Make Money with AvaTrade : A Comprehensive Guide to Online Trading Success.pdf

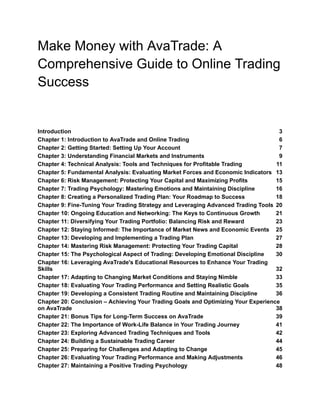

- 1. Make Money with AvaTrade: A Comprehensive Guide to Online Trading Success Introduction 3 Chapter 1: Introduction to AvaTrade and Online Trading 6 Chapter 2: Getting Started: Setting Up Your Account 7 Chapter 3: Understanding Financial Markets and Instruments 9 Chapter 4: Technical Analysis: Tools and Techniques for Profitable Trading 11 Chapter 5: Fundamental Analysis: Evaluating Market Forces and Economic Indicators 13 Chapter 6: Risk Management: Protecting Your Capital and Maximizing Profits 15 Chapter 7: Trading Psychology: Mastering Emotions and Maintaining Discipline 16 Chapter 8: Creating a Personalized Trading Plan: Your Roadmap to Success 18 Chapter 9: Fine-Tuning Your Trading Strategy and Leveraging Advanced Trading Tools 20 Chapter 10: Ongoing Education and Networking: The Keys to Continuous Growth 21 Chapter 11: Diversifying Your Trading Portfolio: Balancing Risk and Reward 23 Chapter 12: Staying Informed: The Importance of Market News and Economic Events 25 Chapter 13: Developing and Implementing a Trading Plan 27 Chapter 14: Mastering Risk Management: Protecting Your Trading Capital 28 Chapter 15: The Psychological Aspect of Trading: Developing Emotional Discipline 30 Chapter 16: Leveraging AvaTrade's Educational Resources to Enhance Your Trading Skills 32 Chapter 17: Adapting to Changing Market Conditions and Staying Nimble 33 Chapter 18: Evaluating Your Trading Performance and Setting Realistic Goals 35 Chapter 19: Developing a Consistent Trading Routine and Maintaining Discipline 36 Chapter 20: Conclusion – Achieving Your Trading Goals and Optimizing Your Experience on AvaTrade 38 Chapter 21: Bonus Tips for Long-Term Success on AvaTrade 39 Chapter 22: The Importance of Work-Life Balance in Your Trading Journey 41 Chapter 23: Exploring Advanced Trading Techniques and Tools 42 Chapter 24: Building a Sustainable Trading Career 44 Chapter 25: Preparing for Challenges and Adapting to Change 45 Chapter 26: Evaluating Your Trading Performance and Making Adjustments 46 Chapter 27: Maintaining a Positive Trading Psychology 48

- 2. Chapter 28: Balancing Risk and Reward for Long-Term Trading Success 49 Chapter 29: Adapting to Different Market Conditions 51 Chapter 30: Staying Informed and Continuously Learning 52 Chapter 31: Developing Healthy Trading Habits 53 Conclusion 55

- 3. Introduction Make Money with AvaTrade: A Comprehensive Guide to Online Trading Success" is your one-stop guide to navigating the world of online trading, leveraging the tools and resources offered by AvaTrade, one of the leading online trading platforms. Whether you are a novice trader or an experienced professional, this book will provide you with valuable insights and practical advice to help you achieve success in the financial markets. In this digital age, online trading has become increasingly popular, offering individuals the opportunity to invest and profit from the financial markets from the comfort of their homes. AvaTrade, an award-winning trading platform, has made it possible for traders to access a wide range of financial instruments, including forex, stocks, indices, commodities, cryptocurrencies, bonds, and ETFs. This book will take you through the process of setting up an account, understanding the financial markets, and developing a profitable trading strategy using the tools and features available on AvaTrade. Chapter 1, "Introduction to AvaTrade and Online Trading," will provide you with a solid foundation in the world of online trading and the benefits of using AvaTrade as your trading platform of choice. You will learn about the company's history, its commitment to security and regulation, and the wide range of financial instruments available for trading. In Chapter 2, "Getting Started: Setting Up Your Account," we will walk you through the process of creating an account on AvaTrade, including account verification, funding options, and platform selection. This chapter will ensure you have everything you need to begin trading with confidence. Understanding the financial markets and the various instruments available for trading is crucial to your success. In Chapter 3, "Understanding Financial Markets and Instruments," we will explore the different types of markets, their characteristics, and the financial instruments you can trade on AvaTrade.

- 4. Choosing the right trading platform is essential, as it will serve as your primary tool for conducting trades and managing your investments. In Chapter 4, "Exploring Trading Platforms: MetaTrader 4 and 5, AvaOptions, and More," you will learn about the various trading platforms offered by AvaTrade, their features, and how to select the best one for your needs. Successful trading requires a comprehensive understanding of both technical and fundamental analysis. In Chapters 5 and 6, we will delve into these critical aspects of trading, covering chart patterns, indicators, strategies, economic indicators, and market events. Risk management, trading psychology, and developing a profitable trading plan are essential components of a successful trading journey. In Chapters 7 through 9, we will discuss the tools and techniques for managing risk, maintaining the right mindset, and creating a well-structured trading plan that aligns with your financial goals and risk tolerance. One of the unique features of AvaTrade is its emphasis on social trading and copy trading. Chapter 10, "Leveraging Social Trading and Copy Trading Features," will guide you through the process of using these powerful tools to learn from the experiences of other traders and potentially increase your profits. In today's fast-paced trading environment, automation has become increasingly important. Chapter 11, "Automated Trading: Exploring Expert Advisors and Algorithmic Strategies," will introduce you to the world of automated trading, including the use of expert advisors and algorithmic strategies to maximize your trading efficiency. Chapters 12 through 15 will provide a deep dive into specific financial markets, such as forex, stocks and indices, commodities, and cryptocurrencies. These chapters will equip you with the knowledge and understanding needed to trade various instruments with confidence and expertise. Expanding your investment horizons is crucial for long-term success. In Chapter 16, "Bonds and ETFs: Expanding Your Investment Horizons," we will explore the world of bonds and ETFs, helping you to diversify your portfolio and manage risk effectively.

- 5. Selecting the right account type for your trading needs is essential for maximizing your potential profits. In Chapter 17, "AvaTrade Account Types: Selecting the Right Account for You," we will discuss the various account types offered by AvaTrade, their features, and how to choose the one that best suits your needs. Education is a cornerstone of trading success, and AvaTrade offers a wealth of educational resources to support your trading journey. In Chapter 18, "Making the Most of AvaTrade's Educational Resources," we will explore these resources, including webinars, video tutorials, eBooks, and market analysis, helping you to continuously improve your trading skills. As a trader, it is essential to be aware of your tax obligations and regulatory compliance requirements. In Chapter 19, "Managing Taxes and Regulatory Compliance," we will discuss the importance of staying compliant with tax laws and regulations in your jurisdiction, as well as provide guidance on managing your trading-related taxes. Finally, in Chapter 20, "Tips and Tricks for Long-term Trading Success," we will provide you with valuable advice and best practices to help you achieve and maintain success in the world of online trading. This chapter will include tips on staying disciplined, managing emotions, and continuously learning and adapting to the ever-changing financial markets. "Make Money with AvaTrade: A Comprehensive Guide to Online Trading Success" is designed to be a valuable resource for traders of all experience levels. With its practical, step-by-step approach, this book will equip you with the knowledge, tools, and strategies needed to succeed in the world of online trading and achieve your financial goals. So, let's embark on this exciting journey and start making money with AvaTrade today!

