1.Assume that The Sandy Creek Nature Center, a private not-for.docx

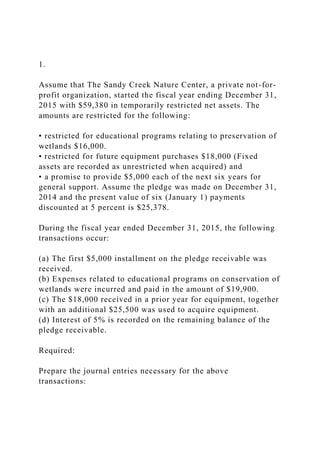

- 1. 1. Assume that The Sandy Creek Nature Center, a private not-for- profit organization, started the fiscal year ending December 31, 2015 with $59,380 in temporarily restricted net assets. The amounts are restricted for the following: • restricted for educational programs relating to preservation of wetlands $16,000. • restricted for future equipment purchases $18,000 (Fixed assets are recorded as unrestricted when acquired) and • a promise to provide $5,000 each of the next six years for general support. Assume the pledge was made on December 31, 2014 and the present value of six (January 1) payments discounted at 5 percent is $25,378. During the fiscal year ended December 31, 2015, the following transactions occur: (a) The first $5,000 installment on the pledge receivable was received. (b) Expenses related to educational programs on conservation of wetlands were incurred and paid in the amount of $19,900. (c) The $18,000 received in a prior year for equipment, together with an additional $25,500 was used to acquire equipment. (d) Interest of 5% is recorded on the remaining balance of the pledge receivable. Required: Prepare the journal entries necessary for the above transactions:

- 2. Continue next page 2. Record the following transactions on the books of Franklin College, a private college. All of the transactions are for the year 2015. (a) The College received $315,000 in funds that were pledged in 2014, to be used for unrestricted purposes in 2015. (b) The College was awarded $600,000 in grants that are to be used for restricted research purposes. $410,000 in cash was received, and $450,000 was expended on these projects. (c) On Dec. 1, the College received a pledge of $6,000,000 to build a new basketball arena. The funds were not expended or received in 2015, but are expected to be received early in 2015. (d) The College had received cash of $200,000 in 2014 to be used to purchase computer equipment for the student labs. The equipment was purchased and put into service in early January 2015. The equipment has a five-year life and the College follows the practice of maintaining the balance of fixed assets (net of depreciation) in the temporarily restricted net asset category. (e) On Dec. 31, the College received an unrestricted pledge to receive $20,000 per year each year for six years, beginning on December 31, 2015. The first installment of $20,000 was received on that date. The discount rate is 6%. The present value of six payments of $20,000 is $104,248.

- 3. Continue next page 3. St. Martha's Hospital, a private not-for-profit, began the year 2015 with the following trial balance: Transactions for 2015 are as follows: (a) Collected $340,000 of the Patient Accounts Receivable that was outstanding at 12-31-2014. Actual contractual adjustments on these receivables totaled $152,000. (b) The Hospital billed patients $2,350,000 for services rendered. Of this amount, 7% is expected to be uncollectible. Contractual adjustments with insurance companies are expected to total $831,000. (Hint: use an allowance account to reduce accounts receivable for estimated contractual adjustments). (c) In 2014 the Hospital had received a contribution of $240,000 to purchase new ultrasound equipment. The equipment was purchased for $300,000 in 2015. (d) Charity care in the amount of $60,000 (at standard charges) was performed for indigent patients. (e) The Hospital received $700,000 in securities to establish a permanent endowment. Income from the endowment is unrestricted. (f) Other revenues collected in cash were: gift shop $11,000 and cafeteria $33,000. (g) The Hospital received in cash unrestricted interest income on endowments of $5,000. Unrealized gains on endowment investments totaled $7,000. (h) Expenses amounting to $1,120,000 for Professional Care of

- 4. Patients, $310,000 for General Services, and $190,000 for Administration were paid in cash. (i) Depreciation on fixed assets, including the ultrasound equipment, totaled $124,000 for the year. ($90,000 for Professional Care of Patients, $18,000 for General Services, and $16,000 for Administration.) (j) Closing entries were prepared. Required: A. Record the transactions described above. B. Prepare in good form, a Statement of Operations for the year ended December 31, 2015. C. Prepare in good form, a Statement of Changes in Net Assets for the year ended December 31, 2015. 4 . Southeastern State University has chosen to report as a public university reporting as a special-purpose entity engaged only in business-type activities. Deferred Revenues were reported as of July 1, 2014 in the amount of $5,000,000. Record the following transactions related to revenue recognition for the year ended June 30, 2015. Include in the account titles the proper revenue classification (operating revenues, nonoperating revenues, etc.): 1. Deferred revenues related to unearned revenues for the summer session, which ended in August 2014. 2. During the fiscal year ended June 30, 2015, student tuition and fees were assessed in the amount of $78,000,000. Of that amount, $71,000,000 was collected in cash. Also, of that amount, $3,300,000 pertained to that portion of the 2015 summer session that took place after June 30, 2015.

