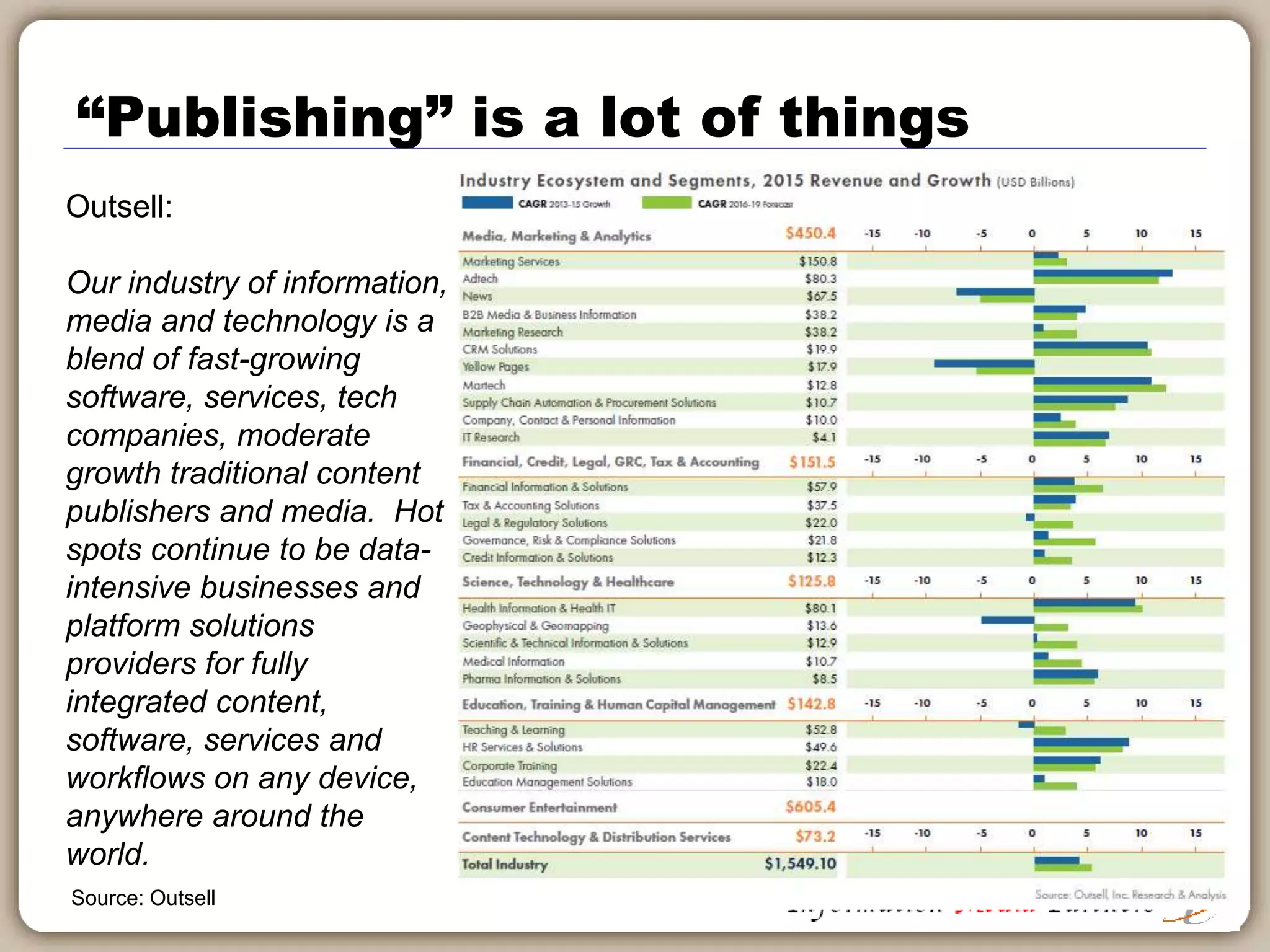

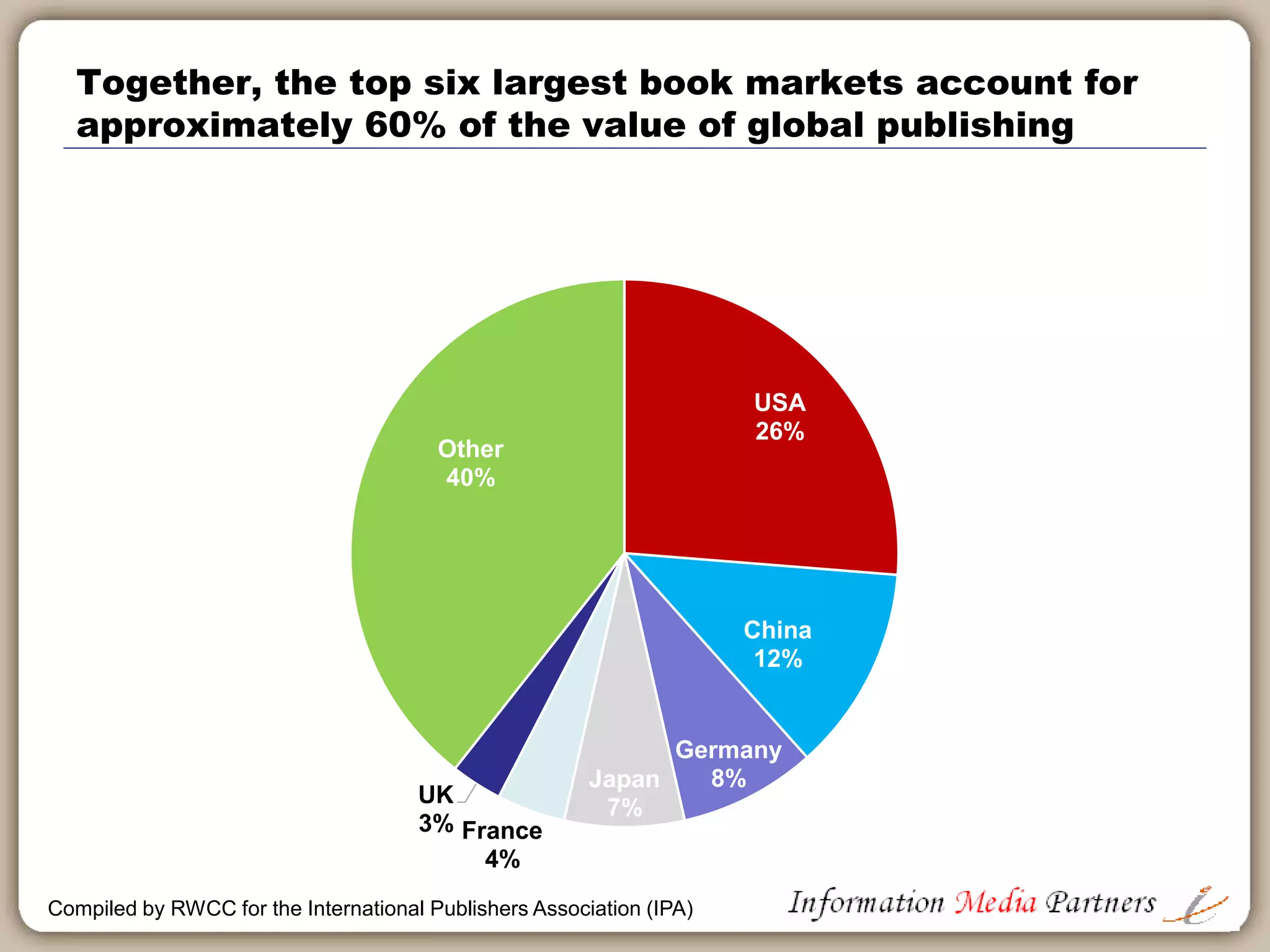

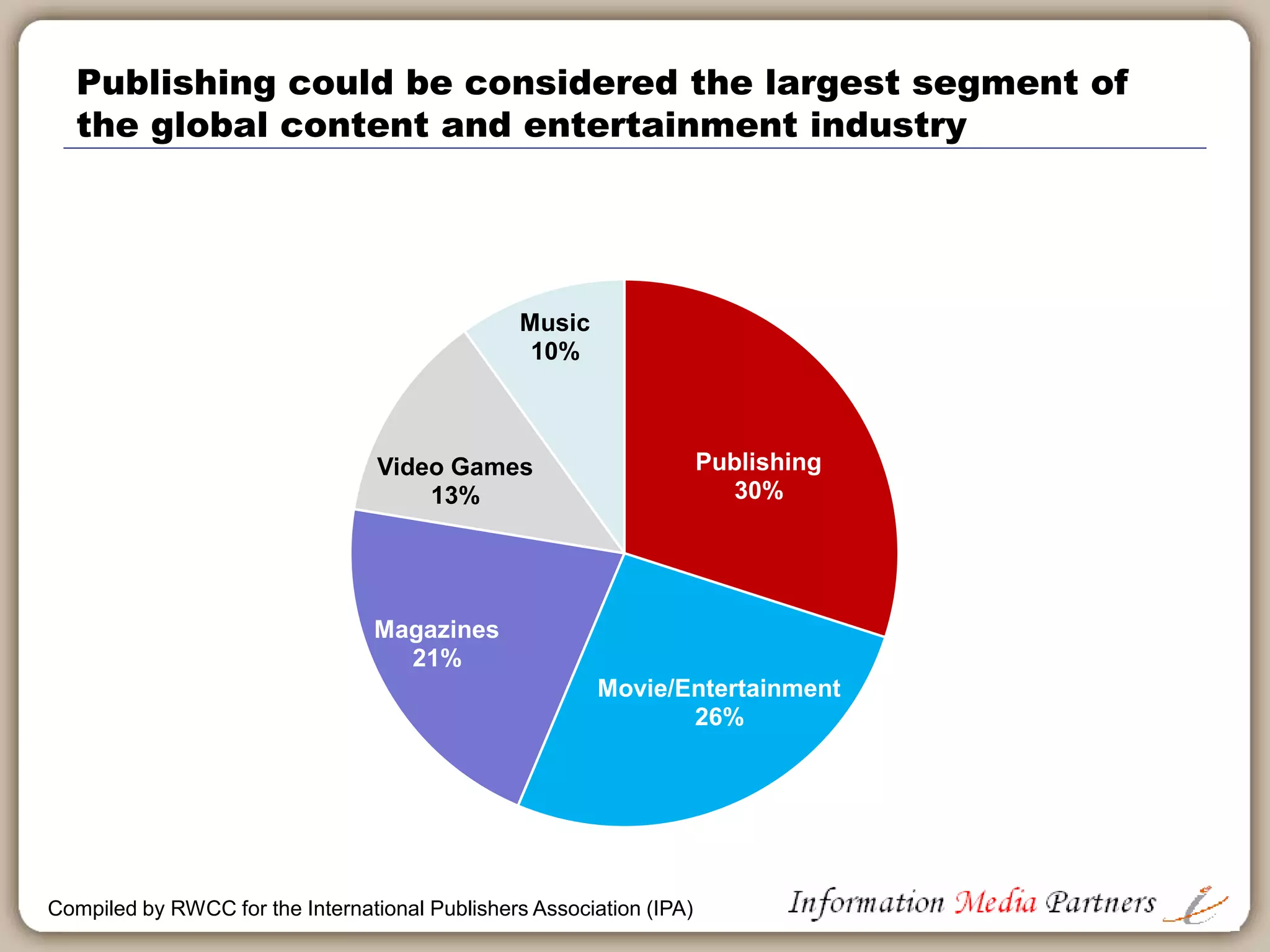

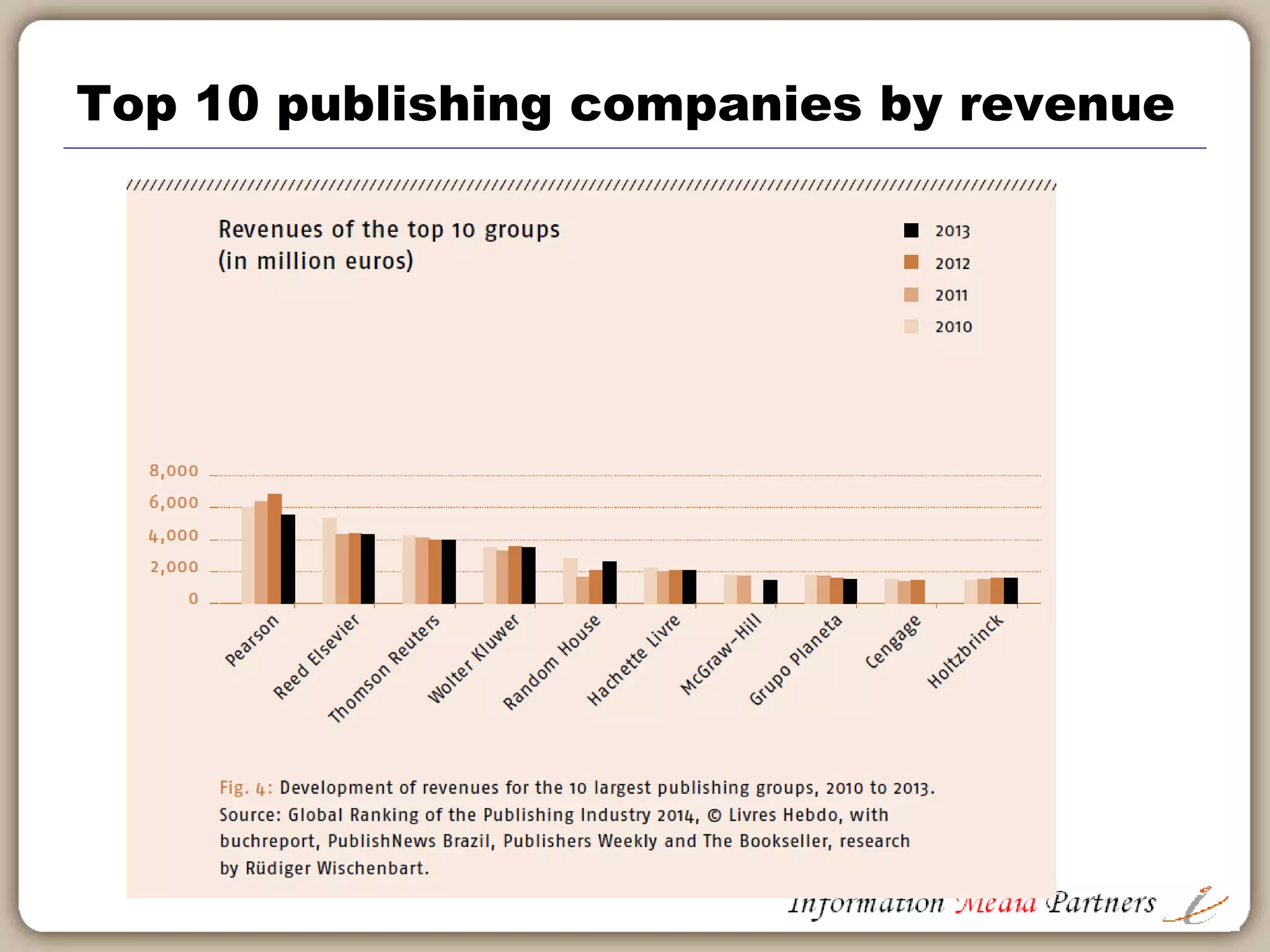

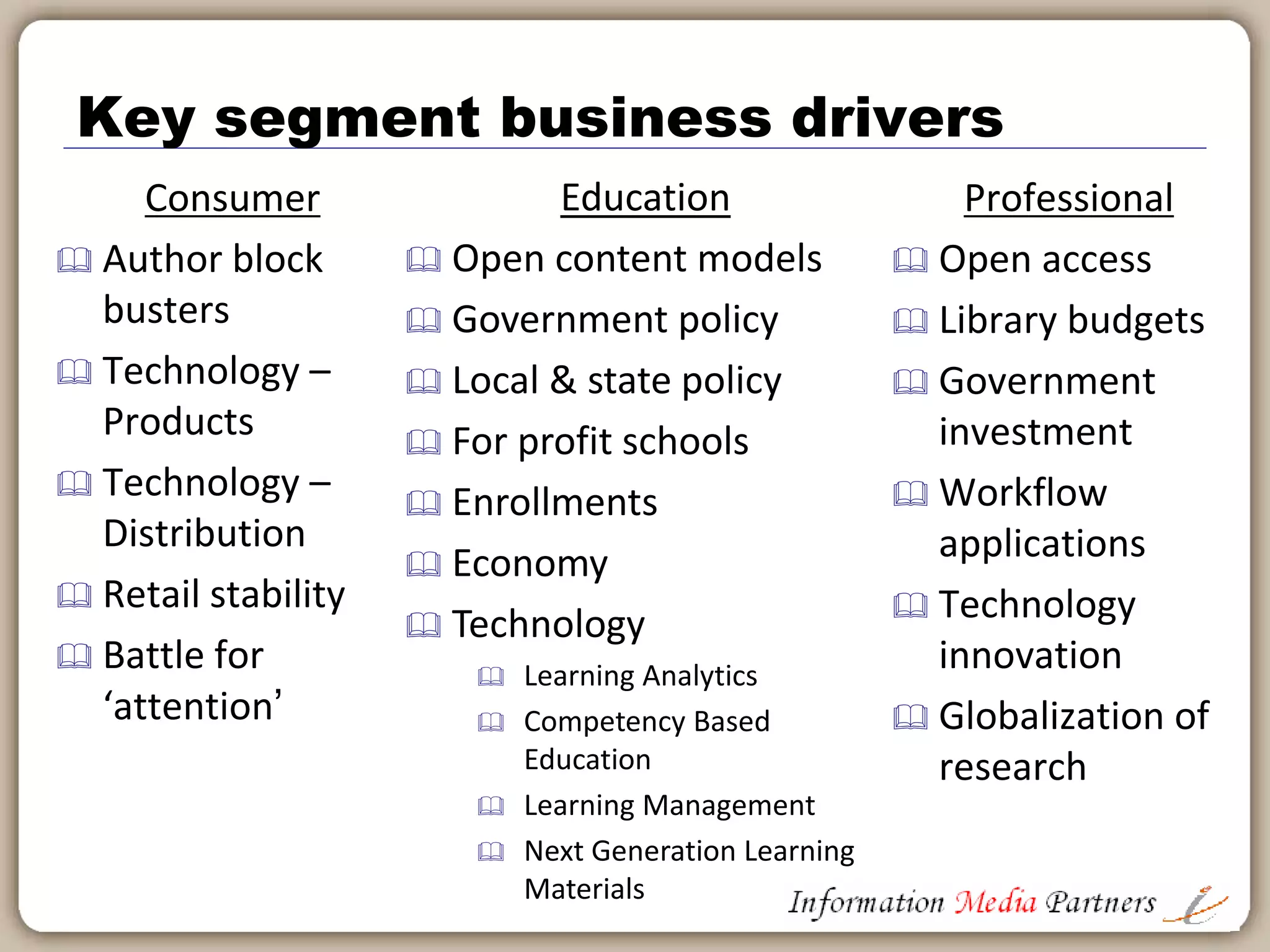

