18 October Daily market report

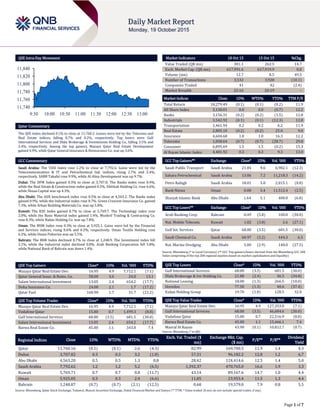

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.1% to close at 11,760.2. Losses were led by the Telecoms and Real Estate indices, falling 0.7% and 0.2%, respectively. Top losers were Gulf International Services and Dlala Brokerage & Investments Holding Co., falling 3.5% and 2.4%, respectively. Among the top gainers, Mazaya Qatar Real Estate Development gained 4.9%, while Qatar General Insurance & Reinsurance Co. was up 3.6%. GCC Commentary Saudi Arabia: The TASI Index rose 1.2% to close at 7,792.6. Gains were led by the Telecommunication & IT and Petrochemical Ind. indices, rising 2.7% and 2.4%, respectively. SABB Takaful rose 9.9%, while Al-Ahsa Development was up 9.7%. Dubai: The DFM Index gained 0.3% to close at 3,707.8. The Banks index rose 0.4%, while the Real Estate & Construction index gained 0.3%. Ekttitab Holding Co. rose 6.6%, while Shuaa Capital was up 4.3%. Abu Dhabi: The ADX benchmark index rose 0.5% to close at 4,563.2. The Banks index gained 0.9%, while the Industrial index rose 0.7%. Green Crescent Insurance Co. gained 7.3%, while Arkan Building Materials Co. was up 5.8%. Kuwait: The KSE Index gained 0.7% to close at 5,769.7. The Technology index rose 2.0%, while the Basic Material index gained 1.4%. Mushrif Trading & Contracting Co. rose 8.3%, while Nafais Holding Co. was up 7.8%. Oman: The MSM Index rose 0.3% to close at 5,925.1. Gains were led by the Financial and Services indices, rising 0.6% and 0.2%, respectively. Oman Textile Holding rose 6.2%, while Oman Fisheries was up 5.5%. Bahrain: The BHB Index declined 0.7% to close at 1,248.9. The Investment index fell 2.1%, while the Industrial index declined 0.8%. Arab Banking Corporation fell 5.8%, while National Bank of Bahrain was down 1.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Mazaya Qatar Real Estate Dev. 16.95 4.9 7,712.1 (7.1) Qatar General Insur. & Reins. Co. 58.00 3.6 24.0 13.1 Salam International Investment 13.05 2.4 654.2 (17.7) Doha Insurance Co. 24.00 2.1 1.7 (17.2) Qatar Fuel 160.90 1.7 31.7 (21.2) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mazaya Qatar Real Estate Dev. 16.95 4.9 7,712.1 (7.1) Vodafone Qatar 15.00 0.7 1,499.3 (8.8) Gulf International Services 68.00 (3.5) 681.5 (30.0) Salam International Investment 13.05 2.4 654.2 (17.7) Barwa Real Estate Co. 45.00 1.1 343.8 7.4 Market Indicators 18 Oct 15 15 Oct 15 %Chg. Value Traded (QR mn) 301.1 262.5 14.7 Exch. Market Cap. (QR mn) 617,991.6 617,919.9 0.0 Volume (mn) 12.7 8.5 49.5 Number of Transactions 3,532 3,928 (10.1) Companies Traded 41 42 (2.4) Market Breadth 22:16 20:19 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,279.49 (0.1) (0.1) (0.2) 11.9 All Share Index 3,130.01 0.0 0.0 (0.7) 12.2 Banks 3,156.31 (0.2) (0.2) (1.5) 12.8 Industrials 3,542.92 (0.1) (0.1) (12.3) 12.8 Transportation 2,461.94 0.2 0.2 6.2 11.9 Real Estate 2,805.10 (0.2) (0.2) 25.0 9.0 Insurance 4,604.68 1.0 1.0 16.3 12.2 Telecoms 1,058.64 (0.7) (0.7) (28.7) 29.8 Consumer 6,895.69 1.5 1.5 (0.2) 15.3 Al Rayan Islamic Index 4,481.92 0.3 0.3 9.3 13.0 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Public Transport Saudi Arabia 21.04 9.6 6,982.1 (12.3) Sahara Petrochemical Saudi Arabia 13.06 7.2 11,218.3 (14.2) Petro Rabigh Saudi Arabia 18.01 5.8 2,015.1 (0.8) Bank Nizwa Oman 0.08 5.4 11,512.4 (2.5) Sharjah Islamic Bank Abu Dhabi 1.64 5.1 400.0 (6.8) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Arab Banking Corp. Bahrain 0.49 (5.8) 100.0 (30.0) Nat. Mobile Telecom. Kuwait 1.02 (3.8) 2.6 (27.1) Gulf Int. Services Qatar 68.00 (3.5) 681.5 (30.0) Saudi Chemical Co. Saudi Arabia 60.97 (3.2) 444.3 6.5 Nat. Marine Dredging Abu Dhabi 5.00 (2.9) 148.0 (27.5) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Gulf International Services 68.00 (3.5) 681.5 (30.0) Dlala Brokerage & Inv Holding Co. 21.80 (2.4) 36.5 (34.8) National Leasing 18.00 (1.3) 266.5 (10.0) Ooredoo 77.50 (1.3) 40.6 (37.4) Ezdan Holding Group 19.70 (1.0) 128.5 32.