- 6. Chapter 1: Introduction to AvaTrade and Online Trading In this chapter, we will introduce you to the world of online trading and provide a detailed overview of AvaTrade as a leading trading platform. Online trading has revolutionized the way people invest and participate in the financial markets. With the advent of the internet and technological advancements, individuals can now access the markets from anywhere in the world, at any time, using a variety of devices such as computers, tablets, and smartphones. AvaTrade is an award-winning online trading platform that was founded in 2006, with the aim of providing retail traders with a user-friendly, secure, and transparent trading environment. Headquartered in Dublin, Ireland, AvaTrade is regulated by multiple international financial authorities, including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and the Financial Services Commission (FSC) in the British Virgin Islands, among others. This strong regulatory framework ensures that AvaTrade maintains high standards of safety, security, and fair trading practices for its clients. AvaTrade offers a wide range of financial instruments for trading, including: 1. Forex (currency pairs) 2. Stocks and Indices (shares and stock market indices) 3. Commodities (oil, gold, silver, and agricultural products) 4. Cryptocurrencies (Bitcoin, Ethereum, Litecoin, and more) 5. Bonds (government and corporate bonds) 6. Exchange-Traded Funds (ETFs) This extensive selection of instruments allows traders to diversify their portfolios, manage risk, and take advantage of various market opportunities. One of the key features that sets AvaTrade apart from other online trading platforms is its commitment to offering powerful trading tools and resources to its clients. The platform provides

- 7. access to multiple trading platforms, such as MetaTrader 4 and 5, AvaOptions, and AvaTradeGO, each with its own unique features and capabilities. Additionally, AvaTrade offers a wealth of educational resources, including webinars, video tutorials, market analysis, and an extensive library of eBooks, to help traders continuously improve their knowledge and skills. These resources cater to both beginners and experienced traders, ensuring that all clients have the support and guidance they need to succeed in the markets. In the upcoming chapters, we will delve deeper into the various aspects of online trading with AvaTrade, guiding you through the process of setting up an account, understanding the financial markets, developing profitable trading strategies, and making the most of the tools and resources available on the platform. By the end of this book, you will be well-equipped to start your journey towards financial success through online trading with AvaTrade. Chapter 2: Getting Started: Setting Up Your Account In this chapter, we will guide you through the process of setting up your AvaTrade account, ensuring that you have everything in place to start trading with confidence. We will cover account verification, funding options, and platform selection, providing you with a solid foundation for your trading journey. 1. Account Registration To get started with AvaTrade, you need to create an account by visiting their website and clicking on the "Register Now" button. You will be required to provide your personal information, such as your name, email address, phone number, and country of residence. It's essential to provide accurate information, as this will be used to verify your identity and ensure compliance with regulatory requirements. 2. Account Verification

- 8. After registering, you will need to verify your account. AvaTrade is committed to adhering to strict anti-money laundering (AML) and know-your-customer (KYC) policies, which require clients to provide proof of identity and proof of address documents. For proof of identity, you can submit a government-issued identification document such as a passport, driver's license, or national ID card. For proof of address, you can provide a utility bill, bank statement, or credit card statement that clearly displays your name and address, and is dated within the last six months. 3. Funding Your Account Once your account has been verified, you can proceed to fund it. AvaTrade offers various deposit methods to accommodate clients from different countries and with different preferences. Some of the most popular funding options include: ● Credit/Debit Card: Visa, MasterCard, Maestro cards are accepted for instant deposits. ● Bank Wire Transfer: You can transfer funds directly from your bank account to your AvaTrade account, although this method may take a few business days for the funds to be credited. ● E-Wallets: AvaTrade accepts deposits via popular e-wallets such as PayPal, Skrill, and Neteller, which typically provide instant transfers. It's important to note that AvaTrade has a minimum deposit requirement, which varies depending on the account type and funding method. Be sure to check the specific requirements for your chosen account and deposit method before proceeding. 4. Selecting a Trading Platform AvaTrade offers a variety of trading platforms to cater to the diverse needs of its clients. Some of the most popular trading platforms include: ● MetaTrader 4 (MT4): This is one of the most widely used trading platforms in the industry, offering a comprehensive suite of tools for technical analysis, charting, and automated trading. MT4 is suitable for both beginners and experienced traders. ● MetaTrader 5 (MT5): An upgraded version of MT4, MT5 offers additional features and functionalities, such as an expanded range of chart types, timeframes, and analytical tools.

- 9. This platform is ideal for advanced traders who require more sophisticated tools for their trading strategies. ● AvaOptions: This platform is specifically designed for trading options and offers advanced risk management tools, customizable charts, and more than 40 forex options and a wide range of other instruments. ● AvaTradeGO: This is AvaTrade's proprietary mobile trading app, which allows you to trade on the go using your smartphone or tablet. The app features a user-friendly interface, advanced charting capabilities, and access to all the financial instruments available on the desktop platforms. You can choose the platform that best suits your trading needs and preferences, and even switch between platforms as your skills and requirements evolve. With your account set up, verified, funded, and your preferred trading platform selected, you are now ready to start trading with AvaTrade. In the following chapters, we will guide you through the process of understanding the financial markets, choosing the right financial instruments, and developing profitable trading strategies using the tools and features available on AvaTrade's platform. Chapter 3: Understanding Financial Markets and Instruments In this chapter, we will explore the various financial markets and instruments that you can trade on AvaTrade's platform. Gaining a solid understanding of these markets and instruments is crucial to your success as a trader, as it will allow you to make informed decisions and develop effective trading strategies. 1. Forex Market The foreign exchange (forex) market is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. Forex trading involves buying one currency while simultaneously selling another, creating a currency pair. Currency pairs are quoted in terms of the

- 10. base currency (the first currency in the pair) and the quote currency (the second currency in the pair). Some of the most popular currency pairs include EUR/USD, GBP/USD, and USD/JPY. 2. Stock Market The stock market allows investors to buy and sell shares of publicly traded companies. When you buy a share of a company, you are essentially purchasing a small piece of ownership in that company. Stocks are typically traded on stock exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq. AvaTrade offers access to a wide range of stocks from various industries and countries, including popular companies like Apple, Amazon, and Tesla. 3. Indices An index is a collection of stocks that represent a particular market or sector. Indices provide a way for traders to gain exposure to the overall performance of a market or sector without having to buy individual stocks. Some popular indices include the S&P 500 (representing the 500 largest U.S. companies), the Dow Jones Industrial Average (30 major U.S. companies), and the FTSE 100 (100 largest U.K. companies). 4. Commodities Commodities are basic goods that are used as inputs in the production of other goods and services. They can be divided into two main categories: hard commodities (such as gold, oil, and copper) and soft commodities (such as wheat, coffee, and sugar). Trading commodities allows investors to profit from changes in supply and demand dynamics, as well as hedge against inflation and other economic risks. 5. Cryptocurrencies Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate on decentralized networks, such as blockchain technology. They have gained significant popularity in recent years due to their potential for high returns and their role in the emerging digital economy.

- 11. Some popular cryptocurrencies available for trading on AvaTrade include Bitcoin, Ethereum, Litecoin, and Ripple. 6. Bonds Bonds are debt securities issued by governments or corporations to raise capital. When you invest in a bond, you are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds can provide a steady income stream and are generally considered less risky than stocks, making them an attractive option for conservative investors. 7. Exchange-Traded Funds (ETFs) ETFs are investment funds that hold a collection of assets, such as stocks, bonds, or commodities, and trade on stock exchanges like individual stocks. ETFs offer investors a simple and cost-effective way to diversify their portfolios and gain exposure to specific markets, sectors, or investment strategies. By understanding the various financial markets and instruments available on AvaTrade's platform, you will be better equipped to choose the right instruments for your trading goals and develop effective trading strategies. In the upcoming chapters, we will delve deeper into technical analysis, fundamental analysis, risk management, and other essential aspects of successful trading. Chapter 4: Technical Analysis: Tools and Techniques for Profitable Trading In this chapter, we will introduce you to the world of technical analysis and explore the various tools and techniques that you can use to make informed trading decisions on AvaTrade's platform.

