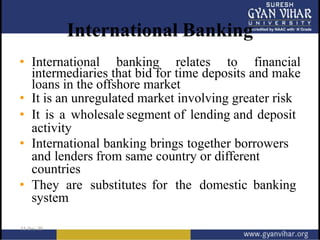

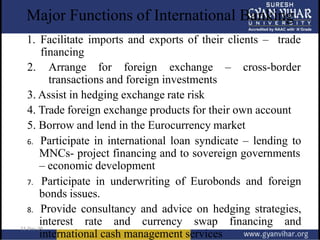

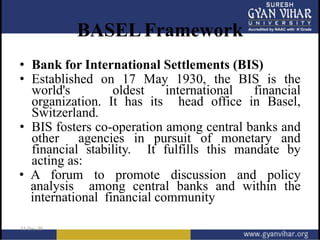

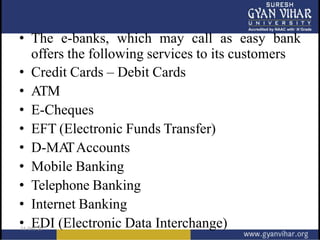

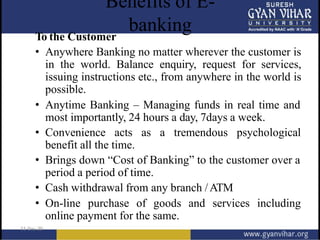

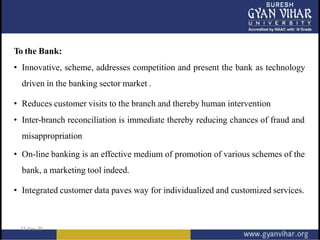

This document discusses international banking, the BASEL framework, and the role of information technology in banking. It provides definitions and examples of international banking activities like facilitating trade, foreign exchange transactions, and lending. It describes the functions of the Bank for International Settlements (BIS) in fostering cooperation among central banks. It also outlines how information technology and e-banking have modernized banking services by providing convenience and reducing costs for both customers and banks.