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Mazaya Qatar Real Estate Dev. 16.95 4.9 127,353.0 (7.1) Gulf International Services 68.00 (3.5) 46,684.6 (30.0) Vodafone Qatar 15.00 0.7 22,516.9 (8.8) Barwa Real Estate Co. 45.00 1.1 15,466.1 7.4 Masraf Al Rayan 43.90 (0.1) 10,812.7 (0.7) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,760.16 (0.1) (0.1) 2.6 (4.3) 82.99 169,700.5 11.9 1.4 4.3 Dubai 3,707.82 0.3 0.3 3.2 (1.8) 57.31 96,182.2 12.8 1.2 6.7 Abu Dhabi 4,563.20 0.5 0.5 1.3 0.8 28.42 124,414.6 12.5 1.4 5.0 Saudi Arabia 7,792.62 1.2 1.2 5.2 (6.5) 1,392.37 470,765.0 16.6 1.9 3.3 Kuwait 5,769.71 0.7 0.7 0.8 (11.7) 43.14 89,167.6 14.7 1.0 4.4 Oman 5,925.05 0.3 0.3 2.4 (6.6) 11.85 23,953.4 11.5 1.3 4.4 Bahrain 1,248.87 (0.7) (0.7) (2.1) (12.5) 0.68 19,579.0 7.9 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,740 11,760 11,780 11,800 11,820 11,840 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.1% to close at 11,760.2. The Telecoms and Real Estate indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari and GCC shareholders. Gulf International Services and Dlala Brokerage & Investments Holding Co. were the top losers, falling 3.5% and 2.4%, respectively. Among the top gainers, Mazaya Qatar Real Estate Development gained 4.9%, while Qatar General Insurance & Reinsurance Co. was up 3.6%. Volume of shares traded on Sunday rose by 49.5% to 12.7mn from 8.5mn on Thursday. Further, as compared to the 30-day moving average of 8.0mn, volume for the day was 59.1% higher. Mazaya Qatar Real Estate Development and Vodafone Qatar were the most active stocks, contributing 60.9% and 11.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY Saudi Basic Industries Corporation (SABIC) Saudi Arabia SR – – 8,560.0 -17.8% 5,600.0 -9.4% Wafrah for Industry & Development Co. Saudi Arabia SR – – -4.9 NA -5.5 NA Saudi Steel Pipe Co. (SSP) Saudi Arabia SR – – 8.3 -15.1% 8.0 21.7% Saudi Transport & Investment Co. (Mubarrad) Saudi Arabia SR – – 19.9 -23.2% 18.0 -45.0% Taiba Holding Co. Saudi Arabia SR – – 71.2 -18.1% 102.1 -87.5% Ash-Sharqiyah Development Co. (SHADCO) Saudi Arabia SR – – 0.6 NA 0.6 NA Sahara Petrochemical Co. Saudi Arabia SR – – 150.8 7,836.8% 121.0 607.6% Advanced Petrochemical Co. (APC) Saudi Arabia SR – – 240.6 22.2% 234.2 2.4% United Wire Factories Co. (ASLAK) Saudi Arabia SR – – 23.3 13.7% 21.2 3.9% Saudi Marketing Co. (Farm Superstores) Saudi Arabia SR – – 36.4 36.4% 29.0 17.2% Nama Chemicals Co. Saudi Arabia SR – – -28.7 NA -24.0 NA Al Jouf Agricultural Development Co. (JADCO) Saudi Arabia SR – – 44.8 17.3% 43.4 16.7% Herfy Food Services Co. Saudi Arabia SR – – 57.0 29.1% 56.7 -0.1% Al Hassan Ghazi Ibrahim Shaker Co. (SHAKER) Saudi Arabia SR – – 27.6 -29.9% 46.2 5.6% Al Abdullatif Industrial Investment Co. (AIIC) Saudi Arabia SR – – 29.7 -41.9% 27.6 -40.3% Saudi Orix Leasing Co. Saudi Arabia SR – – 43.0 -7.9% 23.2 -21.6% National Metal Manufacturing & Casting Co. (Maadaniyah) Saudi Arabia SR – – 9.4 0.1% 8.9 4.1% Al Rajhi Company for Cooperative Insurance (ARCCI) Saudi Arabia SR 262.8 33.7% – – 14.6 250.2% Trade Union Cooperative Insurance Co. (Ittihad) Saudi Arabia SR 239.4 53.7% – – 3.4 NA Hail Cement Co. Saudi Arabia SR – – 29.8 16.9% 17.5 -30.5% Al Alamiya for Cooperative Insurance Co. Saudi Arabia SR 63.0 60.3% – – 11.2 NA Saudi Arabian Mining Co. (Ma’aden) Saudi Arabia SR – – 263.3 -62.0% 79.9 -83.5% Alahli Takaful Co. Saudi Arabia SR 24.0 -2.0% – – 6.3 -23.3% Gulf Union Cooperative Insurance Co. (GUCIC) Saudi Arabia SR 13.3 -63.9% – – 7.2 687.9% United Cooperative Assurance Co. (UCA) Saudi Arabia SR 222.4 25.7% – – 12.1 -41.9% Fitaihi Holding Group Saudi Arabia SR – – 0.4 -95.5% 5.8 -54.7% Allied Cooperative Insurance Group (ACIG) Saudi Arabia SR 84.1 110.7% – – 4.0 105.2% National Petrochemical Co. Saudi Arabia SR – – 591.9 30.6% 321.1 31.5% Saudi Public Transport Co. (SAPTCO) Saudi Arabia SR – – 81.0 579.6% 81.4 242.2% Overall Activity Buy %* Sell %* Net (QR) Qatari 77.56% 81.75% (12,688,966.77) GCC 3.68% 2.79% 2,653,521.23 Non-Qatari 18.77% 15.45% 10,035,445.54

