Lombok Land Investment, Property investment, Land in Lombok for investment

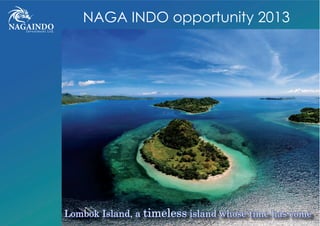

- 1. NAGAINDOInvestment Ltd. NAGA INDO opportunity 2013 Lombok Island, a timeless island whose time has come

- 2. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Lombok and its South Triangle

- 3. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Introduction Emerging Asia is growing strongly Lombok Island is booming Key Questions ASEAN* is a real growth engine (6% growth pa. since 2003, twice the world average). up to 10% in Malaysia. Ex: Foreign tourist arrivals in ASEAN has doubled over the last 10 years to reach 80 million a year. As the Indonesian government try to replicate Malaysia and Bali’s success, it is commited to make lombok a new tourism hotspot. Since Oct. 2011, Lombok has its own international airport, connecting it to Asia and the world. Where is Lombok island? Which business sectors are involved? Why is it such a great entry point? What are Naga Indo’s dealing capabilities? *The Association of Southeast Asian Nations South Lombok, Indonesia Ideal timing Naga Indo’s execution capabilities Fund structure Implementation

- 4. NAGAINDOInvestment Ltd. The proposal South Lombok has well and truly arrived on the investors’ radar.

- 5. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Investment target: South Lombok Strong Emerging Asia Stable Indonesia Lombok, its own story ASEAN growth has strongly and stayed very consistent at around 6% a year. expected to reach $5 000 by reserves stand at over 700 Thailand 180, Malaysia 135, th largest economy and th most populated country in the world. since the 1998 resignation Moody’s and Fitch debt upgrade in December 2011 to investment grade as Consumption is strong and As stunning as its neighbour 2 with 3 million inhabitants. It is dominated by The island has a very unique charm mixing its distinctive local culture with its Muslim heritage. But more than that, and dramatic rocky headlands.

- 6. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Bali / Lombok non beach front land prices (Source: Elite Havens / Tate Development) Real Estate: the investment drive Mean reverting trend between Bali and Lombok. Hotel developers are actively prospecting in South Lombok: Marina Cove, Accor group, Holiday Inn. The business/acquisition process in emerging markets requires KNOW-HOW, and Naga Indo has it.

- 7. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Tourism: the consumption drive Sumbawa 2012”, Indonesia is trying to emulate Malaysia’s success in Asia with a 2 million tourists Foreign tourism in Indonesia has strongly increased, with Asia hover above 75%. Lombok international arrivals expected to lean towards Foreign tourists arrival to ASEAN countries Foreign tourists arrival to Bali 2011

- 8. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Nusa Dua, Bali,1983 Mandalika, Lombok, 2015 took measures to increase visits, including issuing visas on arrival and creating better airline Marketing positioning between cultural Ubud and luxury Nusa Dua. with 3 developers (including Accor group and Marina Cove).

- 9. NAGAINDOInvestment Ltd. Investment rationale Ideal timing and Naga Indo’s outstanding execution capabilities.

- 10. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Phase 1: The Awakening Government-led BTDC took over the capacity Airbus 330, Boeing 767 airliners TODAY Phase 2: The Take Off new hotel construction, several new Government commitment to develop described in the Mandalika master plan, road works and new electricity poles..) 5 year HORIZON Phase 3: Growth Accelerating Malaysia Oct. 2012 while Australia is in the pipeline An expat community is taking

- 11. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Land prices 10-20 times cheaper than Bali Amazing coastline Distinctive local culture

- 12. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Why invest in Naga Indo? CEO has explored and years. he realised how precious his local network island were and how international access to Lombok would be. Invest early in the emerging Asia. Select the right people, create the optimal structure. Maintain the highest ethical standards. Our Management team experience investing in Indonesia, it is skilled in Our shareholding structure includes 21 individual investors, mostly executives at global tier 1 investment banks. Naga Indo legal matters will be handled by International Legal Services (ILS) in Indonesia, while US-based Blank coverage internationally. Our Origins Our Philosophy Our Team

