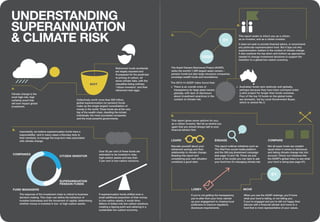

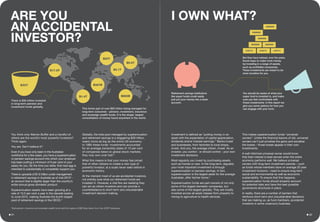

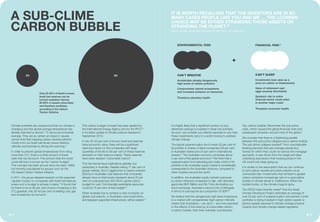

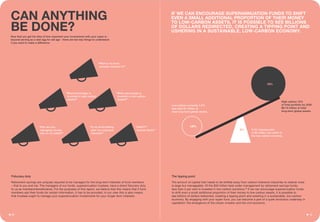

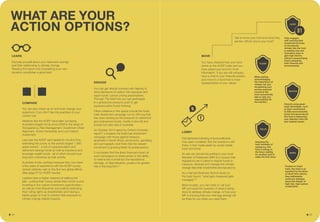

This document summarizes a report about understanding the relationship between climate risk and superannuation (retirement) funds. It discusses how climate change poses risks to investments and the global economy. Superannuation funds collectively total over $30 trillion globally and have significant influence over companies as shareholders. However, most funds are underexposed to low-carbon solutions and overexposed to high-carbon assets vulnerable to climate policies. The report aims to educate citizen investors about engaging with their funds to ensure climate risks are properly managed.