- 3. Page 3 of 7 Ace Arabia Cooperative Insurance Co. (ACE) Saudi Arabia SR 21.1 49.3% – – -0.7 NA Dhofar Poultry Co. (DPC) Oman OMR 5.9 124.3% – – 0.4 NA Oman Investment & Finance Co. (OIFC) * Oman OMR 7.7 13.0% – – 3.6 16.6% National Biscuit Industries (NABIL) Oman OMR 8.1 -5.1% – – 0.4 -10.0% Source: Company data, DFM, ADX, MSM (*6M2015-16 results) Earning Calendar Tickers Company Name Date of reporting 3Q2015 results No. of days remaining Status QNBK QNB Group 7-Oct-15 - Reported QIBK Qatar Islamic Bank 13-Oct-15 - Reported ABQK Al Ahli Bank 14-Oct-15 - Reported MRDS Mazaya Qatar 14-Oct-15 - Reported MCCS Mannai Corp. 16-Oct-15 - Reported CBQK Commercial Bank 18-Oct-15 - Reported QIGD Qatari Investors Group 19-Oct-15 0 Due DBIS Dlala Brokerage & Investment Holding Company 19-Oct-15 0 Due KCBK Al Khaliji 20-Oct-15 1 Due DOHI Doha Insurance 20-Oct-15 1 Due QEWS Qatar Electricity & Water Company 20-Oct-15 1 Due SIIS Salam International Investment 20-Oct-15 1 Due AKHI Al Khaleej Takaful Insurance 20-Oct-15 1 Due IHGS Islamic Holding Group 20-Oct-15 1 Due QIIK Qatar International Islamic Bank 20-Oct-15 1 Due GWCS Gulf Warehousing Company 21-Oct-15 2 Due QGTS Qatar Gas Transport Company (Nakilat) 21-Oct-15 2 Due QNCD Qatar National Cement Company 21-Oct-15 2 Due QIMD Qatar Industrial Manufacturing Company 22-Oct-15 3 Due QNNS Qatar Navigation (Milaha) 24-Oct-15 5 Due QATI Qatar Insurance Company 25-Oct-15 6 Due MARK Masraf Al Rayan 25-Oct-15 6 Due DHBK Doha Bank 25-Oct-15 6 Due QISI Qatar Islamic Insurance 25-Oct-15 6 Due QGRI Qatar General Insurance & Reinsurance 25-Oct-15 6 Due QOIS Qatar & Oman Investment 25-Oct-15 6 Due MCGS Medicare Group 25-Oct-15 6 Due GISS Gulf International Services 25-Oct-15 6 Due QGMD Qatar German Company for Medical Devices 25-Oct-15 6 Due UDCD United Development Company 26-Oct-15 7 Due QFLS Qatar Fuel Company 26-Oct-15 7 Due ERES Ezdan Real Estate Company 26-Oct-15 7 Due MERS Al Meera Consumer Goods Company 27-Oct-15 8 Due MPHC Mesaieed Petrochemical Holding Company 27-Oct-15 8 Due ORDS Ooredoo 28-Oct-15 9 Due IQCD Industries Qatar 28-Oct-15 9 Due AHCS Aamal Company 29-Oct-15 10 Due NLCS National Leasing (Alijarah) 29-Oct-15 10 Due ZHCD Zad Holding Company 29-Oct-15 10 Due BRES Barwa Real Estate Company - - - QCFS Qatar Cinema & Film Distribution Company - - - WDAM Widam Food Company - - - VFQS Vodafone Qatar - - - Source: QSE

- 4. Page 4 of 7 News Qatar CBQK Results Adversely Impacted From UAB – 3Q2015 earnings disappoints on the account of CBQK’s Associate United Arab Bank (UAB). Commercial Bank of Qatar (CBQK) reported a net profit of QR275.9mn in 3Q2015, falling short of our expectation of QR498.9mn (BBG: QR496.25mn). Net income dropped by 51.8% and 43.3% QoQ and YoY, respectively. The miss was mainly due to the loss generated by CBQK’s UAE based associate, UAB. UAB incurred excessive provisions in 3Q2015, reporting a loss of AED273mn. As such, CBQK experienced a loss from associates of QR65.0mn vs. our estimate of QR121.0mn profit. Non-interest income excluding income/(loss) from associates was weak QoQ but strong YoY. CBQK’s fees and commissions dropped by 15.9% QoQ (+26.8% YoY) to QR246.3mn, in-line with our estimate QR237.5mn (+3.7% variation). FX income followed suit and dropped by 38.4% QoQ (+59.0% YoY) to QR34.3mn. Moreover, gains from investment securities was also weak, declining by 68.0% and 67.8% QoQ and YoY, respectively. Net interest income sequentially grew by 3.9% (down 4.5% YoY). CBQK reported net interest income of 651.3mn in 3Q2015 in-line with our estimate of QR653.6mn. NIMs remained broadly stable sequentially at 2.57% vs. 2.52% in 2Q2015 and 2.53% in 1Q2015. Provisions for loan losses improved QoQ but remained elevated on a YoY basis. CBQK’s credit costs declined sequentially by 18.6% (+39.9% YoY) to QR167.6mn. Loans continued to exhibit subdued performance. Net loans inched up by 1.0% QoQ (+1.1% YTD) to QR73.4bn. On the other hand, deposits were flat QoQ and +4.2% YTD. Hence, the LDR ticked up to 114% vs. 113% in 2Q2015 (118% at the