- 5. 3. Student scholarships, for which no services were required, amounted to $2,200,000. Students applied these scholarships to their tuition bills at the beginning of the fall and spring semesters. 4. Student scholarships and fellowships, for which services were required, such as graduate assistantships, amounted to $3,500,000. These students also applied their scholarship and fellowship awards to their tuition bills at the beginning of each semester. 5. Auxiliary enterprise revenues amounted to $8,500,000. 6. The state appropriation for operations amounted to $35,000,000. 7. The state appropriation for capital outlay amounted to $12,900,000. 8. Gifts for endowment purposes amounted to $5,000,000. Gifts for unrestricted purposes amounted to $7,000,000. Interest income, all unrestricted, amounted to $720,000. 5. Northwest State University had the following account balances as of June 30, 2015. Debits are not distinguished from credits, so assume all accounts have a "normal" balance (i.e. cash is a debit and accounts payable a credit). Required: Prepare, in good form, a Statement of Net Position for Northwest State University as of June 30, 2015. Go to next page

- 6. 6. The City of St. Michael received a gift of $800,000 from a local resident on April 1, 2015 and signed an agreement that the funds would be invested permanently and that the income would be used to maintain the city cemetery. The following transactions took place during the year ended December 31, 2015. (a) The gift was recorded on April 1. (b) On April 1, 2015, XYZ Company bonds were purchased in the amount of $750,000, at par. The bonds carry an annual interest rate of 5 percent, payable semiannually on October 1 and April 1. (c) On October 1, the semiannual interest was received. (d) From October 1 through December 1, payments were made totaling $17,200 to a lawn service. (e) On December 31, an accrual was made for interest. (f) Also, on December 31, a reading of the financial press indicated that XYZ bonds had a fair value of $745,500, exclusive of accrued interest. (g) The books were closed. Required: A. Record the transactions on the books of the Cemetery Perpetual Care Fund. B. Prepare a separate Statement of Revenues, Expenditures, and Changes in Fund Balances for the Cemetery Perpetual Care Fund for the Year Ended December 31, 2015. C. Prepare the Balance Sheet for the Cemetery Perpetual Care Fund for the year ended December 31, 2015.

- 7. Go to next page 7. Worth 30 points As of July 1, 2014, the City of Saratoga Springs decided to purchase a privately operated swimming pool and to create a Swimming Pool (Enterprise) Fund. During the year, the following transactions occurred: (a) A permanent contribution of $800,000 was received from the General Fund. (b) $1,000,000 was borrowed with a Note Payable from a local bank at an interest rate of 6%. (c) Purchased for cash several items, the cost breakdown was: land, $300,000; building, $400,000, land improvement, $400,000; equipment, $200,000; supplies, $190,000. (d) Charges for services amounted to $600,000, all received in cash. (e) Cash expenses included: salaries, $200,000; utilities, $100,000; interest (paid on 6/30/2015), $60,000. (f) Supplies were consumed in the amount of $120,000. (g) Depreciation was recorded for: building, $20,000, land improvement, $40,000; equipment, $20,000. (h) The books were closed. Close all accounts to Net Position. Required: 1. Record the above transactions in general journal form (on the books of the swimming pool fund).

- 8. 1. Assume that The Sandy Creek Nature Center, a private not - for - profit organization, s tarted the fiscal year ending December 31, 2015 with $59,380 in temporarily restricted net assets. The amounts are restricted for the following: • restricted for educational programs relating to preservation of wetlands $16,000. • restricted for future eq uipment purchases $18,000 (Fixed assets are recorded as unrestricted when acquired) and • a promise to provide $5,000 each of the next six years for general support. Assume the pledge was made on December 31, 2014 and the present value of six (January 1) p ayments discounted at 5 percent is $25,378. During the fiscal year ended December 31, 2015, the following transactions occur:

- 9. (a) The first $5,000 installment on the pledge receivable was received. (b) Expenses related to educational programs on conserva tion of wetlands were incurred and paid in the amount of $19,900. (c) The $18,000 received in a prior year for equipment, together with an additional $25,500 was used to acquire equipment. (d) Interest of 5% is recorded on the remaining balance of the pled ge receivable. Required: Prepare the journal entries necessary for the above transactions: Continue next page 1. Assume that The Sandy Creek Nature Center, a private not-for-

- 10. profit organization, started the fiscal year ending December 31, 2015 with $59,380 in temporarily restricted net assets. The amounts are restricted for the following: • restricted for educational programs relating to preservation of wetlands $16,000. • restricted for future equipment purchases $18,000 (Fixed assets are recorded as unrestricted when acquired) and • a promise to provide $5,000 each of the next six years for general support. Assume the pledge was made on December 31, 2014 and the present value of six (January 1) payments discounted at 5 percent is $25,378. During the fiscal year ended December 31, 2015, the following transactions occur: (a) The first $5,000 installment on the pledge receivable was received. (b) Expenses related to educational programs on conservation of wetlands were incurred and paid in the amount of $19,900. (c) The $18,000 received in a prior year for equipment, together with an additional $25,500 was used to acquire equipment. (d) Interest of 5% is recorded on the remaining balance of the pledge receivable. Required: Prepare the journal entries necessary for the above transactions: