This document provides an overview of IRS Form 1099 reporting requirements including:

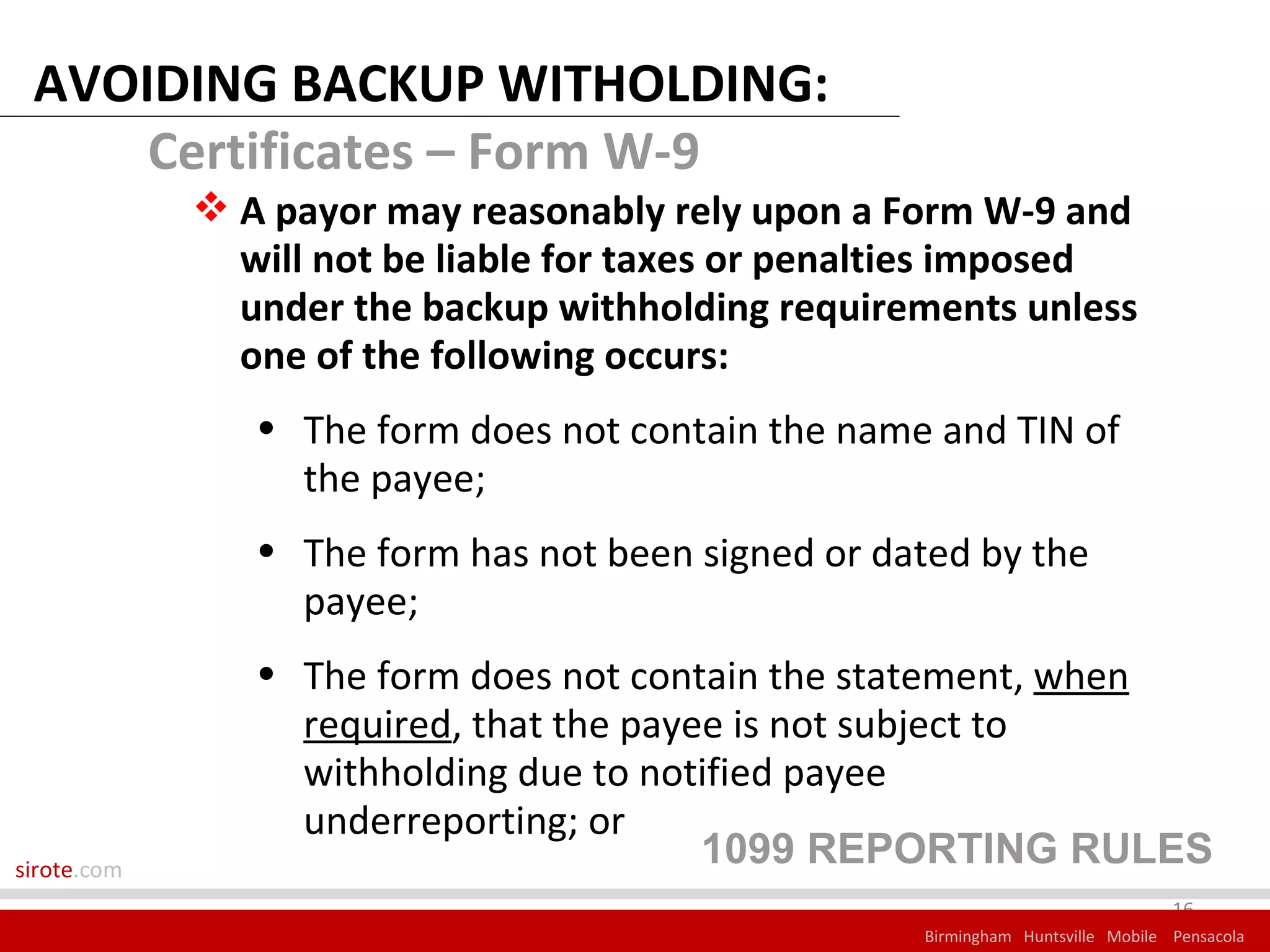

1) Form 1099 reporting alerts the IRS that a payment has been made to a payee and reminds the payee that they received a payment. Payments subject to backup withholding require withholding 28% of the payment unless certain information is provided.