end of 2014). Asset quality deteriorated. CBQK’s NPL’s increased by 7.8% QoQ to 2.7bn vs. 2.5bn in 2Q2015 (down 3.2% YTD). Thus, the NPL ratio jumped to 3.62% vs. 3.39% in 2Q2015 (3.79% at the end of 2014). Moreover, the coverage ratio decreased to 81% vs. 87% in 2Q2015 (74% at the end of 2014). Recommendation and valuation: Under review. (QNBFS Research, Company Financials) QSE successfully launches rights issue of GWCS – The Qatar Stock Exchange (QSE) has successfully launched the rights issue of Gulf Warehousing Company (GWCS). The QSE said that the launch of rights trading went very smoothly from a technical standpoint and was a resounding success with QR1.13mn worth of rights exchanged in 65 trades. As per the Qatar Financial Markets Authority (QFMA) regulations, the trading of GWCS rights will take place over 10 trading sessions and will end on October 29, 2015. QSE CEO, Rashid Al-Mansoori said that the QSE is delighted to expand its product offerings for investors with trading rights. He said this successful launch will comfort issuers that the trading of rights is a viable mechanism to increase their capital. The bourse is looking forward to the upcoming issues, which are at various stages of shareholder or regulatory approval. (QSE) QNCD to disclose financial statements on October 21 – Qatar National Cement Company (QNCD) will announce its financial reports for the period ending September 30, 2015 on October 21, 2015. (QSE) BRES to release financial statements on October 27 – Barwa Real Estate Company (BRES) will announce its financial reports for the period ending September 30, 2015 on October 27, 2015. (QSE) VFQS to announce financials on November 12 – Vodafone Qatar (VFQS) will disclose the financial statements for the period ending September 30, 2015 on November 12, 2015. (QSE) ORDS: Qatar poised to be global leader in fiber penetration – Ooredoo (ORDS) Chief Operating Officer Waleed Mohamed al- Sayed said that Qatar will be number one worldwide in terms of fiber penetration with the expected completion of Phase 3 of the Ooredoo fiber roll-out in 2016. Mr. Waleed said two-third of the country, including 225,000 homes, are already connected to Ooredoo fiber, which was initially rolled out in 2013. Mr Waleed also said internet-to-home speeds have reached 100Mbps, but added that the company has plans to double or triple the speed “in the very near future.” Meanwhile, ORDS and Qatar Business Incubation Center (QBIC) in partnership, will launch ‘Digital and Beyond’ incubator. The incubator will encourage the creation of a new range of start-ups and technology-focused businesses. After signing of the partnership agreement, ORDS and QBIC launched a national contest for new start-up ideas. The incubator will empower young people to start and grow a diverse range of companies. It will include three zones designed specifically for start-ups; a community zone for relaxation & regeneration, a collaboration zone to encourage communication & teamwork and private zones for meetings & innovative thinking. (Gulf-Times.com, Peninsula Qatar) Wage Protection System to be enforced on November 2 – HE the Minister of Labor and Social Affairs, Dr. Abdulla bin Saleh al- Khulaifi said the amended labor law that has made payment of workers’ wages through banks mandatory will be enforced on November 2, 2015. He said that the Labor Inspection Department is ready to enforce the Wage Protection System (WPS) and follow up the matter, adding that the staff concerned had already been trained for executing this task. In addition, companies have been notified and a webpage has been created on the website of the Ministry of Labor & Social Affairs (MOLSA) for communication with different entities. According to the minister, currently 5,50,000 workers are paid their salaries through bank transfer and many companies have adopted the new system. He said violators of the law would be dealt with strictly according to the stipulations, such as administrative closure of the violating company and other