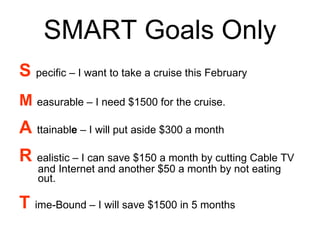

The document outlines 10 smart money moves to help manage personal finances effectively. It recommends creating a financial plan by setting specific, measurable, attainable and time-bound savings goals. It also suggests choosing the right financial products by thoroughly researching savings vehicles, investments and loans. Additionally, it advises saving for emergencies by having 3-6 months of living expenses readily available.

![Jeremy Lushene [email_address]](https://image.slidesharecdn.com/smartmoneymoves-100908181723-phpapp02/85/10-Smart-Money-Moves-2-320.jpg)

![Questions? Jeremy Lushene [email_address] (360) 902-0506 dfi.wa.gov](https://image.slidesharecdn.com/smartmoneymoves-100908181723-phpapp02/85/10-Smart-Money-Moves-41-320.jpg)