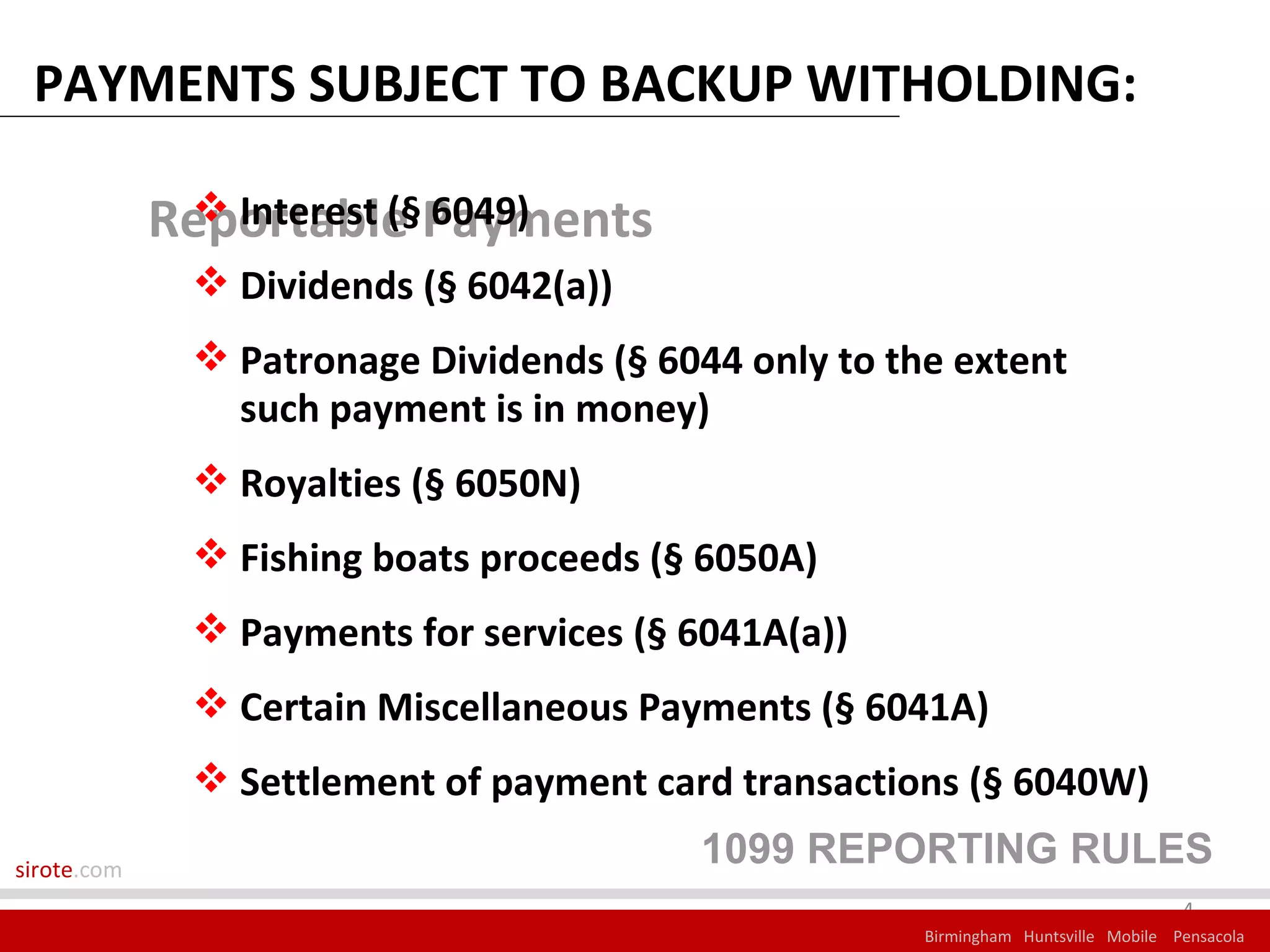

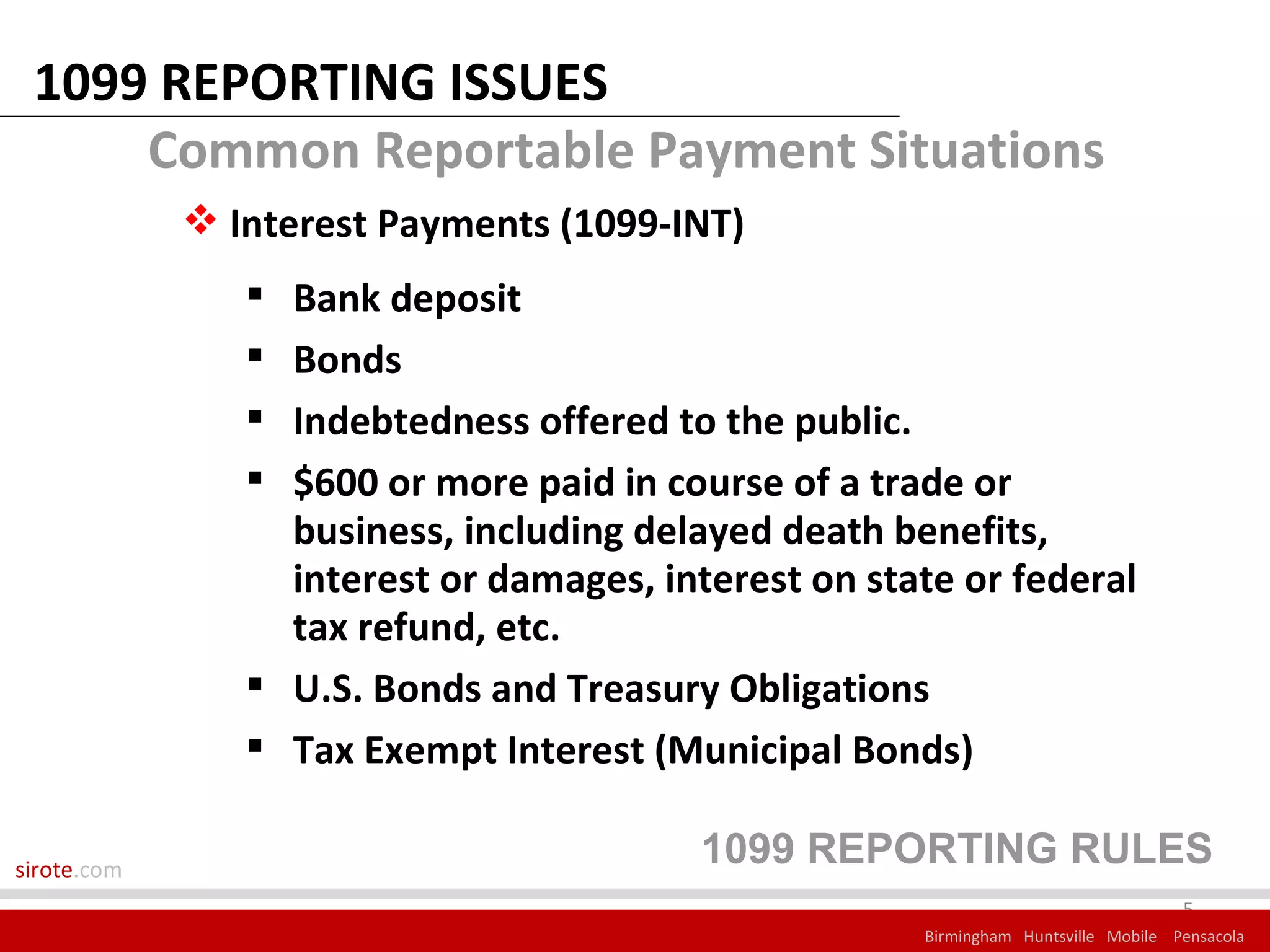

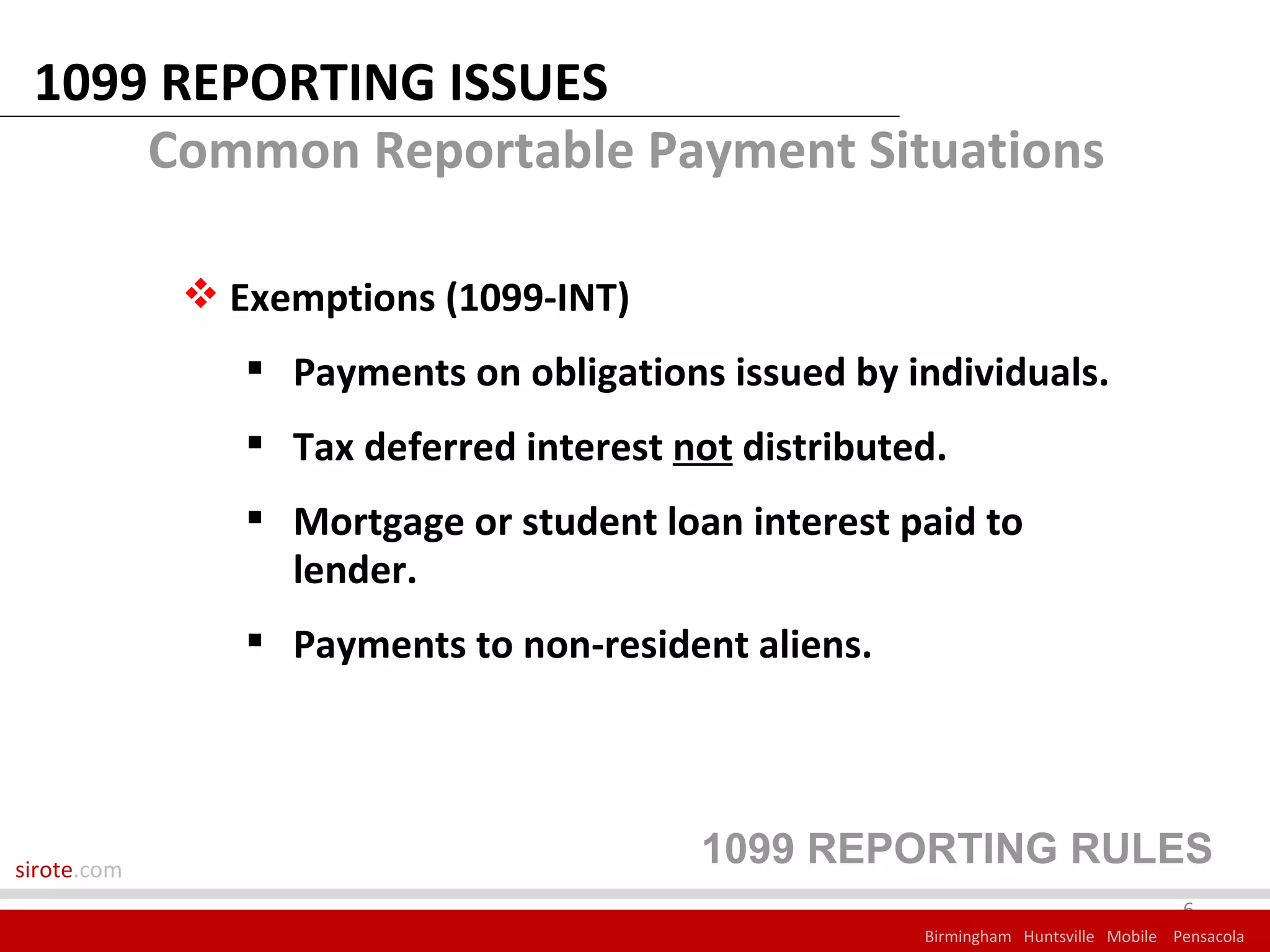

