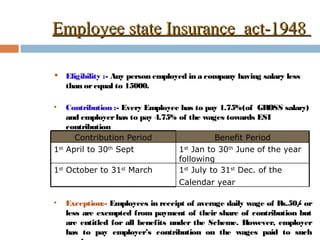

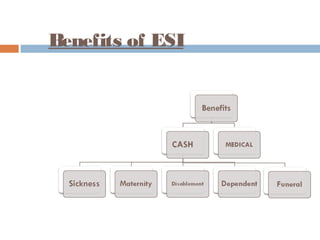

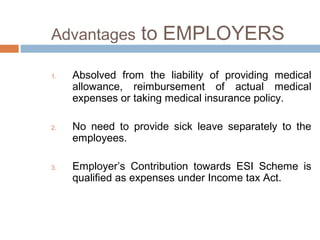

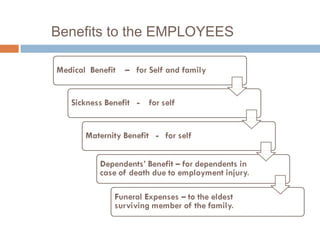

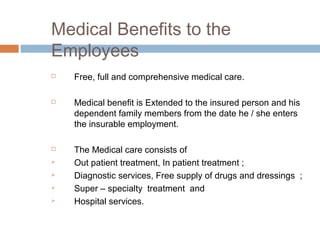

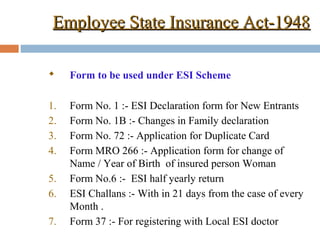

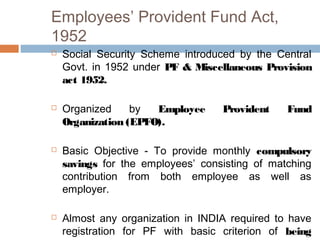

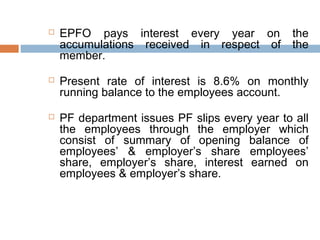

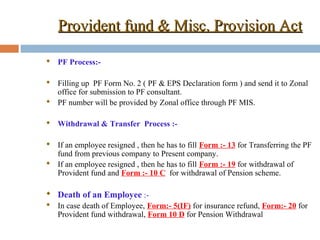

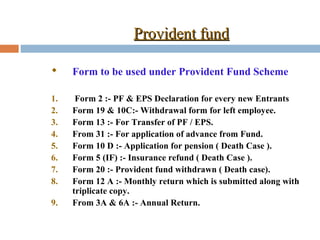

The document outlines the Employee State Insurance (ESI) Scheme and the Employees' Provident Fund (EPF) Act in India. The ESI provides health insurance and social security for employees with salaries up to ₹15,000, while the EPF scheme mandates compulsory savings with contributions from both employees and employers. It also details the processes and forms necessary for participation in both schemes and the benefits provided to employees and employers.