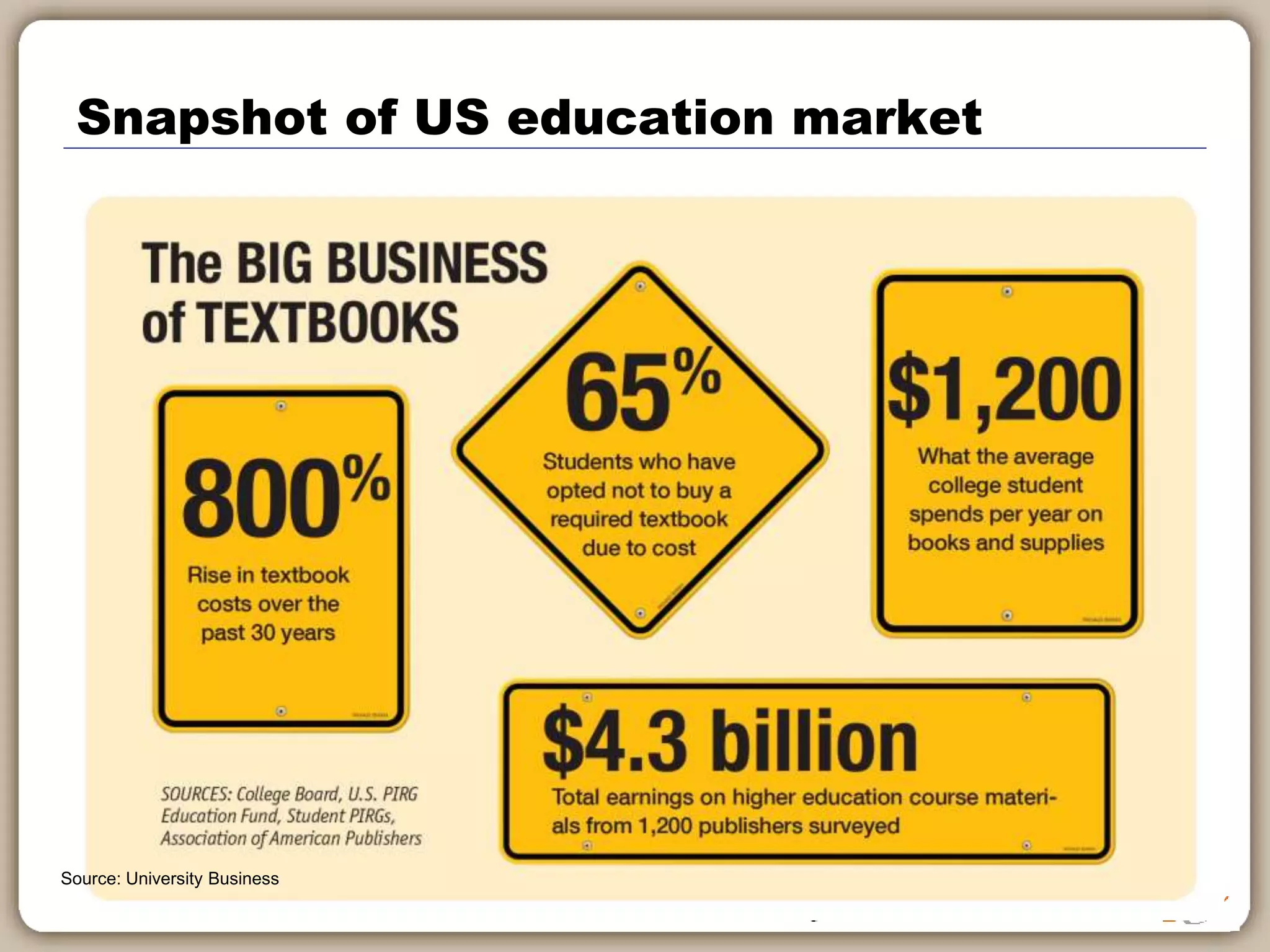

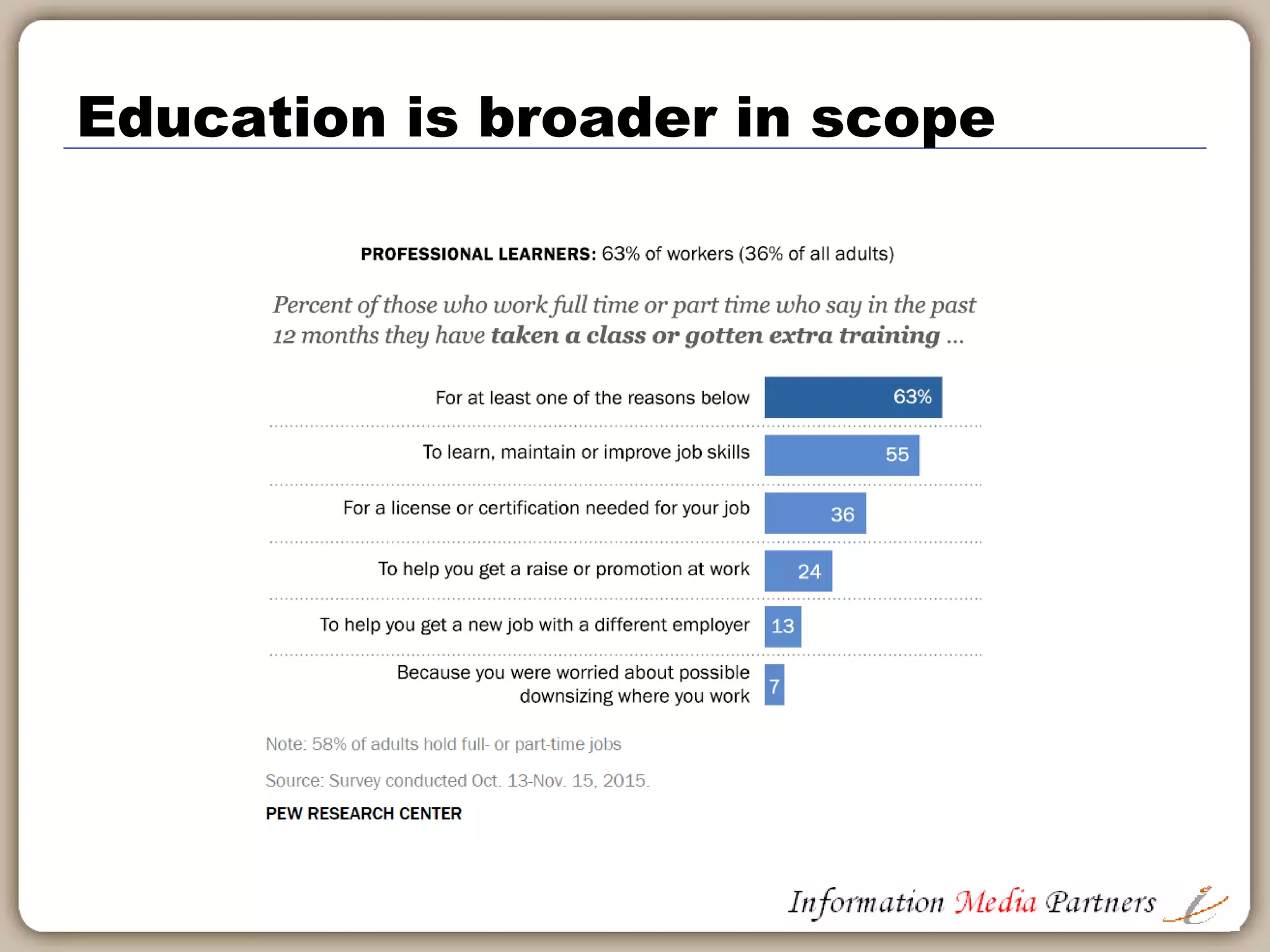

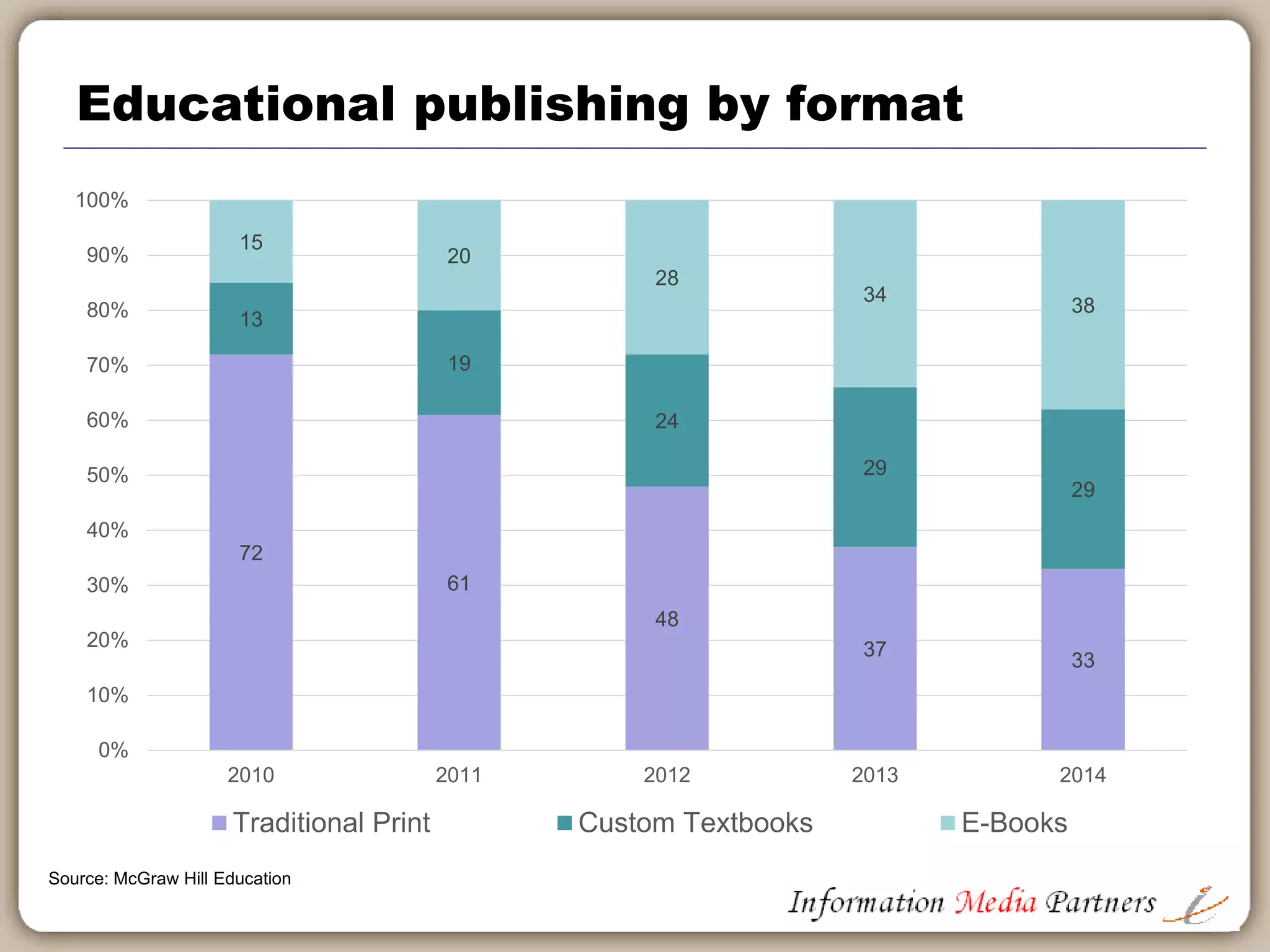

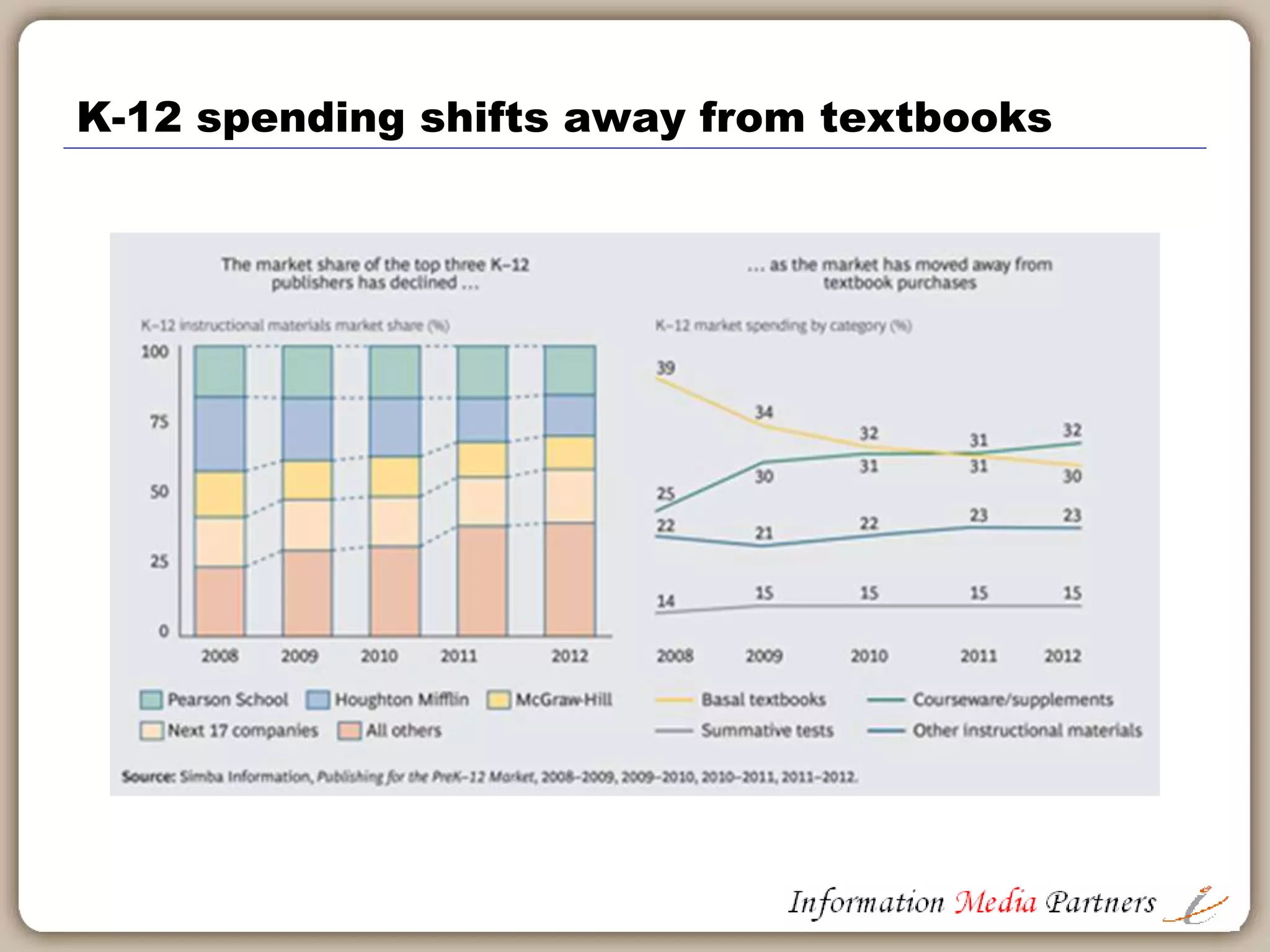

