Embed presentation

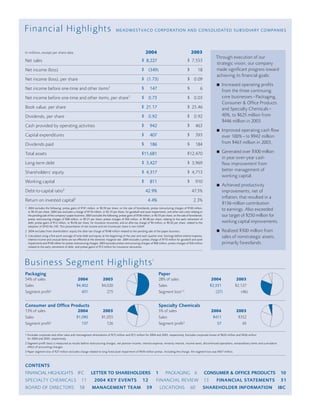

Download to read offline

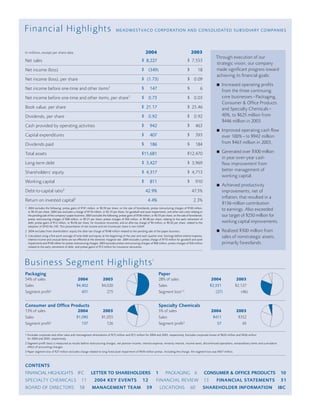

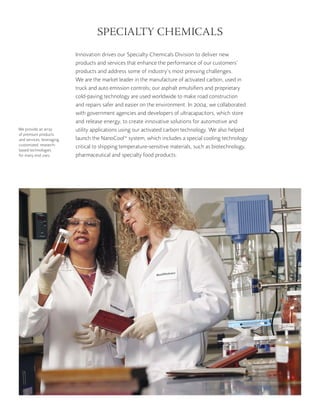

This annual report summarizes MeadWestvaco Corporation's financial highlights for 2004. Some key points: - Net sales increased to $8.227 billion from $7.553 billion the previous year - Net income decreased to a loss of $349 million from a profit of $18 million due to one-time charges - Excluding one-time items, net income increased to $147 million from $6 million the previous year - The company improved operating profits and cash flow through executing its strategic vision focused on its three core businesses