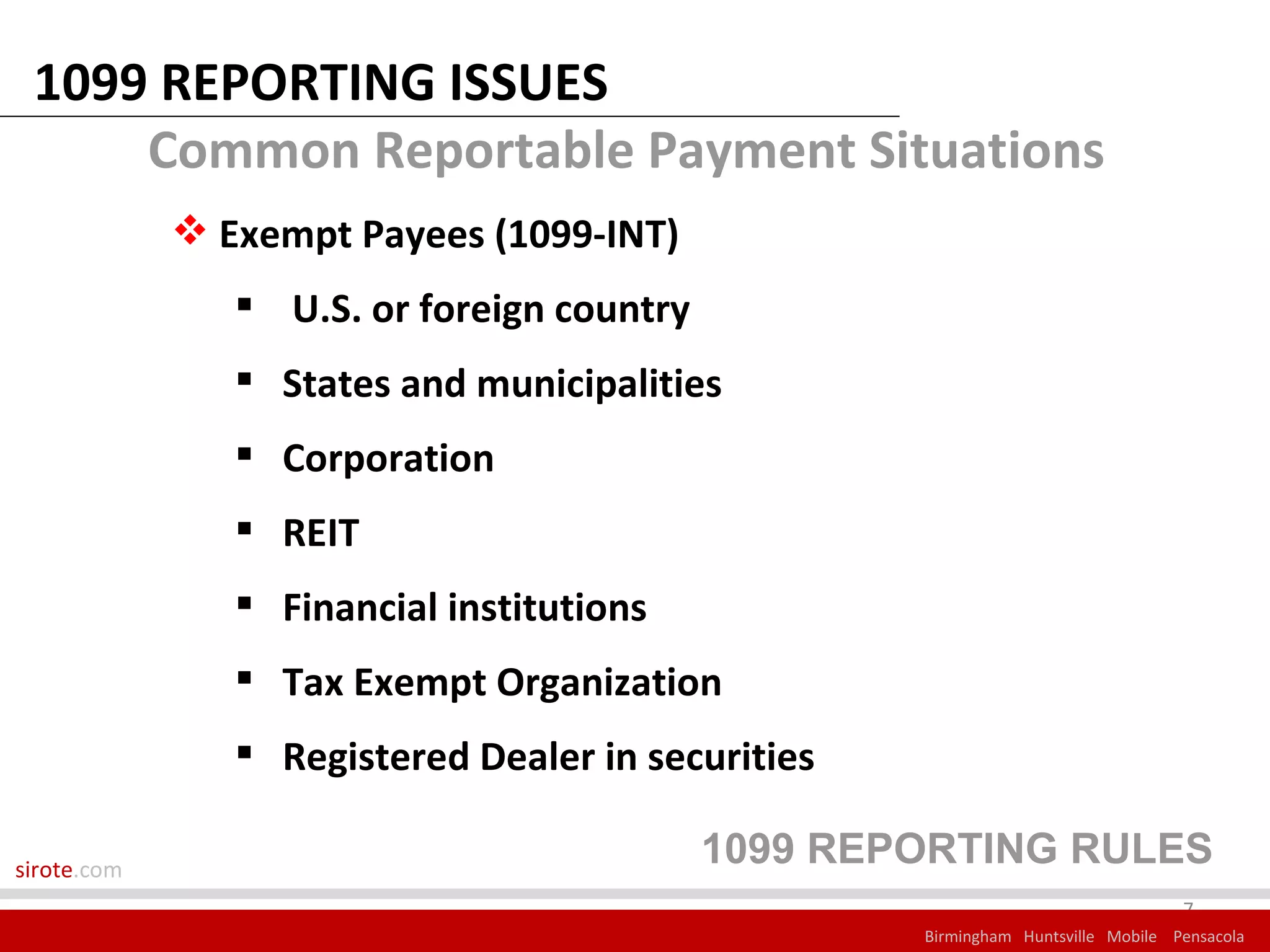

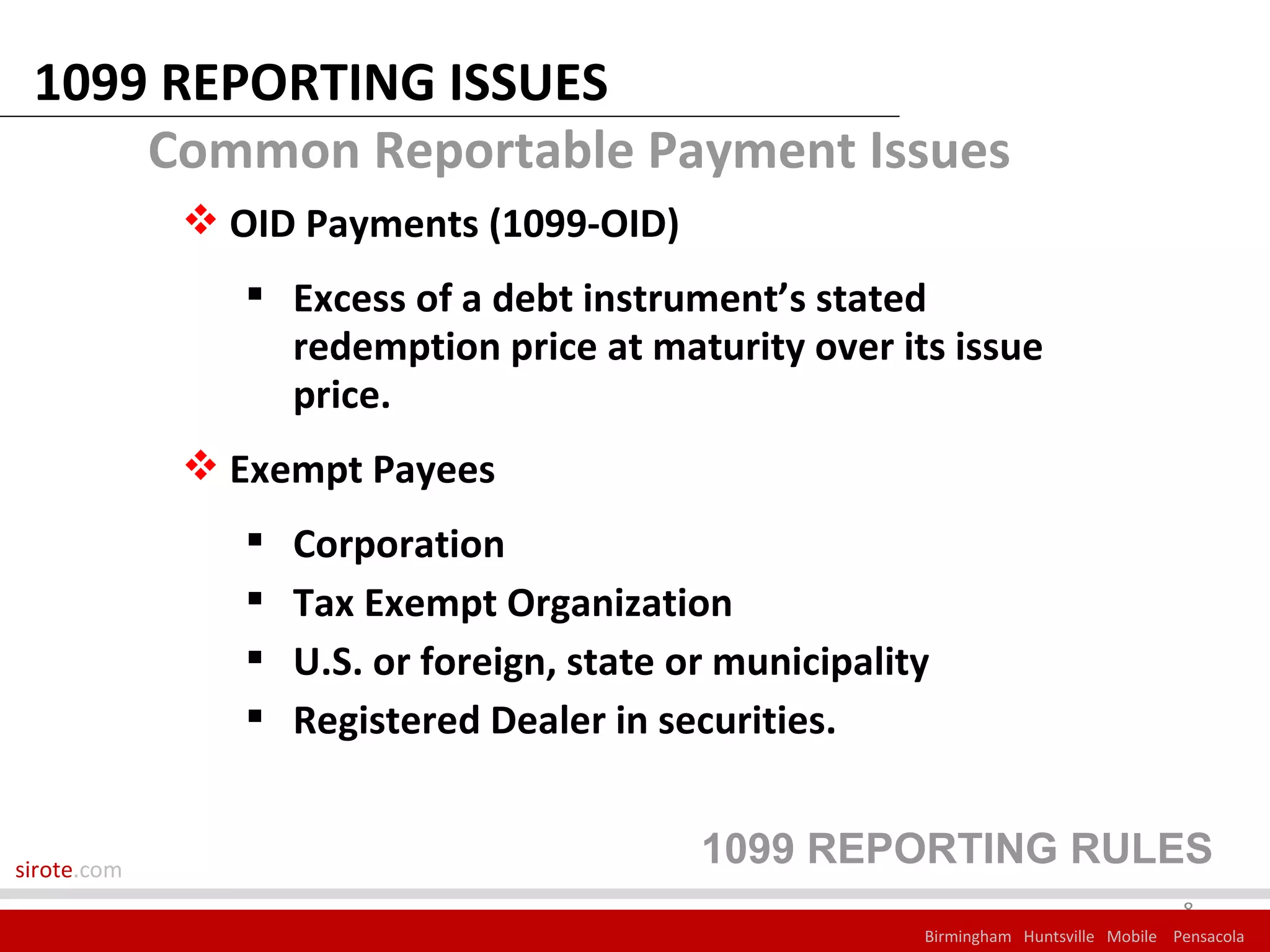

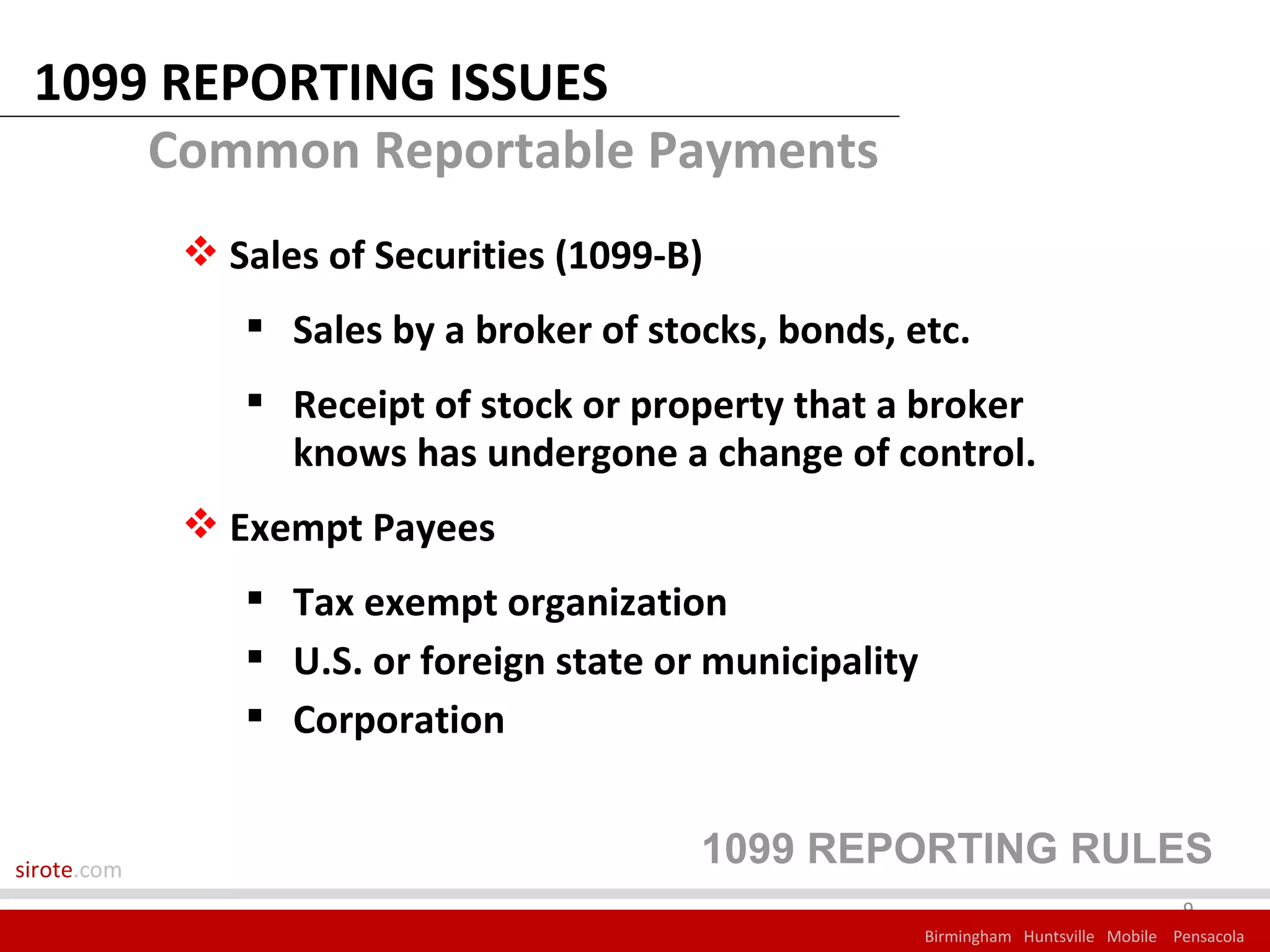