- 12. Technical analysis is the study of historical price movements and trading volumes to identify patterns and trends that can help predict future price movements. 1. Chart Types Charts are an essential tool for technical analysis, as they provide a visual representation of price movements over time. There are several chart types available on AvaTrade's platform, including: ● Line Charts: These charts display a simple line that connects the closing prices of an instrument over a specified period. ● Bar Charts: These charts represent the open, high, low, and close (OHLC) prices of an instrument within a specific time frame, using vertical bars. ● Candlestick Charts: Similar to bar charts, candlestick charts show the OHLC prices but use colored "candles" to represent price movements, making it easier to identify trends and patterns. 2. Technical Indicators Technical indicators are mathematical calculations applied to price and volume data to generate signals that can help traders identify potential trading opportunities. There are many technical indicators available on AvaTrade's platform, including: ● Moving Averages: These indicators smooth out price data to identify trends and potential support and resistance levels. ● Relative Strength Index (RSI): This momentum indicator compares the magnitude of recent gains to recent losses to determine overbought and oversold conditions. ● Bollinger Bands: This indicator consists of a moving average and two standard deviation bands that can help identify potential entry and exit points in volatile markets. 3. Chart Patterns Chart patterns are specific formations that occur in price charts and can provide clues about future price movements. Some common chart patterns include: ● Head and Shoulders: This pattern indicates a potential trend reversal and is characterized by a peak (head), followed by two lower peaks (shoulders). ● Double Top and Double Bottom: These patterns signal potential trend reversals, with double tops indicating a bearish reversal and double bottoms indicating a bullish reversal. ● Triangles: These patterns represent a period of consolidation before a potential breakout in either direction. 4. Support and Resistance Levels

- 13. Support and resistance levels are critical price points where buying or selling pressure is likely to change. Support levels represent areas where buying pressure is expected to be strong enough to prevent prices from falling further, while resistance levels are where selling pressure is likely to prevent prices from rising higher. Identifying support and resistance levels can help traders make better entry and exit decisions. By mastering the tools and techniques of technical analysis, you can improve your ability to identify potential trading opportunities and make more informed decisions on AvaTrade's platform. In the next chapter, we will explore the fundamentals of fundamental analysis, which is another critical aspect of successful trading. Chapter 5: Fundamental Analysis: Evaluating Market Forces and Economic Indicators In this chapter, we will introduce you to the concept of fundamental analysis, which is the study of the underlying economic and financial factors that influence the value of financial instruments. By understanding these factors, you can make more informed trading decisions and develop effective trading strategies on AvaTrade's platform. 1. Macroeconomic Factors Macroeconomic factors are broad economic indicators that can impact the value of financial instruments on a global or regional level. Some key macroeconomic factors include: ● Interest Rates: Central banks set interest rates to influence borrowing, lending, and inflation. Changes in interest rates can have a significant impact on the value of currencies, bonds, and stocks. ● Inflation: Inflation is the rate at which the general price level of goods and services is rising. High inflation can lead to higher interest rates, which can impact the value of various financial instruments.

- 14. ● Gross Domestic Product (GDP): GDP is a measure of a country's total economic output. Strong GDP growth can signal a healthy economy, which can positively impact the value of a country's currency and stock market. 2. Industry-Specific Factors Industry-specific factors are events or conditions that affect specific sectors or industries within the economy. These factors can impact the value of stocks and other financial instruments related to the affected industry. Examples of industry-specific factors include regulatory changes, technological advancements, and shifts in consumer preferences. 3. Company Fundamentals When trading individual stocks, it's crucial to analyze the financial health and performance of the company. Some key company fundamentals to consider include: ● Earnings: A company's earnings (or profits) can significantly impact its stock price. Earnings reports, which are released quarterly, can provide valuable insights into a company's financial performance. ● Dividends: Dividend payments can influence a stock's value, as they represent a return on investment for shareholders. Companies with a history of stable or growing dividends may be considered more attractive to investors. ● Balance Sheet: The balance sheet provides a snapshot of a company's assets, liabilities, and shareholder's equity. A strong balance sheet can indicate a financially healthy company, which can positively impact its stock price. 4. Economic Indicators and Reports Economic indicators and reports provide valuable information about the overall health of an economy and can influence the value of financial instruments. Some widely followed economic indicators include: ● Employment Data: Employment figures, such as the non-farm payroll report and the unemployment rate, can provide insights into the strength of an economy and impact the value of currencies and stock markets. ● Consumer Price Index (CPI): The CPI measures the change in the price of a basket of consumer goods and services, which can help gauge inflation levels. ● Manufacturing and Services Indices: These indices, such as the Purchasing Managers' Index (PMI), provide insights into the performance of the manufacturing and services sectors, which can influence the value of related financial instruments.

- 15. By understanding the principles of fundamental analysis and incorporating them into your trading strategies, you can enhance your ability to make informed decisions on AvaTrade's platform. In the following chapters, we will explore topics such as risk management, trading psychology, and developing a trading plan to help you become a successful trader. Chapter 6: Risk Management: Protecting Your Capital and Maximizing Profits In this chapter, we will discuss the importance of risk management in trading and explore various techniques that can help you protect your capital and maximize profits on AvaTrade's platform. Effective risk management is crucial for long-term success in trading, as it can help you minimize losses and preserve your trading capital. 1. Position Sizing Position sizing is the process of determining the appropriate amount of an asset to buy or sell based on your account size and risk tolerance. By using proper position sizing, you can ensure that you are not overexposed to any single trade and can better manage the potential downside risk. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. 2. Stop Loss Orders A stop loss order is an order placed with a broker to sell a security when it reaches a specific price, effectively limiting your potential loss on a trade. By using stop loss orders, you can automatically exit a losing trade and protect your trading capital. It's essential to set your stop loss orders at a level that gives your trade enough room to breathe while still providing adequate downside protection. 3. Take Profit Orders

- 16. A take profit order is an order placed with a broker to close a position once it reaches a specific profit target. By using take profit orders, you can lock in profits and avoid giving back gains due to market fluctuations. It's crucial to set realistic profit targets based on your analysis and the current market conditions. 4. Diversification Diversification is the practice of spreading your investments across various financial instruments, sectors, and asset classes to reduce risk. By diversifying your portfolio, you can minimize the impact of any single losing trade and improve your overall risk-adjusted returns. AvaTrade offers a wide range of financial instruments, allowing you to create a diversified portfolio tailored to your specific trading goals and risk tolerance. 5. Risk-to-Reward Ratio The risk-to-reward ratio is a measure of the potential profit of a trade relative to its potential loss. A favorable risk-to-reward ratio, such as 1:2 or 1:3, means that the potential profit is significantly higher than the potential loss. By focusing on trades with favorable risk-to-reward ratios, you can improve your overall trading performance and increase the likelihood of long-term success. By incorporating these risk management techniques into your trading strategy, you can protect your capital and maximize your profits on AvaTrade's platform. In the next chapter, we will delve into trading psychology and its importance in achieving consistent trading success. Chapter 7: Trading Psychology: Mastering Emotions and Maintaining Discipline In this chapter, we will discuss the importance of trading psychology and explore strategies for mastering your emotions and maintaining discipline while trading on AvaTrade's platform. Trading

- 17. psychology plays a crucial role in your success as a trader, as emotional decision-making can often lead to poor trading choices and reduced profitability. 1. Understanding Emotional Triggers Emotions such as fear, greed, and hope can significantly impact your trading decisions. It's essential to identify and understand your emotional triggers to avoid making impulsive and irrational choices. By recognizing the emotions that influence your trading, you can develop strategies to manage them effectively. 2. Developing a Trading Plan A well-defined trading plan outlines your trading goals, risk management guidelines, and specific entry and exit criteria for each trade. By following a structured trading plan, you can reduce emotional decision-making and maintain discipline in your trading. A good trading plan should be flexible, allowing you to adapt to changing market conditions and continuously refine your strategy. 3. Maintaining Discipline Discipline is the ability to stick to your trading plan and consistently execute your strategy, even during challenging market conditions. Maintaining discipline is crucial for long-term trading success, as it can help you avoid impulsive decisions and minimize losses. Some strategies for maintaining discipline include setting daily or weekly trading limits, reviewing your trading performance regularly, and seeking feedback from mentors or peers. 4. Managing Stress Trading can be a stressful endeavor, especially during periods of market volatility or when experiencing a series of losses. Effectively managing stress is essential for maintaining a clear mind and making rational decisions. Some techniques for managing stress include practicing relaxation exercises, taking regular breaks from trading, and maintaining a healthy work-life balance. 5. Continuous Learning and Improvement

- 18. Successful traders recognize the importance of continuous learning and improvement. By regularly reviewing your trading performance, you can identify areas of weakness and develop strategies for improvement. This process can help you become more emotionally resilient and better equipped to handle the challenges of trading. Consider participating in educational programs, reading trading books, and staying informed about market news and developments. By mastering your trading psychology and maintaining discipline, you can improve your decision-making and increase your chances of success on AvaTrade's platform. In the upcoming chapters, we will explore additional topics such as creating a personalized trading plan, fine-tuning your trading strategy, and leveraging advanced trading tools to enhance your overall trading experience. Chapter 8: Creating a Personalized Trading Plan: Your Roadmap to Success In this chapter, we will discuss the importance of creating a personalized trading plan and provide guidance on developing a plan tailored to your specific goals, risk tolerance, and trading style. A well-defined trading plan serves as a roadmap for your trading journey, helping you make informed decisions and maintain discipline on AvaTrade's platform. 1. Setting Trading Goals Before creating your trading plan, it's essential to define your trading goals. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Some examples of trading goals include generating a specific percentage of return, achieving a certain risk-to-reward ratio, or improving specific aspects of your trading strategy. 2. Identifying Your Trading Style

- 19. Your trading style is the approach you take to trading, which should align with your personality, time availability, and risk tolerance. There are several trading styles, including: ● Day Trading: Day traders open and close positions within a single trading day, aiming to profit from short-term price movements. ● Swing Trading: Swing traders hold positions for several days or weeks, looking to profit from intermediate-term price movements. ● Position Trading: Position traders hold positions for months or even years, aiming to profit from long-term trends and price movements. 3. Developing Entry and Exit Criteria Your trading plan should include specific entry and exit criteria for each trade, based on your analysis and strategy. This can help you maintain discipline and avoid impulsive decisions. Some examples of entry and exit criteria include: ● Technical Indicators: Traders may use technical indicators, such as moving averages or RSI, to signal entry and exit points. ● Support and Resistance Levels: Traders may enter a trade near support levels or exit near resistance levels to capitalize on potential price reversals. ● Chart Patterns: Traders may use chart patterns, such as triangles or head and shoulders, to identify potential breakouts or reversals and determine entry and exit points. 4. Implementing Risk Management Strategies As discussed in Chapter 6, effective risk management is crucial for long-term trading success. Your trading plan should outline your risk management strategies, including position sizing, stop loss orders, and take profit orders. Be sure to adhere to these guidelines consistently to protect your trading capital. 5. Regularly Reviewing and Adjusting Your Plan Your trading plan should be a dynamic document, regularly reviewed and adjusted as needed. By evaluating your trading performance and analyzing market conditions, you can identify areas for improvement and refine your strategy. This iterative process can help you become a more skilled and adaptable trader. By creating a personalized trading plan, you can enhance your decision-making and increase your chances of success on AvaTrade's platform. In the next chapter, we will discuss the importance of

- 20. fine-tuning your trading strategy and leveraging advanced trading tools to optimize your overall trading experience. Chapter 9: Fine-Tuning Your Trading Strategy and Leveraging Advanced Trading Tools In this chapter, we will explore the process of fine-tuning your trading strategy and discuss the advanced trading tools available on AvaTrade's platform. Continuously refining your strategy and leveraging cutting-edge tools can help you optimize your trading experience and increase your chances of success. 1. Analyzing Your Trading Performance Regularly reviewing your trading performance is crucial for identifying areas of improvement and refining your strategy. Some key metrics to track include: ● Win Rate: The percentage of your trades that are profitable. ● Risk-to-Reward Ratio: The potential profit of a trade relative to its potential loss. ● Average Profit per Trade: The average amount of profit generated per trade. ● Maximum Drawdown: The largest decline in your trading account's value from its peak. By tracking these metrics, you can gain valuable insights into the effectiveness of your trading strategy and make data-driven adjustments as needed. 2. Backtesting and Forward Testing Backtesting involves testing your trading strategy on historical price data to evaluate its performance. This process can help you identify potential issues and refine your strategy before implementing it in live trading. Forward testing, also known as paper trading, involves testing your strategy in real-time market conditions without risking real capital. Both backtesting and forward testing are essential components of fine-tuning your trading strategy.

- 21. 3. Adapting to Changing Market Conditions Financial markets are constantly evolving, and successful traders must be able to adapt their strategies to changing conditions. By staying informed about market news, economic developments, and technical trends, you can make informed adjustments to your strategy and maintain a competitive edge. 4. Leveraging Advanced Trading Tools on AvaTrade AvaTrade offers a range of advanced trading tools that can help you optimize your trading experience, including: ● MetaTrader 4 and MetaTrader 5: These popular trading platforms offer a range of advanced charting and analysis tools, as well as support for automated trading strategies. ● AvaTradeGO: This mobile trading app provides an intuitive and user-friendly interface, allowing you to trade on-the-go and manage your portfolio from your smartphone or tablet. ● Trading Central: Trading Central offers in-depth technical analysis, market insights, and trading signals to help you make informed trading decisions. By fine-tuning your trading strategy and leveraging advanced trading tools on AvaTrade's platform, you can improve your decision-making and increase your chances of success. In the following chapters, we will continue to explore additional topics, such as the importance of ongoing education and networking with other traders, to further enhance your trading journey. Chapter 10: Ongoing Education and Networking: The Keys to Continuous Growth In this chapter, we will discuss the importance of ongoing education and networking for continuous growth as a trader. By continually learning and engaging with others in the trading community, you can stay informed, gain new perspectives, and enhance your trading skills on AvaTrade's platform. 1. Participating in Educational Programs

