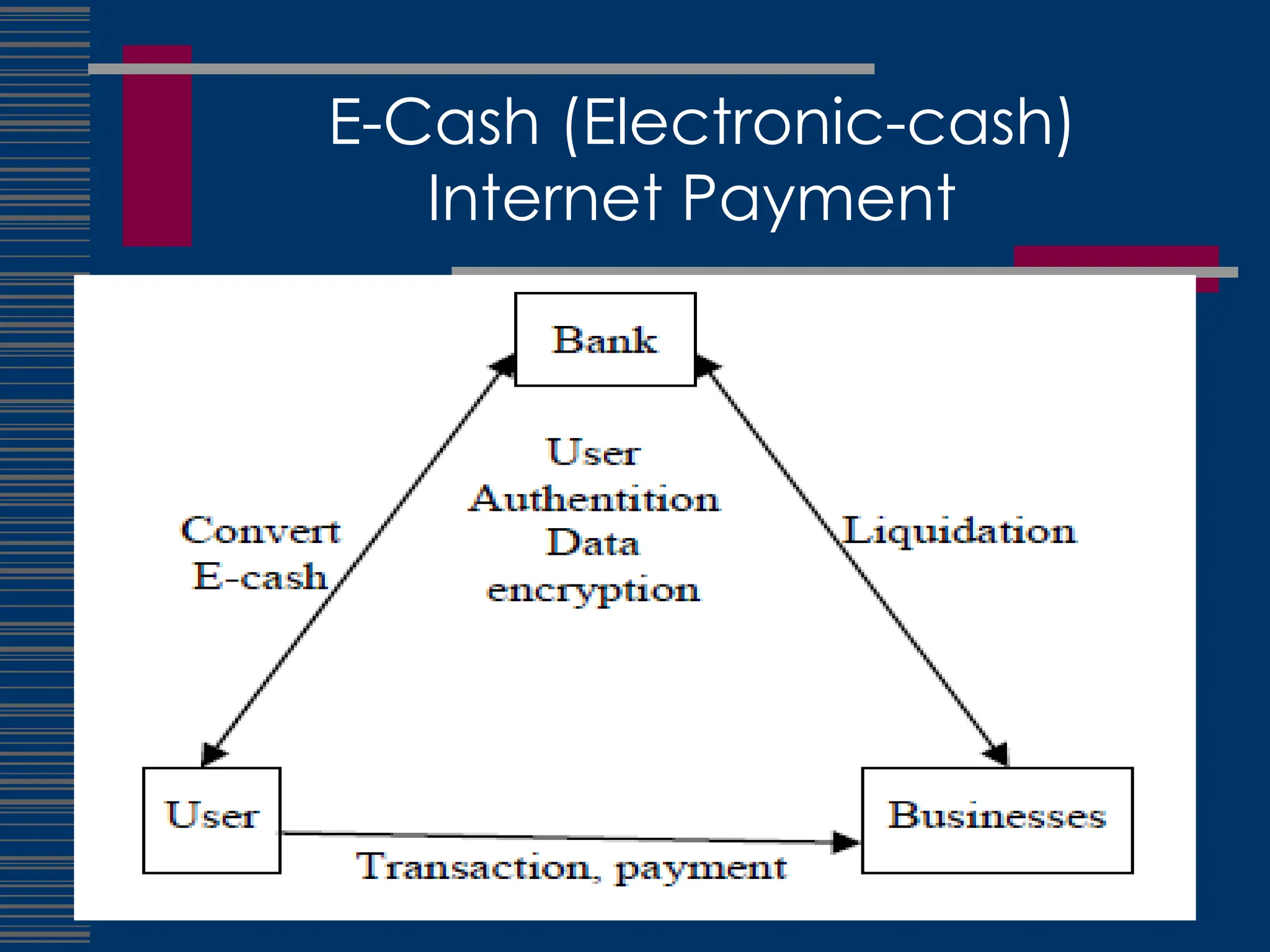

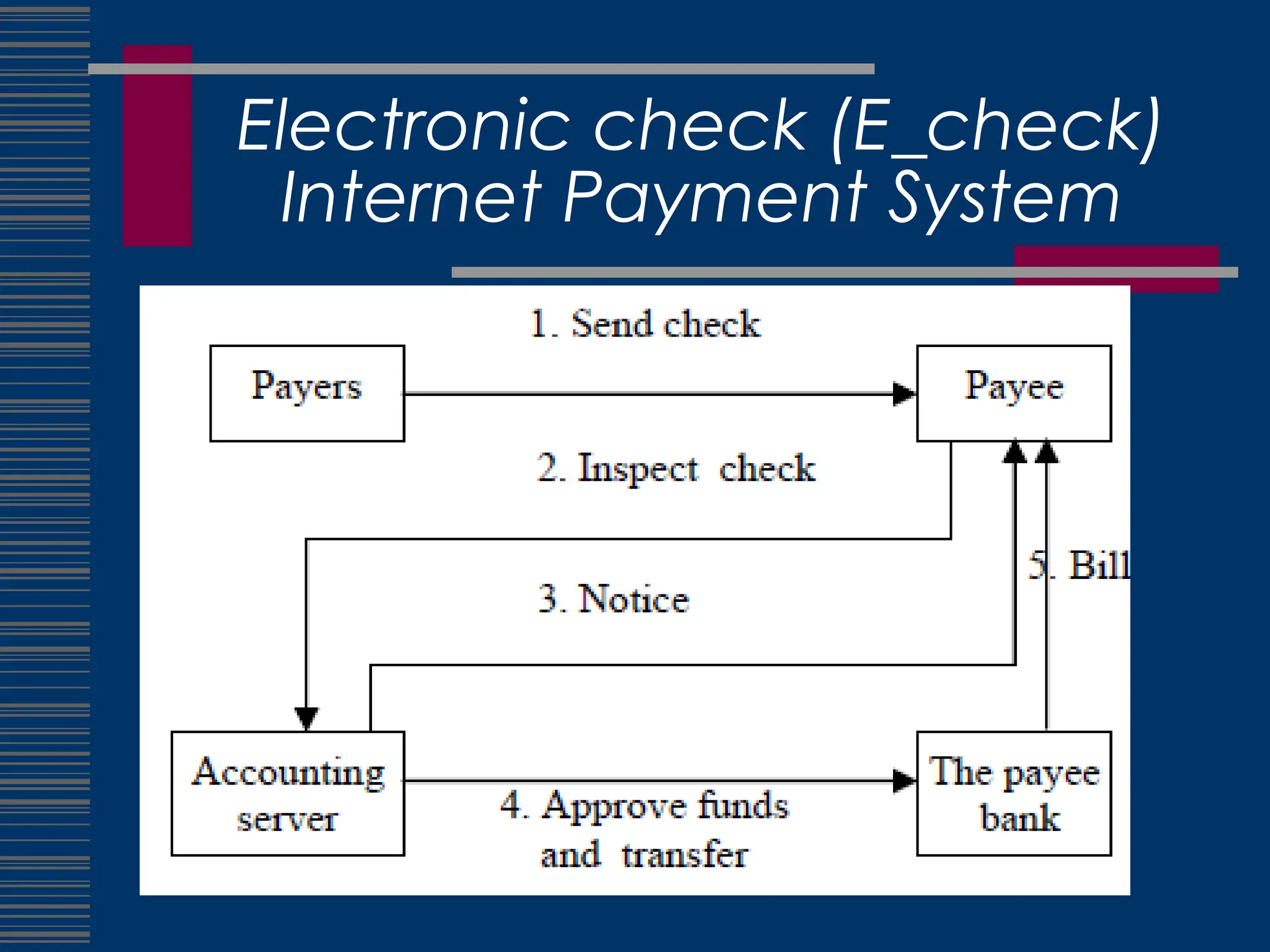

The document discusses electronic payment systems (EPS), which facilitate online financial transactions between buyers and sellers using digital instruments. It outlines the benefits of EPS including improved customer service, increased profitability, and a competitive edge, while also highlighting various payment methods and security measures to protect transaction information. Additionally, it addresses potential risks associated with online payments and the importance of risk assessment in maintaining secure transactions.