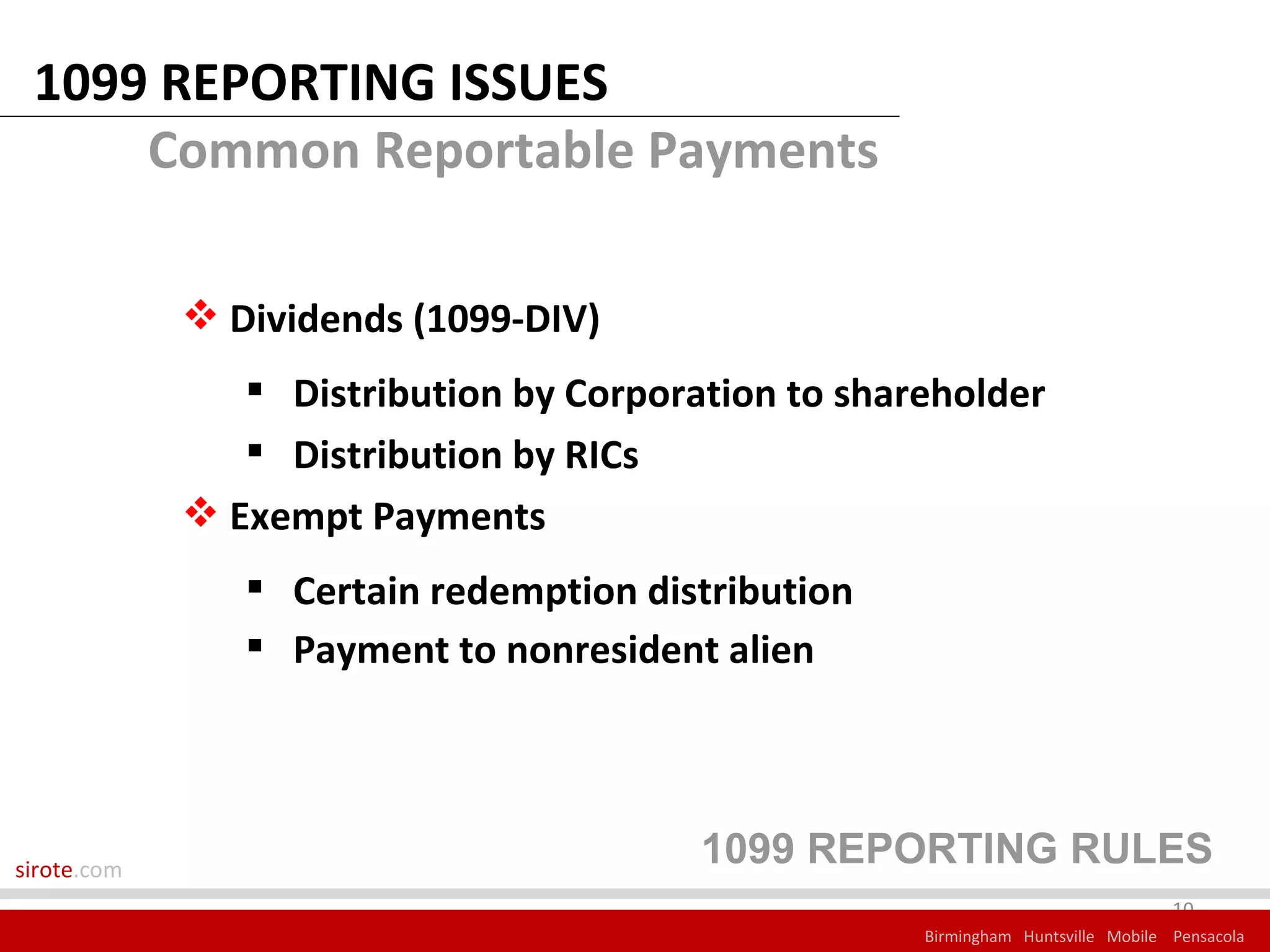

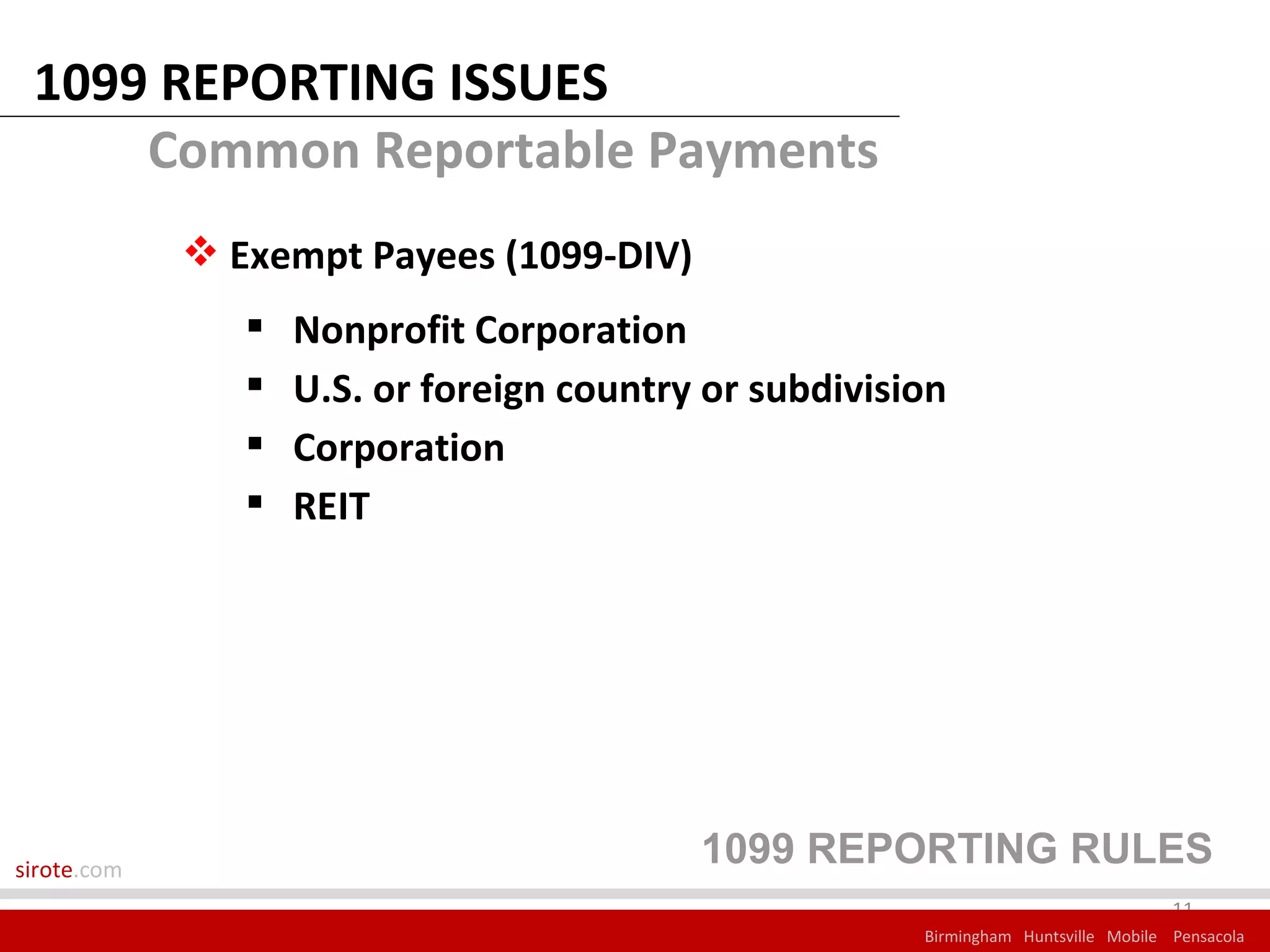

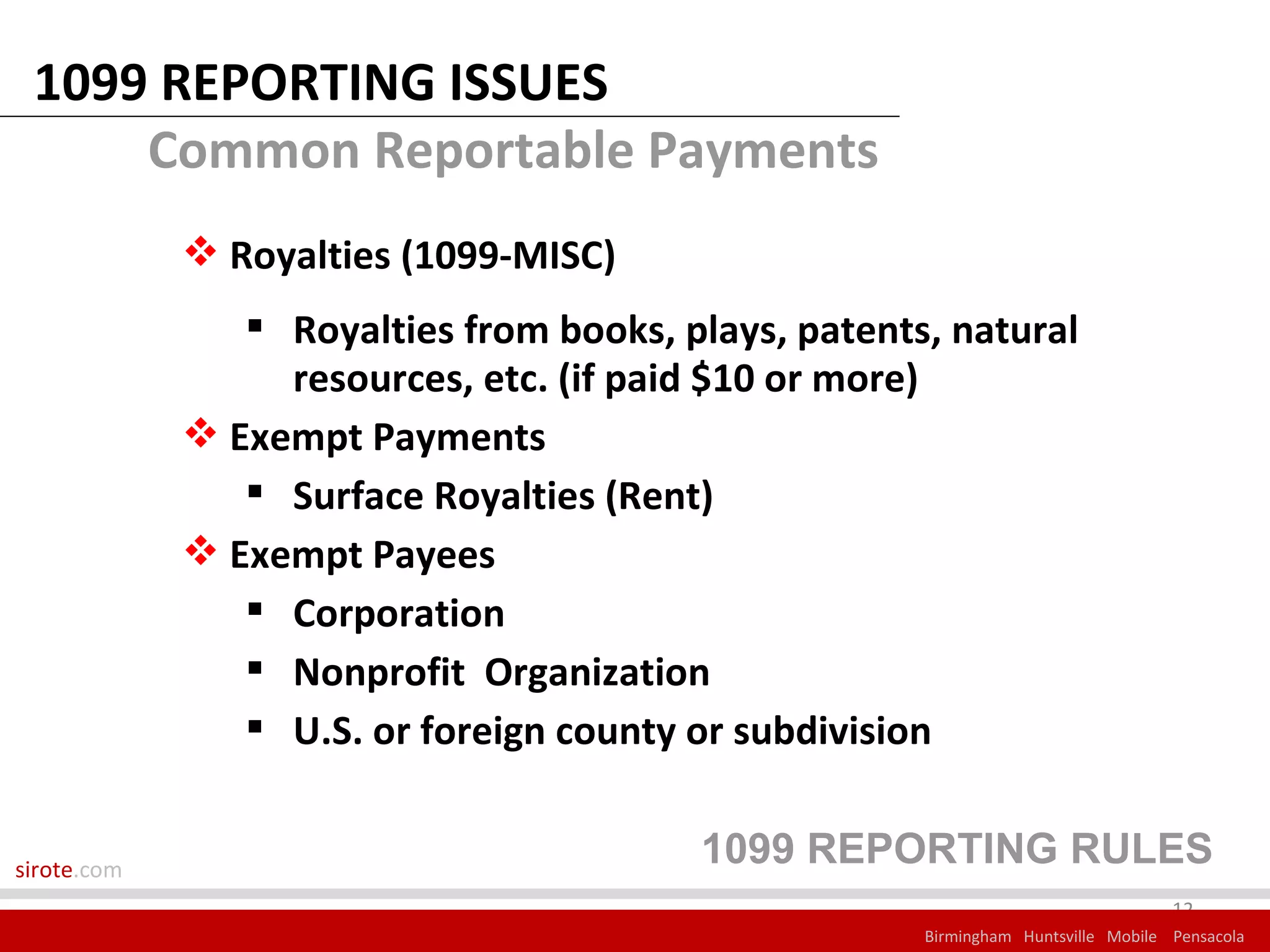

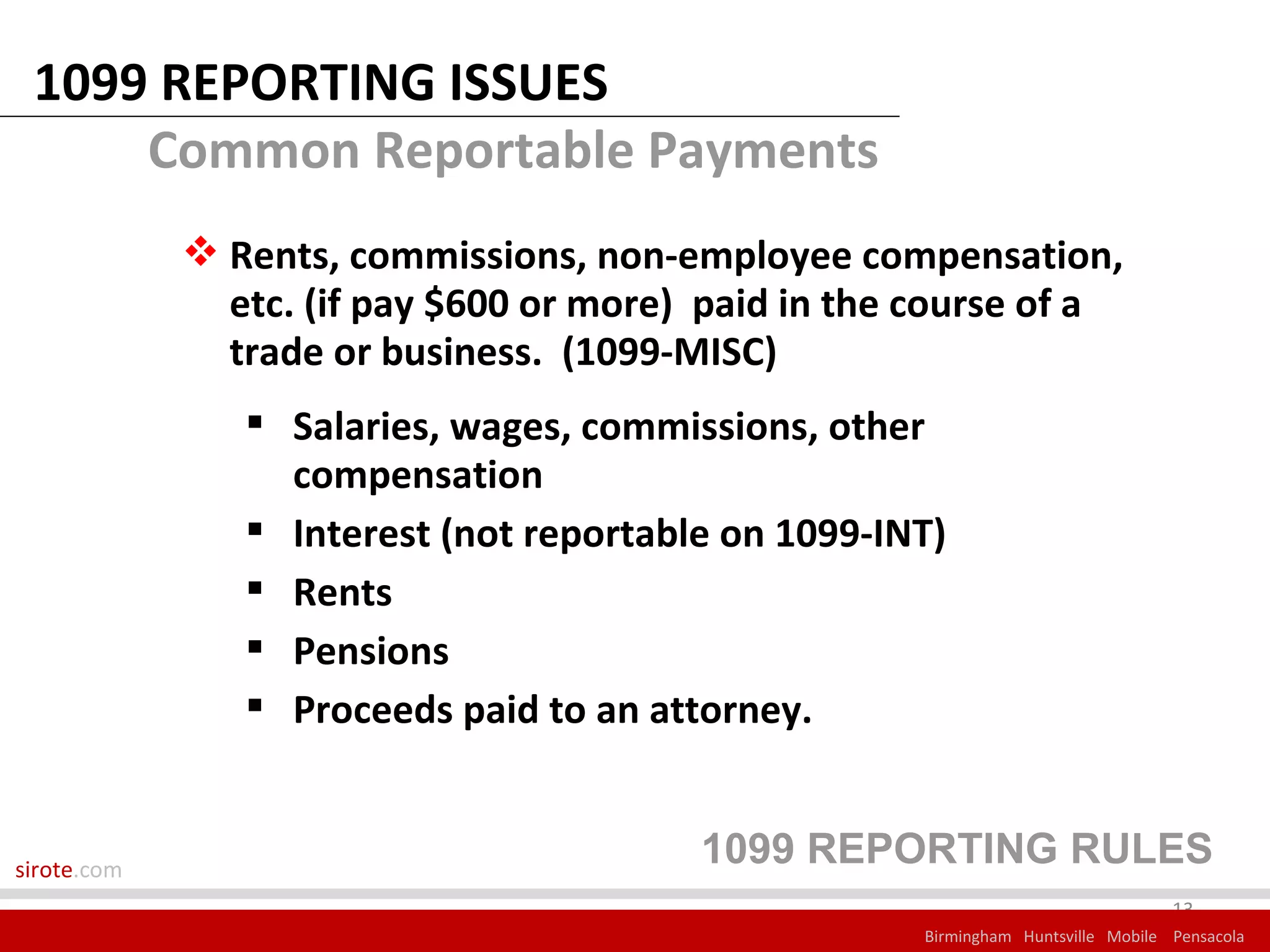

