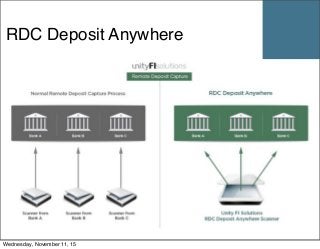

Unity FI Solutions developed RDC Deposit Anywhere. This solution allows for all checks to be scanned with one scanner, and then deposited to multiple banks using our Unity FI Solutions software. This not only saves space in your workspace, but also helps your business significantly reduce scanner and software costs. Visit: http://www.unityfisolutions.com/products/remote-deposit-capture/