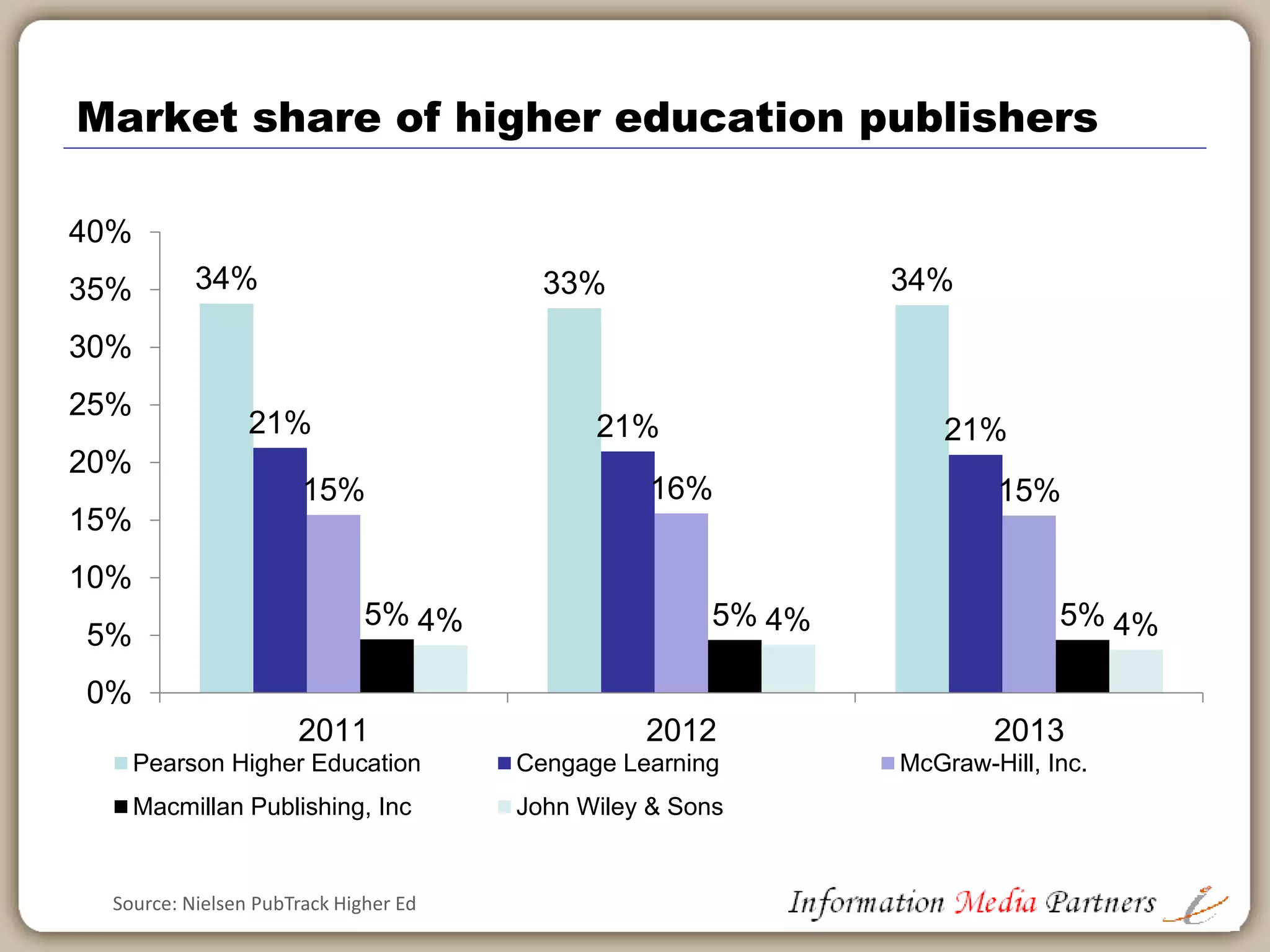

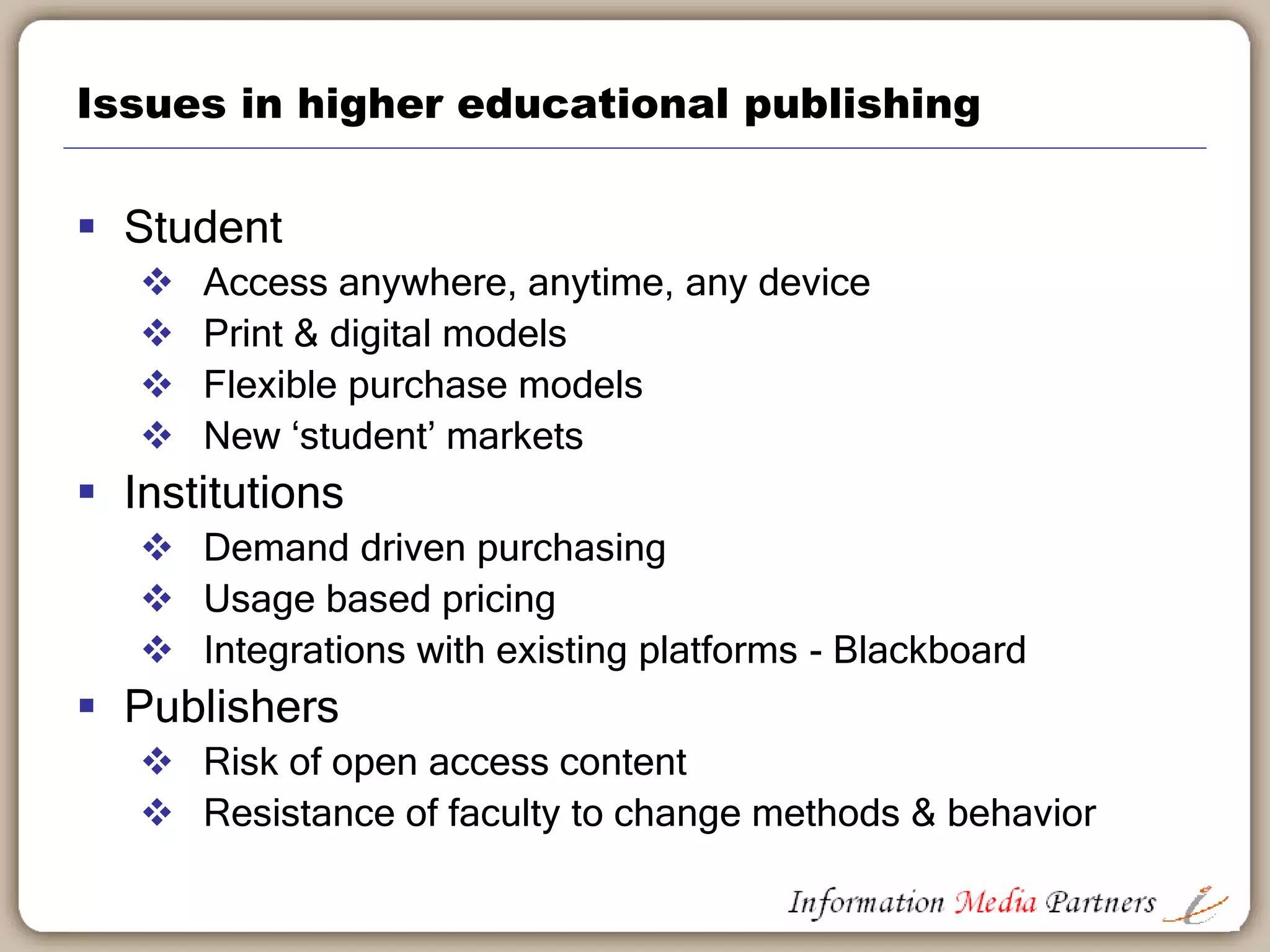

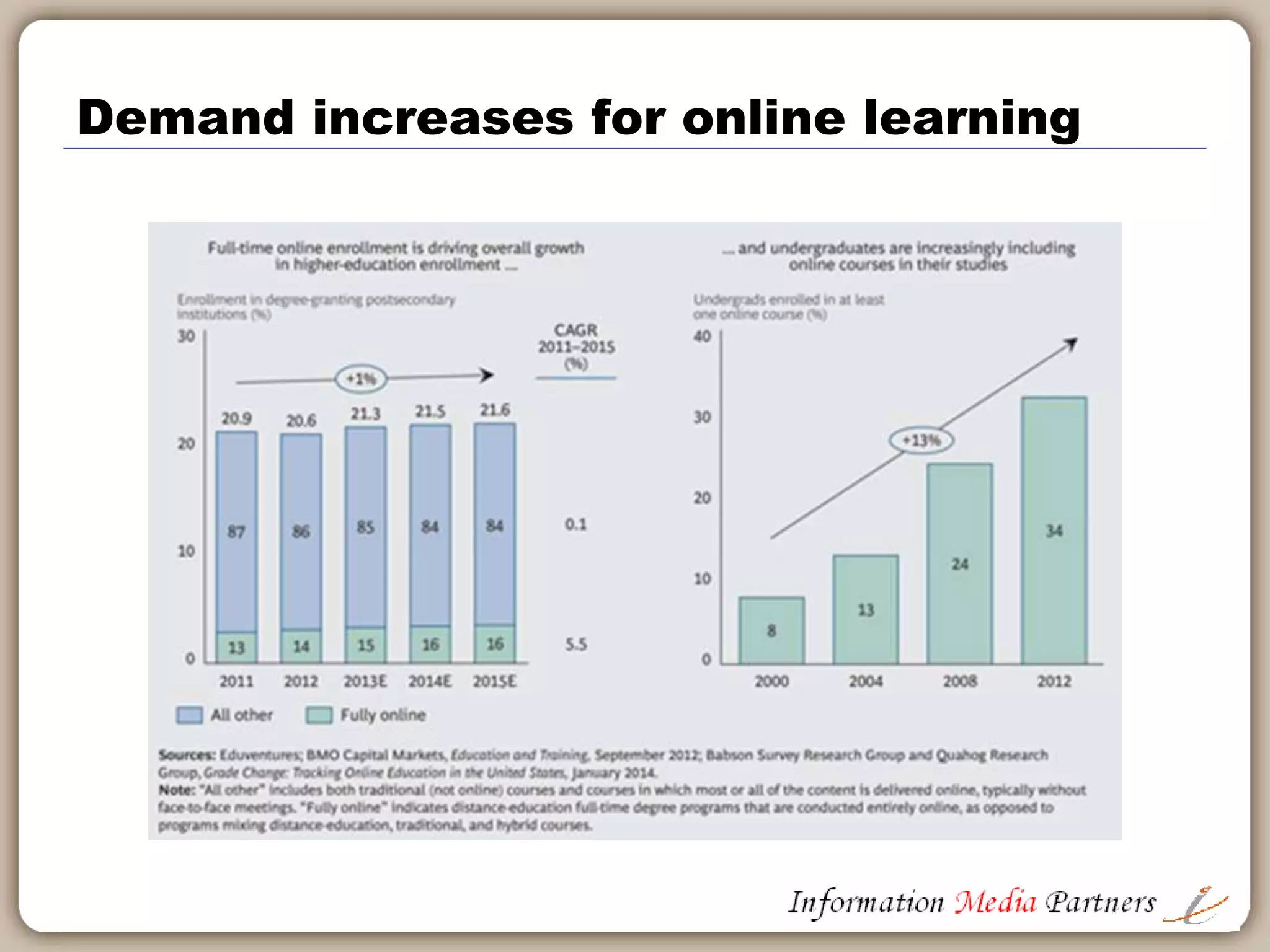

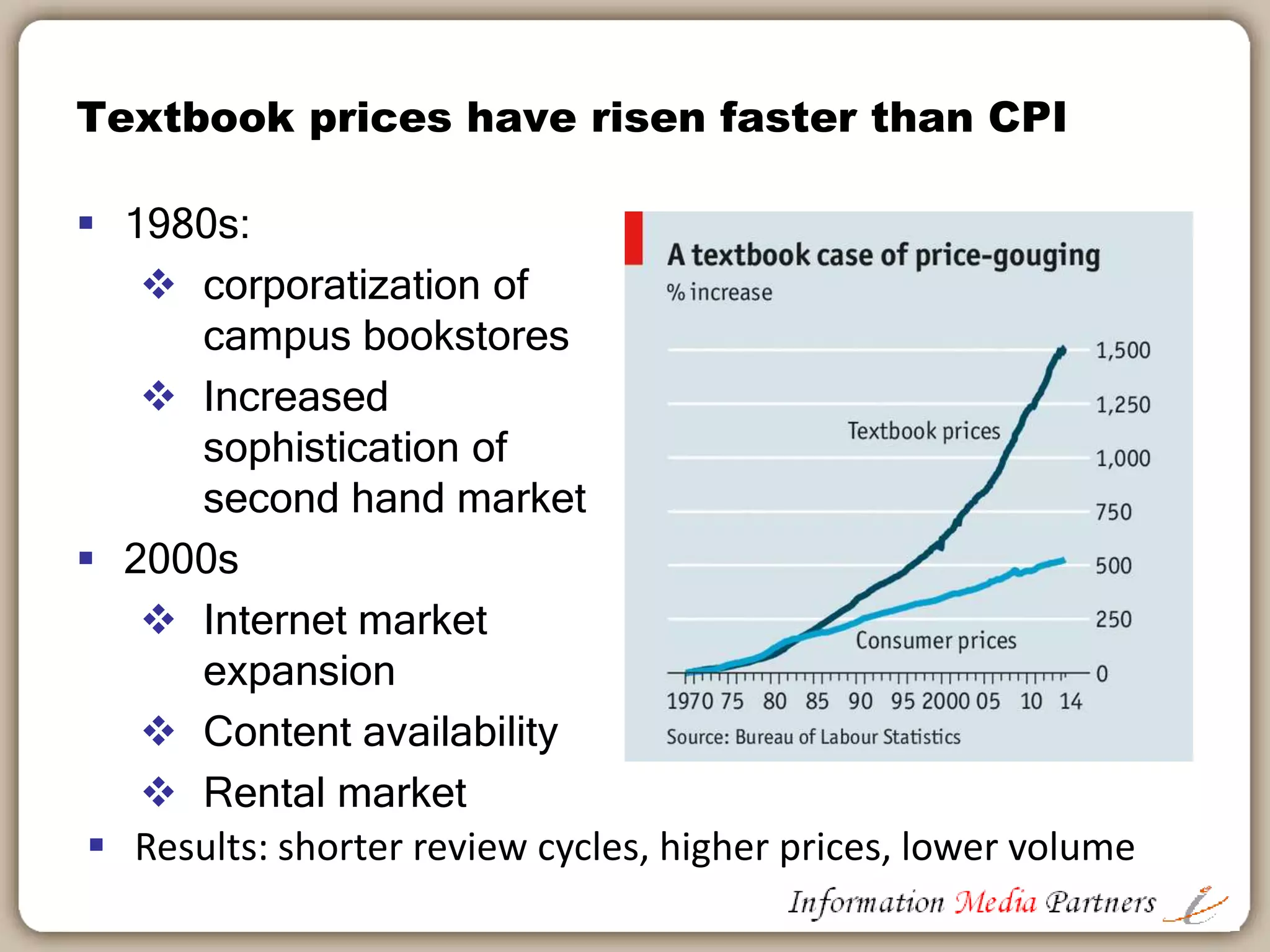

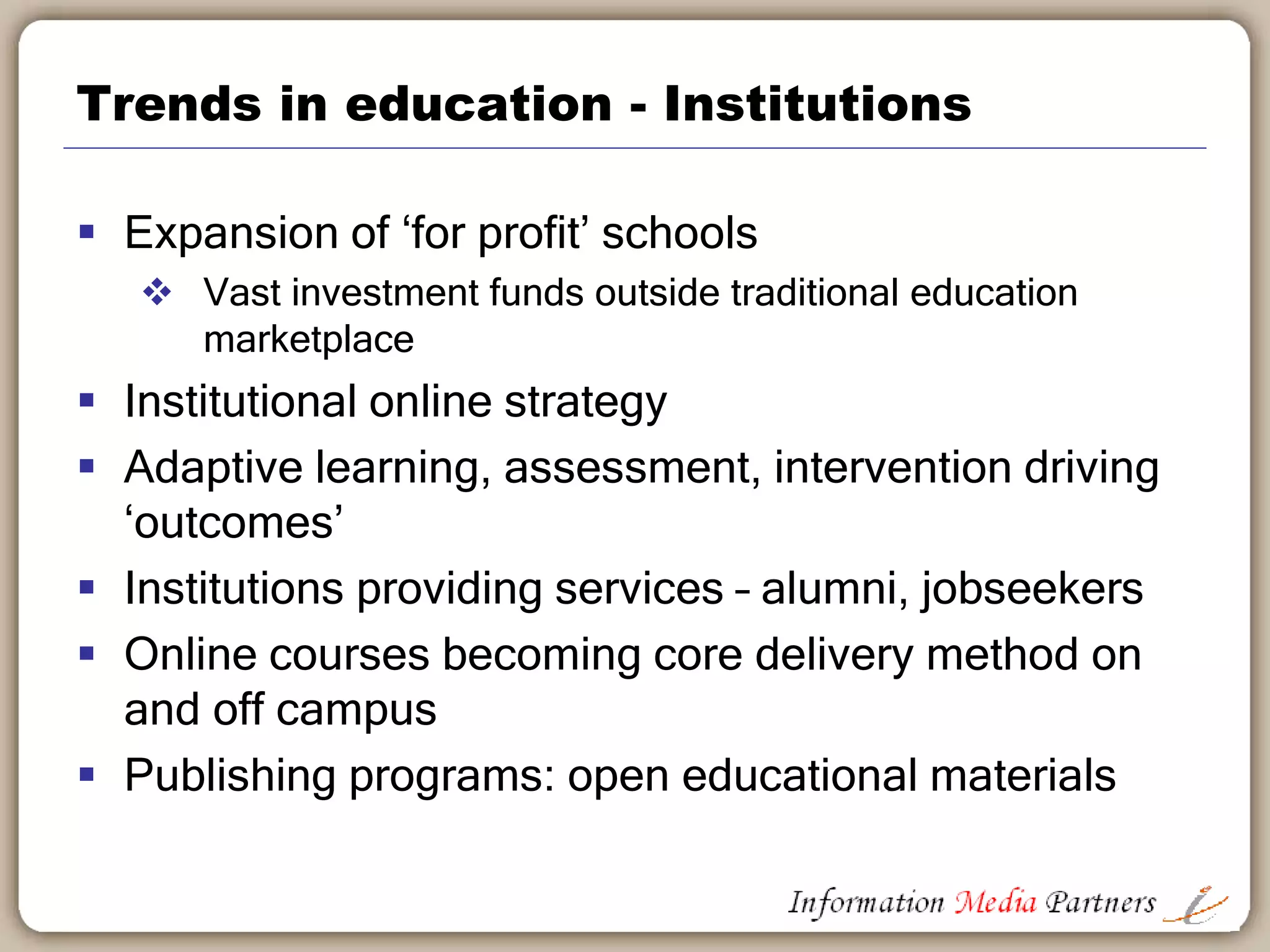

