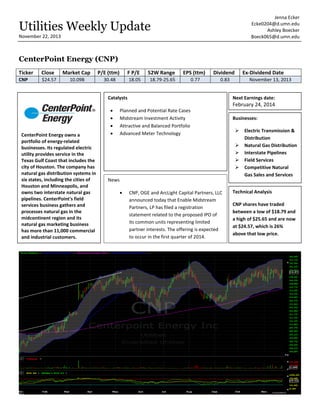

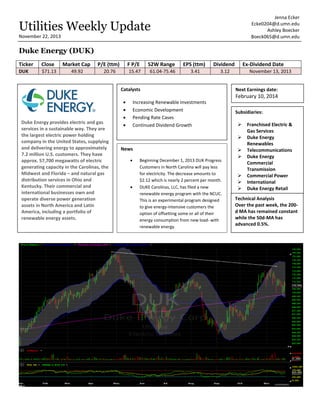

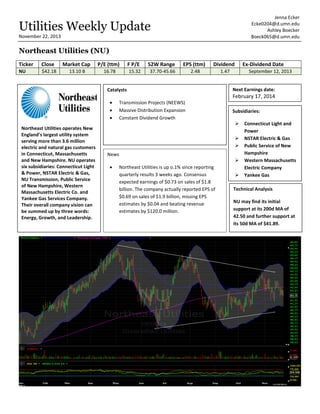

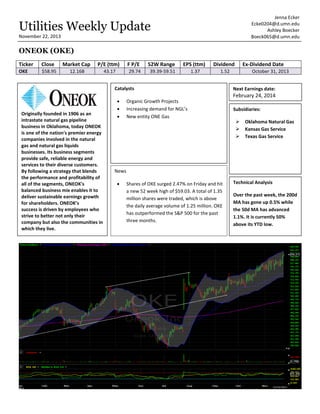

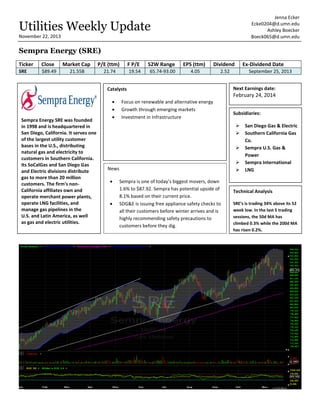

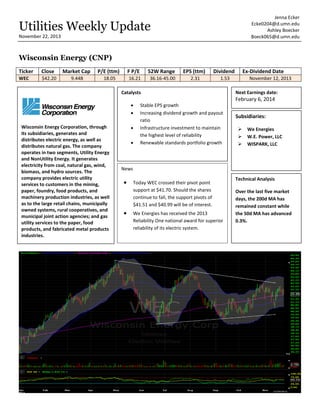

- The document provides an utilities weekly update from Jenna Ecker and Ashley Boecker including performance charts and analyses of 6 utilities companies: CenterPoint Energy, Duke Energy, Northeast Utilities, ONEOK, Sempra Energy, and Wisconsin Energy. Key information on each company's business operations, recent news, catalysts, and technical trading data is summarized. The utilities sector saw large inflows of shares the prior week according to the XLU ETF analysis.