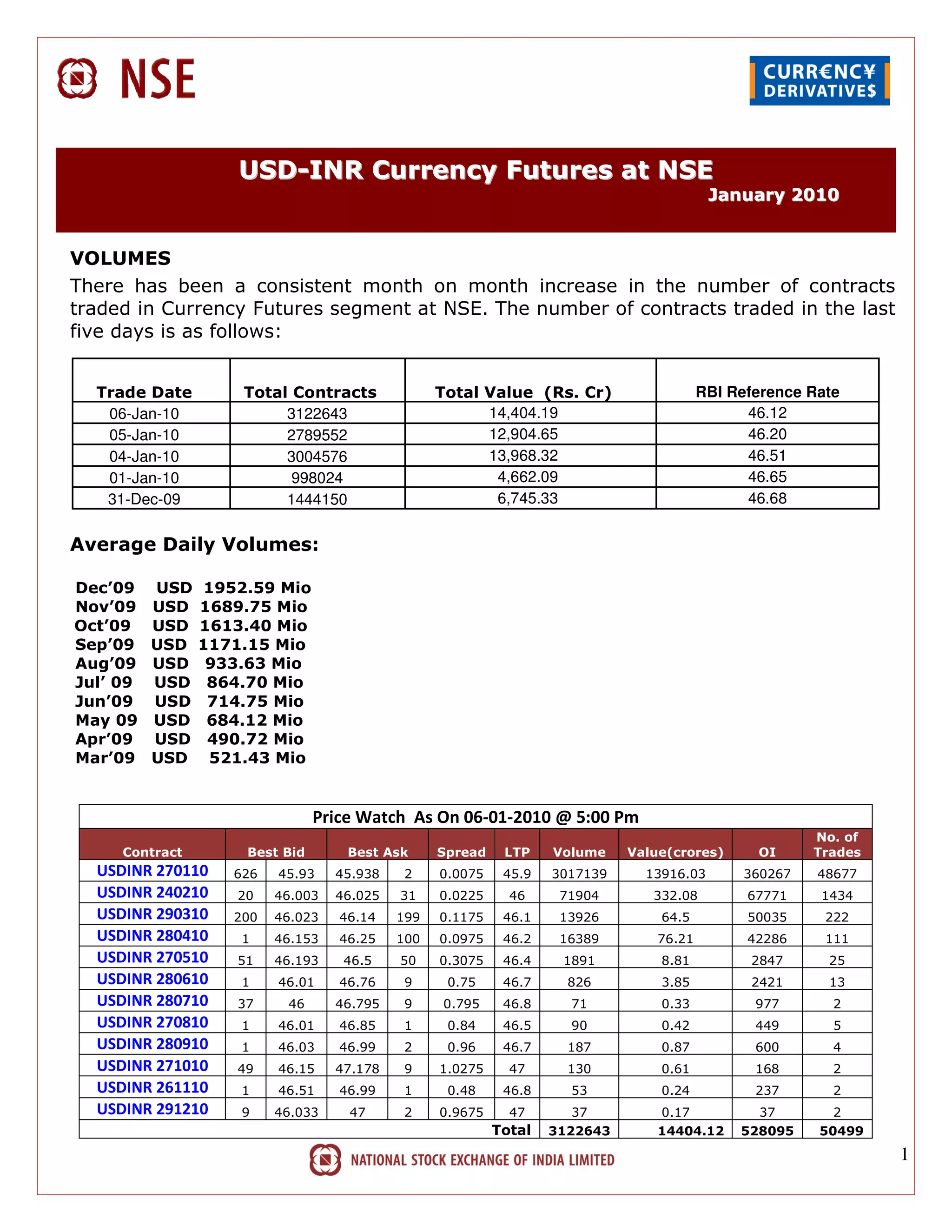

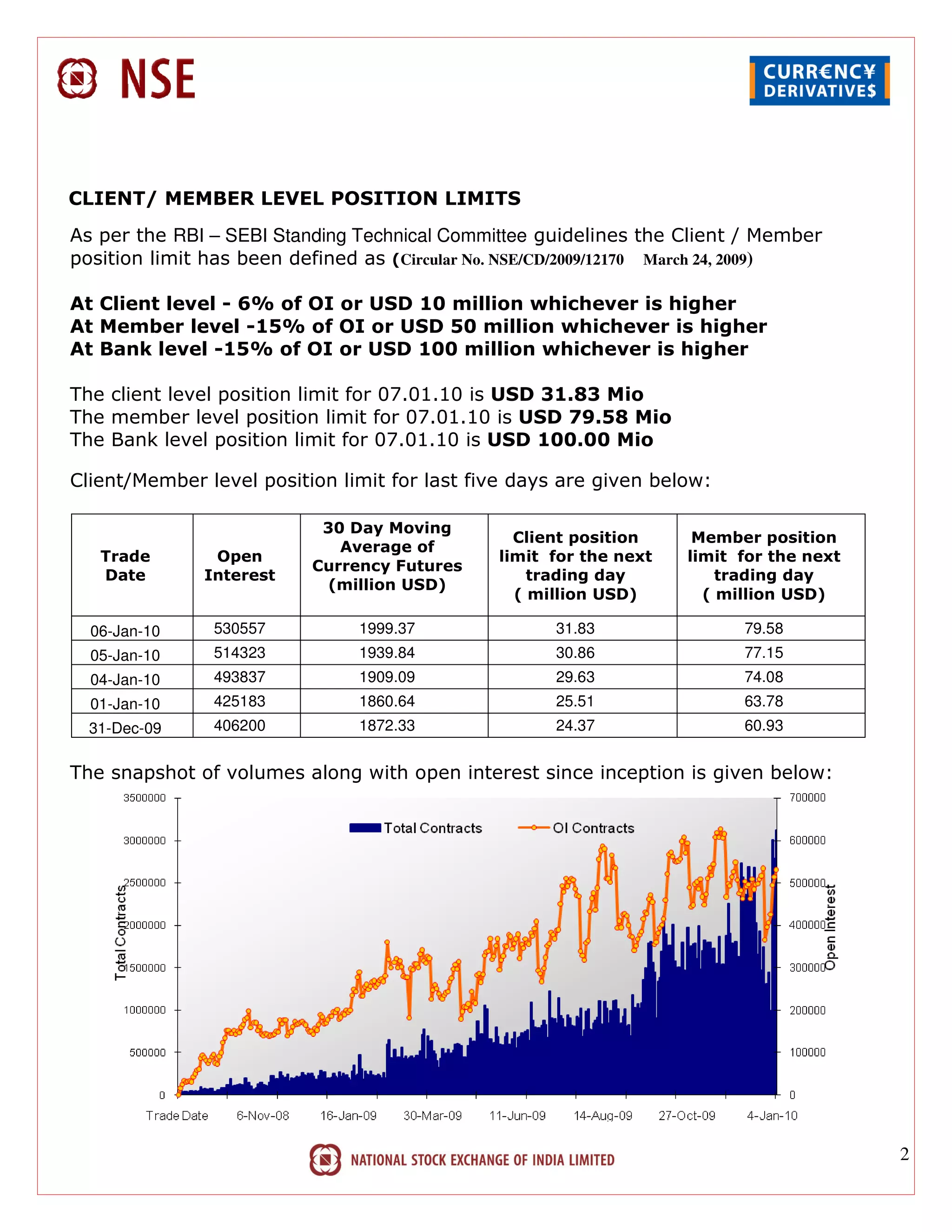

The document provides information on currency futures trading volumes and limits at the National Stock Exchange of India (NSE) for January 2010. Trading volumes for USD-INR futures contracts at the NSE have been increasing month over month. Position limits for clients, members, and banks are also outlined, with the client level position limit for January 7, 2010 given as USD 31.83 million. Tables show daily trading volumes and open interest over the last month as well as volatility metrics for the underlying USD-INR currency pair and stock index futures.