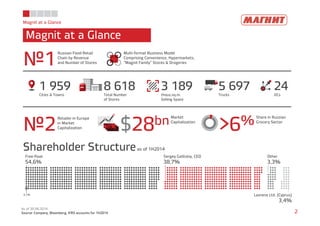

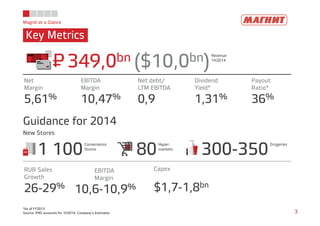

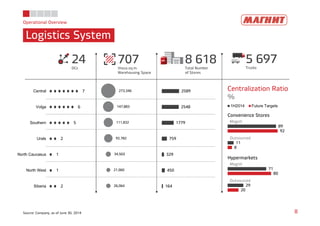

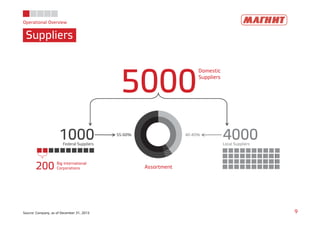

Magnit is the largest food retailer in Russia by revenue and number of stores. As of 1H2014, Magnit operated 8,618 stores across 1,959 cities and towns. The company has a multi-format business model comprising convenience stores, hypermarkets, Magnit Family stores, and drogeries. In 1H2014, Magnit's net sales increased 13.4% to $9.978 billion, EBITDA grew 17.4% to $1.045 billion, and net income rose 19.4% to $560 million. Magnit's strategy focuses on organic store growth, low prices, high quality, and cost management.