CNBC Stocks Track Record

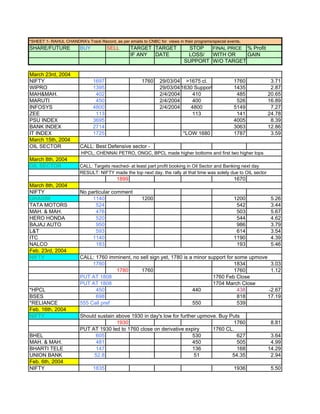

- 1. *SHEET 1- RAHUL CHANDRA's Track Record, as per emails to CNBC for views in their programs/special events. SHARE/FUTURE BUY SELL TARGET TARGET STOP FINAL PRICE % Profit IF ANY DATE LOSS/ WITH OR GAIN SUPPORT W/O TARGET March 23rd, 2004 NIFTY 1697 1760 29/03/04 >1675 cl. 1760 3.71 WIPRO 1395 29/03/04 1630 Support 1435 2.87 MAH&MAH. 402 2/4/2004 410 485 20.65 MARUTI 450 2/4/2004 400 526 16.89 INFOSYS 4800 2/4/2004 4800 5149 7.27 ZEE 113 113 141 24.78 PSU INDEX 3695 4005 8.39 BANK INDEX 2714 3063 12.86 IT INDEX 1725 *LOW 1680 1787 3.59 March 15th, 2004 OIL SECTOR CALL: Best Defensive sector - HPCL, CHENNAI PETRO, ONGC, BPCL made higher bottoms and first two higher tops March 8th, 2004 OIL SECTOR CALL: Targets reached- at least part profit booking in Oil Sector and Banking next day RESULT: NIFTY made the top next day, the rally at that time was solely due to OIL sector 1899 1670 March 8th, 2004 NIFTY No particular comment GRASIM 1140 1200 1200 5.26 TATA MOTORS 524 542 3.44 MAH. & MAH. 476 503 5.67 HERO HONDA 520 544 4.62 BAJAJ AUTO 950 986 3.79 L&T 593 614 3.54 ITC 1140 1190 4.39 NALCO 183 193 5.46 Feb. 23rd, 2004 NIFTY CALL: 1760 imminent, no sell sign yet, 1780 is a minor support for some upmove 1780 1834 3.03 1780 1760 1760 1.12 PUT AT 1808 1760 Feb Close PUT AT 1808 1704 March Close *HPCL 450 440 438 -2.67 BSES 698 818 17.19 *RELIANCE 555 Call pref 550 539 Feb. 16th, 2004 NIFTY Should sustain above 1930 in day's low for further upmove. Buy Puts 1930 1760 8.81 PUT AT 1930 led to 1760 close on derivative expiry 1760 CL. BHEL 605 530 627 3.64 MAH. & MAH. 481 450 505 4.99 BHARTI TELE 147 136 168 14.29 UNION BANK 52.8 51 54.35 2.94 Feb. 6th, 2004 NIFTY 1835 1936 5.50

