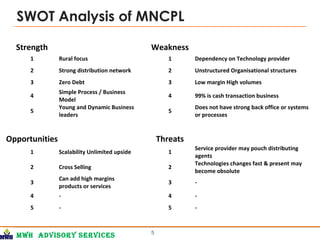

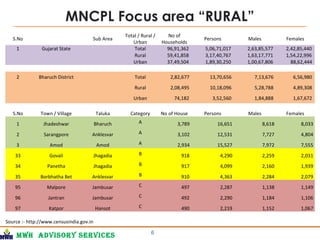

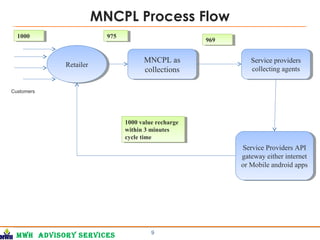

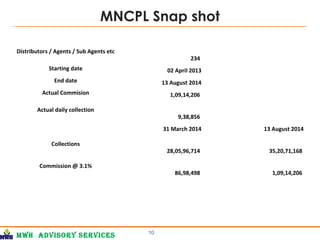

MNCPL will operate an online mall providing mobile/DTH recharges, bill payments, travel bookings, and digital products through its online portal and mobile apps. It aims to acquire customers primarily through recharges and cross-sell higher margin products. MNCPL's focus on customer experience and convenience is intended to increase retention and profitability. The document provides details on MNCPL's business model, team, target rural areas, processes, and comparisons to other players in the digital transactions market.

![MWH Advisory services

Cash flow Projections

16

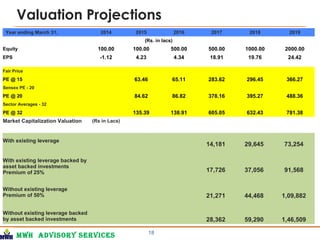

Year ending March 31, 2014 2015 2016 2017 2018 2019

(Rs. in lacs)

No of Distributors 234 468 702 983 1278 1661

Increment % 100.00 60.00 50.00 40.00 30.00

Total No of Distributors 234 702 1404 2387 3664 5325

Revenue Contribution

- Recharge Yield @3.1% 100.00 80.00 68.00 50.00 40.00 35.00

- Bus Tickets Yield @5% 0.00 12.00 18.00 24.00 30.00 30.00

- Hotel Yield @15% 0.00 6.00 10.00 14.00 16.00 18.00

- Online Retailing Yield @20% 0.00 2.00 4.00 12.00 14.00 17.00

Total 100.00 100.00 100.00 100.00 100.00 100.00

Per distributor revenue per year 0.37

Distributor wise Revenue

increment by % (a)

25.00 25.00 25.00 25.00 25.00

Gross Yield % (x) 3.10 4.38 5.31 7.25 7.94 8.69

Gross Yield Growth % (b) 41.29 21.19 36.59 9.52 9.38

Total Simple Sum growth % [(a)+

(b)]

66.29 46.19 61.59 34.52 34.38

Per distributor revenue per year 0.37 0.62 0.90 1.46 1.96 2.64

REVENUES in Lacs Total 87.00 434.02 1,268.96 3,485.78 7,198.96 14,059.05](https://image.slidesharecdn.com/cbd5e1b6-9c93-4603-9dcc-7719ef576e2d-160308074522/85/1_MNCPL-Information-Memorandum-1-4-16-320.jpg)

![MWH Advisory services

Profitability Projections

17

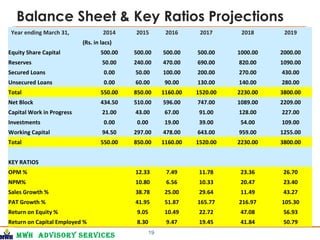

Year ending March 31, 2014 2015 2016 2017 2018 2019

(Rs. in lacs)

REVENUES in Lacs Total

87.00 434.02 1,268.96 3,485.78 7,198.96 14,059.05

REVENUES Breakup

- Recharge 87.00 347.21 862.89 1742.89 2879.58 4920.67

- Bus Tickets 0.00 52.08 228.41 836.59 2159.69 4217.72

- Hotel 0.00 26.04 126.90 488.01 1151.83 2530.63

- Online Retailing 0.00 8.68 50.76 418.29 1007.85 2390.04

Total Revenues (z) 87.00 434.02 1268.96 3485.78 7198.96 14059.05

EXPENSES

Gross Commission including Percent (y) 2.50 3.00 3.50 4.50 5.00 5.00

Amount [(y/x)*z] 70.16 297.27 836.73 2163.59 4533.35 8093.87

Overheads & other expenses Percent 1.00 1.00 1.00 1.00 1.00 1.00

Salaries, incentives & bonus Amount 28.06 99.09 239.06 480.80 906.67 1618.77

Sales & marketing expenses

Total Expenses 98.23 396.36 1075.79 2644.39 5440.02 9712.64

EBIDTA -11.23 37.65 193.16 841.40 1758.94 4346.41

PBT -11.23 37.65 193.16 841.40 1758.94 4346.41

Tax 0.00 -4.65 -23.88 -104.00 -217.40 -537.22

PAT -11.23 42.31 217.04 945.39 1976.35 4883.62

Equity 100.00 100.00 500.00 500.00 1000.00 2000.00

EPS -1.12 4.23 4.34 18.91 19.76 24.42

Fair Price

PE @ 15 63.46 65.11 283.62 296.45 366.27

Sensex PE - 20

PE @ 20 84.62 86.82 378.16 395.27 488.36

Sector Averages - 32

PE @ 32 135.39 138.91 605.05 632.43 781.38](https://image.slidesharecdn.com/cbd5e1b6-9c93-4603-9dcc-7719ef576e2d-160308074522/85/1_MNCPL-Information-Memorandum-1-4-17-320.jpg)