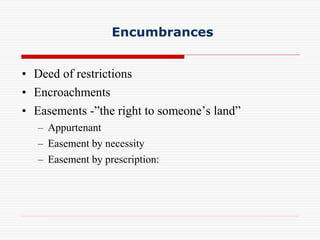

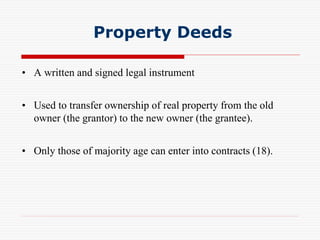

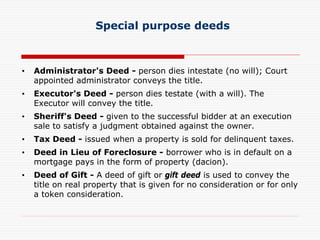

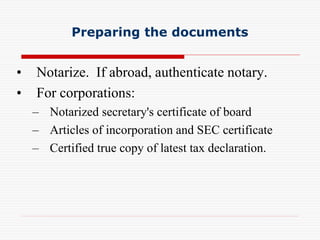

This document discusses various topics related to documenting and registering property transactions including liens, encumbrances, deeds, and essential elements of contracts and deeds. It defines terms like liens, encumbrances, easements, deeds of sale, donation and exchange. It outlines elements required in contracts and deeds, and discusses special purpose deeds and preparing relevant documents.