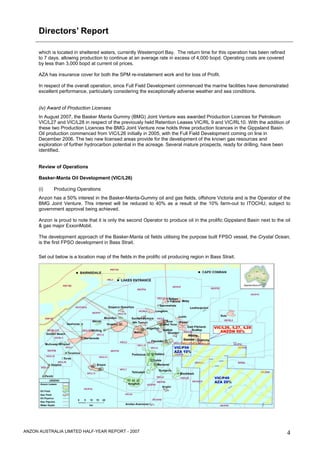

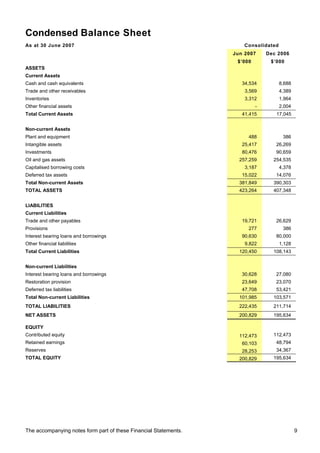

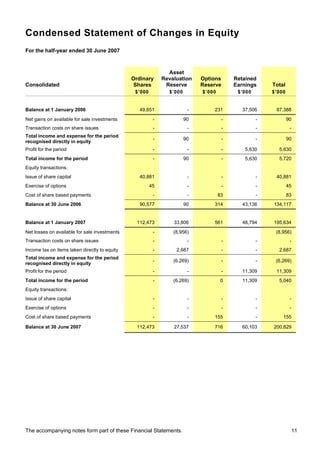

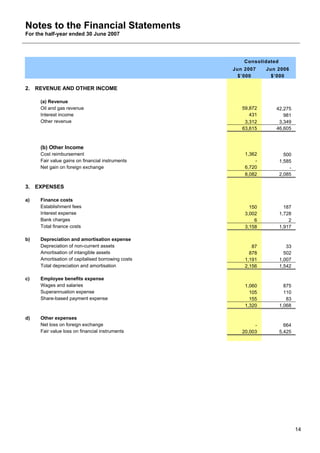

Anzon Australia Limited announced its half year financial report for the period ending 30 June 2007, with a profit after tax of $11.3 million. This does not include substantial additional profit expected from the sale of a 10% interest in the Basker Manta Gummy Joint Venture to ITOCHU Corporation of Japan for $123 million, pending government approval. Highlights included oil production of 1.6 million barrels for the period generating $120 million in revenue, as well as being awarded two new production licenses and making their fourth consecutive profitable announcement since listing in 2004.