legal procedures and fines. (Gulf-Times.com) Qatar tops M&A activities in Middle East – Qatar topped the Mergers & Acquisitions (M&A) activities in the Middle East during the first nine months of 2015. Qatar’s overseas acquisitions accounted for 55% of Middle Eastern outbound M&A activity, while acquisitions by Saudi Arabian and the UAE companies accounted for 27% and 11%, respectively. The total value of outbound deals from the region for 9M2015 stood at $17.2bn and Qatar’s share was more than half of it. The region’s outbound M&A activity was up 57% YoY, the highest first nine month total since 2009. Thomson Reuters’ quarterly investment banking analysis for the Middle East region revealed that China, Germany and UK were the most targeted nations in terms of M&A deals for 9M2015. With 29%, China was the most targeted nation, followed by Germany and the UK. (Peninsula Qatar) QCB: Private sector credit up by 25.2% in August – According to Qatar Central Bank’s (QCB) monthly monetary bulletin for August, Qatar banks’ private sector credit had surged by 25.2% to QR406bn YoY in August 2015. The private sector deposits had increased by 9.9% to QR345bn in August 2015. The bulletin indicated net foreign assets of Qatar banks had declined by a huge 48.1% to QR69bn during August 2015, from QR133bn in August 2014. In contrast, net domestic assets had jumped by 26.5% to QR451bn from QR356bn in August 2014. The Qatar banking system’s net domestic credit rose by 31.9% (QR142bn) to QR589bn from QR446bn a year ago. The data showed the central bank’s total assets had declined to QR205bn in August 2015 from QR215bn for the same month in 2014. The net international reserves also declined to QR147bn from QR156bn a year ago. The total assets had edged up to QR1.05tn from QR948bn recorded in August 2014. The total assets had crossed the one trillion threshold for the first time in December 2014. (Peninsula Qatar)

- 5. Page 5 of 7 Ashghal: QCS conference will be held on November 16 – The Ministry of Environment and Public Works Authority (Ashghal) has announced that the Qatar Construction Specifications (QCS) conference will be held on November 16, 2015. The conference will be associated with the launch of the new edition compiling the American Society for Testing & Materials (ASTM) code and QCS code 2014. (Peninsula Qatar) International BOJ Governor: Japanese economy to recover moderately – Bank of Japan (BOJ) Governor, Haruhiko Kuroda said the country’s economy was expected to continue recovering moderately even though the slowdown in emerging markets was weighing on exports and output. He said the BOJ’s quantitative and qualitative easing is exerting its intended effects. The BOJ has kept monetary policy steady since expanding its massive stimulus program in October 2014. With inflation having ground to a halt on slumping oil prices, the central bank remains under pressure to ease again ahead of a rate review next week. (Reuters) China GDP expands 6.9% in 3Q2015, beat forecasts – China’s economy expanded quicker than economists forecasted in 3Q2015 as the services sector propped up the world’s second-largest economy, suggesting monetary and fiscal stimulus is keeping Premier Li Keqiang’s 2015 expansion target within reach. The National Bureau of Statistics said the GDP rose 6.9% in 3Q2015, beating economists’ estimates of 6.8%. The economic resilience comes as a stronger services sector and robust consumption help offset weakness in manufacturing and exports. The pace of growth in the services sector quickened to 8.4% in 3Q2015, while so- called secondary industry – which includes manufacturing – weakened to a 6% expansion. However, this still was the slowest quarterly expansion since 1Q2009, based off previously announced data. (Bloomberg) Rousseff backs finance minister, austerity drive – Brazilian President Dilma Rousseff expressed support for Finance Minister Joaquim Levy and said the government will continue efforts to push austerity measures through Brazil’s Congress. She said a proposed