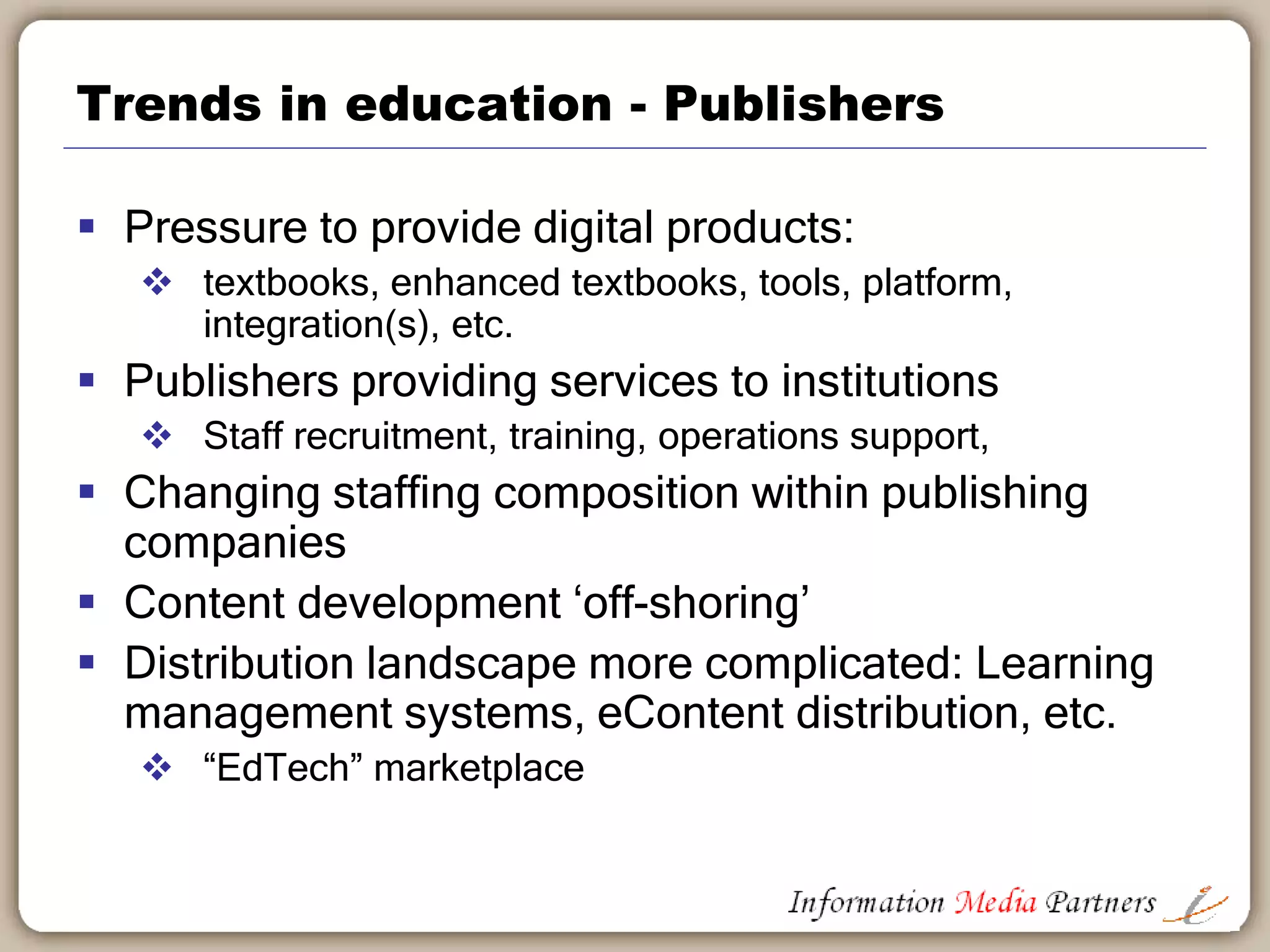

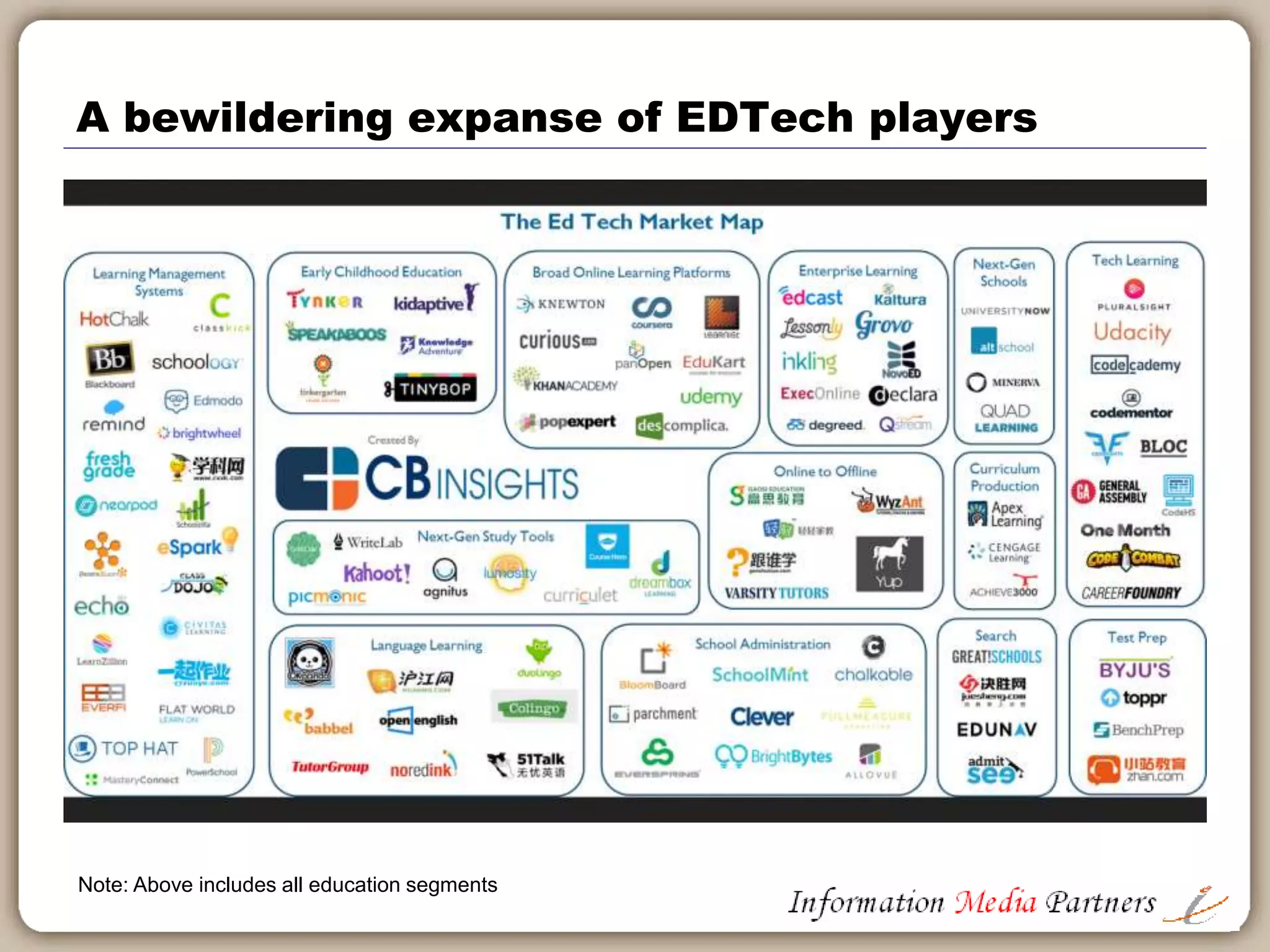

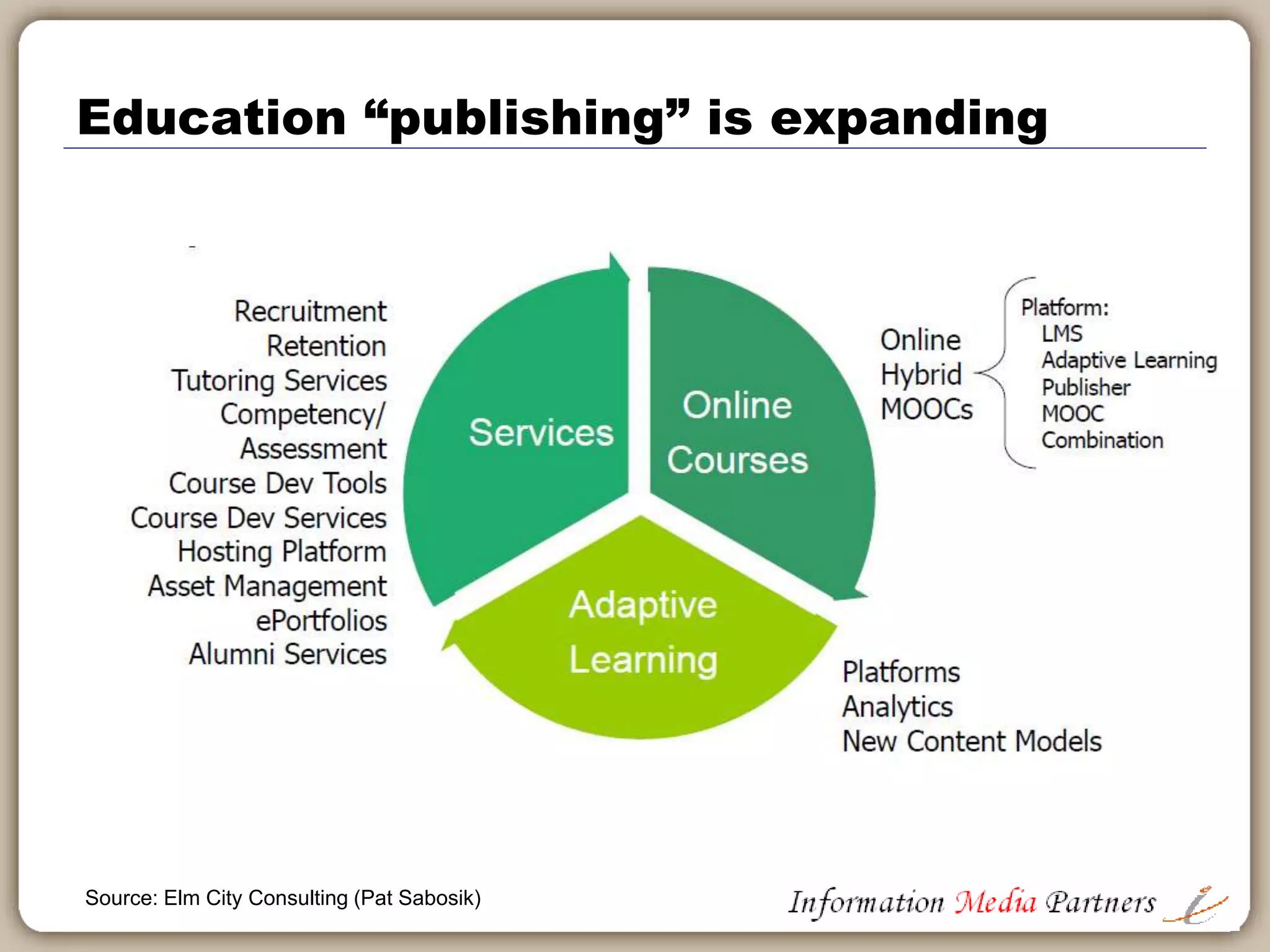

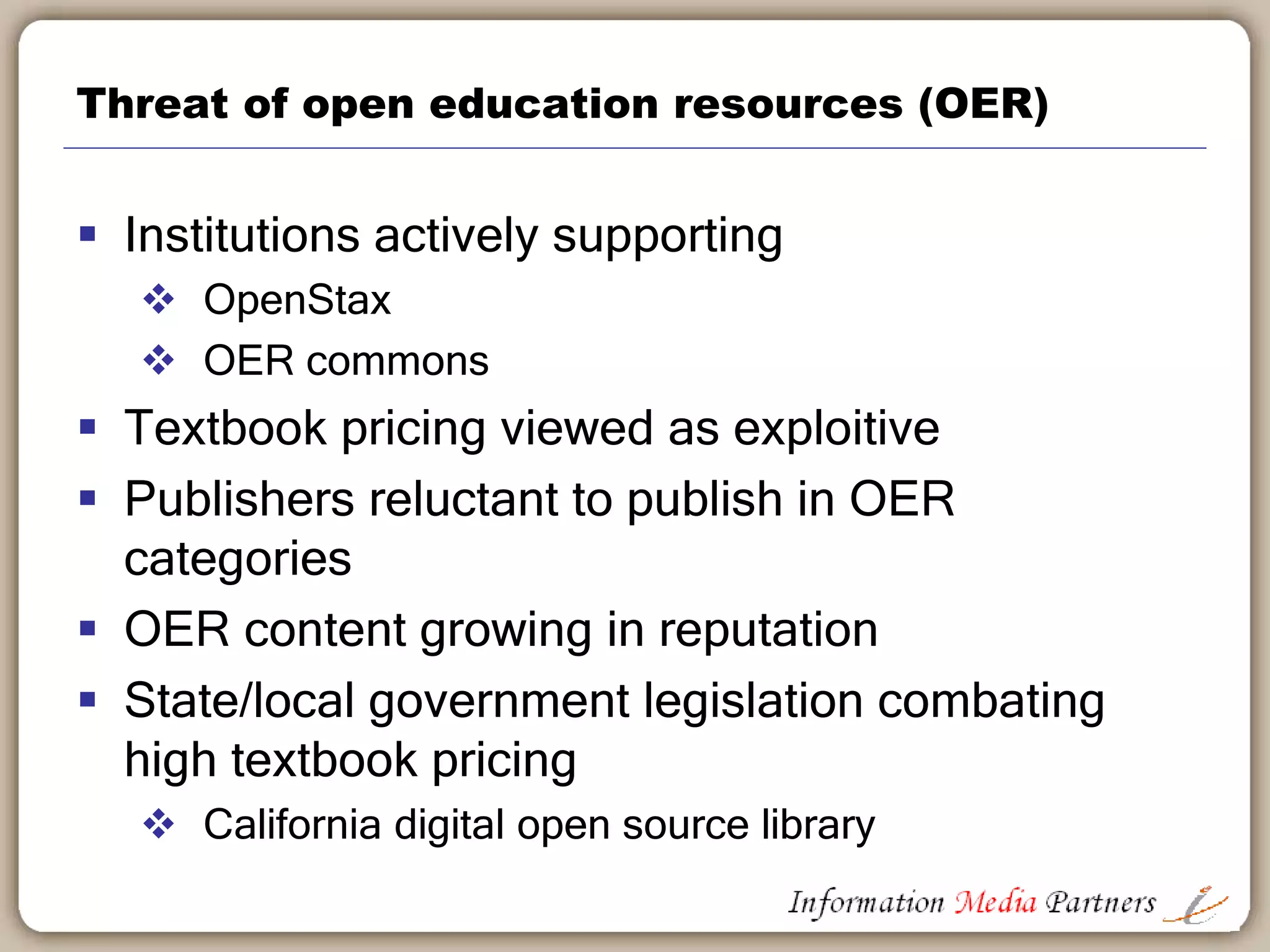