- 13. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix An experienced Management team CEO and Founder Jean-Marc Reynier Fluent in 5 languages including Mandarin, he investment banks in Morgan among others. Over the last 8 years, he has invested in countries like Indonesia and Taiwan and spotted great opportunities across Asia. He has now established boutique to leverage the region. Legal Adviser Abdul Rachman He has been involved in law years. But he decided to start his IT Communications and Hospitality Industry experience. In 2010 he set up ILS, legal advice on Lombok property. Local coordinator Belinda Clarke She was in the travel and hospitality industry Then, she went on to develop and run a care company. Her next adventure became Lombok island in 2007 as a real estate agent. She is completely matters related to real estate on the island. She is also actively involved in local Adviser Neil Tate He has been travelling 30 years. In Australia, he owned and operated a He has now been 6 years and runs his own business on the South Coast.

- 14. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix The natural beauty, crystal-clear water, luxuriant valleys makes Lombok so unique. a moral obligation but also good practice. As a private natural unspoiled beauty and the communities are Lombok’s key assets. responsible environmental policy we are not only doing shareholders. In addition, our members privately take part What our values mean is that Naga Indo ensures that we minimise the impact of our activities on the surrounding habitat, and that we only associate ourselves with suppliers and workers that respect our commitment. Where possible, we will always endeavor to utilise the natural resources like solar power, rain water collection, and reuse of waste water.

- 15. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Naga Indo’s strong execution capabilities Close involvement in current projects Deep familiarity with locations and practices Well established network of key players on the ground and abroad Land development in Bumbang Sunset, Orisun villa management in the region Monthly business trip / road show with clients to Lombok International lawyers & high ranking bankers Ability to source the best land, execute transaction investment grade due diligence

- 16. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Transparent decision process --> Director validates / approves assets Approving Shareholder validates

- 17. NAGAINDOInvestment Ltd. Investment strategy Naga Indo offers you a transparent and reliable structure coupled with a well-practiced strategy.

- 18. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix the South Lombok Triangle, speculative construction risk, target 8700 (+10%). 1 - Asset management policy Land banking prime assets Special situation: distressed seller or government sales development plots and utilities sell our assets, we do have access to: minimizing purchase tax, transaction cost and completion time 2 - Implementation 3 - Exit Strategy

- 19. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Fund structure Tenor 5 years First Closing 1st Average contribution above US$ 100 000, 1 year investment period Hong Kong Second Closing March 2013

- 20. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Investment timeline T0: 1st nd Closing at premium T61: Share redemption

- 21. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Vesting period: st acquisition date. Subscription period: commit capital to acquire shares during the investment period. Closing: during the Subscription period, there will be 2 closing dates where shareholders can Subscription price: shareholders will receive shares at $1 000 per unit during the 1st Closing and at a small premium during the 2nd Closing. Investment period: Exit period: th year st Asset (called T+1 on the graph). 1st and 2nd Asset: Naga Indo will invest into several land assets. The 1st nd Asset value appreciation: we expect asset prices to appreciate by 30% per annum over the Investment timeline

- 22. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Fee model Lock up and exit events Quarterly valuation process Lock up period 5 years, then shares will be redeemed. existing shareholders.

- 23. NAGAINDOInvestment Ltd. Lombok has met its glorious destiny to become Thanks to a smart infrastructure upgrade, market and execution risk

- 24. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix The start of construction of new luxury hotels within the Mandalika (2015) Opening of new international air connections to Australia and Hong Kong US Quantitative Easing to continue and Lombok attracts greater and developers Overcrowding and and unspoiled destinations Strong domestic Indonesian demand driving demand for new holiday and second home destinations

- 25. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix COME INVEST WITH US!

- 26. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Contact Naga Indo team and read great articles about the

- 27. NAGAINDOInvestment Ltd. Introduction The proposal Investment rationale Investment strategy Conclusion Appendix Indonesian Land Title Restrictions: Indonesia, and accordingly Naga Indo Investment Ltd. will employ alternative ownership structures, as advised by Indonesian Land Title Uncertainty: Indo Investment Ltd. acquires an asset to which it subsequently discovers it has questionable title. Market Risk: Key Personnel: Natural Disaster / Tsunami Risk: Exit: Disclaimer

- 28. No. 9-23 Shell Street, www.naga-indo.com contact@naga-indo.com