- 22. AvaTrade offers a range of educational resources and programs designed to help traders at all levels improve their skills and knowledge. These resources include: ● Webinars: Regularly scheduled webinars cover various trading topics, such as technical analysis, risk management, and trading strategies. ● Video Tutorials: A library of video tutorials provides step-by-step guidance on using AvaTrade's platform and trading tools. ● eBooks: In-depth eBooks cover a wide range of trading topics and are available for download on AvaTrade's website. By participating in these educational programs, you can stay up-to-date with the latest trading strategies, techniques, and market developments. 2. Reading Trading Books and Blogs Trading books and blogs can provide valuable insights and knowledge from experienced traders and market experts. Some popular trading books include: ● "Market Wizards" by Jack D. Schwager ● "Trading in the Zone" by Mark Douglas ● "The New Trading for a Living" by Dr. Alexander Elder Reading these books and following reputable trading blogs can help you develop a deeper understanding of various trading concepts and strategies. 3. Engaging in Trading Communities and Forums Joining trading communities and forums can help you connect with like-minded traders, share ideas, and gain new perspectives. These platforms provide an opportunity to discuss market developments, ask questions, and receive feedback from your peers. Some popular trading forums include: ● Forex Factory ● BabyPips ● Elite Trader

- 23. By participating in these communities, you can expand your network, learn from other traders, and continually improve your trading skills. 4. Attending Trading Conferences and Seminars Trading conferences and seminars offer an opportunity to meet industry experts, learn about the latest market trends, and network with other traders. By attending these events, you can gain valuable insights and stay informed about the ever-evolving trading landscape. 5. Seeking Mentorship and Guidance Finding a mentor or experienced trader to guide you can be an invaluable resource for your trading journey. A mentor can provide personalized advice, constructive feedback, and support to help you navigate the challenges of trading and accelerate your growth. By prioritizing ongoing education and networking, you can continuously grow as a trader and enhance your performance on AvaTrade's platform. In the upcoming chapters, we will continue to explore additional topics and strategies to help you optimize your trading experience and achieve long-term success. Chapter 11: Diversifying Your Trading Portfolio: Balancing Risk and Reward In this chapter, we will discuss the importance of diversifying your trading portfolio and provide guidance on creating a well-balanced portfolio that aligns with your goals and risk tolerance. Diversification is a crucial component of risk management, as it can help you spread risk across a variety of assets and reduce the impact of individual losses on your overall performance. 1. Understanding the Benefits of Diversification

- 24. Diversification involves spreading your investments across different asset classes, sectors, and regions to minimize the impact of any single market event on your portfolio. The benefits of diversification include: ● Reduced Portfolio Volatility: A well-diversified portfolio can help you manage risk by spreading it across various assets, reducing the overall volatility of your portfolio. ● Improved Risk-Adjusted Returns: By diversifying your investments, you can potentially achieve higher risk-adjusted returns compared to a concentrated portfolio. ● Increased Resilience to Market Shocks: A diversified portfolio is generally more resilient to market shocks, as it is less reliant on the performance of a single asset or sector. 2. Building a Diversified Portfolio on AvaTrade AvaTrade offers a wide range of assets across various classes, sectors, and regions, allowing you to create a diversified trading portfolio. Some of the asset classes available on AvaTrade's platform include: ● Forex: Trade currency pairs, such as major, minor, and exotic pairs. ● Commodities: Invest in commodities like gold, silver, oil, and agricultural products. ● Indices: Gain exposure to the performance of various stock markets through index trading. ● Stocks: Trade individual stocks from leading global companies. ● Cryptocurrencies: Trade popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin. 3. Assessing Your Risk Tolerance and Goals When creating a diversified portfolio, it's essential to consider your risk tolerance and trading goals. This will help you determine the appropriate allocation of assets in your portfolio. For example, a risk-averse trader may prefer a higher allocation of relatively stable assets, such as government bonds or blue-chip stocks, while a risk-seeking trader may allocate more to higher-risk assets, such as small-cap stocks or cryptocurrencies. 4. Rebalancing Your Portfolio Regularly rebalancing your portfolio is crucial for maintaining your desired level of diversification and managing risk. Rebalancing involves adjusting your portfolio's asset allocation to ensure it remains aligned with your goals and risk tolerance. This may involve selling assets that have performed well and reallocating the proceeds to underperforming assets to maintain your target allocation.

- 25. By diversifying your trading portfolio and regularly rebalancing it, you can balance risk and reward, potentially improving your overall trading performance on AvaTrade's platform. In the next chapter, we will explore the importance of keeping up-to-date with market news and economic events to make well-informed trading decisions. Chapter 12: Staying Informed: The Importance of Market News and Economic Events In this chapter, we will discuss the importance of staying informed about market news and economic events, as well as provide guidance on leveraging these insights to make well-informed trading decisions on AvaTrade's platform. 1. Understanding the Impact of Market News and Economic Events Market news and economic events can have a significant impact on financial markets, influencing asset prices and creating potential trading opportunities. Examples of market-moving events include: ● Earnings Reports: Companies release earnings reports each quarter, providing insights into their financial performance. Strong or weak earnings can significantly impact stock prices. ● Central Bank Decisions: Central banks, such as the Federal Reserve or the European Central Bank, set monetary policy that can influence interest rates and currency values. ● Economic Indicators: Economic indicators, such as GDP growth, inflation, and employment figures, provide insights into the health of an economy and can influence various asset classes. By staying informed about market news and economic events, you can better understand market dynamics and make more informed trading decisions. 2. Utilizing Economic Calendars

- 26. Economic calendars are essential tools for traders, providing a schedule of upcoming economic events and their potential market impact. AvaTrade offers an economic calendar on its platform, allowing you to track relevant events and plan your trading accordingly. Some key features of economic calendars include: ● Event Details: Each event listing includes the date, time, and description of the event, as well as its expected market impact. ● Forecasts: Economic calendars often provide consensus forecasts for economic indicators, helping you gauge market expectations and potential price reactions. ● Historical Data: Accessing historical data for economic events can help you analyze trends and understand the potential impact of future events. By using an economic calendar, you can stay up-to-date with market-moving events and better anticipate potential trading opportunities. 3. Following Market News and Analysis Keeping up with market news and analysis is crucial for staying informed about current market trends, developments, and sentiment. Some reliable sources of market news and analysis include: ● Financial News Websites: Websites such as Bloomberg, CNBC, and Reuters provide comprehensive coverage of financial news and market developments. ● AvaTrade's Market Analysis: AvaTrade offers in-depth market analysis and insights on its platform, helping you stay informed about key market trends and events. ● Social Media: Following reputable financial news sources, analysts, and traders on social media platforms like Twitter and LinkedIn can provide timely market insights and analysis. By staying informed about market news and economic events, you can make well-informed trading decisions and better navigate the ever-changing financial markets on AvaTrade's platform. In the following chapters, we will continue to explore additional strategies and topics to help you optimize your trading experience and achieve long-term success.

- 27. Chapter 13: Developing and Implementing a Trading Plan In this chapter, we will discuss the importance of developing and implementing a trading plan and provide guidance on creating a plan that aligns with your goals, risk tolerance, and trading style. A well-structured trading plan can help you make more disciplined and consistent trading decisions on AvaTrade's platform. 1. Defining Your Trading Goals The first step in creating a trading plan is defining your trading goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, you might set a goal to achieve a certain percentage return on your investment within a specific time frame, such as a 20% return within one year. 2. Identifying Your Trading Style and Time Horizon Next, you need to identify your trading style and time horizon. Your trading style will depend on factors such as your risk tolerance, market knowledge, and time commitment. Common trading styles include: ● Day Trading: Involves making multiple trades within a single day, with all positions closed by the end of the trading session. ● Swing Trading: Focuses on capturing short-to-medium-term price movements, with trades typically lasting from a few days to a few weeks. ● Position Trading: A longer-term approach that involves holding trades for weeks or months, aiming to capitalize on broader market trends. 3. Developing a Trading Strategy Once you have defined your goals and trading style, you can develop a trading strategy that aligns with these parameters. Your trading strategy should outline the specific criteria for entering and exiting trades, as well as any risk management measures, such as stop-loss and take-profit orders. Some common trading strategies include:

- 28. ● Trend Following: Involves trading in the direction of the prevailing market trend, using technical indicators such as moving averages to identify entry and exit points. ● Breakout Trading: Focuses on trading when an asset's price breaks through a significant support or resistance level, signaling a potential continuation or reversal of the current trend. ● Range Trading: Involves trading within a defined price range, buying near support levels and selling near resistance levels. 4. Implementing Your Trading Plan on AvaTrade's Platform With your trading plan in place, you can implement it on AvaTrade's platform, using the various tools and features available to execute your trades and manage your portfolio. Key aspects of implementing your trading plan include: ● Trade Execution: Use AvaTrade's advanced order types, such as market, limit, and stop orders, to execute your trades according to your strategy. ● Risk Management: Employ risk management tools, such as stop-loss and take-profit orders, to protect your positions and lock in profits. ● Portfolio Monitoring: Regularly monitor your portfolio's performance and make adjustments to your plan as needed to ensure it remains aligned with your goals and risk tolerance. By developing and implementing a well-structured trading plan, you can make more disciplined and consistent trading decisions, ultimately improving your performance on AvaTrade's platform. In the upcoming chapters, we will continue to explore additional topics and strategies to help you optimize your trading experience and achieve long-term success. Chapter 14: Mastering Risk Management: Protecting Your Trading Capital In this chapter, we will discuss the importance of mastering risk management and provide guidance on implementing effective risk management strategies to protect your trading capital on AvaTrade's platform. 1. Understanding the Importance of Risk Management

- 29. Effective risk management is essential for long-term trading success, as it helps to protect your trading capital and minimize the impact of losing trades. By managing risk effectively, you can increase the likelihood of achieving your trading goals and maintain a consistent performance over time. 2. Setting Stop-Loss and Take-Profit Orders One of the most important risk management tools available to traders is the stop-loss order. A stop-loss order is an instruction to close a trade at a specified price level, limiting the potential loss on a position. By setting a stop-loss order, you can protect your capital and prevent significant losses. Take-profit orders are another essential risk management tool, allowing you to lock in profits when a trade reaches a predetermined price level. By setting take-profit orders, you can ensure that you capitalize on profitable trades and avoid giving back gains due to market reversals. 3. Employing Position Sizing and Risk-Reward Ratios Position sizing involves determining the appropriate size of each trade based on your risk tolerance and account size. By employing proper position sizing, you can manage risk more effectively and avoid overexposing your account to potential losses. A risk-reward ratio is a measure of the potential gain on a trade relative to the potential loss. By considering the risk-reward ratio of each trade, you can ensure that your potential gains outweigh your potential losses, improving the overall performance of your trading portfolio. 4. Implementing Diversification and Portfolio Rebalancing As discussed in Chapter 11, diversification is a crucial component of risk management, helping to spread risk across various assets and reduce the impact of individual losses on your overall performance. Regularly rebalancing your portfolio can also help to maintain your desired level of diversification and manage risk effectively.

- 30. 5. Learning from Mistakes and Adjusting Your Strategies One of the most valuable aspects of risk management is learning from your mistakes and adjusting your strategies accordingly. By reviewing your trading performance regularly, you can identify areas for improvement, refine your risk management techniques, and ultimately enhance your trading success. By mastering risk management, you can protect your trading capital, improve your overall performance, and achieve long-term success on AvaTrade's platform. In the following chapters, we will continue to explore additional topics and strategies to help you optimize your trading experience and achieve your trading goals. Chapter 15: The Psychological Aspect of Trading: Developing Emotional Discipline In this chapter, we will discuss the psychological aspect of trading and provide guidance on developing emotional discipline to improve your decision-making and performance on AvaTrade's platform. 1. Understanding the Role of Emotions in Trading Emotions can play a significant role in trading, influencing your decision-making and overall performance. Common emotions that can impact your trading include fear, greed, overconfidence, and regret. By recognizing and managing these emotions, you can make more rational and consistent decisions, ultimately improving your trading success. 2. Developing a Trading Plan and Sticking to It

- 31. As discussed in Chapter 13, creating and implementing a well-structured trading plan is essential for disciplined and consistent decision-making. By adhering to your trading plan, you can minimize the influence of emotions on your decisions and avoid impulsive, reactive trading. 3. Practicing Mindfulness and Self-Awareness Mindfulness and self-awareness techniques can help you recognize and manage your emotions more effectively. By practicing mindfulness, you can cultivate a greater awareness of your emotional state, allowing you to identify and address any emotional triggers that may impact your trading. 4. Managing Stress and Maintaining a Balanced Lifestyle Stress can significantly impact your emotional state and trading performance. By managing stress effectively and maintaining a balanced lifestyle, you can ensure that you remain focused, calm, and composed during your trading sessions. Some strategies for managing stress include regular exercise, meditation, and maintaining a healthy work-life balance. 5. Learning from Mistakes and Embracing Losses Losses are an inevitable part of trading, and it's crucial to learn from them and use them as opportunities for growth and improvement. By embracing losses and analyzing your mistakes, you can refine your trading strategies and enhance your emotional resilience. 6. Maintaining a Trading Journal Keeping a trading journal is an excellent way to track your trading performance, emotions, and decision-making processes. By regularly reviewing your trading journal, you can identify patterns in your emotional responses, address any issues that may be affecting your performance, and ultimately develop greater emotional discipline. By developing emotional discipline and focusing on the psychological aspect of trading, you can improve your decision-making and overall performance on AvaTrade's platform. In the upcoming chapters, we will continue to explore additional topics and strategies to help you optimize your trading experience and achieve long-term success.

- 32. Chapter 16: Leveraging AvaTrade's Educational Resources to Enhance Your Trading Skills In this chapter, we will discuss the various educational resources available on AvaTrade's platform and provide guidance on leveraging these resources to enhance your trading skills and knowledge. 1. AvaTrade's Education Center AvaTrade offers a comprehensive Education Center, providing a wide range of resources to help traders of all levels improve their trading skills and knowledge. Some key components of AvaTrade's Education Center include: ● Video Tutorials: AvaTrade provides an extensive library of video tutorials, covering topics such as trading strategies, technical analysis, risk management, and platform navigation. ● Webinars: AvaTrade regularly hosts live webinars, led by experienced traders and market analysts, covering various trading topics and providing insights into current market trends and events. ● eBooks: AvaTrade offers a selection of eBooks, providing in-depth information on various trading concepts, strategies, and techniques. 2. Demo Account: Practice Trading in a Risk-Free Environment One of the most valuable educational resources available on AvaTrade's platform is the demo account. A demo account allows you to practice trading in a risk-free environment, using virtual funds to test your strategies and familiarize yourself with the platform's features and tools. By practicing with a demo account, you can develop your trading skills and gain confidence before transitioning to a live trading account. 3. Market Analysis and News As discussed in Chapter 12, staying informed about market news and analysis is crucial for making well-informed trading decisions. AvaTrade offers in-depth market analysis and insights on its platform, helping you stay informed about key market trends and events. By leveraging this