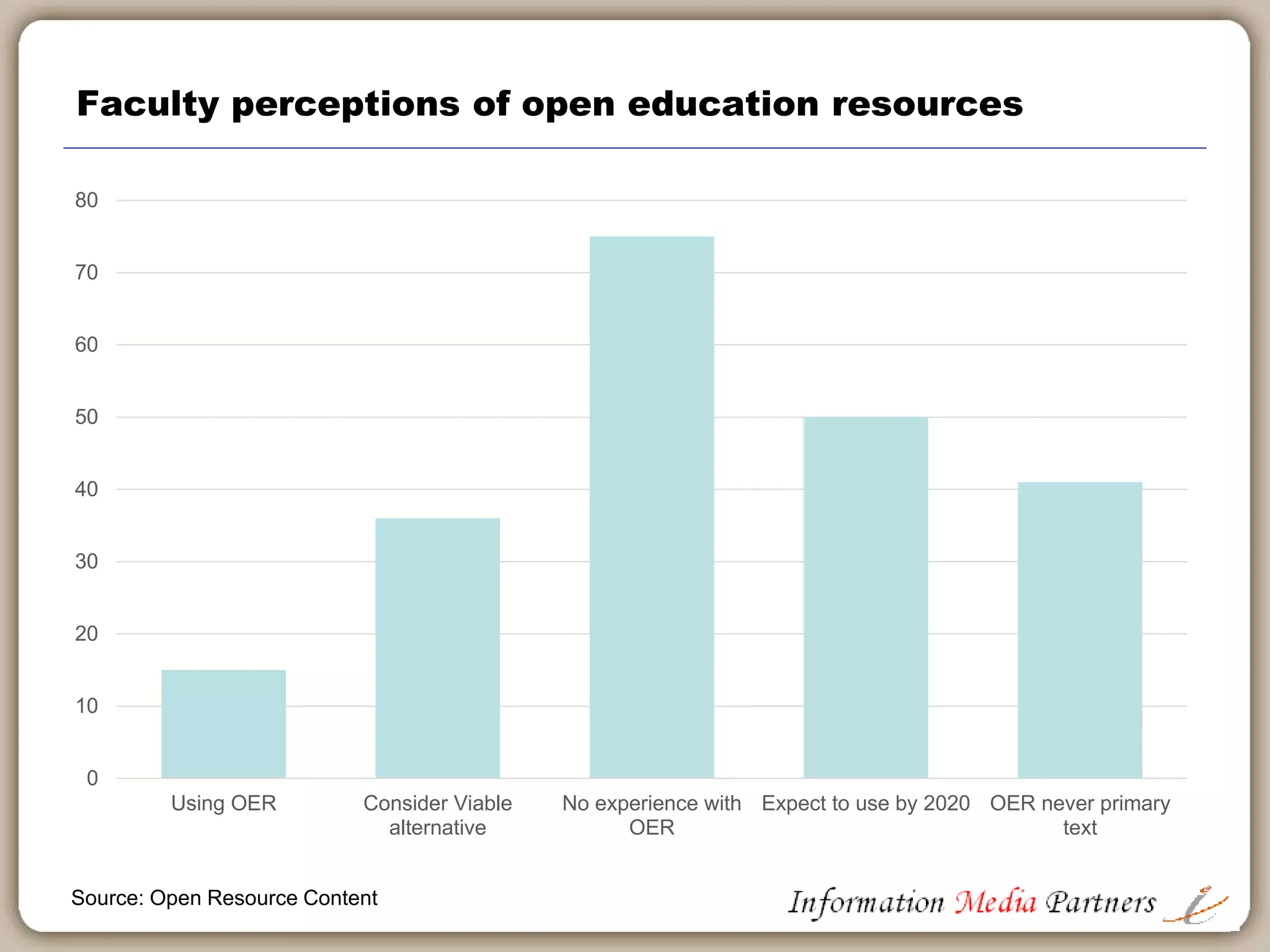

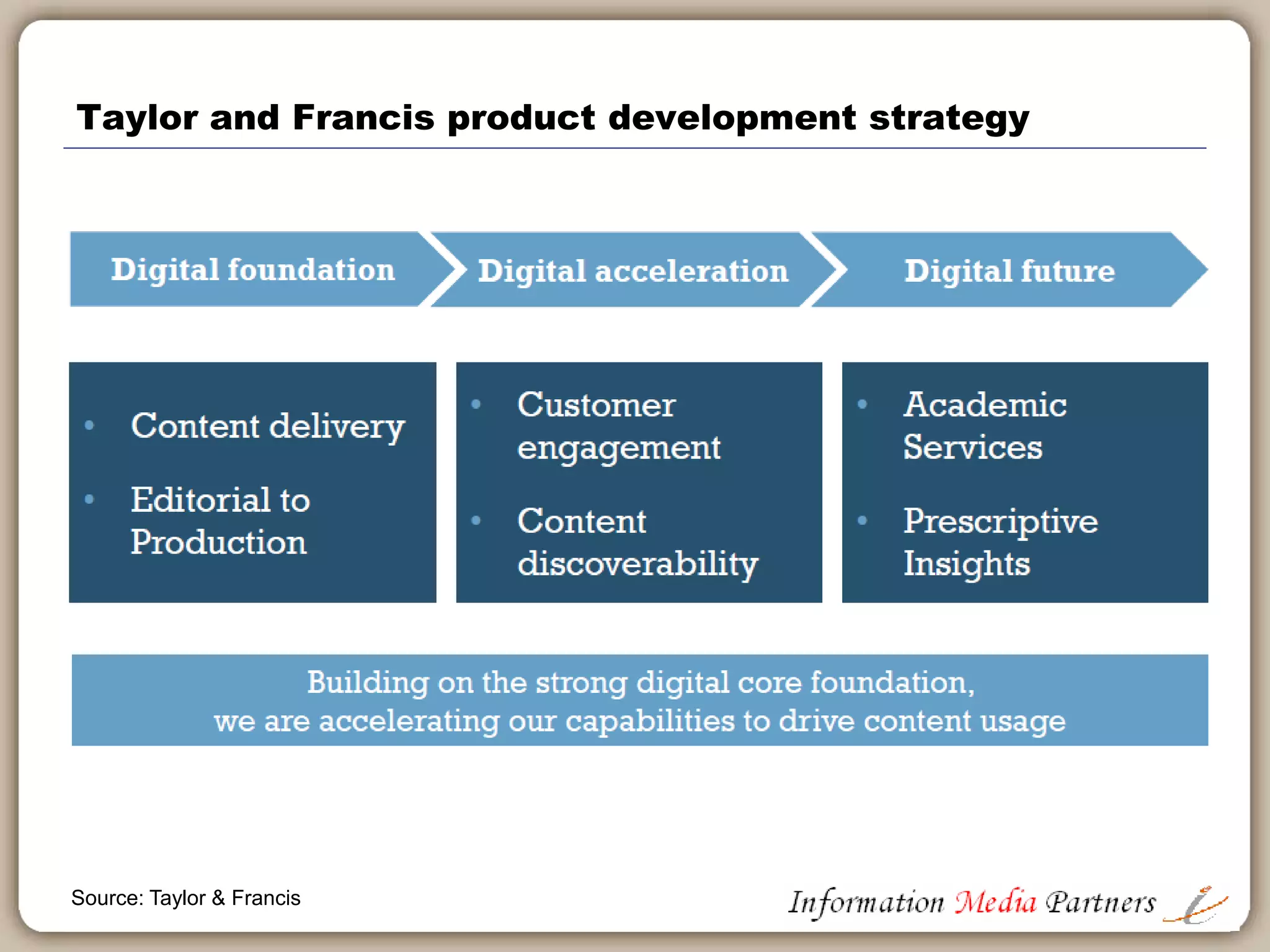

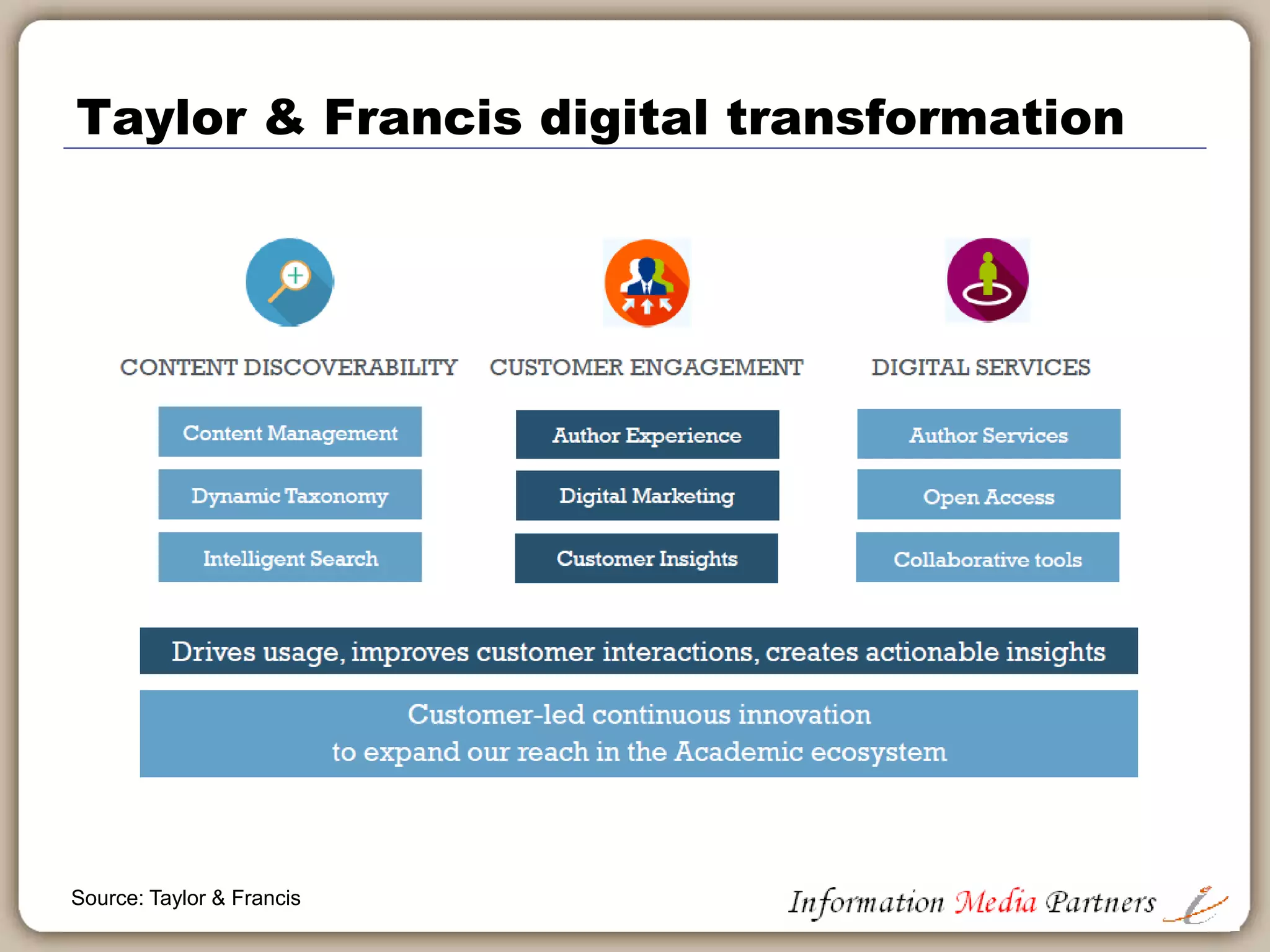

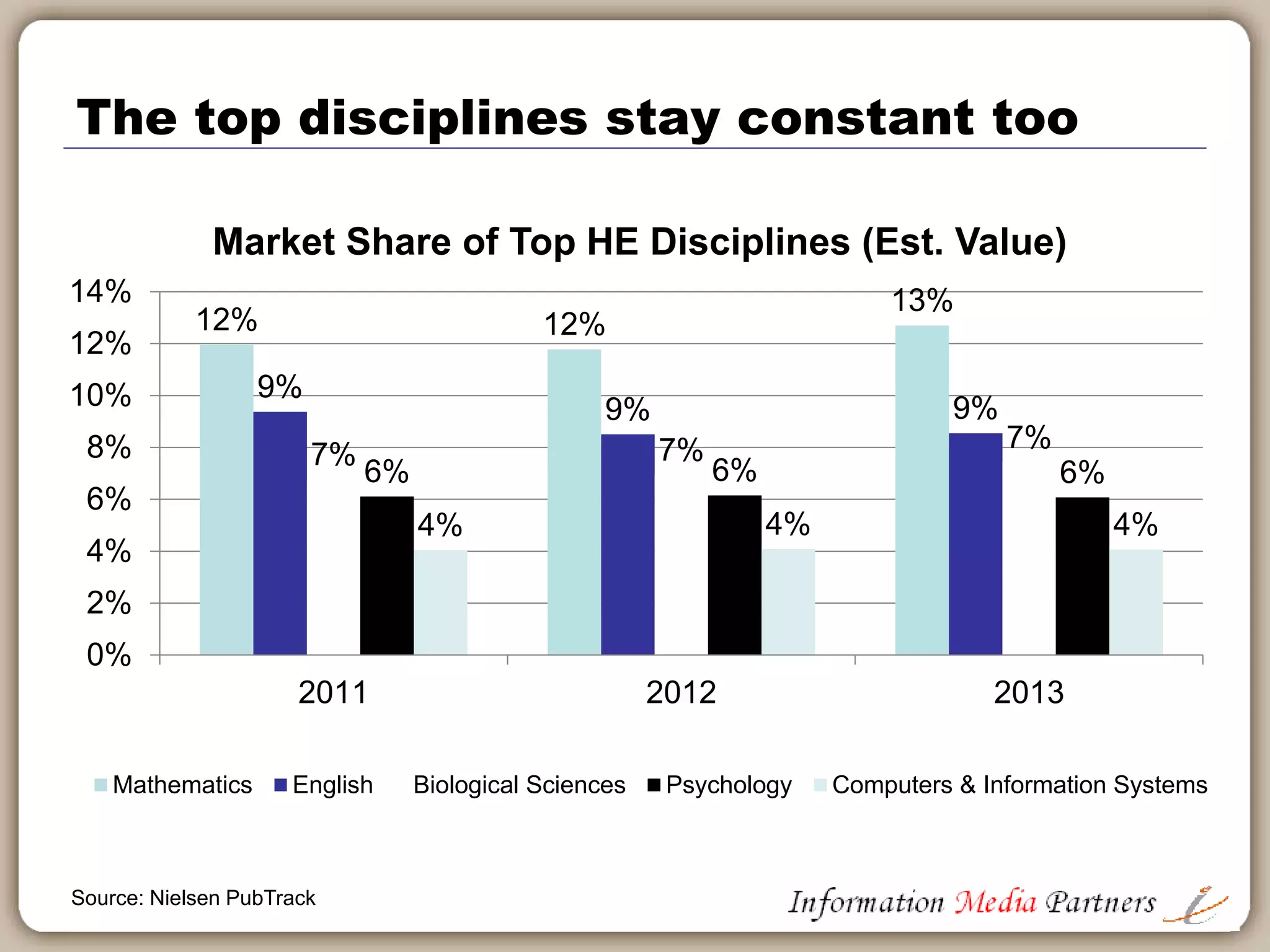

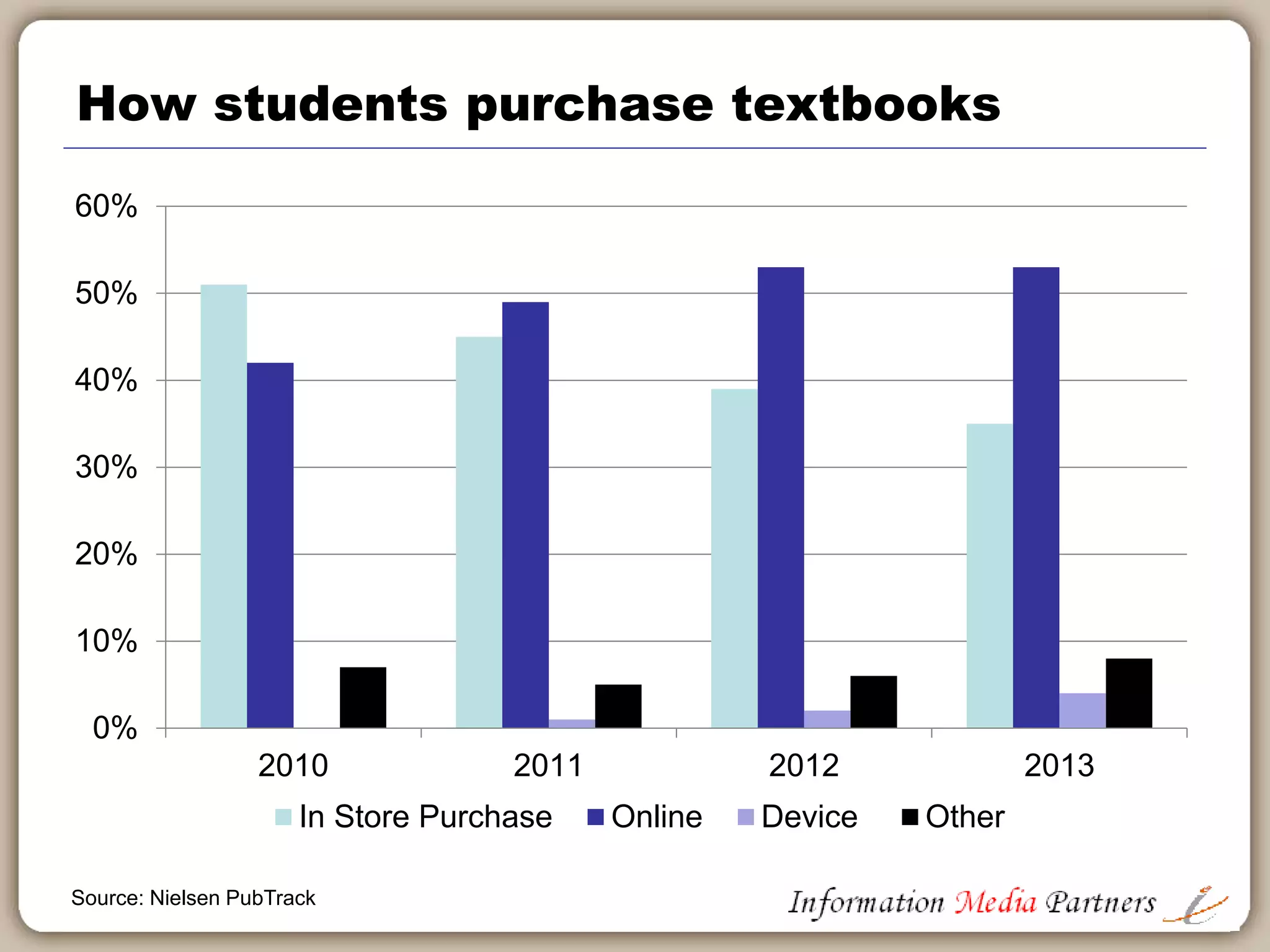

Michael Cairns, a publishing and media executive with extensive experience in business strategy and operations, founded Information Media Partners in 2006 to focus on the education and information publishing sector. The document outlines his background, consulting work, and examples of strategic initiatives in the publishing industry, including market trends and shifting dynamics in educational publishing. Key observations highlight a concentration in global markets, the impact of digital transformation, and evolving challenges related to open educational resources.