tax on financial transactions is crucial that is needed to boost government revenues that have plummeted in recent years. Levy, a former banker seeking to introduce austerity measures needed to rebalance overdrawn government accounts, faces increasing criticism from ruling party officials who oppose the measures and support economic stimulus instead. The President’s backing for the Finance Minister came following a recent flurry of speculation in Brazilian media that the finance chief was getting ready to step down. (Reuters) Reuters: Sub-Saharan Africa debt issuance down to a third in 9M2015 – According to data from Thomson Reuters, debt issuance in sub-Saharan Africa fell by nearly a third to $10.3bn in the first nine months of 2015, as sinking currencies and faltering economies forced borrowers to take a breather. Africans have borrowed heavily in international markets in recent years, taking advantage of historically low yields and strong investor appetite, with debt sales reaching record highs in 2014. But with the prospect of a hike in US interest rates, slowing economies at home and a gloomy outlook for commodity prices, African states and companies have been more reluctant to tap capital markets this year. Thomson Reuters’ quarterly investment banking analysis showed South Africa was the biggest issuing country, accounting for almost half of the activity, followed by the Ivory Coast with 25%. Equity and equity-linked issuance dropped 16% from the same period in 2014, to $5.4bn. But investment banking fees for sub-Saharan African investment banking services inched up 4% to $306mn. (Reuters) Regional HSBC Saudi Arabia announces rebalancing of HSBC Saudi 20 ETF – HSBC Saudi Arabia Limited has said that rebalancing of the HSBC Saudi 20 ETF has been carried out on Oct 18, 2015 in line with the Index. The revised portfolio composition is available on the HSBC Saudi website. (Tadawul) JODI: Saudi crude stockpiles reach record high in August – Saudi Arabia, the world’s largest oil exporter, is storing record amounts of crude in its quest to maintain market share as it cut shipments. According to data published by the Riyadh-based Joint Organizations Data Initiative (JODI), commercial crude stockpiles in August 2015 rose to 326.6mn barrels, the highest since at least 2002, from 320.2mn barrels in July. Crude inventories have been at record highs since May, a month before Saudi Arabia’s production hit an all-time high of 10.56mn barrels per day. The nation has led the Organization of Petroleum Exporting Countries (OPEC) in boosting production to defend market share, abandoning its previous role of cutting output to boost prices. (Bloomberg) Allianz SF gets SAMA approval for insurance product – Allianz Saudi Fransi Cooperative Insurance Company (Allianz SF) has obtained Saudi Arabian Monetary Agency’s (SAMA) final approval for its visitor’s insurance product, which is designed to insure individuals wishing to obtain visit visa to Saudi Arabia. (Tadawul) Buruj Cooperative Insurance discloses use of rights issue proceeds – Buruj Cooperative Insurance Company has said that gross proceeds from its rights issue, which happened in April 2015, amounted to SR120mn and net SR115.23mn, after deducting the direct and indirect costs of SR4.77mn. An amount of SR12mn has been added to the statutory deposit to align it with the capital increase, while the remaining of SR103.23mn has been used to fulfill the solvency margin requirements. The company invested SR10mn in local funds and SR5mn in Sukuk of a local listed company, while it deposited SR60mn in a local bank. Balance SR28.23mn is remaining in a current account. (Tadawul) USC reaches full claim settlement with Al Alamiya – United Sugar Company (USC), a subsidiary of Savola Group, has reached a full and final settlement agreement with Al Alamiya for Cooperative Insurance Company regarding its property damage and business interruption claims caused by fire at its raw sugar warehouse in Jeddah on June 20, 2013. The amount finally agreed