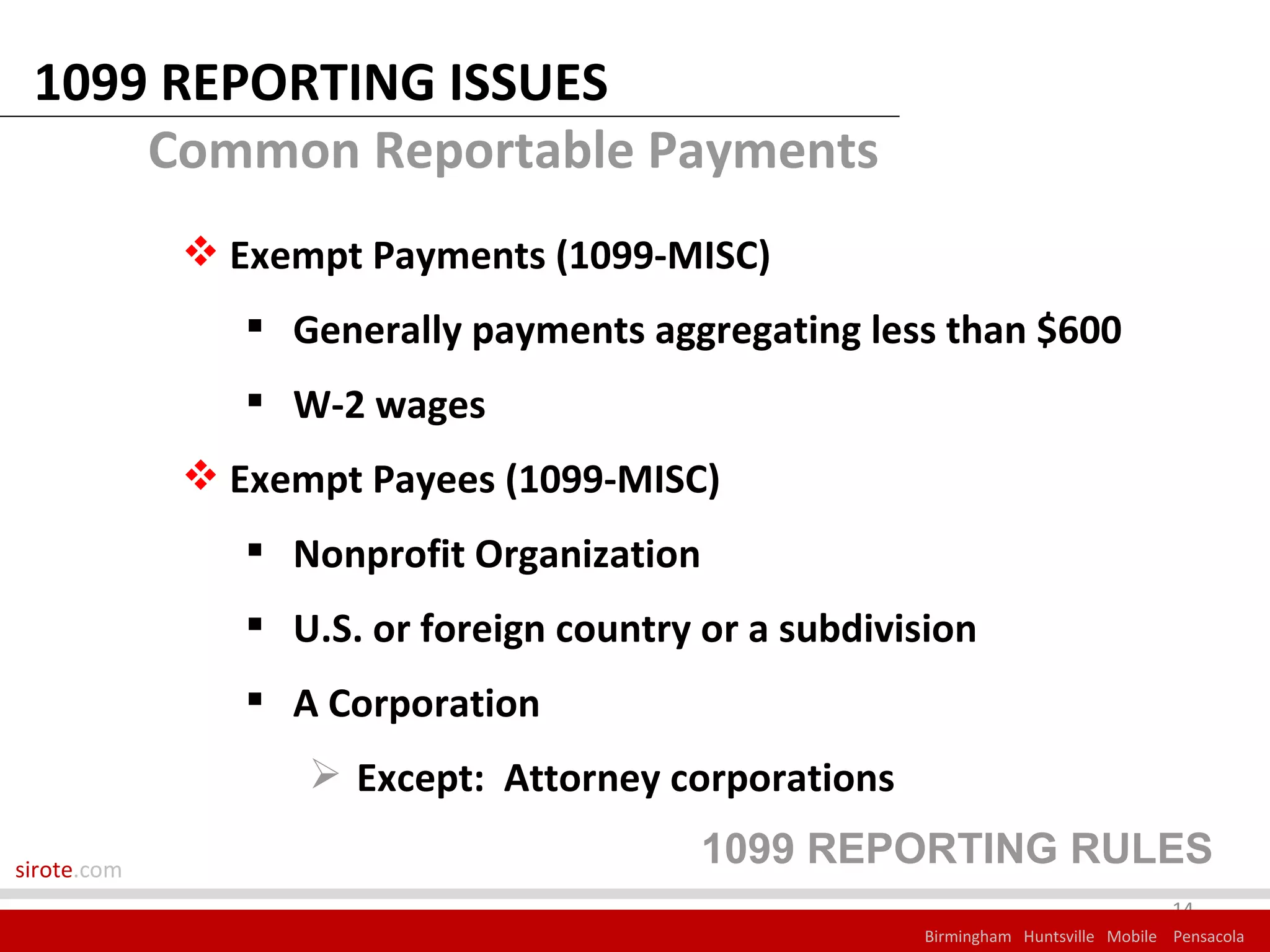

2) Common reportable payments include interest, dividends, royalties, payments for services, and certain miscellaneous payments. The document discusses reporting issues for these payments and exempt payees.