- 2. 1740 1675 3.74 Jan. 23rd, 2004 NIFTY 1848 1730 1885 2.00 Jan. 22nd, 2004 EXACT PANIC BOTTOM CAUGHT NIFTY 1756 1755 1936 10.25 Jan. 16th, 2004 WARNING ABOUT SEVERITY OF FALL 1902 1800 5.36 HINDALCO 1300 1200 7.69 Jan. 6th, 2004 SENSEX Caution in case of bull failure around 6150 region, warning of fall for weeks in some Tech shares. No sell sign yet but, Caution in case of bull failure around 6150 region. TECH. SECTOR POLARIS 246 159 35.37 MASTEK 339 192 43.36 HCL TECH 303 234 22.77 SATYAM( 345-355) 355 391 10.14 INFOSYS 5600 6100 8.93 NIIT 250 239 -4.40 Dec. 31st, 2003 SENSEX If sensex sustains above 6200 then target is 7400, Trailing SL, Puts…otherwise RELIANCE 580 600 600 3.45 STATE BANK 540 690 27.78 ONGC 810 934 15.31 NALCO 196 206 5.10 TATA TEA 346 420 21.39 TATA STEEL 445 466 4.72 HDFC 646 687 6.35 Dec. 19th, 2003 NIFTY Wild movements possible as testing NIFTY highs of around 1800 region. TATA MOTORS 434 18/02/2004 570 31.34 BAJAJ AUTO 1061 30/12/2003 1210 14.04 TATA TEA 328 9/1/2004 5-10% 412 25.61 GRASIM 980 15/01/2004 5-10% 1203 22.76 RELIANCE 521 606 16.31 Dec. 5th, 2003 TARGET NIFTY 1800+ subject to > 1450 & > 1600-1630 NIFTY 1645 1800 1800 9.42 SATYAM 320 358 15/12/2004 317 358 11.88 ONGC 618 590 BSE 5/1/2004 995 61.00 Nov. 28th, 2003 Consolidation, upward bias in present movement TATA MOTORS 410 18/02/2004 570 39.02 TATA POWER 278 14/01/2004 427 53.60 NATIONAL ALUM. 157 5/1/2004 206 31.21 Nov. 17th, 2003 1590 1509 5.09 SATYAM 308 300-308 386 25.32 ACC 332 9/1/2004 298 -10.24 Oct. 31st, 2003 GRASIM BANKS No clear trend except BOB & ICICI Bank…finally…all others had correction BANK OF BARODA BUY, next day opening- 192 but went down till 162 before going to 269 on 15/01/2003 ICICI BANK BUY, next day opening was 250, but it went down to 220 before going to 352 Oct. 24th, 2003

- 3. NIFTY Clear uptrend only after sustenance above 1525-1535 There was a correction from 1531 to 1471…60 points as indicated…not considered here Thereafter rise to 1601 and then fall to 1509 after 1 month…then final rise to 2015 Oct. 6th, 2003 No clear view, waiting for confirmation Sept. 26, 2003 NIFTY 1386 1431 3.25 BAJAJ AUTO 805 1000 24.22 RELIANCE Will definitely test historic highs(440-450) with volatility, but looking good. INFOSYS Comment was- no clear signal but may go upto 4800 also. Finally went to 4800. Sept. 18, 2003 NIFTY Comment was- Repeat support at 1300 or 1260 or 1230 to resume upward journey. Actual bottom was 1285 HINDUSTAN PETR Supports 320/312/300 etc…. From 312 bottom on 31/10/2003, kept rising only. August 14th, 2003 NIFTY 1248 1330 6.57 July 31st, 2003 NIFTY Comment was either of 1188/1205/1218 may halt upmove for short to medium term. On 22/08/03 from 1319, correction till 1246, next day erroneous opening high of 1332 July 30th, 2003 NIFTY Nifty sustenance above 1205-1235 necessary for a big bull move ahead. Sensex Resistances & Targets… 3780-3840-3950-4370 April 8th, 2003 Nifty exact top caught...Comment was Short and book full profits. NIFTY 1032 1035 920 10.85 SATYAM 181 195 127 29.83 INFOSYS 4341 4400 2300 47.02 TATA TEA 195 195 198 -1.54 Jan. 02, 2003 NIFTY Nifty exact top caught…Expressed view to book full profits at 1100(actual top 1506), & fell to 920, -16.35%) Average Gain 13.36 * NOTES (in %) All the above calls are as per confirmatory emails to CNBC, India for views expressed in their programs/ special event emails Writing of confirmatory emails to CNBC after each program was started quite late, for the purpose of a track record. Generally there were no targets in BUY/SELL calls,so the targets are highs/lows reached before any imp. correction. Next day opening prices have been considered as buy or sell prices. Almost all prices are from NSE, if there was erroneous opening/high/low on some day then BSE prices considered Green letters in light blue background denote that a major bottom or top was caught. Blue denotes buying price…which is next day opening price if no specific price given Red denotes selling price….which is next day opening price if no specific level given COMMENTS are given for those moves where it cannot be called as a clear buy or sell call but is important call. Contents are correct to the best of my knowledge…if any error is found…please inform me. NSE(National Stock Exchange, India) prices/graphs can be checked at www.nseindia.com BSE(Bombay Stock Exchange, India) prices/graphs can be checked at www.bseindia.com, violet color prices