reached SR548mn, net of the policy excesses. Al Alamiya continued making payments on account to USC to facilitate the rebuilding of damaged facilities and these advance payments will be offset against this final payment. This settlement will have a net positive impact of around SR94mn on the income statement of the Savola Group for 4Q2015. (Tadawul) NBK: KSA resilient but growth slowing amid oil price slump – The National Bank of Kuwait (NBK), in its latest economic update, predicts headline growth in the Saudi Arabia economy to remain at 3.5% in 2015, boosted by a record high oil production, before moderating to 2.4% in 2016. Non-oil growth is projected at 3.7% over 2015-16, underpinned by firm but more disciplined government spending, especially in terms of capital spending. As per the report, despite over 50% decline in oil prices since June 2014 and the knock-on effect that it has had on real output, Saudi’s economy has, so far, proven quite resilient, growing by 4.0% YoY in 2Q2015. In the oil sector, which grew by 4.8% YoY in 2Q2015, production has surged to a record high in excess of 10.0mn barrels per day on average so far in 2015. The Saudi authorities are committed to issuing $27bn in sovereign debt by 2015-end to help finance the deficit and lessen the depletion of the Kingdom’s foreign reserves. As of August 2015, reserves had declined by 9.4% YTD to $662.2bn. (GulfBase.com)

- 6. Page 6 of 7 SABIC plans more than three ventures in China – Saudi Basic Industries Corporation (SABIC) acting CEO Yousef Al Benyan has said that the company is planning more than three joint venture projects in China. He said SABIC would hopefully be announcing them in 1Q2016. SABIC is also on track to expand investment in the US shale gas projects through joint ventures. Al Benyan said current market conditions place some pressure on some of these investment opportunities, but in the long-term these investment are feasible and SABIC is hoping to announce some of these investments in the US in 2016. (Bloomberg) Marka to launch Dinh Van in Nov 2015 – Marka has been appointed as an exclusive franchisee for the House of Dinh Van. It will be launching the brand in November 2015 in City Walk in Dubai. The company has also confirmed its plans to open five Dinh Van boutiques in the UAE and Qatar by 2020. Founded by Jean Dinh Van in Paris in 1965, the House of Dinh Van is a French jewelry brand. (DFM) Aramex BoD postpones alliance with OTMT – Aramex’s board of directors (BoD) has reviewed the proposal of entering into a strategic partnership with Orascom Telecom Media & Technology Holding (OTMT) to establish logistics areas in Egypt. Following further consideration, the board has decided to postpone the decision on the matter till a later stage. (DFM) Aster DM Healthcare buys additional 57% stake in Sanad Hospital – Aster DM Healthcare has acquired an additional 57% stake in Saudi-based Sanad Hospital for AED900mn to up the total stake to 97%. With the latest acquisition, Aster now has six hospitals in the Gulf Arab region. Aster has five greenfield projects underway in the GCC, including a new hospital in Qatar and three in the UAE. (Reuters) DUSUP to float private tender to buy LNG – According to trade sources, the Dubai Supply Authority (DUSUP) is floating a private tender to buy 4-6 liquefied natural gas (LNG) cargoes each in 2016 and 2017, and is nearing the final stages of the process with an award expected soon. Around 15 companies participated in the process via bilateral discussions and price offers were extremely aggressive, sliding below 12% of the price of Brent crude oil. (GulfBase.com) Invest Bank reports AED77.7mn net profit in 3Q2015 – Invest Bank has reported a net profit of AED77.67mn in 3Q2015 as compared to AED77.05mn in 3Q2014. The bank posted an operational income of AED183.95mn, whereas the total net interest income in 3Q2015 reached AED129.96mn. The bank’s total assets had stood at AED14.95bn as of September 30, 2015 as compared to AED13.83bn on December 31, 2014. Loans & advances to customers reached AED10.7bn, while customer’s deposits had stood at AED11.05bn. EPS amounted to AED0.05 in 3Q2015, same as in 3Q2014. (ADX) ADCB net profit surges 18% YoY in 3Q2015 – Abu Dhabi Commercial Bank (ADCB) reported a net profit of AED1.2bn in 3Q2015 as compared to AED1.02bn in 3Q2014, representing a YoY increase of 18%. The bank’s operating income for 3Q2015 was up 8% YoY at AED2.01bn, with total net interest & Islamic financing income up 10% YoY to AED1.55bn. Non-interest income was down 1% YoY to AED466mn. ADCB’s total assets grew 9% YoY to reach AED215.33bn as of September 30. Net loans & advances increased 11% YoY to AED150.65bn, while deposits from customers were up 7% YoY at AED130bn. By 3Q2015-end, ADCB’s capital adequacy ratio was 19.68% and Tier I ratio was 16.14%. (ADX) DCRP: Oman faces scarcity of qualified Grade A contractors – The Distribution Code Review Panel (DCRP) has regretted over the scarcity of qualified Grade A contractors to undertake vital electrical infrastructure contracts worth in excess of OMR400mn annually. DCRP Chairman Eng. Hamad bin Salim al Maghdari said of the estimated 195 electrical contractors registered with the DCRP, only around 15 are in the Grade A category, meaning they are deemed qualified to undertake technically challenging contracts, involving notably the construction of power stations, primary substations and 132KV networks. However, in reality, only five of these contractors are functional and up to the task in executing Grade A category projects. (GulfBase.com) Omani firms urged to invest in India’s textile sector – Indian ambassador to Oman Indra Mani Pandey has appealed to Omani companies to invest in India’s textile sector, which is the second largest employer in India, offering direct employment to around 35mn people. (GulfBase.com) Bahrain may tax expat remittances – Bahrain may introduce new taxes on remittances and other foreign transactions, if parliament votes in favor of the move this week. The proposal has been submitted by five MPs led by Mohammed Al Ahmed, who said that Bahrain urgently needed to find new revenue streams other than oil. Oil accounts for over 80% of Bahraini government revenue at present, meaning the recent global price slump has had a serious adverse effect on the nation's finances. (GulfBase.com) ABG unit picks arrangers for capital-boosting Sukuk – According to sources, Turkish Islamic bank, Albaraka Turk, has picked seven arrangers for a potential dollar-denominated Sukuk to bolster its supplementary or Tier 2 capital. The bank has chosen Barwa Bank, Dubai Islamic Bank, Emirates NBD, Nomura, Noor Bank, Standard Chartered and QInvest to arrange the Sukuk issue. Albaraka Turk is a unit of Bahrain-based Al Baraka Banking Group (ABG). (Reuters)

- 7. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE In dex S&P Pan Arab S&P GCC 1.2% (0.1%) 0.7% (0.7%) 0.3% 0.5% 0.3% (0.8%) 0.0% 0.8% 1.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,177.32 (0.5) 1.7 (0.6) MSCI World Index 1,683.55 0.5 0.6 (1.5) Silver/Ounce 16.06 (0.4) 1.4 2.3 DJ Industrial 17,215.97 0.4 0.8 (3.4) Crude Oil (Brent)/Barrel (FM Future) 50.46 3.6 (4.2) (12.0) S&P 500 2,033.11 0.5 0.9 (1.3) Crude Oil (WTI)/Barrel (FM Future) 47.26 1.9 (4.8) (11.3) NASDAQ 100 4,886.69 0.3 1.2 3.2 Natural Gas (Henry Hub)/MMBtu 2.38 (4.5) 0.6 (20.5) STOXX 600 363.13 0.4 0.1 (0.3) LPG Propane (Arab Gulf)/Ton 44.25 2.3 (9.7) (9.7) DAX 10,104.43 0.2 0.1 (3.5) LPG Butane (Arab Gulf)/Ton 60.37 0.2 (7.7) (7.8) FTSE 100 6,378.04 0.3 0.2 (3.7) Euro 1.13 (0.3) (0.1) (6.2) CAC 40 4,702.79 0.4 0.0 3.5 Yen 119.44 0.5 (0.7) (0.3) Nikkei 18,291.80 0.2 (0.1) 4.9 GBP 1.54 (0.1) 0.8 (0.9) MSCI EM 865.28 0.1 0.7 (9.5) CHF 1.05 (0.3) 0.9 4.3 SHANGHAI SE Composite 3,391.35 1.4 6.3 2.4 AUD 0.73 (0.9) (1.0) (11.1) HANG SENG 23,067.37 0.8 2.7 (2.2) USD Index 94.54 0.2 (0.3) 4.7 BSE SENSEX 27,214.60 0.8 0.4 (3.4) RUB 61.28 (0.2) (0.4) 0.9 Bovespa 47,236.11 (0.4) (6.4) (34.9) BRL 0.25 (3.2) (4.1) (32.5) RTS 881.19 0.6 (0.5) 11.4 140.8 118.9 114.5