- 33. information, you can refine your trading strategies and better anticipate potential trading opportunities. 4. Customer Support and Personalized Assistance AvaTrade provides dedicated customer support, offering personalized assistance to help you navigate the platform and enhance your trading skills. By reaching out to AvaTrade's customer support team, you can receive guidance on various topics, such as platform features, account management, and trading strategies. By leveraging AvaTrade's educational resources, you can continually improve your trading skills and knowledge, ultimately increasing your chances of long-term success on the platform. In the upcoming chapters, we will continue to explore additional topics and strategies to help you optimize your trading experience and achieve your trading goals. Chapter 17: Adapting to Changing Market Conditions and Staying Nimble In this chapter, we will discuss the importance of adapting to changing market conditions and provide guidance on staying nimble in your trading approach to succeed on AvaTrade's platform. 1. Recognizing Market Shifts and Trends Successful traders are skilled at recognizing market shifts and trends, allowing them to adjust their strategies and capitalize on new trading opportunities. By staying informed about market news and analysis, as discussed in Chapter 12, you can identify key market developments and potential trend reversals, helping you make more informed trading decisions. 2. Continuously Evaluating and Adjusting Your Trading Strategies

- 34. As market conditions change, it's crucial to continuously evaluate and adjust your trading strategies to ensure they remain effective and aligned with your goals. By regularly reviewing your trading performance and analyzing the success of your strategies, you can identify areas for improvement and make necessary adjustments to optimize your results. 3. Embracing Flexibility and Open-Mindedness Successful traders are open-minded and flexible in their approach, willing to adapt their strategies when market conditions dictate. By embracing flexibility and maintaining an open-minded attitude, you can more effectively respond to changing market conditions and capitalize on new trading opportunities. 4. Diversifying Your Trading Toolbox To stay nimble in changing market conditions, it's essential to have a diversified trading toolbox, including various technical indicators, trading strategies, and risk management techniques. By continuously expanding your trading toolbox, you can better adapt to different market scenarios and improve your overall performance. 5. Learning from Other Traders and Market Professionals One of the most effective ways to stay nimble and adapt to changing market conditions is by learning from other traders and market professionals. By participating in trading communities, attending webinars, and following market analysts, you can gain insights into various trading strategies and techniques, helping you stay informed and adaptable in your approach. By staying nimble and adapting to changing market conditions, you can enhance your trading performance and achieve long-term success on AvaTrade's platform. In the upcoming chapters, we will continue to explore additional topics and strategies to help you optimize your trading experience and achieve your trading goals.

- 35. Chapter 18: Evaluating Your Trading Performance and Setting Realistic Goals In this chapter, we will discuss the importance of evaluating your trading performance and setting realistic goals to achieve long-term success on AvaTrade's platform. 1. Monitoring and Analyzing Your Trading Performance Regularly monitoring and analyzing your trading performance is essential for identifying areas of improvement and ensuring that your strategies remain effective. By reviewing your trade history, win-loss ratio, average profit and loss, and other performance metrics, you can gain insights into your strengths and weaknesses and make informed adjustments to your trading approach. 2. Keeping a Trading Journal As discussed in Chapter 15, maintaining a trading journal is a valuable tool for tracking your trading performance, emotions, and decision-making processes. By regularly reviewing your trading journal, you can identify patterns in your performance and emotional responses, helping you refine your trading strategies and develop greater emotional discipline. 3. Setting Realistic Trading Goals Setting realistic and attainable trading goals is crucial for maintaining motivation and focus in your trading journey. By establishing clear and measurable objectives, such as monthly profit targets or a specific win-loss ratio, you can track your progress and maintain accountability for your trading performance. 4. Balancing Risk and Reward Balancing risk and reward is a critical aspect of successful trading, as discussed in Chapter 14. By maintaining an appropriate risk-reward ratio and employing effective risk management techniques,

- 36. you can ensure that your potential gains outweigh your potential losses, improving the overall performance of your trading portfolio. 5. Continuously Learning and Improving Successful traders are committed to continuous learning and improvement, regularly seeking new knowledge and insights to enhance their trading skills. By leveraging AvaTrade's educational resources, as discussed in Chapter 16, you can stay up-to-date on market trends and trading strategies, helping you achieve your trading goals and maintain long-term success. By evaluating your trading performance and setting realistic goals, you can optimize your trading experience and achieve long-term success on AvaTrade's platform. In the upcoming chapters, we will continue to explore additional topics and strategies to help you enhance your trading skills and achieve your trading objectives. Chapter 19: Developing a Consistent Trading Routine and Maintaining Discipline In this chapter, we will discuss the importance of developing a consistent trading routine and maintaining discipline to achieve long-term success on AvaTrade's platform. 1. Establishing a Daily Trading Routine Developing a consistent daily trading routine can help you maintain focus, discipline, and productivity in your trading activities. By setting aside specific times each day for market analysis, trading, and performance review, you can create a structured environment that promotes optimal decision-making and performance. 2. Preparing for Your Trading Session

- 37. Before starting your trading session, it's essential to prepare yourself mentally and gather all necessary resources and information. By reviewing market news and analysis, setting up your trading workspace, and mentally preparing yourself for the trading day, you can ensure that you are focused and ready to make informed decisions. 3. Following Your Trading Plan As discussed in Chapter 13, creating and implementing a well-structured trading plan is essential for disciplined and consistent decision-making. By adhering to your trading plan and executing your strategies with precision, you can minimize the influence of emotions on your decisions and maintain a consistent performance. 4. Managing Emotions and Developing Emotional Discipline As highlighted in Chapter 15, managing your emotions and developing emotional discipline is crucial for consistent decision-making and trading success. By practicing mindfulness, self-awareness, and stress management techniques, you can effectively manage your emotions and maintain discipline in your trading approach. 5. Regularly Reviewing and Adjusting Your Trading Routine To ensure that your trading routine remains effective and aligned with your goals, it's essential to regularly review and adjust your routine as needed. By evaluating your daily activities and identifying areas for improvement, you can optimize your trading routine and enhance your overall performance. By developing a consistent trading routine and maintaining discipline, you can achieve long-term success on AvaTrade's platform. In the final chapter, we will summarize the key topics covered throughout this book and provide some closing thoughts on achieving your trading goals and optimizing your trading experience on AvaTrade.

- 38. Chapter 20: Conclusion – Achieving Your Trading Goals and Optimizing Your Experience on AvaTrade In this final chapter, we will summarize the key topics covered throughout this book and provide some closing thoughts on achieving your trading goals and optimizing your trading experience on AvaTrade. 1. Understanding the AvaTrade Platform We began by exploring the features and tools available on AvaTrade's platform, highlighting the importance of familiarizing yourself with the platform's functionalities to maximize your trading experience. 2. Developing Effective Trading Strategies We discussed the importance of developing effective trading strategies, focusing on various approaches such as technical and fundamental analysis, risk management, and trading psychology. 3. Leveraging AvaTrade's Educational Resources We emphasized the value of leveraging AvaTrade's educational resources, including video tutorials, webinars, eBooks, and demo accounts, to enhance your trading skills and knowledge. 4. Staying Informed and Adapting to Market Conditions We highlighted the importance of staying informed about market trends and events and emphasized the need to adapt your trading strategies to changing market conditions. 5. Maintaining Emotional Discipline and Developing a Consistent Trading Routine

- 39. We discussed the significance of maintaining emotional discipline and developing a consistent trading routine to ensure long-term success on AvaTrade's platform. 6. Evaluating Your Performance and Setting Realistic Goals Finally, we emphasized the importance of evaluating your trading performance, setting realistic goals, and continuously learning and improving to achieve your trading objectives. In conclusion, achieving your trading goals and optimizing your experience on AvaTrade requires a combination of knowledge, skill, discipline, and adaptability. By applying the concepts and strategies discussed throughout this book, you can develop a solid foundation for long-term success on AvaTrade's platform. Remember to stay informed, continue learning, and maintain discipline in your trading approach as you progress in your trading journey. Chapter 21: Bonus Tips for Long-Term Success on AvaTrade In this bonus chapter, we will share additional tips to help you achieve long-term success on AvaTrade's platform and continue to optimize your trading experience. 1. Building a Support Network Having a support network of fellow traders and market professionals can significantly enhance your trading experience. By participating in trading forums, social media groups, and attending trading events, you can exchange ideas, gain new insights, and stay motivated throughout your trading journey. 2. Staying Current with Industry Developments