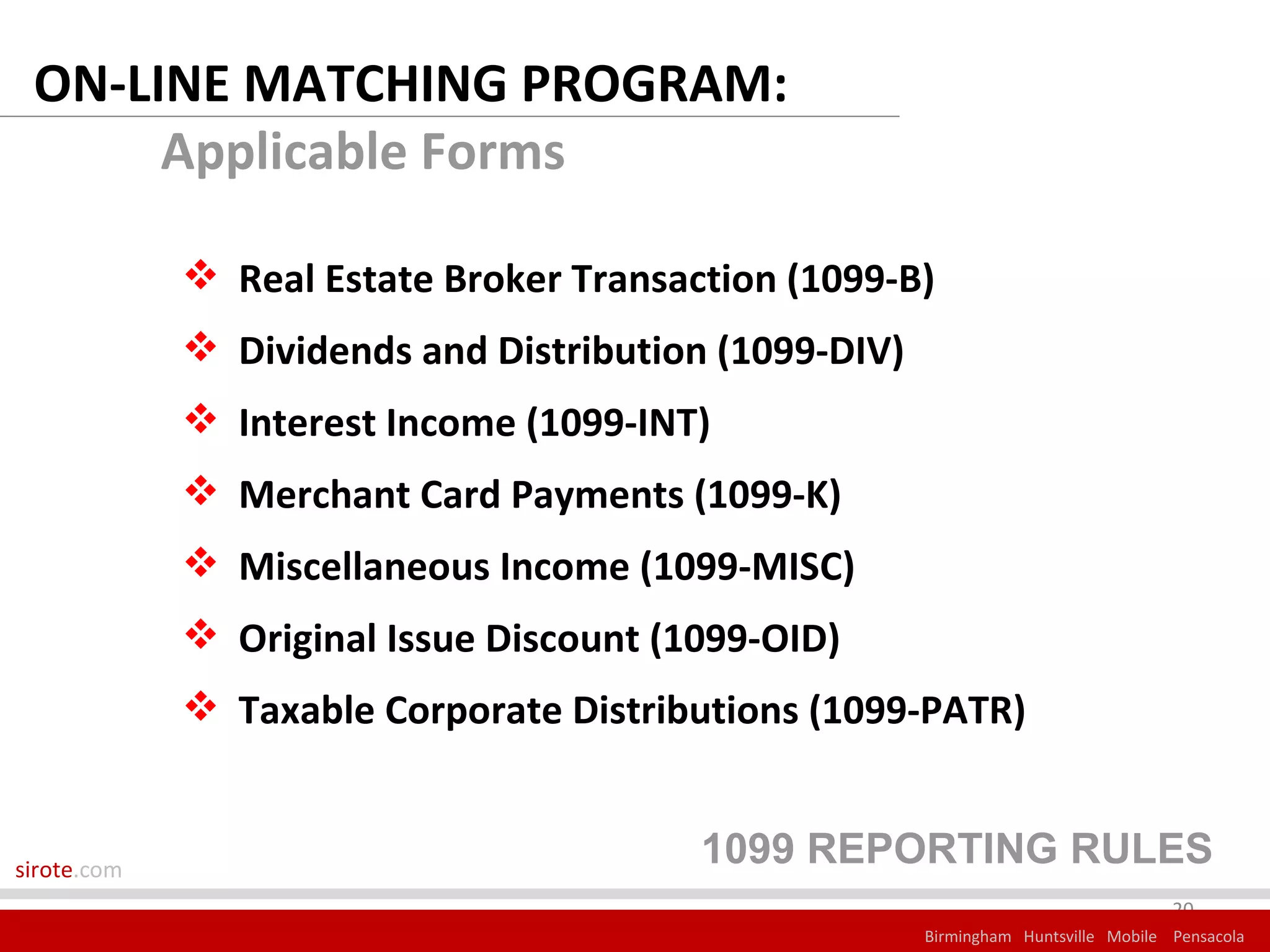

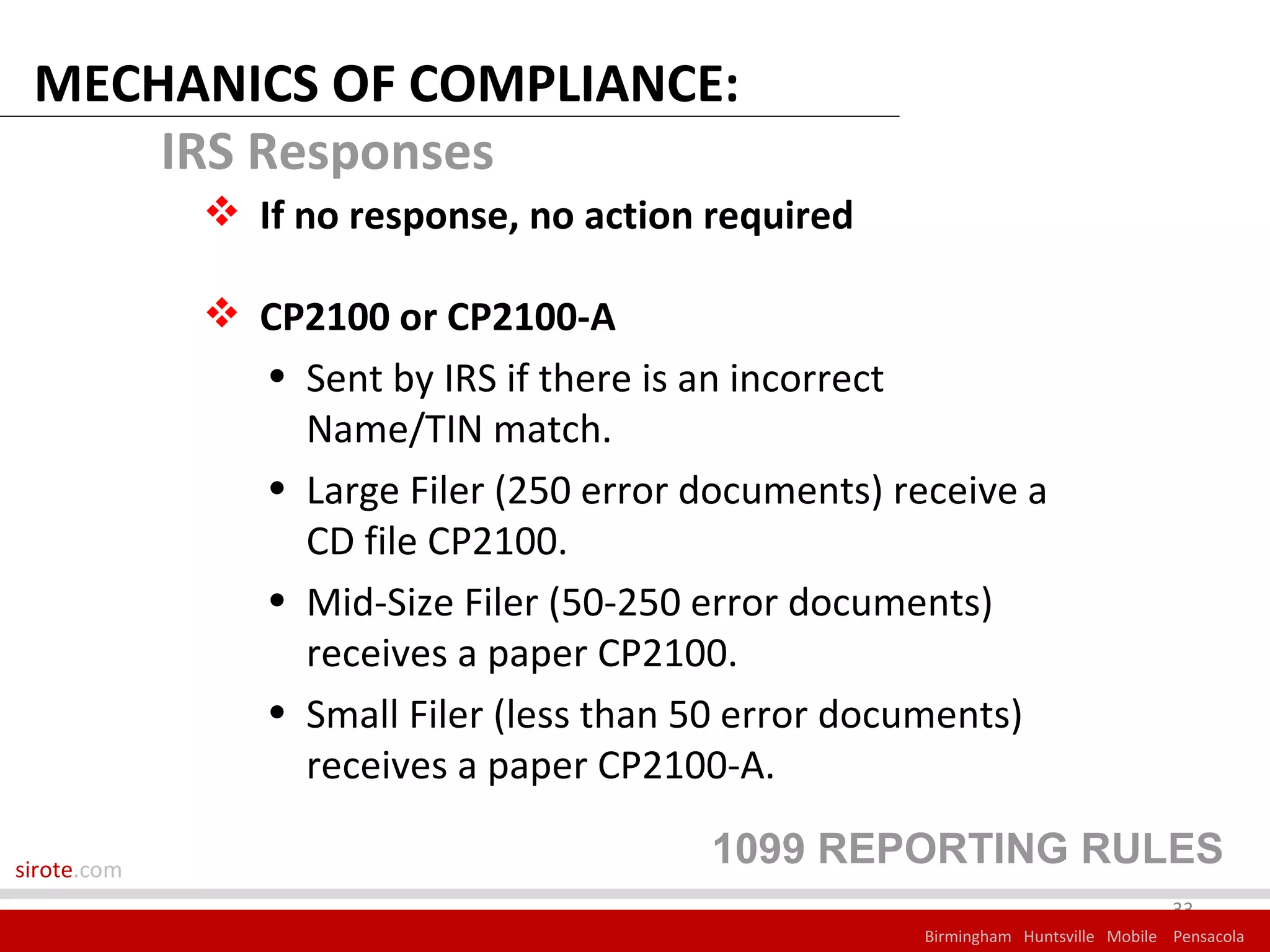

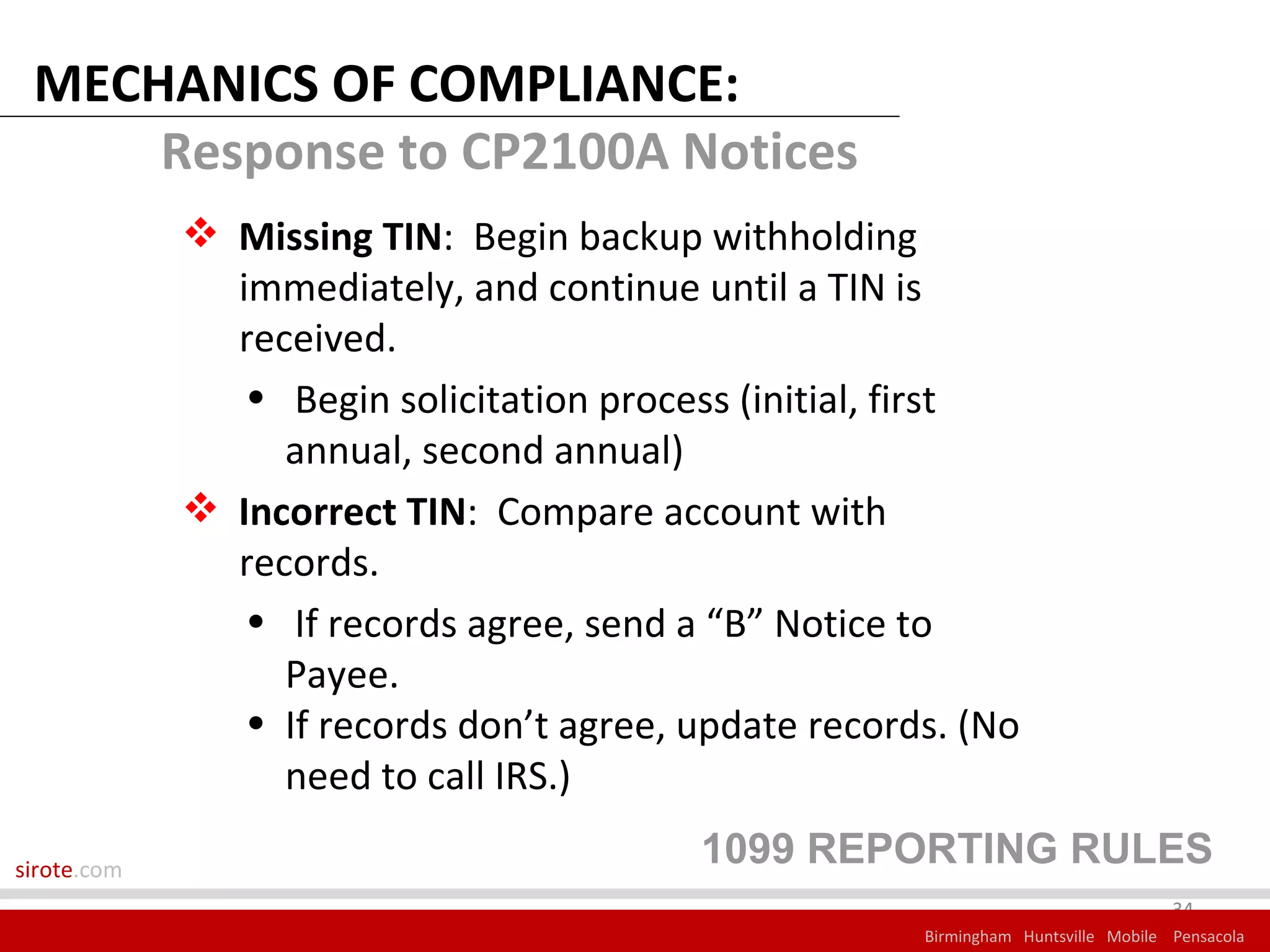

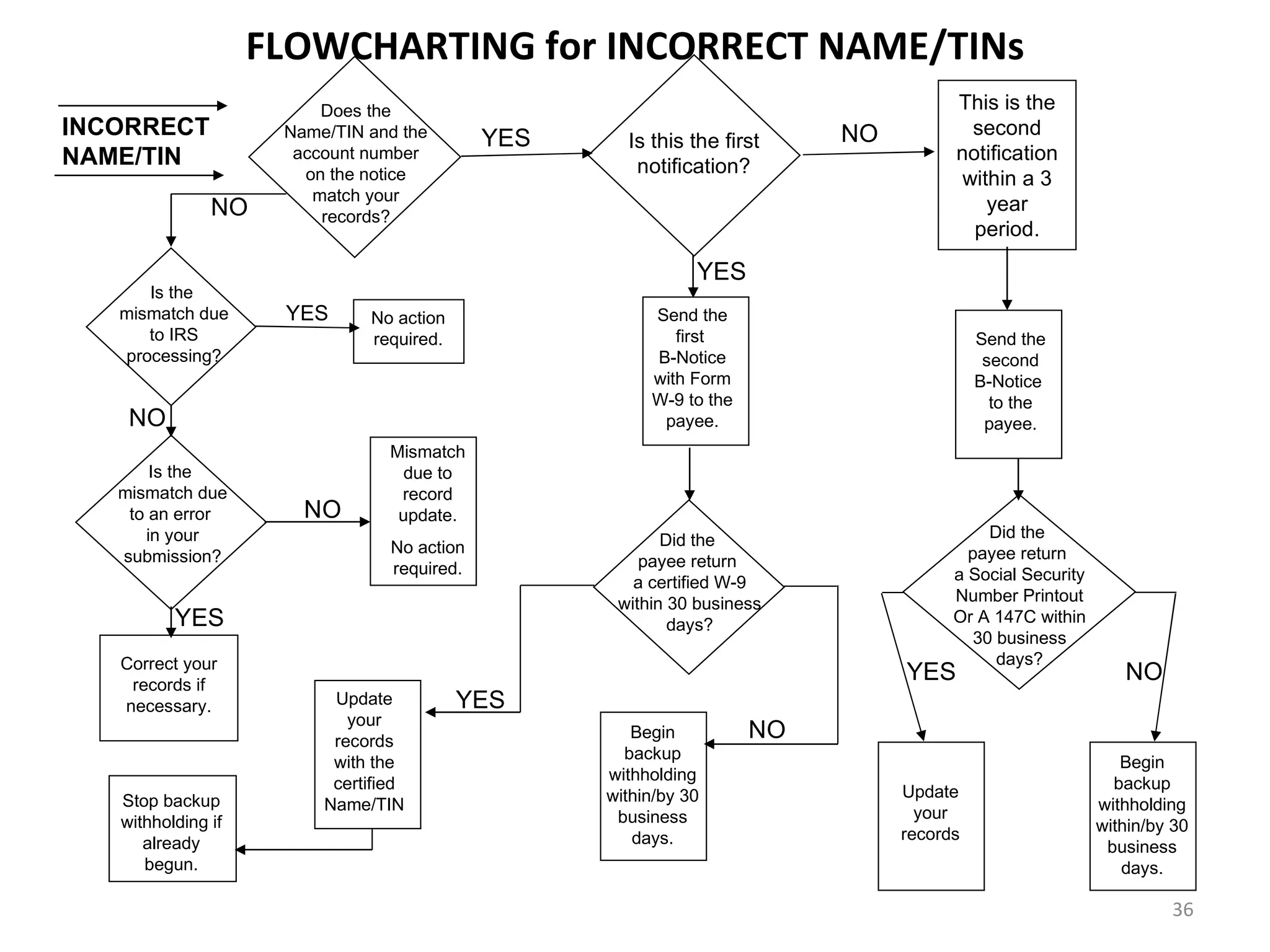

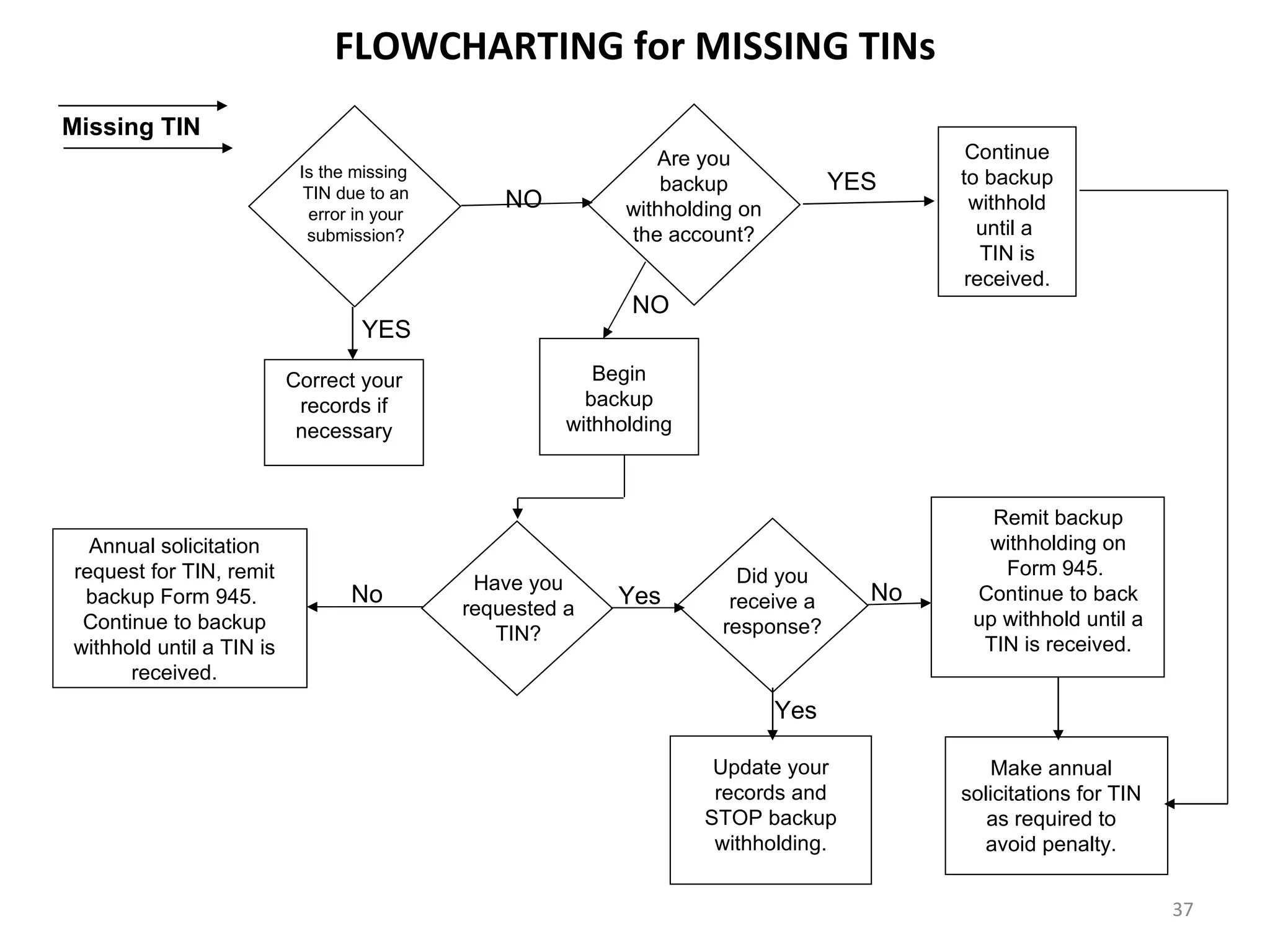

3) The online matching program allows payors to check TIN/payee name combinations to reduce backup withholding notices. Completing Form 1099 requires the primary account owner's