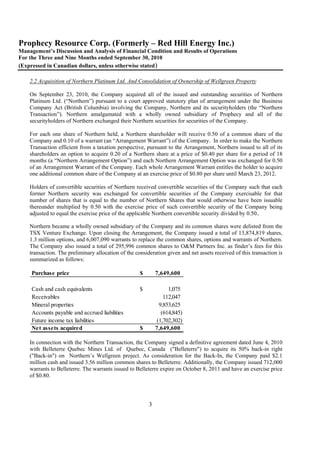

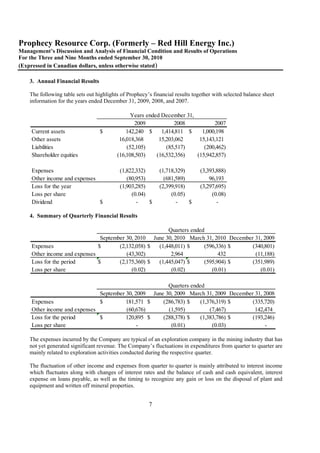

This document provides a summary of Prophecy Resource Corp.'s financial results and business activities for the third quarter of 2010. Some key highlights include acquiring Northern Platinum Ltd and its nickel-copper and platinum project, raising $2.1 million in financing, recording a net loss of $2.1 million, and subsequently obtaining the permit to begin mining operations at its Ulaan Ovoo coal mine in Mongolia. The business overview discusses Prophecy's diversified project portfolio and provides details on transactions completed during the period involving its coal and platinum assets.