- 40. The trading industry is continuously evolving, with new technologies, regulations, and market participants emerging regularly. Staying informed about industry developments can help you adapt your trading strategies and maintain a competitive edge in the market. 3. Embracing a Growth Mindset Successful traders embrace a growth mindset, viewing challenges and setbacks as opportunities for learning and improvement. By maintaining a positive attitude and remaining open to learning from your experiences, you can continually develop your trading skills and achieve long-term success. 4. Practicing Patience and Perseverance Trading success often requires patience and perseverance, as it may take time to develop your skills, refine your strategies, and achieve consistent profitability. By remaining patient and committed to your trading journey, you can overcome obstacles and reach your trading goals. 5. Seeking Professional Guidance If you find yourself struggling with specific aspects of your trading, such as risk management or emotional discipline, seeking professional guidance from experienced traders or trading coaches can be highly beneficial. Professional guidance can provide personalized insights and support to help you overcome your challenges and enhance your trading performance. In summary, achieving long-term success on AvaTrade's platform requires an ongoing commitment to learning, improvement, and adaptability. By applying the tips and strategies discussed in this book and the additional tips provided in this bonus chapter, you can continue to optimize your trading experience and work towards achieving your trading goals.

- 41. Chapter 22: The Importance of Work-Life Balance in Your Trading Journey In this chapter, we will discuss the importance of maintaining a healthy work-life balance in your trading journey and share tips for achieving equilibrium between your trading activities and personal life. 1. Setting Boundaries for Your Trading Activities To maintain a healthy work-life balance, it's crucial to set boundaries for your trading activities. Establish specific trading hours and stick to them, avoiding the temptation to trade outside these hours. By doing so, you can prevent trading from consuming your personal life and ensure you have adequate time for relaxation and self-care. 2. Prioritizing Self-Care and Stress Management Trading can be a high-stress endeavor, making self-care and stress management essential components of a healthy work-life balance. Engage in regular physical exercise, practice mindfulness techniques, and ensure you get enough sleep to maintain your mental and physical wellbeing. 3. Cultivating Hobbies and Interests Outside of Trading It's essential to cultivate hobbies and interests outside of trading to maintain a well-rounded lifestyle and prevent trading-related burnout. Pursue activities that bring you joy, relaxation, and personal fulfillment, such as sports, arts, or community involvement. 4. Building and Maintaining Supportive Relationships Building and maintaining supportive relationships with friends and family is vital for achieving a healthy work-life balance. Make time for social interactions and foster meaningful connections with

- 42. the people in your life, as these relationships can provide emotional support and help you maintain perspective during challenging times in your trading journey. 5. Regularly Assessing and Adjusting Your Work-Life Balance Maintaining a healthy work-life balance is an ongoing process that requires regular assessment and adjustment. Periodically evaluate your work-life balance and make any necessary changes to ensure you are prioritizing both your trading success and personal wellbeing. By maintaining a healthy work-life balance, you can ensure your trading journey is sustainable and enjoyable while also preserving your mental and emotional wellbeing. As you continue to optimize your trading experience on AvaTrade, remember to prioritize your work-life balance and invest in your personal wellbeing alongside your trading success. Chapter 23: Exploring Advanced Trading Techniques and Tools In this chapter, we will introduce some advanced trading techniques and tools that can help you further optimize your trading experience on AvaTrade's platform and enhance your trading performance. 1. Algorithmic Trading and Expert Advisors (EAs) Algorithmic trading involves the use of computer algorithms to execute trades based on predefined trading strategies. This approach can help eliminate human emotions from the decision-making process and increase the speed and efficiency of your trading. AvaTrade supports the use of Expert Advisors (EAs), which are algorithmic trading programs designed for the MetaTrader platform. 2. Social Trading and Copy Trading

- 43. Social trading and copy trading platforms, such as ZuluTrade and DupliTrade, allow you to follow and automatically copy the trades of experienced traders. These platforms can provide valuable insights into successful trading strategies and help you diversify your trading portfolio. 3. Advanced Charting Techniques Expanding your knowledge of advanced charting techniques, such as Elliott Wave Theory, Fibonacci retracements, and harmonic patterns, can help you identify more sophisticated trading opportunities and refine your technical analysis skills. 4. Options Trading and Hedging Strategies Trading options can provide additional opportunities for profit and risk management. By learning about options trading and incorporating hedging strategies, you can protect your trading portfolio from adverse market movements and potentially enhance your overall performance. 5. Custom Indicators and Trading Tools Creating and using custom indicators and trading tools can help you develop unique trading strategies tailored to your preferences and goals. With the MetaTrader platform, you can develop custom indicators and tools using the MetaQuotes Language (MQL) or explore the MQL marketplace for pre-built solutions. By exploring advanced trading techniques and tools, you can continue to expand your trading skillset and optimize your trading experience on AvaTrade's platform. As you progress in your trading journey, always remember to practice risk management, maintain discipline, and prioritize learning and improvement to achieve long-term trading success.

- 44. Chapter 24: Building a Sustainable Trading Career In this chapter, we will discuss strategies for building a sustainable trading career on AvaTrade's platform, focusing on long-term growth and success. 1. Continuously Enhancing Your Trading Skills Building a sustainable trading career requires a commitment to ongoing learning and skill development. Stay up-to-date with market trends, trading technologies, and new strategies to ensure that you remain competitive in the industry. Regularly review your trading performance to identify areas for improvement and seek out educational resources to help you enhance your skills. 2. Diversifying Your Trading Portfolio Diversifying your trading portfolio can help you manage risk and increase the potential for consistent returns. By trading multiple assets, instruments, and strategies, you can spread your risk across various markets and reduce the impact of individual market fluctuations on your overall performance. 3. Maintaining a Long-Term Perspective Focusing on long-term growth and success is essential for building a sustainable trading career. Set realistic long-term goals, and avoid getting discouraged by short-term setbacks. Recognize that your trading journey will likely include ups and downs, and stay committed to continuous improvement and adaptation. 4. Adhering to Strict Risk Management Principles Consistently following strict risk management principles is crucial for preserving your trading capital and ensuring the longevity of your trading career. Establish and adhere to risk management guidelines, such as setting stop-loss orders, managing position sizes, and regularly reviewing your portfolio's risk exposure.

- 45. 5. Balancing Trading with Personal Life As discussed in Chapter 22, maintaining a healthy work-life balance is vital for a sustainable trading career. Prioritize your personal wellbeing and invest in self-care to ensure that you can continue trading effectively over the long term. By focusing on continuous learning, diversification, long-term growth, risk management, and work-life balance, you can build a sustainable trading career on AvaTrade's platform. Remember to stay disciplined, adaptable, and committed to your trading journey as you work towards long-term success and financial freedom. Chapter 25: Preparing for Challenges and Adapting to Change In this chapter, we will discuss the importance of preparing for challenges and adapting to change in your trading journey, providing strategies to help you navigate the ever-evolving trading landscape. 1. Anticipating Market Volatility Market volatility is a natural part of the trading environment and can present both challenges and opportunities for traders. By anticipating market volatility and adjusting your trading strategies accordingly, you can mitigate risks and capitalize on profitable opportunities. 2. Monitoring Global Economic and Political Developments Global economic and political developments can have significant impacts on financial markets. Stay informed about these events and consider their potential effects on your trading portfolio to ensure you are prepared to adapt your strategies as necessary. 3. Keeping Up with Technological Innovations