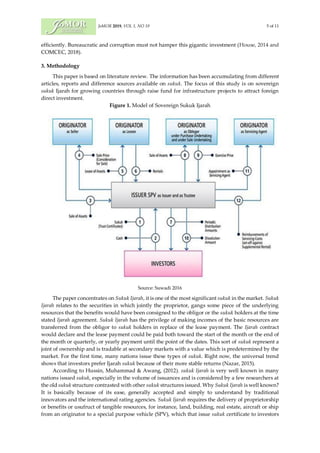

This document discusses using sukuk (Islamic bonds) as an alternative to conventional bonds for financing infrastructure projects. It notes that many developing countries struggle to finance infrastructure due to lack of foreign investment and high costs of international loans. The document examines how Gulf countries and Malaysia have successfully used sukuk to fund infrastructure development. It argues that sukuk could help countries raise funds for projects while avoiding interest, with profits reinvested in the domestic economy. The document reviews literature on applying different types of sukuk structures, like sovereign ijarah sukuk, to infrastructure financing.